Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

May 20, 2019 Narrative Map – US Equities

Planning to irrigate arid lands with produced water [Albuquerque Journal]

Encore Green Environmental is jockeying to become the first company to recycle oil-and-gas wastewater to irrigate arid lands in New Mexico.

The Wyoming-based company has developed a patent-pending process to identify all ingredients in oil-and-gas effluent, known as produced water, before sending it on for recycling. Through the process, the company tests and documents all changes in chemical content during treatment to assure compliance with regulatory standards. And it does detailed analysis of soil content and moisture levels in targeted arid areas to make sure recycled water matches the conditions and requirements of soil and vegetation before irrigating.

I have no idea if this is on the level or not. But I have a very strong idea that the ONLY solution to the environmental debacle that humankind is perpetrating on the Earth will come from procedural and bottom-up technological advances like this. Not from someone inventing cold fusion. Not from government-sponsored moon shots. But from new twists on old ideas, motivated by people wanting to do well for themselves by doing good for all of us.

Bonds aren’t a set-it-and-forget-it investment. Here’s what you need to know. [USA Today]

It’s an infomercial from Ken Fisher, who would famously rather die and go to hell than sell you an annuity, and who is a fairly profoundly weird dude. But he’s not wrong.

Today, your long-dated government bonds are a core holding. They should become a tactical holding.

I don’t mean that you sell them tomorrow. I don’t mean that you sell them next week or next month or next year. In fact, if we get a deflationary shock from a Fed-driven recession, a China-driven global credit freeze or an Italy-led Euro crisis, you’re going to want to buy more. This “tactical holding” will be a very large chunk of your portfolio. But make it a tactical holding. Make it something that you are willing to sell. Without hesitation. Without losing your nerve.

Save the Buyback, Save Jobs [Journal of Applied Corporate Finance]

Too Many Companies Are Paying Too Much for Stock Buybacks [Fortune]

Booking Holdings Is Gobbling Up Stock [Seeking Alpha]

I’m not going to give any quotes from these articles, because there’s nothing here you haven’t read umpteen times before. My point here is that whatever you might think about stock buybacks, it really doesn’t matter what you think.

This is now an issue dominated by Common Knowledge – what everyone thinks that everyone thinks.

Uber, Lyft and Pinterest prove that private investors are sucking up all the value [CNBC]

Marc Andreessen called “the effective death of the IPO” in 2014 and said that with high-flying tech companies staying private longer, “gains from the growth accrue to the private investor, not the public investor.”

Fred Wilson of Union Square Ventures told CNBC the following year that these late-stage IPOs mean “all of the gains are captured among a very small cohort of people.”

In 2016, Alex Mittal of FundersClub wrote that today’s top tech companies are raising gobs of private cash, “leaving the bulk of returns out of public investors’ reach.”

These are the very people that benefit from companies who stay private longer while their valuations skyrocket, because they’re the early investors. They get to ride the valuation up from the millions to $10 billion, $20 billion or $50 billion and then sell their shares to the masses of public market investors who are thirsting for the next Amazon or Google.

The headline is hyperbolic and silly, but what Andreessen and Fred Wilson are saying is not.

What’s the dominant institutional investment narrative today?

Private > Public

It’s really as simple as that, and there are zero signs of this abating or reversing. On the contrary …

Schools Teach Civics. Do They Model It? [Education Week]

But by late 2017, seniors at the high school had grown frustrated by the school’s limited extracurriculars, lack of spirit activities, and punishments for late homework. Inspired by pro football player Colin Kaepernick’s widely covered “take a knee” protests, they decided to press their case through a small but significant act of civil disobedience.

During morning assembly on Sept. 28 of that year, the school’s 15 or so seniors sat down quietly, rather than recite VPA’s “challenge,” a pledge in which they commit to do their best for “myself, my family, my school, and my community.” Some lowerclassmen followed suit.

“We just didn’t like how we were being treated,” recalled Beverly Felipe, a student plaintiff in the lawsuit. “It was very unfair. We wanted some change in the school and we were hopeful that it was going to happen.”

Punishment for late homework! Lack of spirit activities! The horror!

This article gets it all wrong of course. The school’s response in bringing down the hammer IS the teachable moment. And a good one, too.

Know who else talks like this? The guy in the White House.

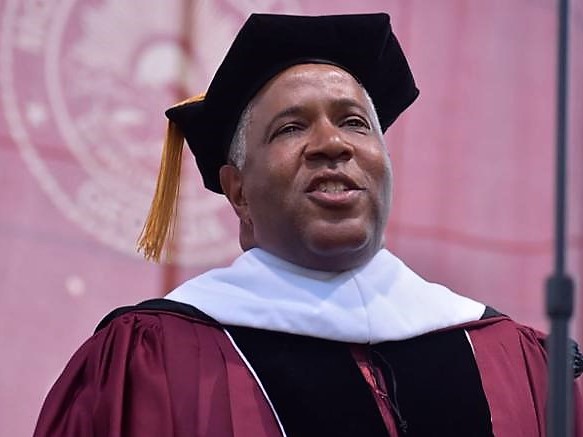

It was already a proud day for these new college graduates. Then a billionaire told them he’s paying off their student loans [CNN]

Of course I love what Robert Smith did!

My favorite part is the pressure this puts on other billionaires when they get an invite from alma mater.

Then again, most billionaires are high-functioning sociopaths, so they truly believe that their words and moving speeches are reward enough for graduates.

“But from new twists on old ideas, motivated by people wanting to do well for themselves by doing good for all of us.”

That sounds a lot like Adam Smith’s invisible hand or - horrors to any college grad in the last twenty years - capitalism.

Regarding the high school - many colleges who have face student “protests” over the past several years could use some of its backbone.