Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

I’m channeling my inner MST3K with the comments here. Premium subscribers should feel free to join me in the Comments section (but only if you know what MST3K is!), and I’ll reprint the best ones in an upcoming Mailbag note.

Norway Gives Wealth Fund Approval to Cut Some Oil [Bloomberg]

The narratives around climate change and socially responsible investing are powerful ones. Why? Because they are presented as existential. They matter for the same reason that attaching the national security! Meme to trade negotiations instantly took their importance up a notch. What is interesting about this issue in particular, however, is just how malleable the underlying approach to leveraging the narrative can be so long as you say the magic words. This climate-motivated change in Norway – more than two years in the making! – ended up justifying keeping the huge positions in integrated oil companies because they were more likely to be a part of climate solutions. I’m on record saying I think that actually is true, but do you have any doubts that they could have justified practically any interpretation as long as the forms were observed?

A lot of people believe in investing in big shifts – mega-trends, super-themes, whatever – because they think that issues like climate change create big, unpredictable changes and inflection points. Most of these people underestimate, however, how powerfully entrenched forces can use the language and taxonomy of those change narratives to protect the status quo.

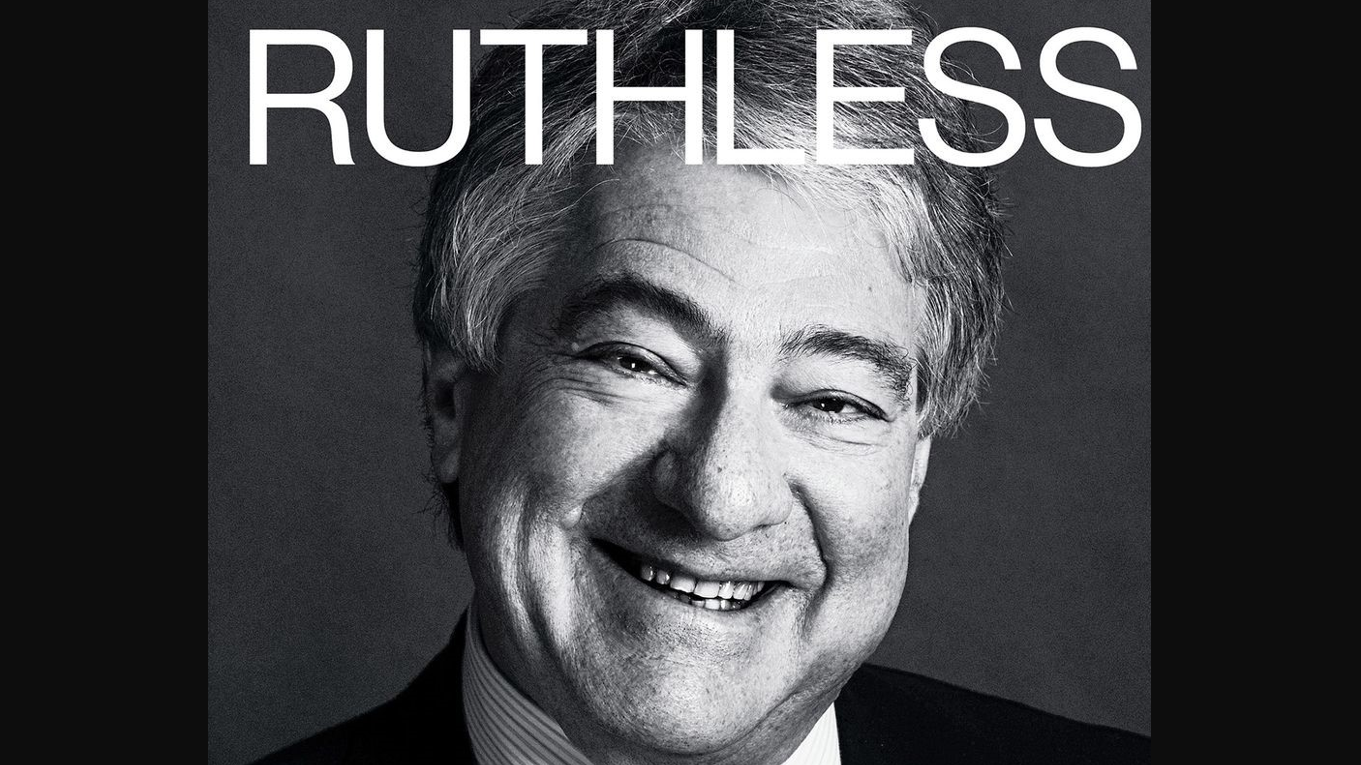

Where does the endowment money go?; $44 billion K-12 endowment sends less to schools than decades ago [Houston Chronicle]

We’ve written a lot about Gell-Mann Amnesia, the phenomenon in which you read about a topic you understand in the newspaper and shake your head in disgust at how poorly the authors understood the details, but then blithely turn the page and nod along to some other specialized topic you know less intimately. Stories about big, public investing institutions are my #1 Gell-Mann Amnesia trigger.

A regional investigative journalist can be forgiven for not completely understanding why comparing returns on a pool of real assets and royalties with a bizarre legislature-imposed mandate to the Yale University Endowment makes zero sense. A professor at Johns Hopkins University, however, has no such excuse. Good grief.

Boat Race Bank BNY Mellon Could Face Landmark Legal Fight After It Bans Staff From Working at Home [Evening Standard (UK)]

Well, that didn’t last long.

Separately, Britons, please advise: What the devil is a Boat Race Bank?

The Gazillion-Dollar Standoff Over Two High-Frequency Trading Towers [Bloomberg]

Ever since I saw the documentary about Disney’s highly secretive landgrabs under a range of oddly named development companies to build Disney World, my brain has started to auto-tune any story of up-and-coming entities staking out surprisingly aggressive positions. I was about two lines into this one when I decided, “Nice. These guys are just Citadel.” It wasn’t until later in the piece that I realized I wasn’t alone.

Part of the kick-in-the-teeth of writing so much about narrative is that you really do see it everywhere. The other part is the response to that: You fight the pattern-recognition impulses that usually do serve you well.

Chinese Shares Suffer Worst Day in Five Months as Exports Slump [Morningstar]

It is de rigeur for us and others to take on the tiresome “Markets [slump/rally/dive/soar] as [event]” takes from financial media, analysts and other commentators, but sometimes someone still manages to say something so vague and hand-wavy that, while we recognize they’re trying their hand at Missionary work, we can’t quite figure out what view they’re promoting.

Real Estate Home News: Last Blockbuster Store & Last Blockbuster Mansion [Press Release]

Wait, wait, wait. The Last Blockbuster is real?

Re: Chinese Shares Suffer…

Isn’t the selection mechanism for this “The Zeitgeist” series going to guarantee bland, handwavy writing? The most representative articles are going to be automatically generic in the same way that writing-by-committee guarantees a crappy, wordsmithed product.

Heh, yeah, I get the concern! I actually think there’s been a pretty good mix of the good and bad, but just in case, we sort on a couple metrics that approach the problem differently (which are most similar in the aggregate, and which are more similar to articles in other clusters) to make sure we don’t end up with the staleness you describe.

Wordsmithing doesn’t seem to really be a real problem - it’s actually topical genericism that is more problematic. You see that in “News Briefing” pieces, for example. We exclude those for that reason.

Boat Race bank? BNY are sponsors of the annual varsity boat race between Oxford and Cambridge

https://en.wikipedia.org/wiki/The_Boat_Race

Aha!

Rusty, I tried to reply directly to your response below, but there’s something weird going on where your profile pic is automatically popping up huge and blocking the reply button.

I guess the handwaviness of the Zeitgeist pieces will depend on how representative handwaviness is in the topic. Topics that are well-written on will generate well-written exemplars. It’s the difference between the mode and the mean, and it’s a huge difference.