Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

May 2, 2019 Narrative Map – US Equities

Facebook’s privacy push puts Messenger in the spotlight – but pitfalls abound [Fast Company]

Messaging apps are by nature places for more private interactions than open social networks. But will users trust Facebook to facilitate those experiences? And will Wall Street let it?

No and no. #SavedYouAClick

VEON Reports Good Q1 2019 Results [Press Release]

Best. Press. Release. Headline. Ever.

Building Unlisted Infrastructure Into Your Portfolio – Overcoming 4 Key Obstacles [Seeking Alpha]

Obstacles to investing in unlisted infrastructure

We see four categories of challenges that investors face throughout the lifecycle of creating and managing a private infrastructure allocation:

Constructing a diversified portfolio

Maintaining exposure

Handling the ongoing operational burden

Investing with discipline and flexibility

Each of these obstacles introduces execution risk and requires specialized capabilities to get right. Some investors have sufficient resources and skills in-house, but for those who don’t, leaning on the private-markets capabilities of an experienced third party may make sense. A skilled third party can streamline these challenges to establishing and maintaining a fully invested, diversified portfolio that is managed in real-time.

I wonder if Russell Investments is a skilled third party that can streamline these challenges for me?

Serious question, and I know that ET has a lot of readers at the asset management firms that place this sort of “content” … does this idiocy work? Ever? Does it generate a single new client or a dime in new revenue?

I’ve come to believe that hiring a team of “content specialists” and publishing claptrap like this is an intentional inefficiency. It signifies that you are such an important and well-established asset manager that you can afford to waste money publishing material that NO ONE reads or cares about.

Content placement is like the elaborate plumage of the male frigate bird. It is SO wasteful and extravagant that – in an economically perverse way – it demonstrates your evolutionary fitness.

I honestly think that’s the reason this stuff exists.

Apple eyes $1 trillion valuation as strong services, revenue forecast fuel comeback [Fox Business]

Top Apple analyst: The surge in services is not enough because 75% of Apple’s business likely to decline [CNBC]

Ditto for why the sell-side still cares about II ratings and “who’s the ax?” and all that stuff that hasn’t mattered for 20 years.

It’s plumage.

The Deadly African Virus That’s Killing China’s Pigs [Washington Post]

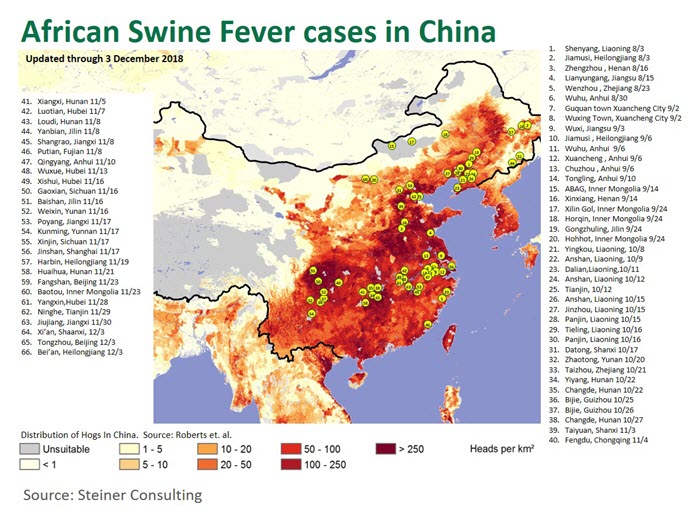

A deadly swine disease is spreading across eastern Asia, infecting thousands of pigs and threatening the world’s largest hog industry. Since emerging in China in August, African swine fever has been detected in neighboring Mongolia and Vietnam, increasing the chances of transmission to other countries. The first outbreak in Cambodia was reported in early April in backyard pigs, about 10 kilometers (6 miles) from the Vietnam border.

That’s through November 2018.

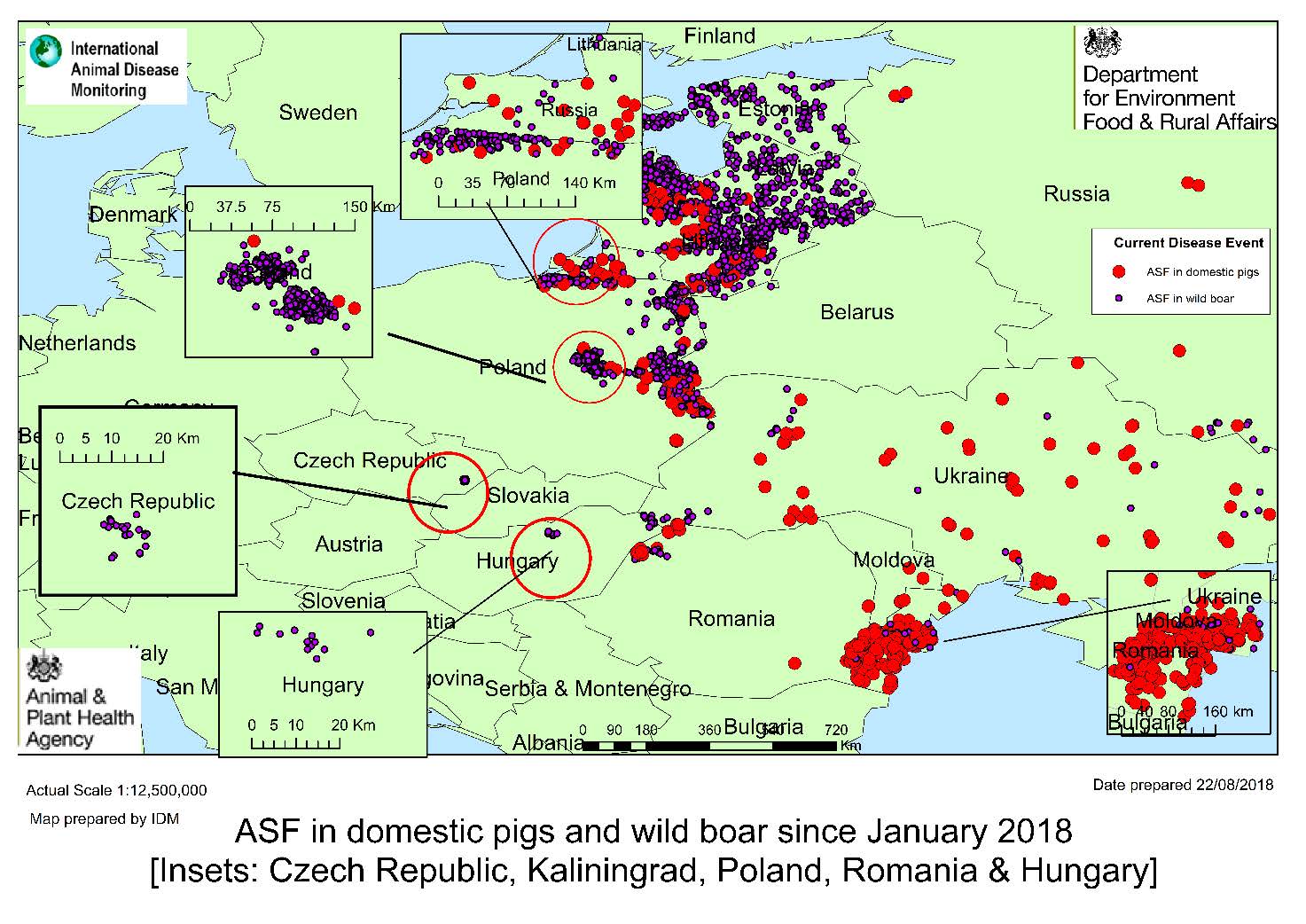

And this is not just a China and Vietnam thing. Here’s an August 2018 map of outbreaks in Central Europe. It’s worse now.

This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper.

Start the discussion at the Epsilon Theory Forum