Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

They Had It Coming [The Atlantic]

Sweet Christ, vindication!

How long has it been? Years? No, decades. If hope is the thing with feathers, I was a plucked bird. Long ago, I surrendered myself to the fact that the horrible, horrible private-school parents of Los Angeles would get away with their nastiness forever.

Schadenfreude is the second most powerful other-regarding emotion, just a tad less overwhelming than jealousy, and you’ve seen a lot of it in the aftermath of the celebrity college admissions scandal. But rarely in as pure a form as this Atlantic article. I’m not going to act holier-than-thou on this. But I will say that schadenfreude and jealousy are the primary tools of the Nudging Oligarchy and the Nudging State. You’re being played.

Here’s the ET note on other-regarding emotions, Sheep Logic:

And here’s the ET note on how I think we should try to think about the college admissions scandal, The Ministry of Rites and the Compassionate Man:

Clear Eyes and Full Hearts, my friends.

Jeffrey Skilling, Former Enron Chief, Released After 12 Years in Prison [New York Times]

True story. I graduated from Vanderbilt in 1986 and had an offer from McKinsey to join one of their practices. You know, the two-years-and-then-we’ll-pay-for-biz-school-gig. They gave me a list of practices and asked where I wanted to go. My brother was in college at Rice at the time, so I bizarrely said that Houston was my first choice, even though 1986 Houston was … well, let’s just say it was a far cry from 2016 Houston, which is actually a great city.

So I had an offer letter and a plane ticket to Hobby Field when I got a letter from the NSF that I had won a graduate school fellowship good for any school that would take me. Figuring that McKinsey could wait, I nixed the job offer and never took that flight to Houston.

For those of you who don’t know the Enron back story, Jeff Skilling was the lead partner in that Houston McKinsey practice in 1986. Skilling started consulting for Enron in 1987, developing one of the first forwards markets in nat gas, and he left McKinsey in 1990 to be the CEO of Enron Finance Corp. The rest, as they say, is history.

I’d like to think that I wouldn’t have become a Jeff Skilling acolyte. I’d like to think that even if I had become a Jeff Skilling acolyte and followed him to Enron, that I wouldn’t have followed him down the path of fraud and perdition.

I’d like to think that, but it’s not true. I know who I was when I was 22 years old, and there is no doubt in my mind that I would have burned myself on this stove. Burn? I mean incinerate.

Our lives are defined by the roads we avoid as much as by the roads we take. And more often than not, sheer blind luck is responsible for the difference.

I think about that a lot these days, especially as I watch my children grow into adulthood.

Lyft plunges below IPO price in second day [Washington Post]

I’m old enough to remember the Facebook IPO.

Netflix prices are going up [CNN]

The streaming service sent emails this week to US subscribers about a price increase that starts in their next billing cycle. It’s an increase some Netflix customers have already seen.

Netflix (NFLX) announced the price hikes in January, and said at the time that the increased revenue would help itadd more television shows and movies. The company has been rolling out the price increases over the last few months, based on billing cycles.

There’s a word for “price increases and higher wages”. But it’s a word that the Fed says doesn’t exist, so … you know … I guess it doesn’t.

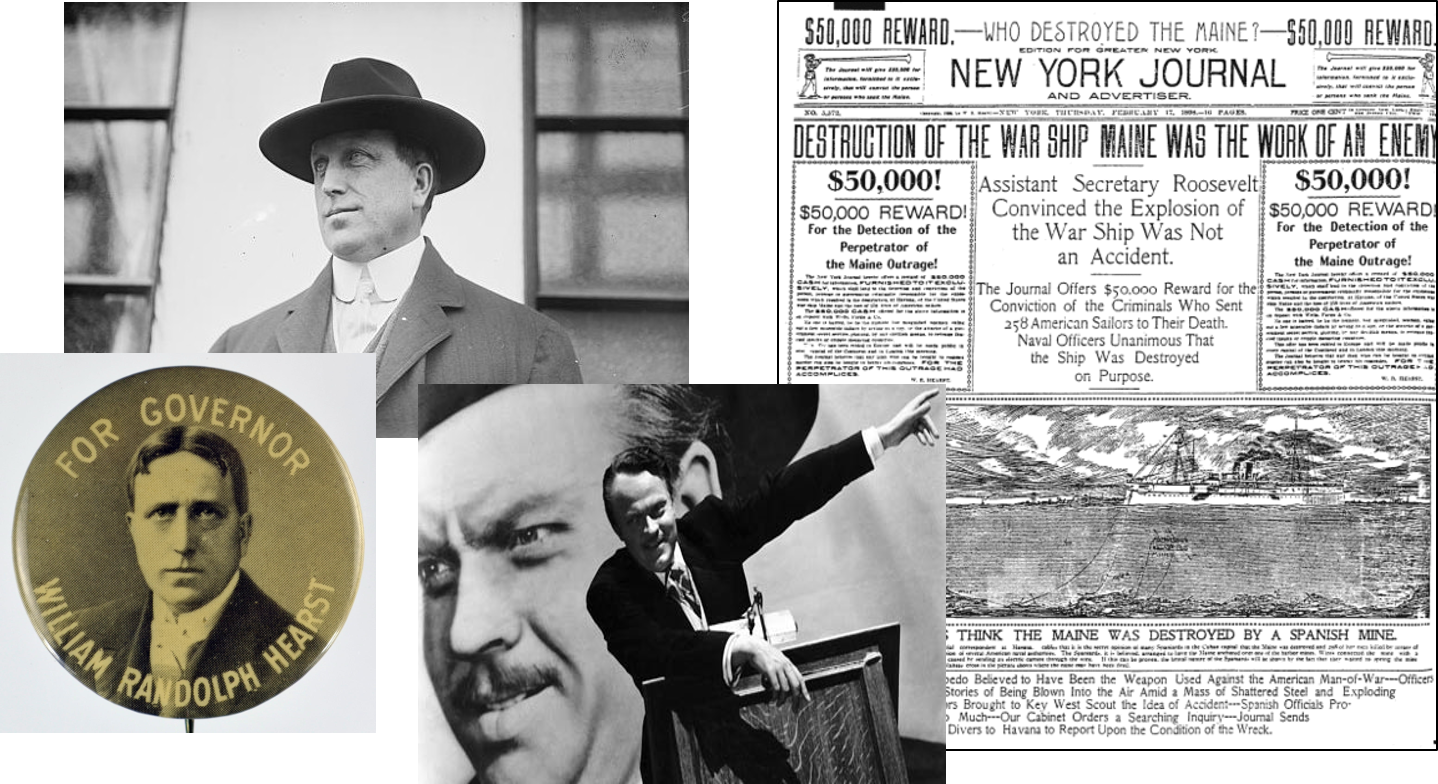

How Rupert Murdochs Empire of Influence Remade the World [New York Times]

David Byrne called it.

Same as it ever was. Same as it ever was. Same as it ever was.

Start the discussion at the Epsilon Theory Forum