Here’s what we’re reading and working on this week at Epsilon Theory.

To receive a weekly full-text email of The Zeitgeist, please sign up here. It’s free, and your email will not be shared with anyone. Ever.

Every item in this email is a discussion thread on the Epsilon Theory Forum – a safe space to speak your mind, a safe space to find like-minded truth-seekers. Watch from a distance if you like, but when you’re ready … join us.

Now Hiring

From a Wall Street Journal article on Thursday:

Millions Are Unemployed. Why Can’t Companies Find Workers?

In a red-hot economy coming out of a pandemic and lockdowns, with unemployment still far higher than it was pre-Covid, the country is in a striking predicament. Businesses can’t find enough people to hire.

Rising vaccination rates, easing lockdowns and enormous amounts of federal stimulus aid are boosting consumer spending on goods and services. Yet employers in sectors like manufacturing, restaurants and construction are struggling to find workers. There are more job openings in the U.S. this spring than before the pandemic hit in March 2020, and fewer people in the labor force, according to the Labor Department and private recruiting sites.

If only there were some mechanism by which companies could entice people to work for them. I dunno, it’s a real head scratcher.

What Sort of Business is Investment Banking?

If you haven’t read Marc Rubinstein’s note we published this week, it’s well worth checking out!

So fortunate to have the chance to republish some of Marc’s notes, and his Meme-craft is beyond compare. Honestly, this is the best meme I’ve seen on Fintwit in a loooong time.

Origins of the Panopticon

Also well worth checking out is the podcast we put out this week — In Praise of Bitcoin. I think this is our best pod yet, not just for what it has to say about Bitcoin, but as a good entry point to what Epsilon Theory is all about.

Part of what Epsilon Theory is all about is pointing out modern implementations of the Panopticon … a proposal from the late 1700s for the perfect prison, where the inmates (that’s us!) willingly enforce the jailer’s discipline on themselves.

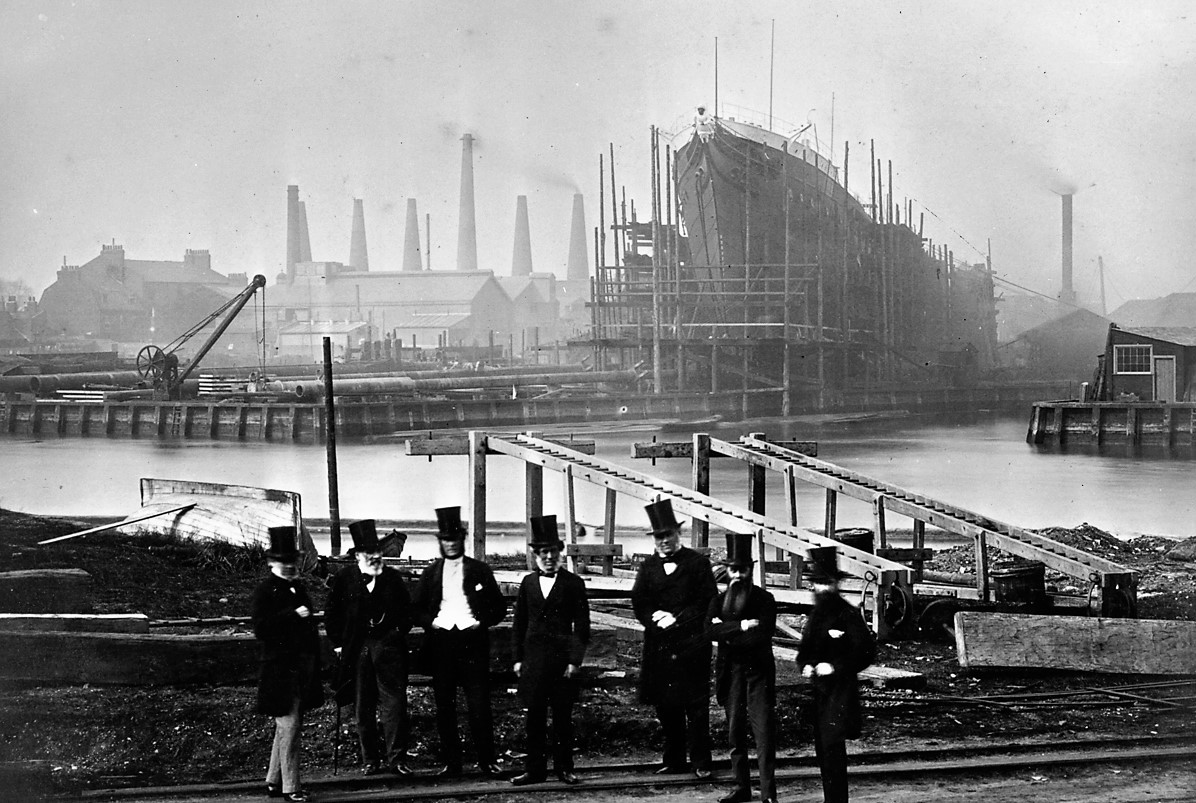

An ET Pack member sent me this DM regarding the origins of the Panopticon concept, which I found fascinating! Yes, Jeremy Bentham proposed the design as a perfect prison, but it was his brother Samuel who originally conceived the idea as a way of forcing shipyard laborers to accept fiat and snitch on each other regarding their favored form of compensation: leftover lumber.

Ben, forgive me if you already know this bit of panopticon history, but I didn’t see it mentioned in the original ET Panopticon note, nor hear it in the recent Bitcoin podcast. I thought you’d enjoy it if you aren’t already familiar:

I believe it was in fact Jeremy’s brother, Samuel Bentham, who developed the concept for the Panopticon.

The inspiration for its development came from Samuel’s time working in British naval yards and trying to develop a way to enforce laborers to ACCEPT MONETARY WAGES as a form of remuneration. They didn’t want the currency, they wanted “chips” — bits of unused material from the ship building process for which they could negotiate value.

Excellent reading on the topic here. And credit for my knowledge of this to the late, great David Graeber, who mentioned it in Debt, IIRC:

https://newxcommoners.files.wordpress.com/2013/01/linebaugh-ships-and-chips1.pdf

But the Windmills!

From a Wall Street Journal article on Friday:

As Texas Went Dark, the State Paid Natural-Gas Companies to Go Offline

The Electric Reliability Council of Texas activated a program that pays large industrial power users to reduce their consumption during emergencies. But the grid operator, known as Ercot, didn’t know who was being paid to participate in this program and what type of facilities were getting shut off, it has since acknowledged.

The Journal’s analysis of grid records shows that participants included dozens of critical pieces of natural-gas infrastructure. Ercot ordered them to stay off for more than four days, as gas prices surged to extraordinary levels and some power plants stopped producing electricity because they couldn’t get enough fuel to function.

The estimated value of the program for the five days of the blackout was about $2 billion—and participants including oil-and-gas companies earned a portion of that for turning themselves off at Ercot’s behest.

“Ercot officials told the Journal that it was unaware it was cutting off some gas supplies when it ordered the big industrial users to stop using power.”

The Best Way to Rob a Bank – Epilogue

Here’s a follow-up from our note on the Greensill fraud and all its associated raccoons: Greensill made its bankruptcy filing!

We’ve saved this document for posterity on our servers, and you can download it here: Greensill BK Filing.

I haven’t had the chance yet to review this masterpiece in detail, but I’m certain that there must be some choice nuggets in here for enterprising Epsilon Theory readers to unearth.

Reading the synopses above, especially the ERCOT natural gas story, I feel like I am in Idiocracy. The movie was funny to watch but it isn’t when you have to live it.

On item #1 I’ll make a prediction , - this fall we will see advertisements by law firms about helping individuals get enrolled for disability benefits.

Did things change? I thought that when an unemployed person was called back to work, the person had to accept or lose the payments. So I guess the employers are not asking them back. Or out of business. They can’t borrow or get shoveled cash with no equity for it like the 4 biggest airlines, combined with stock buybacks with free money and Raccoon CEO compensation out of control, but the plebians and untouchables do not deserve to be paid fair wages. Schools closed no child care, why work and be exposed to Covid I could go on, but…OK Lindsey.

What ever happened to the concept of free market economics? If there are massive labor shortages, shouldn’t the market be able to address that with adjustments to the price of labor? Or maybe they could (and will) hire robots. Of course increases in wage rates could lead to other adjustments like product price increases, which I assume could imply inflation.

What I read from most of the “free market” folks is that the concept of labor being an input subject to market forces is somehow anathema to their concept of how a market should work. They seem to believe that government’s job is to keep wage rates down.

My siblings are builders , they build about 150 residential homes per year. Right now they cannot hire framers unless they are willing to pay them under the table , which they are not.

When you pay someone $15 to watch TV and play video games , they really don’t see a 20/per hour job as all that appealing - to them it looks like $5. None of this is free market capitalism because in a free market , idleness is not rewarded.

I am not saying it wasn’t needed , but the stimulus has filled the hole created by Covid 6x over.

I have been struck by the surprise that the millions of pre-Covid jobs haven’t come back as quickly as the V-shaped expectations, and that competition to find workers to fill open positions is so intense. Some of the factors at play:

- The economy from 2009-2019 created 19.7 million non-agriculture jobs (BLS).

- 17.2 million were in the Services sector (Health Care/Social Assistance 3.9 mil, Leisure/Hospitality 3.5 mil, Transport/Whse 1.4 mil, Retail trade 1.1 mil) explain over half of those Services jobs. They are disproportionally lower wage and benefit jobs.

- Worker share of corporate income has been falling, particularly since the '01-'02 and '08-'09 recessions. It used to represent 80-81% and has dropped below 75%.

- Services businesses were the most impacted by Covid mandated changes that were implemented (school closings, lockdowns, cancelling of large gatherings, and travel prohibitions).

- Benefit replacement programs such as expanded unemployment compensation and duration and transfer payments with zero work requirement impact those at the lowest wage scale with the least savings the most.

- Economic statistics factor in huge increases in personal income that emanate from the support programs, while the private sector economy still operates well below 2019 levels absent those government transfers.

If the past year, and political demands for more similar support are a feature for the next few years, there will need to be a fundamental remake of the US economy. The recovery from the job losses of the 'oughts produced mostly low-wage, lower skill jobs. If workers are going to get a greater share of corporate income via a higher minimum wage, expanded benefits or ultimately Universal Basic Income, we should expect a dramatic further slowdown in job creation. If something that is a business cost rises substantially, we will see less of it. And, the corollary that is less explored is the probable spike in business failures for the hundreds of thousands of businesses that rely on very low wage workers for their labor force. The Unicorn business models operating to steal the growth in so many industries is also a prohibitive force against simply raising wages in these businesses to a rate that attracts workers to fill the open jobs.That’s a good question. There may be some time limit after a layoff for callbacks.

Also, there seems to be a “not eligible for rehire” status that gets branded on to some employees once they have been slated for layoffs that cause problems for re-hire later. It might be part of a lawsuit-prevention effort.

Your post uses good facts and logic except that I don’t feel that a higher minimum wage or expanded benefits would have the same impact as UBI in discouraging people from taking lower wage jobs. The economy and society have done better when workers share of GDP (or corporate income) is higher (whether it is causative or not is somewhat open). I think that the major problem in our country at the moment is increasing workers share of income in a way that doesn’t distort the economy too much. Once could argue that high marginal income tax rates on high earners doesn’t hurt (historically it didn’t) but overall tax rates were lower and capital couldn’t move as easily then. I think a better way would be to either provide certain services (such as health care, child care, and education) at a subsidized rate which would allow a much better standard of living on the income that most people have now or to expand the use of the earned income tax credit (I like this one because it rewards those who do work although one can argue that it also rewards those who pay low wages). What I don’t see is any serious policy analysis. Spraying money at the problem has one of the least likely chances to work. I am not opposed to paying higher taxes but I would at least like them to have a chance of making the situation better.

Well, maybe just maybe they should pay more, offer health care, etc.

I forgot where I read it (maybe here!) that Western European democracies shake their heads about our private health care setup and socialized home mortgages…