Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

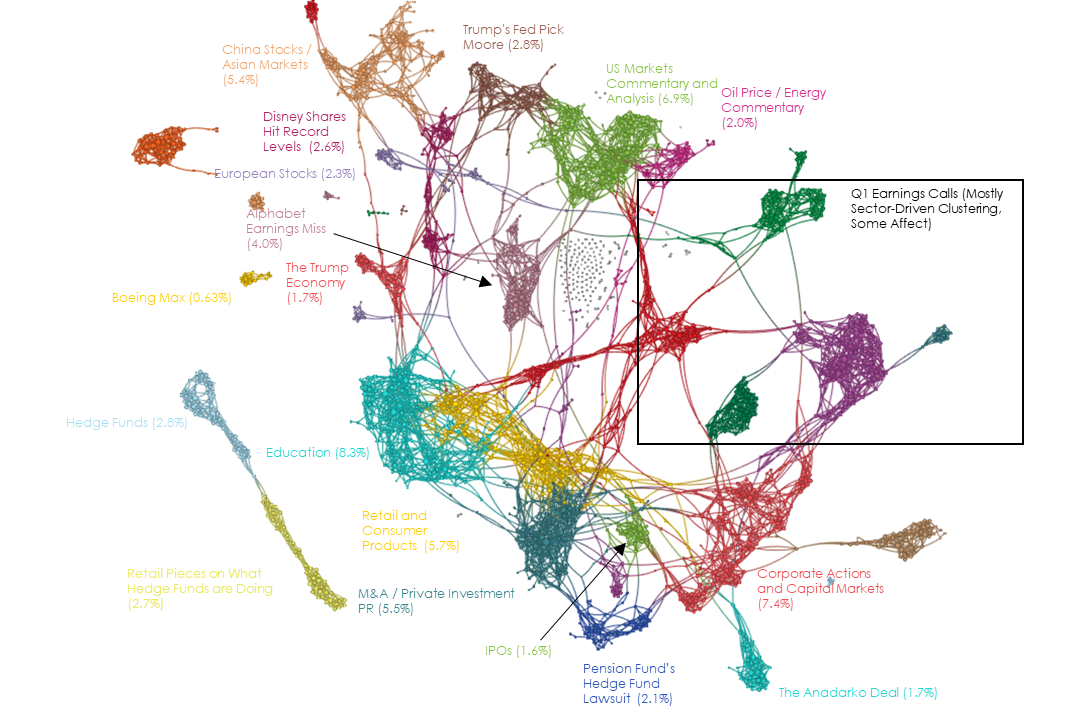

April 30, 2019 Narrative Map – US Equities

Market `Melt-Up’ Exposes Investor Gap, Bernstein Quants Say [Bloomberg]

Part of the reason behind our narrative research effort was our observation that most investment applications of NLP boiled down to sentiment scraping. We think it’s really tough to find a lot of value in most measures of sentiment alone, and the popularity of “most hated rally = future volatility” takes over the last few years has been a testament to that.

Far more tiresome, however, are the articles which exist to give you the “you could go with this, or you could go with that treatment.” Henceforth, when they show up in the Zeitgeist, they will receive the Christopher Walken treatment.

Flagship Argentine Airline Cancels Tuesday Flights Due to Strike [US News]

If you’ve been following along, you will have seen that labor disputes and labor costs have popped up with some regularity in our network graphs, both in the Zeitgeist and in our ET Pro monitors. In most cases, they are highly connected stories because of Fiat News techniques like the above, which selectively and casually attach issues like this to politics and elections.

What’s the key to spotting the technique? “As”

Yeah, it’s an innocent word in most usage, but it’s also a word which allows the author to juxtapose two concepts, events or statements in a way that isn’t wrong or non-factual or fake news, but which is clearly meant to communicate the author’s opinion about the relationship by forced proximity. Textbook Fiat News.

PetSmart’s Online Pet Company Chewy Files For IPO [IB Times]

No, I’m not going to make the obvious Pets.com joke. I respect the ET audience more than that.

I will, however, allow you to delight with me in the determination by a team of financial writers and editors that it was newsworthy to note that the offering would be “made only by means of a prospectus.” Hard hitting stuff.

IPO documents filed by WeWork, shared office space giant [Fox Business]

Yes, IPOs have been a familiar face on the Zeitgeist, although WeWork has not gotten nearly the attention of Uber or Lyft in financial media, probably because it doesn’t sell a product directly to consumers in the same way.

Except in San Francisco, where this kind of thing is normal (h/t NickatFP).

Nokia: Another Ugly Quarter, But Is The Story Over? [Seeking Alpha]

Every once in a while, I am delighted to be reminded that both Nokia and Blackberry still exist (yes, I know that both companies have carved out different niches from their pre-iPhone, pre-Android identities, please don’t @ me).

But I couldn’t figure out why, exactly, Nokia was showing up as being so closely related to the overall network. Was it a topical relationship or a relationship of meaning? So here are some of the stories linked most closely by language to this one, the ones that are within a degree of ‘adjacency’ in the matrix used to construct the graph. Interpretations are my judgements:

- Coca-Cola and Pepsi: Endgame [Seeking Alpha] – Related because of the “story over” language, the general similarity in structure and language in Seeking Alpha-sourced pieces, and the comparable language relating Coca-Cola’s restructuring and where Nokia is as a company.

- Tradeweb Shares Slide as Wall Street Weighs in With Caution [Bloomberg]- Related because of some of the “fundamental value” and “unique asset” language and various sections conveying similar sentiments from analyst writeups.

- AMD’s Outlook Needs to be Better than its Results [Motley Fool] – Related both by meaning in its negative treatment of recent results, where the structure of the article is to tell the story, “It’s bad, but will it stay bad?”, as well as the retail-geared language that Motley Fool and Seeking Alpha share.

In short, my take is that the prevalence of this specific flavor of pieces – and those from professional analysts, as in the Bloomberg note – in the Zeitgeist is the nature of the “next big trade” being pitched right now. What is that next big trade/rotation being pushed? “Long high quality stuff that got hurt in the recent mixed earnings or which hasn’t fully participated in the 2019 bounce back.”

Profitable Giants Like Amazon Pay $0 in Corporate Taxes. Some Voters Are Sick of It. [New York Times]

This is a lede on a beautiful case study in Fiat News – a New York Times feature piece that reads like it was ghostwritten by a speechwriter for Bernie. Don’t gloat, Fox News fans. There’s a reason the Motley Fool / Fox Business always ends up on its own Zeitgeist cluster over in Cloud Cuckoo Land, too.

The most important thing we can demand from our media of all political persuasions is bright lines around opinion journalism. Feature journalism like this is where it first became commonplace to present opinions, judgments and subjective emotional responses to topics as facts.

Rusty, on the BB/NOK angle, your suggestions are interesting, I’d be curious what the Discovery Map is indicating lately on NOK/BB as Friendly Alternatives to Huawei/5G infrastructure projects, 5 Eyes, etc. Articles like these:

https://www.reuters.com/article/us-usa-pentagon-5g/pentagon-eyeing-5g-solutions-with-huawei-rivals-ericsson-and-nokia-official-idUSKCN1R62SP

https://www.forbes.com/sites/stephenmcbride1/2019/02/27/nokia-and-ericsson-are-making-a-huge-comeback-buy-them-before-most-investors-realize-this/#69fb2acd5dc1

https://www.bnnbloomberg.ca/blackberry-in-pretty-good-position-amid-mounting-scrutiny-on-china-chen-1.1224858

https://www.cbc.ca/news/business/government-nokia-huawei-5g-1.4991435

As a Canuck, before the more public Meng Wanzhou detainment and the subsequent escalation in Canada/China tensions, even going back to H2 2017, it was impossible to not notice the Canadian MSM narrative shifting strongly against Huawei. Why were there weekly interviews with retired Cdn generals and intelligence chiefs on Canadian MSM nudging for over a year beforehand, without overtly story telling at that point?. Deep state (5 Eyes/intelligence community) opinion pushing, or the nudging state slowly walking the public down a path of its choosing, or both? Of course there are artifacts of the ‘harmonious’ times, after all CBC still advertises for Huawei on Hockey Night in Canada!

You dovetail that “Security” story with the" Value, High Quality Laggard story" and maybe that’s jet fuel to these 2000s darlings? Does Ericsson land anywhere here?

Of course this could be all spurious and my wife should be asking me where all the tin foil from the cupboard has gone!