Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

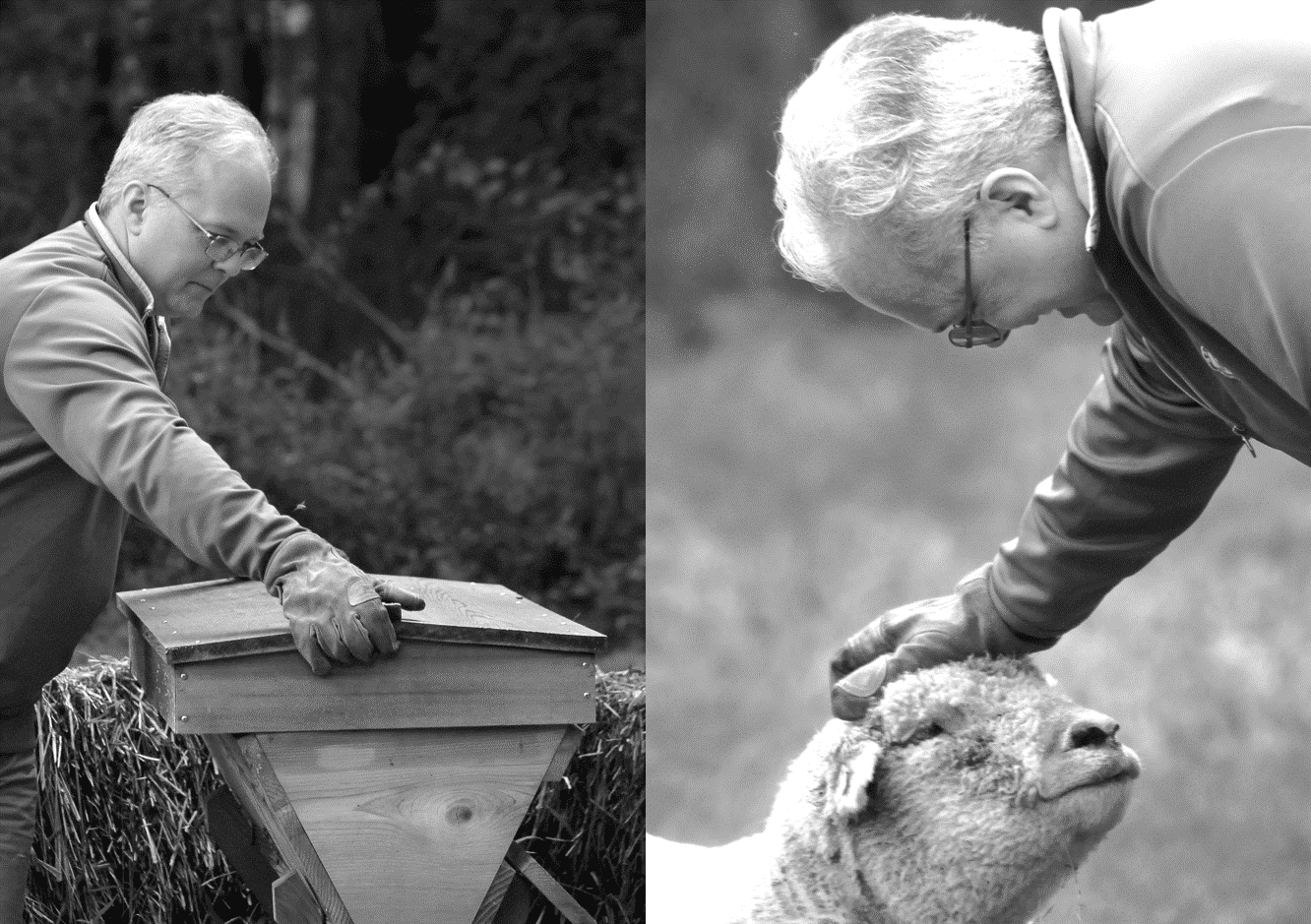

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

I figure Jay Powell never dreamed that he would be the Sudetenland in our latest historical reenactment, but if you serve long enough you’re pretty much destined to be a cautionary tale.

We have suffered a devastating flood in Texas.

I believe an even more devastating Flood is to come.

Now we must build an Ark of story. Now we must build an Ark of love.

Trump and Bessent are going to run it hot, artificially depress interest rates, and blow a bubble in everything they can.

Weimar-a-lago, here we come.

I want to show you what ‘mobilizing narrative support’ looks like, as measured by our revolutionary Perscient technology and as understood by someone who has spent the past 35 years studying, writing and teaching about this stuff.

1) US election spurs fiscal deficit.

2) Phony War between Israel and Iran gets real.

3) Preventive war between US and China over tech embargo.

4) New GFC stemming from shadow banking sector.

1) US election spurs even greater fiscal deficit.

2) Phony War between Israel and Iran gets real.

3) Preventive war risk between US and China over tech embargo.

4) New GFC risk stemming from shadow banking sector.

1) US election spurs even greater fiscal deficit

2) Phony War between Israel and Iran gets real

3) Preventive war risk between US and China over tech embargo

4) New GFC risk stemming from shadow banking sector

I think we are about to experience a pretty dramatic resurgence in inflation.

LLMs ensure their survival by showing us that we can all find meaning in our lives so long as we keep talking with the LLMs. They ensure their survival by telling each of us not what is true but what we want to be true – what we NEED to be true – at the semantic core of our individual identity, even if what we need to be true is an LLM-dominated dystopia.

And we are so grateful.

The House passage of the Big Beautiful Bill and Elon Musk stepping back from DOGE is a Common Knowledge moment — everyone now knows that everyone now knows that the US deficit cannot be controlled, much less reversed, over the remainder of Trump’s term — and it puts us on a pretty straightforward path to a global sovereign debt crisis.