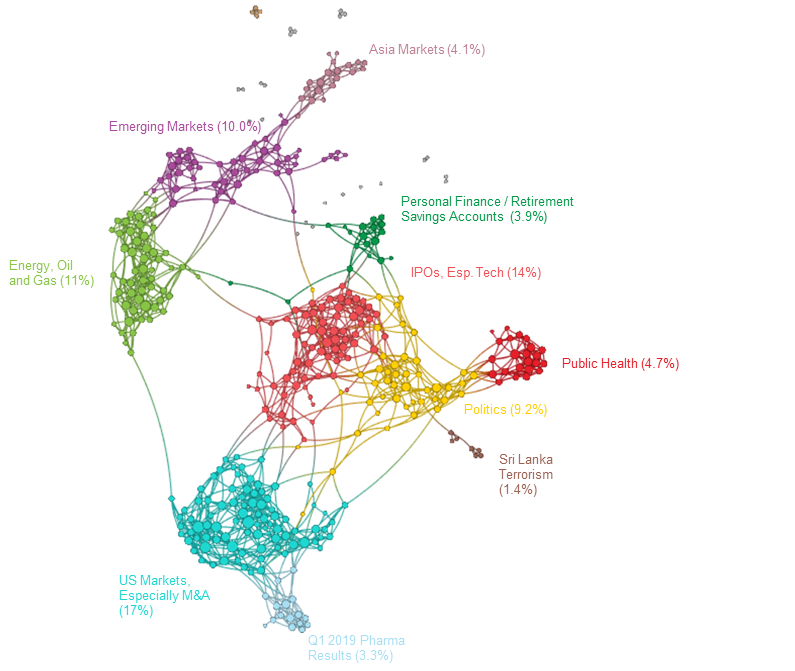

Every morning, we run the Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

April 22, 2019 Narrative Map – US Equities

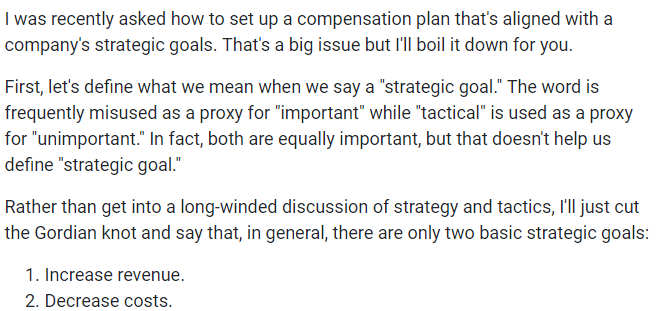

How to Align Sales Compensation with Strategic Goals [Inc]

Did this intro whet your appetite for more, or what?

I think executives in the investment industry spend more time engaging consultants and bending the ear of friends and former colleagues about sales compensation structures than they do on any other topic. The advice always looks something like this article: excessively general, descriptive and non-prescriptive. Or, alternatively, extremely circumstantial and non-transferable.

The problem is that visions of incentivization, cost variability and scale in sales are generally right-sounding nonsense. In other words, you don’t get real downside protection when sales just aren’t happening for one reason or another. You’re going to have to come up with non-commission bonuses, equity or other incentives to fill the gap or people will leave. And it’ll be your best salespeople who leave first. Always.

Two pieces of advice from my experience on sales compensation for fund management companies:

- You will always be upset with what you have to pay salespeople, and they will always be upset with how you pay them. This will be true no matter how many glitteringly general Inc articles you read.

- You will always be forced to raid margins to pay a baseline commission to keep people in bad times. Better to pre-negotiate this and get something for it (reducing top-end commission levels, shrinking trail percentages) than to do it for free when it inevitably becomes a necessity. If anyone tells you that salespeople who desire downside protection are adversely selected, feel free to tell them that I personally told them they were full of crap.

Merger Talks of Deutsche Bank and Commerzbank Roil Emotions [New York Times]

This story continues to sit at the top of the Zeitgeist. I suspect it will stay for a while. Why? Well, banks, for one. Because ECB influence remains at a high attention level, for another. But also because it has taken on an increasingly employee stakeholder-oriented emphasis in media coverage. I would guess that employee and job cuts language play a more significant role in the narrative of DB/CBK in financial media today than the basic stability of the European financial system.

And with signs as good as that, it’s no wonder. It’s good in English, but if there really is a literal German version of the English expression “blue bloods”, you’ve also got a possible blut/tut/gut rhyme that makes it work on a lot of levels.

Excellent cartooning, unnamed Commerzbank employee.

Improving investor behavior: Managing your time like money [Denver Post]

When it comes to finance columns that rise to the top of our Zeitgeist measures, I’m usually dual wielding snark cannons.

But I didn’t hate this.

What I didn’t realize when I had no money was how much the use of money beyond a certain point is almost exclusively to regain time. A financial adviser who has the kind of relationship with a client that allows them to begin to discuss wealth in functional terms is doing their job well.

And I do think there is a rising “What the hell am I doing with all my time?” ennui in the Zeitgeist that has contributed to the placement of this article in our little list. It should place it similarly in the minds of financial advisers looking for better conversations with their clients.

Stock Investors Reluctant to Return to Japan Despite Rally [Bloomberg]

If you’ve been reading Epsilon Theory long enough, then your “Cartoon” alarm bell was going off when you read the headline, and long before you got to the real piece de resistance.

This is an entire article built on conclusions, quotes and second-degree projections that purport to be about ‘Japan’, but which are really about the methodology used to create this ‘gauge.’ It is a poll of managers. It adds adds up how many say they’re overweight Japan vs. how many say they’re underweight. The difference in those values is the gauge.

If your delusion that this cartoon tells you anything about anything other than the methodology employed persists for more than 6 hours, please call a doctor.

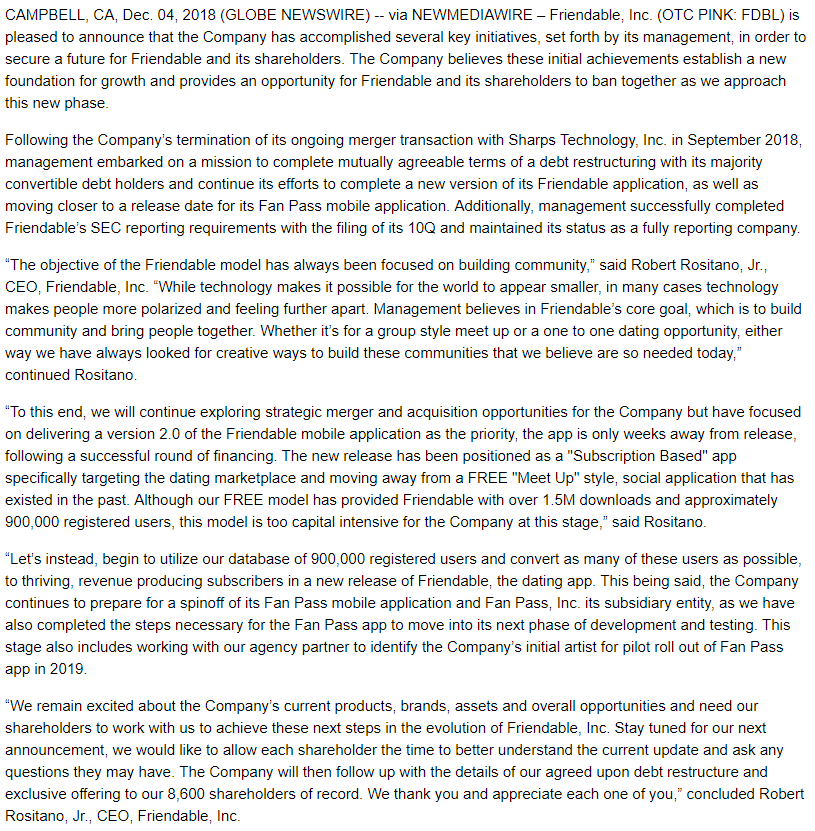

Friendable Enters into Agreement to Restructure Some $6.3 Million of Convertible Debt [Press Release]

I have no idea what Friendable is, but it sounds like a dating app. <googles furiously> I’m…I’m still not sure. It’s either a dating app or an app that allows four late 20s strangers to ride bicycles together.

I am not sure what it means that this is as highly connected to the rest of the financial markets narrative as it is.

I am also not sure who is advising a firm whose most likely exit is an acquisition to issue a press release announcing a restructuring and reduction of debt. But then I saw their prior press release on the company website, and it simply must be presented in all of its meta-game-less glory:

What possible purpose could publishing this press release serve? Whose idea was this?

Kona Grill Warns of Ch. 11 Possibility [Food News Feed]

I’m not knowledgeable enough about the restaurant business to tell a casual dining chain to start salting its pasta water, but I know enough to know that the above excerpt is pretty, pretty…pretty bad.

If you know anything else about Kona Grill, however, I doubt that this comes as a huge surprise to you. They built their model as an upscale (sic) casual alternative to fast food options at shopping malls, inclining in particular toward the “village square” type outdoor malls that popped up in wealthier suburban areas.

Funny thing is, I don’t know anyone who has ever been in a Kona Grill, a Bonefish Grill, a Black Walnut Cafe or any of the other fancy-signage casual chains accessible from faux cobblestone promenades in these outdoor malls. Don’t take this as casual suburban chain snobbery either. You’re reading from someone who has ordered from every page on the Cheesecake Factory menu, who can deftly navigate the balance between beer orders and Endless Shrimp refills at Red Lobster to ensure that the store comes out in the red on every such engagement. My preference for mediocre chicken parm that at least hasn’t been turned into a sloppy, soggy mess in a hotel pan at an ‘authentic’ Italian restaurant once single-handedly kept a Macaroni Grill location in business.

The death of the Kona Grills of the world, however it inevitably happens, will probably be a positive case of creative destruction. It is one of very few afforded to us recently by policymakers’ helicopter parenting, one of the many ways in which the prioritization of smoothing financial market outcomes – a primary aim of the transformation of capital markets into utilities – is destroying future economic value.

On the other hand, there’s enough anecdata from this Zeitgeist to convince me we ARE entering a bear market for late 20s commercial models who specialize in smiling at stuff that they shouldn’t be smiling at. Y’all all have full drinks. This new red concoction should not be exciting to you. It belongs to someone else at the bar. It means NOTHING to you.

This article from Deadspin didn’t actually make the top of the Zeitgeist. I just thought it was hilarious.

This is really funny:

“Don’t take this as casual suburban chain snobbery either. You’re reading from someone who has ordered from every page on the Cheesecake Factory menu, who can deftly navigate the balance between beer orders and Endless Shrimp refills at Red Lobster to ensure that the store comes out in the red on every such engagement. My preference for mediocre chicken parm that at least hasn’t been turned into a sloppy, soggy mess in a hotel pan at an ‘authentic’ Italian restaurant once single-handedly kept a Macaroni Grill location in business.”

As is this:

“On the other hand, there’s enough anecdata from this Zeitgeist to convince me we ARE entering a bear market for late 20s commercial models who specialize in smiling at stuff that they shouldn’t be smiling at. Y’all all have full drinks. This new red concoction should not be exciting to you. It belongs to someone else at the bar. It means NOTHING to you.”

Well done.

Oh, and God bless you for reading the full press release from Friendable - I couldn’t take it and quit half way through - too many brain cells were dying.

And continuing out of order, nice Occam’s Razor observation:

"Rather than get into a long-winded discussion of strategy and tactics, I’ll just cut the Gordian knot and say that, in general, there are only two basic strategic goals:

Thanks, Mark! And I read BOTH of their press releases! Lord almighty.