Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

April 16, 2019 Narrative Map – US Equities

Fading fears of a ‘hard landing’ for China’s economy could push stocks higher, strategist predicts [CNBC]

China increasingly appears set to avoid a dreaded “hard landing” and that could help push the country’s stock markets higher the rest of this year, says Stefan Hofer, chief investment strategist at LGT Bank in Hong Kong.

Hofer said investors have been focused on whether China can sidestep that scenario, which he said has hung over the market as “one of the more frightening tail risks.”

The dreaded hard-landing! LOL.

It’s not even a wall of worry any more. More like tiny little speed hurdles that we set up to clear by a mile.

All Aboard the Brand Carousel! Companies Spin Off Brands at Accelerating Pace [Forbes]

Let’s take a look at a few recent cases of companies reaching for and getting rid of rings or brands that they no longer wanted. The carousel took a big spin when last week Campbell Soup Co. sold Bolthouse Farms to Los Angeles-based private equity company Butterfly Equity for $510 million. That’s about one-third of the $1.55 billion that Campbell paid for the company in 2012. Butterfly saw the brand come spinning by at a price it liked and grabbed it.

It literally took me a few minutes to find the text of this article because Forbes has now passed the event horizon of ad placements … known in the scientific parlance as the Zerohedge Limit.

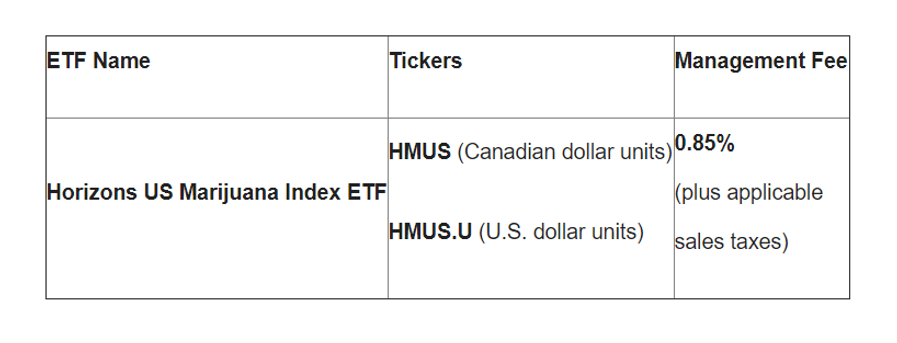

Horizons ETFs to Launch World’s First U.S.-Focused Marijuana ETF [Press Release]

Thematic ETFs are all the rage. Why? Because fees.

Goldman Sachs crushes earnings, hikes dividend [Business Insider]

Stocks slip after lackluster earnings from Goldman Sachs and Citigroup [CNBC]

Stocks close slightly lower amid lackluster Goldman, Citi earnings [Marketwatch]

From “crushes” to “lackluster” … all in a day’s work for the Fiat News machine.

You Think You Didn’t Get a Tax Cut, but You’re Probably Wrong [New York Times]

If you’re an American taxpayer, you probably got a tax cut last year. And there’s a good chance you don’t believe it.

Weird, right? Hard to understand how Team Elite could spend the better part of a year Vox-splaining why the tax cuts were only going to those gosh darn bazillionaires and mega-corporations, and then it turns out that people believe the tax cuts only went to those gosh darn bazillionaires and mega-corporations.

Asian shares buoyed by optimism on U.S.-China trade talks [Reuters]

Evergreen.

I did not get a tax cut. And I know I’m right.

Re: Forbes ad placements.

Wise man say to achieve inner peace, first you must HOSTS file.