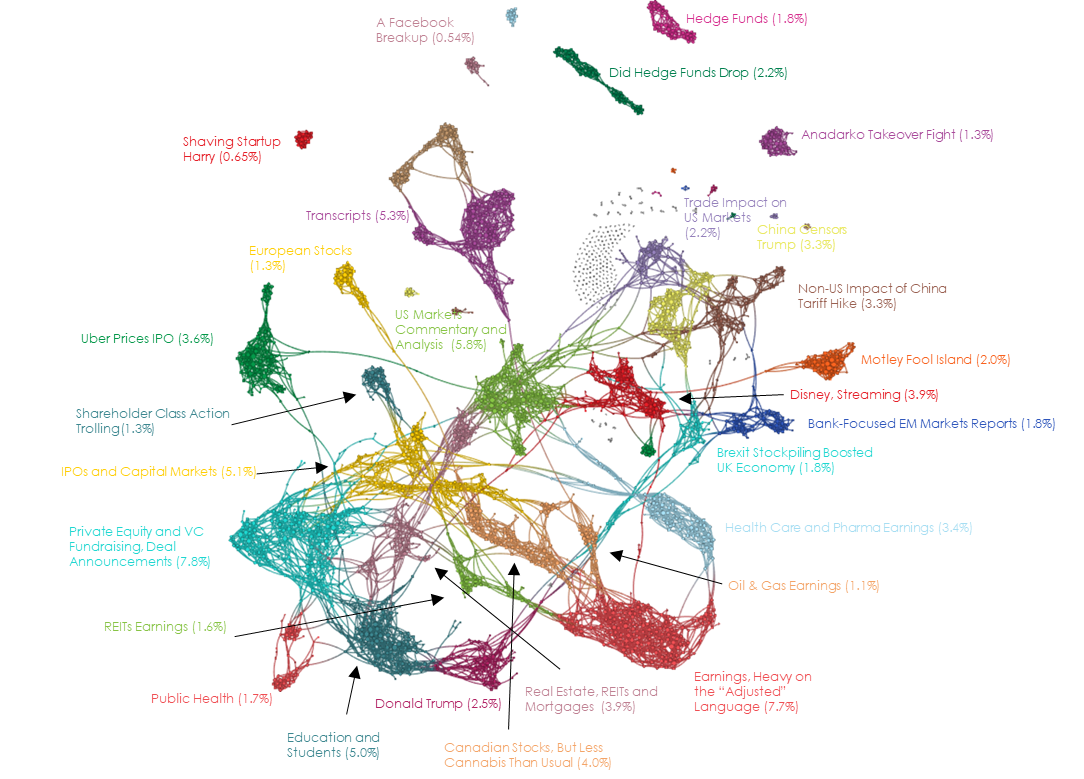

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

May 10, 2019 Narrative Map – US Equities

Coworking Ecosystem & Crowdfunding Platform Announce Partnership [Press Release]

Digital Asset Monetary Network Co-Founds Marketing Services Firm for Reg A and Crowdfunding Ventures [Press Release]

Back in the distant past when there were people in our industry called value investors (if you’re under 30, you’ll have to ask a coworker born before 1990), it was common to hear them wax eloquent about companies which had found an ecological niche inside the coverage gaps of larger industries and fully scaled competitors. It wasn’t whether your hedge fund was long a dental supply company, you see, it was whether you liked PDCO or HSIC more.

Coworking and crowdfunding occupy exactly those kinds of ecological niches, emergent in response to the resource availability-skewing dominance of commercial real estate and DCM/ECM/VC conventions. These are not realistic scale plays. By any historical analog, they should be very interesting, higher-than-big-cap-comp ROIC businesses, maybe even trading at interesting valuations.

That was, of course, until we discovered the cost-of-capital reducing magic of riding the valuation coat-tails of venture tech narratives. This now trendy tactic is, perhaps, irritating to those nostalgia-porn addicted stalwarts who still call ourselves value investors, but it may be the only benign influence of the zeitgeist-transformation of capital markets into public utilities. With obvious exceptions, the people who have been pushed out on the risk curve, who are now taking even more insane risks in entrepreneurial ventures on the basis of these narratives – or occasionally on the basis of some fundamental belief in actual disruption – are the people who can most afford to bear them. It’s a good thing. Even if we think what they are doing is stupid, the people who sink their effort, reputations, capital and time into an entrepreneurial venture make the whole system work. It’s the other side of the coin from our concerns about financialization and the lack of incentive for public companies to reinvest in growth.

Or in other words, as is so often the case, Taleb’s not wrong. He’s just an asshole.

Wall Street Dusts Off Trade-War Battle Plan Now All Bets Are Off [Bloomberg]

When I say that the ol’ fire your guns at the ground and tell ’em to dance bit is one of the oldest tropes in the book, I mean that literally. It comes straight out of one of the earliest, most influential, most ‘anatomically modern’ films ever made: 1903’s Great Train Robbery.

And that’s exactly what this is.

Dusting off the battle plans? Hell, these hedging strategies, baskets and tactical trading approaches haven’t even been moved from that folder on our desktop to our personal network storage drives in the monthly purge we do so that IT doesn’t bark at us. You may not know the odds of the Game of Chicken that is the US/China Trade & Tariffs war, but I hope you know the odds that financial media will do their part to support the ecosystem that feeds on our collective aversion to inaction in the face of incalculable odds.

Investors pull more than $20 billion from stocks on ‘trade deal trauma’: BAML [Reuters]

Trauma! So we’re breaking out the big guns on language after we’ve had a couple days of completely normal volatility. I guess that means it’s time to play our favorite game: Who’s Going to Blame Risk Parity First?

The winner usually comes in the week following the volatility, but since it has become such a popular game, triggers have gotten a bit looser. So do we have a winner yet? Did someone jump the gun?

Yes! Two people!

Our search of the Newsdesk database shows a number of articles referring to “risk parity”, “risk targeting” or “vol targeting” this week, most of which are reprintings of comments made by AQR’s Cliff Asness about factor investing performance. The first of the two articles which mention it in context of volatility-blaming comes from Justina Lee at Bloomberg; however, her article shoots down the theory. So by default, the award this drawdown goes to Nomura’s Charlie McElligott, whose Wednesday morning note got picked up by ZeroHedge.

Congratulations! You Blamed Risk Parity First!

My Cousin Was My Hero. Until the Day He Tried to Kill Me.; Feature [NY Times]

I don’t have much to say about this article, although I’ll leave you to consider why this scored so high on its interconnectedness to the language in all financial markets news stories from the last day.

What I do have to say is that I’m glad the NY Times has started flagging its articles as Features, at least in its database feed. Press insiders who care about its integrity and the critical role it must play in a free society should be demanding the clear, unequivocal marking of opinion, analysis and feature journalism by all outlets. It doesn’t go anywhere near fixing the problem of Fiat News, but it’s a good step.

How Today’s Tech I.P.O.s Differ From Those of the Dot-Com Boom [NY Times]

This is not a terrible piece in the aggregate, but the statement above is not something that belongs in a news report. It’s a near-verbatim parroting of the right-sounding Cartoon that’s being promoted by the management teams and banks running these processes. They have had more runway to figure out how to get BIGGER, and all of these parties have an interest in us equating that abstraction with “figuring out sustainable business models.”

Unless we’re all capital-markets-as-utilities advocates now, and “continue to raise capital at shockingly low costs ad nauseam to finance profitless top-line growth” IS a sustainable business model. From a founder’s perspective, maybe there’s not a difference.

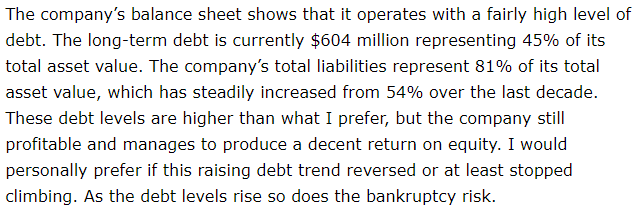

Fair Isaac Is Profitable, But Its Debt Is Climbing And It’s Expensive [Seeking Alpha]

So meta.

Part of the reason this piece – a pretty standard Seeking Alpha blog – is more connected to the aggregate narrative right now is the broader discussion about progressive politicians’ proposals to institute usury-style caps on chargeable rates.

It’s an issue that Ben and I disagree on from a practical (read: policy) perspective. But we sit in agreement on the core problem.

If you wandered into an off-brand car dealership in 2004 or 2005 and had a sub-600 FICO, chances are that one of the rates offered to you came from my desk. Well, the buy rate did, anyway. The finance guy at the dealership probably bought it up 100-200bp without telling you. There’s one exception: if you lived in Arkansas, you probably didn’t get a rate from me. Why?

Because the Arkansas Constitution wouldn’t let us charge as much as we felt we needed to to compensate us for the credit risk (and as years that followed would indicate, even what we were charging probably wasn’t enough). There is no doubt in my mind that the market-clearing, risk-appropriate price for unsecured – or kinda/sorta secured, like auto – debt for many consumers is well into the high 20s and above. My libertarian predisposition is to say, ‘Let people be adults and burn their hands if they want to.’

But I’ve also seen – no, built – the economic models supporting this kind of lending. You do not enter in with the expectation that you will be paid back principal. You enter into the average loan with a significant portion of your expected return in the form of recoveries. You are pricing in the dear cost of brutal collections and servicing agents. It is an inherently ugly and cruel practice, entered into with the one-sided expectation that it will very likely end in ugliness and cruelty.

Is it uglier or crueler than denying the availability of that credit by statute? I still come out to “No.” I can’t stomach denying capital to anyone who wants to bet on themselves. I think Ben comes out to “Yes”, and he’s got damn good reasons for it. After all, the cruelty of this kind of lending isn’t a theoretically possible outcome – it’s embedded as a fundamental component of the model. But Ben and I are really close friends, and we trust the other’s heart and mind implicitly. We can talk about this stuff.

Outside those circles? Well, like the Myth of College, this is an issue made almost impossible to discuss and debate in good faith by the Widening Gyre.

Rusty, I have to respectfully disagree with your last point. I don’t believe this is one of those impossible to discuss issues like the Myth of College. I think the issue of legislating caps on lending rates can be discussed in good faith because it can be debated as a policy issue whereas higher education cannot.

In fact, I think it’s an ideal topic to debate in this Widening Gyre precisely because it returns our political discussion back to policy and back towards the fundamental principles that our political beliefs are based on.

I generally refrain from talking about “politics” as a topic of conversation. When I do, I try to discuss philosophy and beliefs in relation to political issues. It’s not easy to do anymore, but this used to be what political conversation meant. How do we get back to that?

That’s exactly the argument I make in this piece (https://www.epsilontheory.com/before-and-after-the-storm/). There’s no question in my mind that we should, or that we are.

I’m just making the observation that I see the seeds of the politically convenient abstractions in this topic that permit those not acting in good faith to paint one side as economically illiterate socialists and the other as cruel, sadistic monsters. Those committed to good faith - and with a willingness to lose, because it will feel like we are losing the argument - should continue their efforts all the same.

I was chuckling about the Kevin Bacon pic and, then, it hit me, Bacon actually “won” that game of chicken not by having more “guts,” but because his shoelace got caught in the pedals and he couldn’t get off the tractor.

It isn’t clear, but it appeared that Bacon was trying to, or was considering jumping first, but he was stuck. Meanwhile, his competitor, who appeared to have more staying power, did quit when he saw that Bacon wasn’t going to.

So, not only were there no fundamentals to put odds on, you couldn’t even bet - in this one - based on your belief in one or the other’s character (or, as Ben said back in his 2015 ET piece on the game of chicken - their “will and intent:” https://www.epsilontheory.com/inherent-vice/).

If you believe the NYT (yes, I chuckled at the absurdity of that too), then Trump changed his tactic as he, during the China-trade “game,” saw an opportunity to leverage his trade “toughness” for the 2020 campaign - he tied his own shoelace to the pedals, what were the odds of that?