Here’s what we’re reading and working on this week at Epsilon Theory.

To receive a weekly full-text email of The Zeitgeist, please sign up here. It’s free, and your email will not be shared with anyone. Ever.

What’s Happening in the Chinese Financial Sector?

I think the blow-up of Chinese asset manager Huarong ($42 billion in outstanding debt!) and the recent tightening of Chinese monetary policy are the biggest stories that NO ONE is talking about.

Here’s a Bloomberg article on Huarong. It’s a classic fraud like Greensill, only much bigger. The Chairman/CEO was executed (!) in January for his crimes, and now the company has suspended its earnings report. Huarong bonds are trading at 52. LOL.

Huarong Debacle Highlights Problems at Hundreds of Chinese Banks – Bloomberg

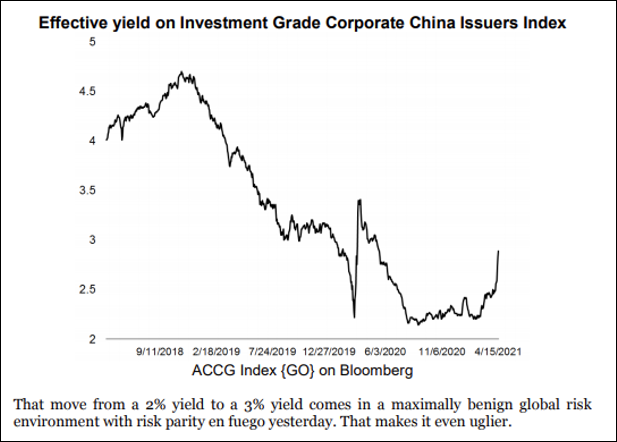

As for China tightening and IG spreads widening, I’m shamelessly stealing this chart of the effective yield on China investment grade credit issuers from a note ET contributor Brent Donnelly wrote last Friday.

Money quote: That move from a 2% yield to a 3% yield comes in a maximally benign global risk environment with risk parity en fuego yesterday. That makes it even uglier.

Fact check: TRUE.

Stock Trading by US House Members

ET Pack member Brad forwarded this website that focuses on stock trading by US House Reps. Some crazy data here, like the fact that Gilbert Cisneros made nearly 700 separate stock trades in 2020 in his PA. LOL. Talk about a degen.

https://unusualwhales.com/i_am_the_senate

Economics in Nouns and Verbs

An academic paper by W. Brian Arthur at the Santa Fe Institute. As the Pack member who recommended this to me described it, “a small rewiring of my brain happened when I read it.” https://arxiv.org/abs/2104.01868

“Standard economic theory uses mathematics as its main means of understanding, and this brings clarity of reasoning and logical power. But there is a drawback: algebraic mathematics restricts economic modeling to what can be expressed only in quantitative nouns, and this forces theory to leave out matters to do with process, formation, adjustment, creation and nonequilibrium. For these we need a different means of understanding, one that allows verbs as well as nouns. Algorithmic expression is such a means. It allows verbs (processes) as well as nouns (objects and quantities). It allows fuller description in economics, and can include heterogeneity of agents, actions as well as objects, and realistic models of behavior in ill-defined situations. The world that algorithms reveal is action-based as well as object-based, organic, possibly ever-changing, and not fully knowable. But it is strangely and wonderfully alive.”

When I read the abstract for this paper I thought it might be awful, but it’s actually VERY thought provoking and has a lot of links to narrative theory. And yes, there’s an ET note on that:

We’re Doing It Wrong

The market is not a clockwork machine.

The market is a bonfire.

The Bear Case for Inflation

Here’s the Q1 2021 Hoisington letter, hot off the press: https://hoisington.com/pdf/HIM2021Q1NP.pdf

I like Lacy a lot. But I think the long bond is his hammer and everything becomes a nail. Specifically, I get the debt trap concern, but I think this is mechanistic and tautological (over a long enough time period), so that you end up minimizing/downplaying expectations, Common Knowledge, and more pressing macro factors, like a reversal in globalization.

Volatility Suppression and You!

And finally, a full thread from the ET Forum this week …

@Spotgamma has a *great* post up that I think would be of interest to the pack. *IF* they are correct, when the current volatility suppression regime has its inevitable hiccup, it’s going to be quick & violent. To the downside. https://spotgamma.com/remember-gamma-squeezes/

Key takeaway: “This implies that the cost of buying options is cheaper relative to any point this quarter, and likely since February of ’20.”

Would love to know what the pack thinks. I am in agreement with spotgamma & am looking for reasons why they are wrong. I can’t find any, which concerns me that I’m missing something obvious.

Paul

Interesting. Intellectually, I understand the dynamics of options trading, but like all equity-focused PMs I am actually just an options dilettante. I don’t have a good “feel” – or any feel at all, really – for immersive options trading, so I don’t know if gamma squeezes are for real or if they’re the slightly more cerebral equivalent of the risk parity boogeyman that gets trotted out whenever markets go down for whatever random-walk reason.

Ben

I trade options as a pro for a small boutique fund. First, I concur with Ben that so called “gamma-squeeze” might be the most suitable ex-post Narrative justification for sudden, unexpected rally or dip after they happened. Recently they have also become the hallmark of some well-known head quants like Nomura’s Charlie McElligott or JPMorgan’s Marko Kolanovic who can be legitimately regarded as trustful “missionaries” in the Street. Secondly, it is still true that under certain circumstances – for instance in coincidence with monthly or quarterly multiple technical expirations- such forced buying or selling by dealers around some key flip-from-positive-to-negative Dollar Gamma levels can be able to throw the market over the cliff by a sort of self-fulfilling prophecy mechanism. Just my two cents though.

Bob

I have nothing to offer on the dynamics/mechanics of options per se. I do have a view on what it means to have an exploitable feature of a game come into the common knowledge of a crowd intent on disrupting the established order.

Whether it was directly, indirectly or not at all caused by the options play – the power of the Options Artefact has become legend and many new, creative minds will be looking at options and their underlying leverage, not in accordance to the established lore, but as a new toy/weapon to deploy in creative and unusual ways.

My expectation is that over the next 12-24 months we are going to see some unexpectedly creative uses of systemic hidden leverage by the r/wsb crowd in an effort to mess with the system. If my experience in prior MMORPGs is at all relevant (and I think it is) – god help the system. Its in for a wild ride.

Zenzei

Yes, this is OUR Pack.

Every item in this email is a discussion thread on the Epsilon Theory Forum – a safe space to speak your mind, a safe space to find like-minded truth-seekers. We’re not crowd-sourcing ideas for being better investors and citizens, we’re pack-sourcing them.

Clear Eyes. Full Hearts. Can’t lose.

Watch from a distance if you like, but when you’re ready … join us.

“I like Lacy a lot. But I think the long bond is his hammer and everything becomes a nail.” This 100%. Focusing on velocity had them on the right side of the post-GFC inflation debate, but I think it’s telling the letter never even mentions MMT. That simply changes the game of reserve creation - it’s actual not imagined monetization.

I was a bit behind on the Huarong situation. Thanks for the update. This week’s Odd Lot’s podcast https://www.bloomberg.com/news/audio/2021-04-18/john-hempton-on-what-it-s-like-to-short-right-now-podcast interviews John Hempton. The key element they focus on is that in the midst of volatility suppression and liquidity support we are seeing financial firms blow up. Greensill and Archegos run into trouble when policy conditions are historically easy. We can add Huarong to that list. If one can’t maintain a fraud or heavily leveraged portfolio now, in the best of conditions, it suggests profound fragility. I can’t imagine what goes silly when policy support begins to be withdrawn.

I agree completely, but will point out that Lacy mentioned MMT a year ago (Q1 2020). Here is what he said: “For the Fed to engage in true MMT, a major regulatory change to the Federal Reserve Acts would be necessary: the Fed’s liabilities would need to be made legal tender. Having the Treasury sell securities directly to the Fed could do this; the Treasury’s deposits would be credited and then the Treasury would write checks against these deposits. In this case, the Fed would, in essence, write checks to pay the obligations of the Treasury. If this change is enacted, rising inflation would ensue and the entire international monetary system would be severely destabilized and the U.S. banking system would be irrelevant.” In essence his position is that MMT can’t happen. I disagree, because it seems politically inevitable to me. I suspect Lacy’s equations will be correct until the game changes, at which point he will be hopelessly late.

Agree. MMT will happen. We just aren’t sure of the precise means (or cool name) that will be used.

A note on the China stuff - listen to Ben 10x more than any bank. The conflict is obvious but I also found it amusing what MS put in writing and what they didn’t. Their report was “We do not expect Huarong to cause systemic risks.” When it was forwarded to me the summary was “we think Huarong is TBTF and the government is engineering volatility to mitigate moral hazard.” Neither comment appears in the report. Maybe this isn’t the event, but when it comes, you can bet your life the Street will whistle past whatever it is.

Is there an alternative explanation: It this just normal background noise of company failures?

How many similarly sized financial companies are there? We have three that have blown up, two involving fraud (Does the fraud really mean that the failed some time in the past, and the failure has been hidden for a time?). Do these three failures teach us something systemically significant, or is 3 blowups out of N finance companies of that size par for the course?

Note we are talking about China + USA at least. If you consider China+USA how many finance companies of that size are there? i.e. is N = 10, or 100, or 1000, or 10,000. If N=100, is 3 companies failing, two involving fraud, just normal background noise, or is it 3 dead canaries in the coal mine (i.e. time to evacuate)?

Perhaps other readers can help us understand if this is signal or if this is noise.