Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Building Trust In The Trustless: Blockchain’s Best Asset Is Holding It Back [Forbes]

There are a few gags that are like candy to journalists. The “lack of trust in a trustless system” bit is one. It is like truffle oil to a gastropub restaurateur. Like 808 to a hip hop producer. Like saying “taking things one day at a time” to a professional coach. Like a purple cape to a LARPer.

Indispensable, irresistible and after a certain point, a little bit irritating.

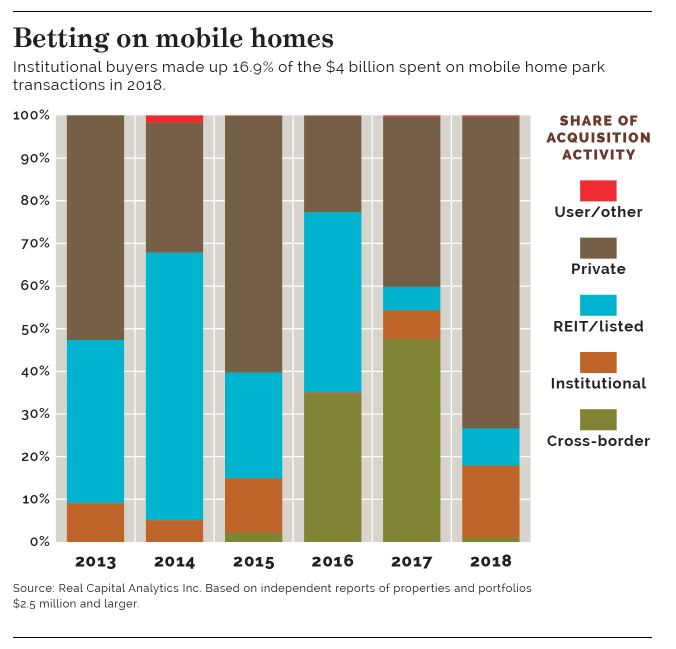

More managers make move to mobile homes [P&I]

Private equity has been heavily targeted in financial media and public asset manager commentary lately, mostly in the form of shock at the continued success PE funds have had raising new money – and the asset owners who have continued to move capital there. Still, the glowingly positive industry narrative around private equity which we monitor has barely moved since Q4 2018.

To me, however, far more than even private equity (if obviously not in scale), there is only one bucket in most big institutional portfolios where hope always seems to spring eternal, regardless of outcomes, evidence or narrative: value-added real estate. I have no explanation for this, other than a belief that most institutional boards consist of people who – because of their own professional successes – much more intuitively understand making money by buying-and-improving than by temporarily owning a fractional listed share of an operating company.

Investors getting better ways to gauge risk-parity success [P&I]

In most cases, I would (obviously) caution skepticism about what fund managers and consultants are telling you about how to benchmark what they are selling you, and would usually take the side of asset owners. Not here. I’m with the fund managers.

The question behind benchmarking – or really any data-driven oversight process – has to boil down to this: What am I going to do with this data? It’s easy enough to answer for long-only equity or fixed income managers, even if most institutions aren’t very good at doing the right things with those answers. Likewise, I can think of all sorts of things you can do to oversee a risk parity portfolio with an index-based benchmark, but almost all of those things are bad.

Risk parity managers are not, for the most part, trying to produce alpha. The differences between them are structural. In general order of importance, they will differ by:

- The quantity of risk they target;

- The methodology whereby risk buckets subject to equalization or balancing are defined (e.g. regimes, categories, etc.)

- The assets / premia they include in their universe;

- The instruments they use to express those assets / premia

- The risk estimation and rebalancing methodology (e.g. decay horizon, etc.)

If you want to be in the business of measuring performance deviations of risk parity strategies against a benchmark, know that you will be in the business of evaluating whether you should change your comfort level with one of the above structural decisions. And if that’s a business you want to be in, there are a hell of a lot better ways to perform ongoing diligence on those structural decisions than the weak-as-hell proxy of performance against the generic set of structuring assumptions built into an index.

Decide if you believe in risk parity or not, test the risk efficiency assertions over long periods, and measure managers internally to confirm they are doing what they say they do. Beyond that, if you think that benchmark-related performance monitoring is going to be part of your ongoing diligence, just sell them now and save yourself the trouble of firing them after a surprisingly bad year for their rates buckets.

By the by, I STILL think there is utility for RP indices (my old business used to run one of the first!), but mostly to help asset owners think about portfolio construction and the uses and traits of the strategy more generally.

Sports Direct Considers Bid for Debenhams [Reuters]

When we updated our internal narrative analysis of the private equity industry, as noted above, we didn’t see much shift. There were, however, three oddly negative clusters that stood out:

- Private equity executives and bankers/lawyers from noteworthy financial sponsors practices caught up in #MeToo scandals;

- The same, except college admission bribery scandals; and

- UK Retailing.

The third issue was meaningfully connected to the rest of the network and seems worthy of ongoing notice. Then again, I’ve been burned by UK retail before (Hello, DRTY/Kesa/Comet), so it’s possible I’m projecting here.

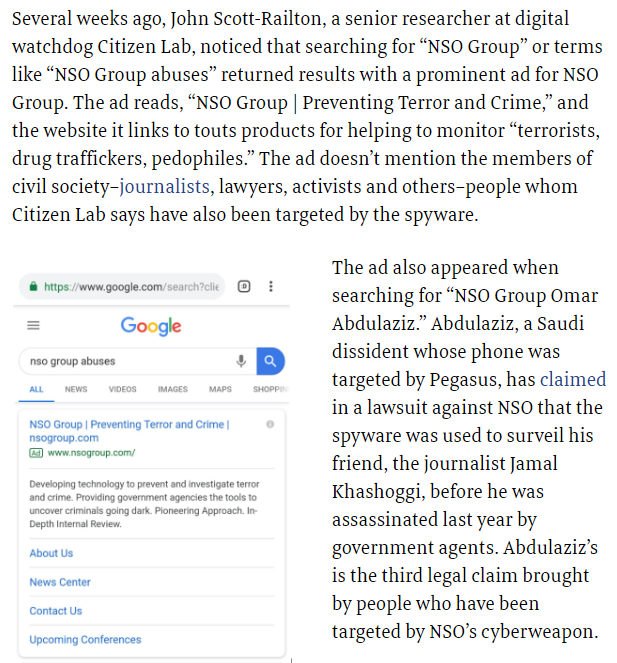

Hacking firm NSO battles abuse claims with PR and Google ads [Fast Company]

I’m always somewhat fascinated when the whole MacGuffin of an article is a total fantasy. In this case, the conceit is the implication that the company in question purchased ads with specific bad-sounding search terms to soften its image in the face of the most negative claims about it. It paints a clear picture in your mind, doesn’t it? And without a single explicitly false statement.

There’s just one thing:

I’ve got nothing to say about the company or situation – I don’t know enough to do so, although I think we’ve been pretty consistent in our views about the panoptistate. But it’s when we agree most with what we’re reading that we need to be most careful about what appear to be selective facts chosen to promote a particular interpretation that the author prefers.

In This Tech I.P.O. Wave, Big Investors Grab More of the Gains [New York Times]

The article is fine (although of course it has a pretty transparent Fiat News angle), but the missing piece here is this: the utilitization of markets has hit private markets every bit as much as public markets. Guess what happens when plentiful, cheap capital remains available to you in those markets?

What Happens When Women Stop Leading Like Men [New York Times]

We have pointed it out in some of our prior analyses of sector-level narratives: the representation of women in leadership roles is a very cohesive, highly connected topic, especially in financial services. Ignore it at your peril.

What Are Fat Fingers and Why Don’t They Go Away? [Washington Post]

Simple answer? Because order management system software is, generally speaking, hot garbage water, and because the pressure desks get from clients to remove or loosen fat-finger limits is more profitable and interesting than the pressure they get from credit or compliance.

Great stuff - I have no idea how anyone at ET gets anything done in his day besides producing written pieces.

Two quick thoughts. I get that the indefeasibility of Blockchain is different from all the fraud that has happened around cryptos, but if narratives matter more than facts, then the fact that cryptos seem less safe than leaving money lying around your house has to undo / has undone the holiness of Blockchain.

Second, the value-added real estate myth / belief is, as you note, pretty simple: most people believe they “understand” real estate in a way they never will stocks (or more complex financial products) and, heck, most people’s homes have gone up in value (unless their timing has really sucked), so they know it “works.”

I’ve managed my mother’s small number of assets for over twenty-five years (since she retired) and, despite her equities being up over four times (and some a ridiculous number) and her high-grade, medium duration municipal ladder having provided solid returns, it’s her stupid condo up less than three times over that period that excites her - despite the negative cash flow and periodic large capital costs for repairs, etc., it entails that makes it a pretty poor investment on a risk-adjusted basis. My quick take - people just love real estate and believe somehow they “understand” it.

On the first point, I think you’re right that it undoes some of the holiness, but I’m not sure that is a fatal problem. Parts of the crypto community seem to like to pretend that the existence of resistance is evidence that they are right (it isn’t), but obviously new technologies do go through an adoption and trust period, so I don’t think that trust issues at this point are disqualifying for the tech in any sense, except in the sense that anyone thinks it won’t affect the price of their coin speculation (it will).

Yep on RE, but especially on VA. I’ve never met an RE allocator who wasn’t gunning to allocate some of the core portfolio to Opportunistic / VA at all times.

Blockchain is certainly interesting technologically. Its applications are in jeopardy because they require an application utilizing that technology, but the applications are not, ever, as secure as that of its technology - i.e. code is code and we trust, without exception, the integrity of the software implementing the application, to say nothing of the multiplicity of fake apps and inevitable errors in software design and implementation.

Short Version: Blockchain is a technology. Its uses are outside applications. The two are not likely to be (tempted to say cannot be) connected with the same level of privacy/security/trust. This is a common error in evaluating privacy or security issues with particular technological advances.

Shorter Version: Blockchain looks good. Its uses depend on very different technologies. Those uses are not, today, as secure or private as blockchain.