Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

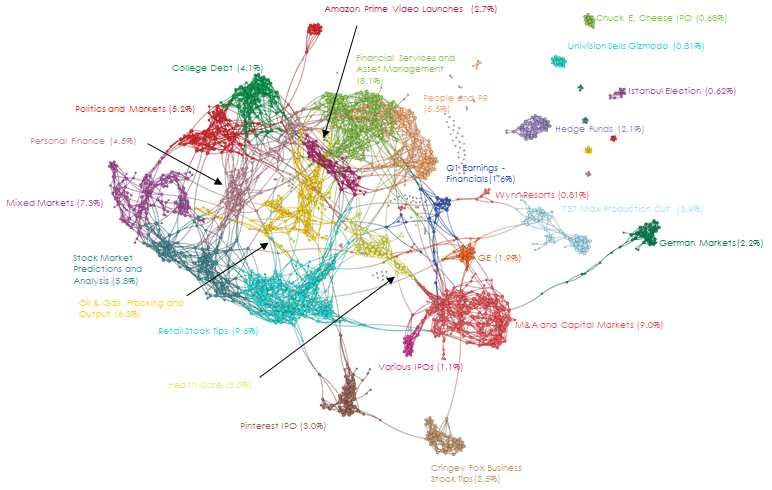

April 8, 2019 Narrative Map – US Equities

Here’s what does (and doesn’t) drive mortgage rates [Bank Rate]

If I were a betting man (and I am), I’d put a significant wager on the proposition that a similar mortgage primer written pre-GFC would not have mentioned the Fed at all, or at least would have had the Fed way down on the list.

Whatever you think about the Fed’s real-world power, you can’t deny the Fed’s narrative-world power.

It’s the narrative of Central Bank Omnipotence – that ALL market outcomes, good or bad, are the result of Central Bank policy – and its growth over the past decade in narrative-world is unlike anything I’ve ever seen in a professional career of studying this stuff.

The Fed is now at the top of the American Gods pantheon. They’re a classic Sun God.

Impact Partners BrandVoice: The Truth About Indexed Annuities And Market Risk [Forbes]

This is not a comment about indexed annuities and market risk, as exciting as that might be to Ken Fisher. This is a comment about the fresh hell that is Forbes Brandvoice.

Apart from having creepy eyeballs in the imagery, the point of Brandvoice is to eliminate once and for all that pesky line between editorial content and commercial content.

If you pay Forbes money, they will present your commercial advertisement exactly as if it were researched news. Not kinda sorta like researched news, but EXACTLY like researched news. It’s all just “content” to Forbes, and reporters or analysts or advertisers or marketers … they’re all just “content creators”.

To keep going with the American Gods shtick, Fiat News is a classic Trickster God.

And Forbes is their high priest.

Ecstasy and Empathy [Forbes]

MDMA is currently being assessed in two Phase III trials as a treatment for post-traumatic stress disorder. The drug’s mechanism of action consists of eliciting release of the neurotransmitters serotonin, dopamine, and noradrenaline.

Have you seen Cell, the latest Stephen King story-to-movie adaptation? It’s a really terrible movie. I also can’t stop thinking about it.

The Nudging State and Nudging Oligarchy are coming for your neurotransmitters.

I think maybe they’ve already got ’em, but I also think that we ain’t seen nothing yet.

How Can I Teach My Great-Granddaughter to Be Charitable? [New York Times]

I have an 8-year-old great-grandchild. I would like to help her develop a sense of charity. If I were to give her $40 per year to donate, how should I present the options to her, without overwhelming her?

Were I to show her images of starving Yemeni children, homeless Americans, threatened wildlife, Syrian/Central American refugees and so on, I fear she wouldn’t be able to process such a burden of information.

I think Kwame Anthony Appiah does a great job with The Ethicist column in the NYT Magazine, and his advice here is no exception.

Charity begins at home.

So does politics and investing.

More Oil & Gas Consolidation Seen in MLP Sector [24/7 Wall Street]

Upon the transaction’s close, AmeriGas will no longer be classified as an MLP and it will become a wholly owned subsidiary of UGI.

I’ve been meaning to write about the MLP-as-an-asset-class narrative for a while now, and if I don’t hurry up I won’t have anything to write about. MLPs began their life in narrative-world as a tax play (it’s literally in the name), adopted the growth/shale narrative while that was hot, and now they’re trying to become a utility/infrastructure play. A deeper dive forthcoming …

Futures subdued as investors brace for tepid earnings season [Reuters]

NEW YORK (Reuters) – The S&P 500 and the Nasdaq edged into positive territory on Monday, with gains held in check by falling industrials as investors braced for what analysts now expect to be the first quarter of contracting earnings since 2016.

As I may have mentioned once or 200 times, I am a betting man. And I would make a very substantial wager that a month from now we will see a slew of articles celebrating the “news” that 70% of companies beat Q1 earnings expectations.

Are you aware of any government funded, paid clinical trials for Soma? Asking for a friend.

Very excited to read your longer thoughts on MLPs as I feel I’ve lost my grasp on something I (probably falsely) believed I had a reasonable understanding of.

And, yes, especially in the last week, the “earnings are going to be terrible this quarter” story has been pushed hard to the point that you can feel that the follow-up stories of “earnings are surprisingly better than expected” are all teed up to go.

Yes! But there is no placebo arm.