Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

April 8, 2019 Narrative Map – US Equities

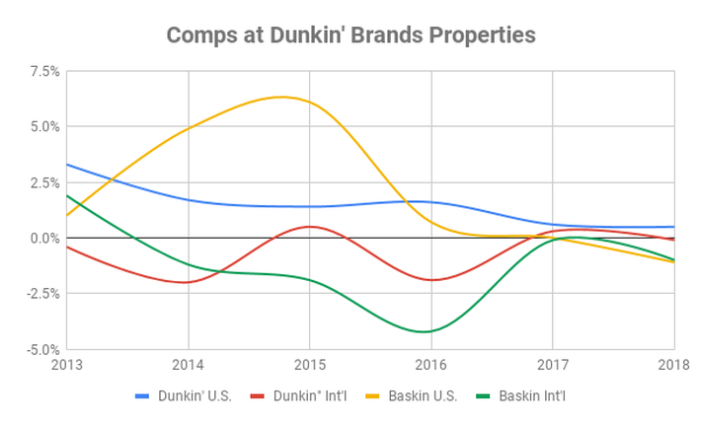

How to Invest in Coffee Stocks [Motley Fool]

It isn’t until you start really digging into the meta-data of financial media on a daily basis that you realize just how dominated these channels are with book report-style articles which mix slightly dated facts and vanilla qualitative assessments with headlines that indicate that those things are guides on how to invest.

I know, I know, it’s Motley Fool, but there’s a reason this was such an interconnected topic. There is a lot of this kind of content out there, from a lot of publishers.

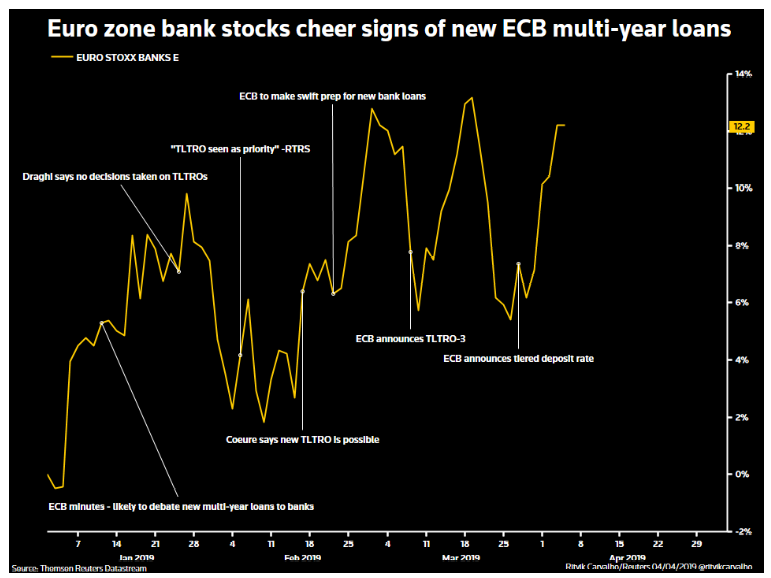

Whatever it takes, Part 2?: Five questions for the ECB [Reuters]

Anyone who caught the most recent ET Live!, and any ET Pro subscribers who have read our March monitors update know where Ben and I come out on this. The return of the central bank put is now part of Common Knowledge. We think a hawkish deviation on any of these questions would be treated as a meaningful surprise.

No, you don’t need 20 percent; How Chicago millennials are buying first homes with down payment programs [Chicago Tribune]

So stay with me here. We’re going to finance this customer in our sophisticated new lending structure, in which they’d just make the principal payments that would have been a down payment over time. No, no, it’s not a 100 LTV loan, it’s an 80 LTV loan, but where the down payment is made in installments over time…why are you looking at me like that, it’s genius!

More seriously, I am rarely certain how often the author of an article like this knows that their piece is just being used as an advertisement. This guy wants to open his origination funnel, and he found someone willing to print an ad without charging him for it. More power to him, I suppose.

Outside of the advertising portion of the piece, how about the meat of the topic? The intersection of student loan debt, housing prices and lifestyles available to Millennials relative to their parents’ generations is incredibly and consistently central to all media we review. Perhaps the only theme which weaves its way into more social, cultural and financial topics (other than pro- and anti-Trump politics) is health care and drug costs.

Namaste, Now Pay [New York Times]

This article scored near the top of our (1) list of interconnected financial services stories, (2) centrality ranking of Weekend Zeitgeist non-financial stories and (3) social engagement rankings of highly central stories over the last week. It really seems to touch a lot of nerves at once.

What I find most interesting, however, is that the response to discovering a MLM scheme is almost always the same: I can’t believe it would happen here, to something as pure as [Fill in the blank here]. Y’all, that’s the only way these things work in the first place. Can’t get your old high school friends to swallow their pride and hit you and rest of the class of 1994 up for money if they don’t believe in their heart-of-hearts that introducing you to this amazing new program is really an act of service to you.

Suspected Rhino Poacher Trampled by Elephants and Eaten by Lions in South Africa [Slate]

Something, something, circle of life.

Ray Dalio: Wealth gap a “national emergency” [CBS News]

I know we are all supposed to hate billionaires now, and yes, I think it was just as big of a meta-game gaffe for Dalio to stick his head up at this place and time as I thought it was when Schultz did it.

But I like Ray. I like Howard, too, for that matter.

Still, you don’t get to argue for the easy money / easy credit policies necessary to facilitate a beautiful deleveraging, and then go on national television to decry the most direct result of those policies as a national emergency. I mean, you get to, but not if believability is something you still care about.

Principle 31.

I’m surprised that “weak Q1 earnings” didn’t show up in the narrative map as that “story” seemed to be all over the media the past several days.

“Down payments are made over time -” great opportunity to use the best of all “The Princess Bride” quotes:

And one more on the “new” downpayment model - technology has sped everything up, even the time it takes for our society to forget the mistakes it made that led to the last financial crisis.

Just nudge it a little bit: “Ray Dalio: I play probabilities. And I would say it’s probably 60-40, 65-35 that it will probably be done badly and that it would be a bad path. But I’m saying it doesn’t have to be that way. by realizing that it is a juncture maybe we can nudge just a little bit the probabilities so that we can have a better outcome.”

I took a look.

Topically I think that you are right, but the language isn’t there yet. From what I can tell, it appears that discussions of earnings are siloed. This article about airlines, this one about Europe, this one about Alcoa, this one about Intel. There are a couple which are putting it together as what we’d call a narrative, but mostly it’s just the stuff of beat-writing right now. In ET-speak, it is very probably a high cohesion discussion (w/i sub-topics like sectors) but presently a low attention narrative in that it isn’t really influencing the overall conversation of markets in a measurable, coherent way.

Thank you. And, love the insanity of a “down payment” made over time.

I’m curious as to whether the articles that appear in the Zeitgeist are strictly chosen by QUID/AI/algorithm or is there some human discretion involved in what we see each day?

Fair question! There are three places where discretion is present. The first is in how we define the query. It’s a static query (other than the variant on the weekend), but it is inherently biased to exclude articles that don’t have the words we defined as being indicative of a “financial markets” story. We have to define our universe, and that is discretionary.

The second is that when we sort by (1) the overall connectedness of each node, (2) the interconnectedness of each node specifically to OTHER clusters and (3) social engagement, the mix we pick from each of those categories is discretionary. Usually we include a mix of all three ways of defining connectedness, but there is a discretionary element of “will people care” to deciding whether to add one more highly connected article before moving on to highly interconnected articles across clusters, for example.

The third is that we do filter (1) recurring or repackaged articles/content from prior days or (2) “broad survey” articles that are autopublished to be compendia of what’s going on across a wide variety of markets and news. In other words, ‘Morning Briefing’ pieces which are definitionally like The Zeitgeist will frequently rise to the top because of their breadth, so we will exclude those on a discretionary basis.

I think you would be safe concluding that these are all highly connected articles AND (because of the second point above in particular) that they also reflect some of our sensibilities on what connectedness is “noteworthy.”

Thanks for the great explanation. To quote St Elon, “Yes, excessive automation at Tesla was a mistake. To be precise, my mistake. Humans are underrated.”