Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

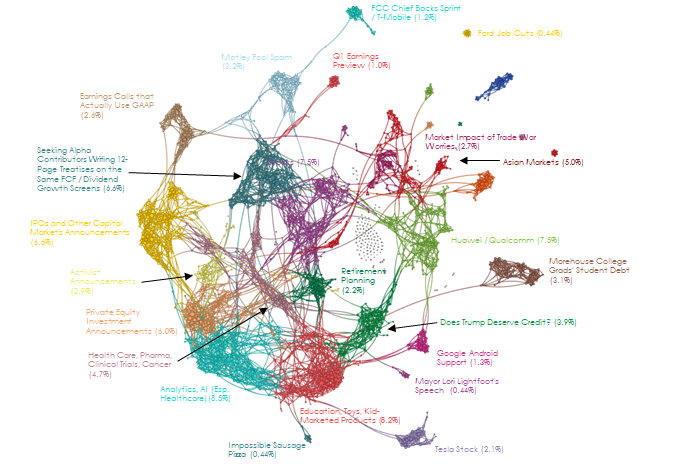

May 21, 2019 Narrative Map – US Equities

Washington’s Huawei reprieve triggers relief rally in bruised EU chip stocks [Reuters]

Shares in European semiconductor companies, one of the most sensitive sectors to the global trade tensions, recovered from their worst day in 4-1/2 months on Tuesday after the White House backtracked overnight on tough limits on China’s Huawei.

If you’re playing this game out of necessity … my condolences.

If you’re playing this game out of choice … you’re nuts.

Rise in CMBS IO Loan Issuance Surpasses Pre-Recession Levels, Worrying Some in the Industry [NREI]

Competition that is fueling a spike in interest-only (IO) loan issuance is drawing mixed responses from industry observers. Some view the spike as a worrisome rise in risk that could come back to bite borrowers if 10-year loans mature in a higher interest rate market. Others see IO loans as an opportunity for borrowers to take advantage of healthy lender competition for high quality deals.

Things you see at a top …

Institutional Investors Think They’re Ready for the Next Downturn [Institutional Investor]

Eighty-seven percent of the 75 institutional investors surveyed by Wilshire Associates say they are more or “far more” prepared for a bear market than in 2007, according to a statement Monday from the consulting firm. About 95 percent of investors are at least “somewhat confident” in their readiness to steer through market volatility, while 39 percent feel “very confident,” Wilshire said.

And they’re right.

Not because they’re doing anything special or have any new awareness, but because central banks Will. Not. Allow. a 2008-style deflationary crisis to exist.

Everyone always prepares for the last war …

The Shocking Number of Americans Without a Retirement Account [Fox Business]

According to the Aspen Institute, close to 6 in 10 working-age Americans do not have a retirement account. Sadly, the Aspen Institute also warns that things are likely to get worse due to the changing nature of work.

“Sadly.”

The American worker is the proverbial boiled frog. Or Milton from Office Space. Same thing.

And yes, there’s an Epsilon Theory note for that. First read this:

And then read this:

Money quote:

Over the past eight years we have thrown our money into relatively unproductive activities (experiential consumption), and we have thrown our bodies into relatively unproductive jobs (experiential production).

It’s as if we’ve intentionally returned to the recommended farming practices of Cato the Elder in 200 BC, where instead of a tractor with a 43 horsepower engine to get the work done, we’ve got “a foreman, a foreman’s wife, ten laborers, one ox driver, one donkey driver, one man in charge of the willow grove, and one swineherd”. Because god forbid we miss out on the experience of being a swineherd. Hey, with modern technology, you can

drive for Uberherd swine whenever you like. Just imagine the personal satisfaction, not to mention all that extra cash, that comes with “being your own boss” as an on-demand swineherd.It’s as if we’ve intentionally returned to the recommended farming practices of Cato the Elder because it IS intentional.

Why High-Class People Get Away With Incompetence [New York Times]

In several experiments, researchers found that people who came from a higher social class were more likely to have an inflated sense of their skills — even when tests proved that they were average.

It’s the only possible outcome of the Lake Wobegon effect … where all of our children are above average. Now they’ve grown up believing that.

Not that we were necessarily considered “high class,” but my parents’ most common refrain growing up was, “Life ain’t fair and you ain’t special.” Seems like a message more kids would benefit from hearing.

Remember, you’re unique, just like everyone else.