Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

April 23, 2019 Narrative Map – US Equities

Walmart stores get modernized [Mass Market Retailers]

The company also plans to offer a grocery pickup option. This service gives customers the convenience of shopping online and the ease of quickly picking up groceries without having to leave their cars at no additional cost.

The company said it expects to finish the current year with about 2,140 grocery pickup sites nationwide, and it plans to boost that number to about 3,100 by the end of fiscal 2020.

Other improvements call for pickup towers, which are 16-feet tall, high-tech vending machines capable of fulfilling a customer’s online order in less than a minute once they arrive at the store.

The retailer will also be adding autonomous shelf scanners. These scanners use automation to scan shelves and help identify where in-stock levels are low, prices are wrong or labels are missing.

You just can’t escape Mr. Handy!

But here’s the thing. I would place a significant wager that this automation and robotification of Walmart won’t cut the human headcount or hours worked by a lot. Why not? Because you need humans to staff the grocery pick-up and online pick-up services.

Technology isn’t giving us more production or more services per hour of labor.

It’s pushing our labor down the foodchain into jobs that the robots don’t want to do.

New S&P 500 ESG Index Threatens Valuations Of Ineligible Utilities [Seeking Alpha]

S&P Dow Jones Indices has announced a new index focusing on ESG – environment, social, and governance – values for S&P 500 companies.

Nine utility stocks in the S&P 500 Index have been deemed ineligible for inclusion in the new S&P 500 ESG Index.

Long-term utility investors need to consider whether they should include ESG-ineligible stocks in their portfolios.

Hey, this was the topic for Demonetized’s first ET contribution!

It’s also the topic for a great piece Rusty wrote for ET Pro.

For one day only … I’ve taken Rusty’s note off ET Pro and made it free to read.

Check out ET Pro when you get a chance. It’s the only way to get direct access to our narrative research.

Indonesia, Malaysia Rail Projects May Give China More Deals [New York Times]

According to a draft communique seen by Reuters, participants at this week’s summit will agree to project financing that respects global debt goals and promotes green growth.

Of the total $6 billion cost, China’s Development Bank will provide a $4.5 billion loan at 2 percent interest, according a project prospectus seen by Reuters. The remaining 25 percent of the project cost will be funded by equity provided by the consortium.

The Belt and Road Initiative (BRI) is a for-profit Marshall Plan for Asia and Africa. It’s not stopping. It’s accelerating. OF COURSE Indonesia is going to take 2% non-recourse financing on a high-speed railway “to the textile hub of Bandung”. OF COURSE everyone is going to say something-something-green and something-something-sensible-debt. OF COURSE the Indonesian Oligarchy and State are going to skim 40% of this.

Welcome to modernity with Chinese characteristics. Same as it ever was.

IPOs: Considerations When Investing In Newly Public Companies [Benzinga]

Try to avoid confusing a company’s popular brand with its business. You may love a particular product, but that doesn’t mean you have to love the stock, too. The financials of a company are ultimately what matters for investors.

Oh.

And there are people who seriously propose that accredited investor restrictions on private placements should be abolished. Because, you know, how else are you going to buy this hot new narrative before it goes to the moon?

At least it’s harder to lose ALL of your money in public markets. Liquidity and all that boring jazz.

For every Raccoon in public markets, there are a dozen in private markets.

Here’s what to know about Elizabeth Warren’s higher education plan [Boston Informer]

Elizabeth Warren Wants College to Be Free [The Atlantic]

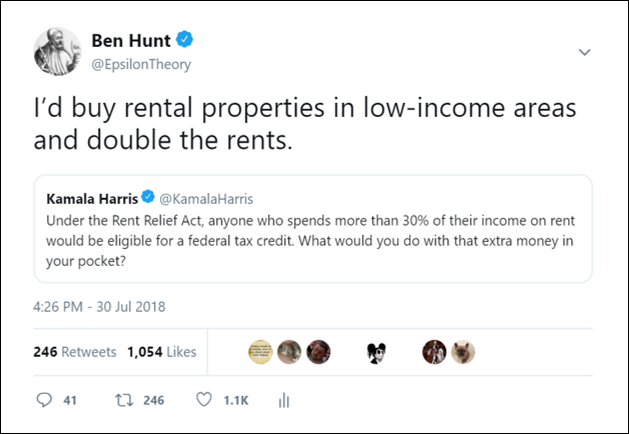

My best tweet ever.

At least Warren isn’t asking what you’ll do with all the extra money you’re getting from a subsidized college education. Yet. Because that IS the idea.

Here’s the Truth. College education consumption is going up. It’s now your “right”. College is the new healthcare. And you think tuition costs will go down? LOL.

If you don’t see that our deflationary world is becoming an inflationary world, you’re just not paying attention.

The “soul” of a prosecutor with the authority of POTUS is not something to be trifled with. You’re selling vol, bro.

We are indeed in the time of inflation, brother Ben.

It is hard to ascertain the price of money when the entire framework for measurement is unmoored in the same way that it is hard to tell which way a plane is pointing when the horizon disappears in the clouds. ¯_(ツ)_/¯

I would like to apply for the Zeitgeist Photo Editor position.