Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

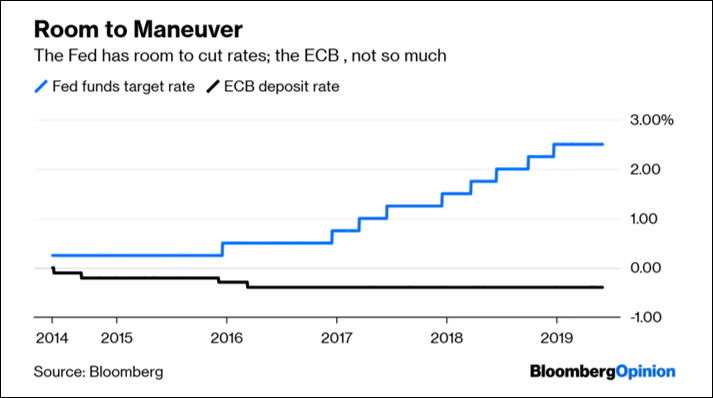

Trade War Traps ECB With Bund Yields at Record Low [Bloomberg]

The yield on 10-year German government bonds has declined to its lowest ever, reaching -0.213% on Friday. That’s almost a basis point below the previous low, reached on July 6, 2016.

ECB President Mario Draghi can expect to get grilled at the press conference about what he has left in the toolbox to counter the headwinds assailing the economy. If the bond market doesn’t like what it hears, the benchmark German yield could yet plumb new depths.

It’s the truest thing I know about the State.

What begins as emergency government action ALWAYS becomes permanent government policy.

I’m not saying this is good. I’m not saying this is bad. I’m saying that it IS.

In the summer of 2012, Mario Draghi took emergency action to save the Euro system. There wasn’t actually much action, but the WORDS and the NARRATIVE that Draghi set in motion with his “whatever it takes” speech in London was enough.

But as ALWAYS happens in an entrenched, self-interested bureaucracy, the policies designed to be part of that emergency action … the liquidity programs and the balance sheet expansion and all that goes along with pushing interest rates into negative-world … they kept going long after the emergency was past. Because there’s always another target for your bazooka. Because that’s what entrenched, self-interested bureaucracies DO.

So now here we are, where “whatever it takes” has morphed from saving the entire European project to … [checks notes] … preventing a garden-variety recession.

But as mad as I get at the mandarins in Frankfurt and Washington and Tokyo, there’s someone who bothers me even more.

From Magical Thinking …

Yep, at first I was disappointed in them. But on reflection I became more and more disappointed in us.

See, the problem isn’t with the Fed. They’re going to do what solipsistic, magical thinking priest-kings have done for ten thousand years … more of THAT. More solipsism. More magical thinking. More 4 year old egomaniacal determination that their spell casting efforts are the ONLY thing that stand between us and utter ruin.

No, the bigger problem is with us. The bigger problem is that we cannot imagine a solution for our current economic and political problems that does not rely on greater and greater state-directed spell casting. Monetary policy spells not working? Well, golly, I guess our ONLY alternative is to try some fiscal policy spells. Really? That’s the best we can come up with? I understand that this is what the courtiers are going to say. But I expect more from the rest of us. I expect more from myself.

It’s time to expect more. Not from Draghi or Powell or their cultists, but from us and from me.

It’s time to expect more from the Pack.

“Men cannot improve a society by setting fire to it: they must seek out its old virtues, and bring them back into the light.” …said Russell Kirk. It appears a lot of Jacksonian America…including me…wanted to set it all ablaze. Alas, it’s not that easy.

Of course the ECB cannot change tactics or their strategy, indeed if they ever had a strategy to begin with. There is now the institutional imperative to act by central bankers irrespective of whether acting produces the original intended result or whether it is going to be long-term harmful. Nothing is more damaging to an institutions collective psychology than being proven wrong, especially to people who are meant to be “experts” who have spent decades bouncing around academia and central banks.

Indeed they have to double-down their bet in order to be proven right because the implications of realising they are wrong, both for the institution and themselves, is too great a threat to their survival… so like a King Rat they cooperate in this game of taking temporary extraordinary action and making it a permanent reality.

My problem with expecting more from the Pack is that I never end up fitting as much stuff in the go-bag as I wanted to try and pack in. Like the crossbow, it really doesn’t fit well, even when I downgraded it to a wrist model variety. Also, do you know how much room commodities take up in your luggage? Seriously.

Oh wait…you didn’t mean pack and leave?

Never mind.

It’s the classic addiction problem, right? Continuing is not sustainable long-term, but stopping is too painful.

The more the economy is distorted in the direction of serving up luxuries to the lucky, the more painful any decline in demand will be, and the more you ‘have to’ prop up demand.

State-controlled money comes with a money-back guarantee that addiction will happen!

I imagine it goes on for a long time (like Japan) or not - either way, it ends when it “breaks -” “it” being (ET’s brilliantly named) the narrative of central bank omnipotence, it being the ability of the market to levitate negative (or low)-rate bonds, it being markets divorced from fundamentals, it being debt levels divorced from GDP, it being zombie companies raising money at historically low rates, it being financialization “creating” earnings, it being all of IT.

And when it breaks, we get loss assignment, massive bankruptcy, deleveraging - everything that should have been allowed to happen (with less pain then) in '08 / everything that was allowed to happen in the S&L crisis of the late '80s.

Then, we do what we always do - and should have already done - we start anew from a better foundation. That’s this pack member’s view and suggestion - let’s get on with the pain as there is no other way to the other side except through the debris field of a debt implosion.

I’m inclined to agree with Mark K but no gov or CB us going to let it all go to hell without a scapegoat. Any volunteers out there? Or we could just keep going Japanese for as long as the printing ink doesn’t run out.

If we get the big reset it will change they world forever and a lot of folk aren’t prepared and won’t like it. The populist demonstrations in Europe will look like a picnic on a sunny day in comparison.

Or do we say okay no money in politics policy driven by achieving the best outcome for the highest number of people. Far fewer folk pissed off going that route ex the 1% ers who will lose their cosy existence.

What does “get on with it” look like? A gradual but steady increase in the Fed Funds rate? Just curious how you’d define the process of getting to the other side…

I commented yesterday to a like minded peer in Chicago…“that I feel like I’m in a house of ill-repute”. Here we are…well hedged and killing the indexes of late, only for a Fed policy utterance that they would move to head-off the next recession. Several days of hedged blocking and tackling vaporized by THE NARRATIVE! Markets no longer ride the escalator up and elevator down, but the escalator down and the elevator up…with Powell et all as elevator men. Haul-ass, Bypass, and Re-gas!

Yes, I think the Fed needs to continue normalizing rates and its balance sheet, which will cause a large stock market selloff and all the other deleveraging/loss assignment I described (that’s what was starting to happen in December). I hate that, but the alternative is worse as we just keep blowing the financial bubbles up further.

IMHO, we are on the Japanese path until it breaks. Who knows, Japan has done it for three decades, but then again, every economy and period is different. We could go on for years or break tomorrow. I agree with you, no CB will take us there willingly.