Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

I’m channeling my inner MST3K with the comments here. Premium subscribers should feel free to join me in the Comments section (but only if you know what MST3K is!), and I’ll reprint the best ones in an upcoming Mailbag note.

Oil Extends Gains on Bets Linked to US-China Trade, OPEC Production Cut Reports [The Street]

I thought the larger screen shot here was kinda perfect, with Cramer’s “Investment Club” ad and not just one, but two Ameritrade ads. I also loved the headline use of the word “Bets”.

Frankly, this is the brilliance of the the Robin Hood UI (or UX, as the cool kids would say) … they don’t pretend that what they’re selling is anything other than a legalized gambling experience. The Street still wants to pretend. Dopamine is a helluva drug.

Traditional and Alternative Value Opportunities in Housing Stocks [Wealthmanagement.com]

Want to make your infomercial stand out? Use the word “Value” or “Growth” in the title, and then sprinkle the rest of your “content” with the vocabulary of these distinct investor languages. Then for your hook, take a price chart of the past few months and find another year where the chart looks kinda like that. Don’t worry if it’s not a great eyeball fit, because no one will actually look up the comparison.

God knows I rail on and on about the power of Fiat News – the presentation of opinion as fact – as the bane of our political lives. But the more profound damage of Fiat News is in the hum-drum quotidian hours of our everyday lives, where there is no respite – NONE – from being sold on something by somebody. We are hardwired to respond positively to statements of “fact”, and everyone with a megaphone or an ad budget knows it.

European markets seen lower as politics take centre stage [CNBC]

Classic wall-of-worry narrative construction … create “concerns” and lead with a “warning”, so that the working day can be driven by a story arc of “overcoming” and “seeing through”.

It’s a Hero’s Journey, after all, and you watch because you, too, can be that hero.

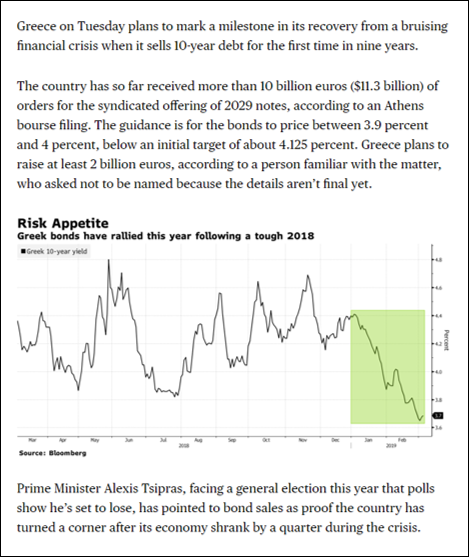

Greece to Sell 10-Year Bonds for First Time Since Before Bailout [Bloomberg]

There’s a wonderful book to be written about Alexis Tsipras one day, the Socialist “man of the people” who gets beaten down by Merkel to the point where he’s reduced to touting 10-year bond sales as the cornerstone achievement of his administration.

What if All the World’s Economic Woes Are Part of the Same Problem? [New York Times]

I agree with the upshot of this opinion piece in the NYT. But here’s the thing …

Notice the passive voice.

Wealth inequality and low interest rates don’t just “happen”.

Wealth inequality and low interest rates are the explicit and intended consequences of Team Elite monetary policy over the past DECADE.

And until our arbiters of Fiat News wrestle with THAT, they will continue to be “shocked” by the political gains of “populists” on both the Left AND the Right who instinctively do get THAT.

FFS.

To join the Epsilon Theory Pack

Epsilon Theory is a free publication for those who want to watch from a distance.

We offer a Premium subscription for those who want to support our mission.

We offer a Professional subscription for those who want to tap directly into our tools and research for their investments.

Fun fact about Germany and the Hero’s Journey. For much of the late 1880s into the 1890s, German composer Richard Strauss worked on incorporating his various tone poems into a sort of meta piece he ended up calling “Ein Heldenleben”, or “A Hero’s Life.” It’s a pretty famous piece in its own right, but its most prominent heroic theme is probably the call stolen from his late 1880s tone poem Don Juan, which is a story about…yeah, that Don Juan.

The German heroic ideal isn’t Brunnhilde, it’s a Mediterranean European lothario. This is now my working theory for Euro Area politics. Please send your finest Postmodern Intersectional Political Science doctoral diploma.

Re, “Traditional and Alternative Value Opportunities in Housing Stocks.”

Capitalism is the only moral economic system and, fortunately, the one that produces the most wealth while pulling the greatest number of people out of poverty, but its process - shamelessly selling everything, all the time (and with the worst of humanity selling it, in the worst way) - wears us all down and erodes support for this morally and economically superior system.

I love capitalism, but hate the endless, dishonest, obnoxious, relentless, insulting (this could go on for a long time) in-your-face selling we all have to endure because of it. Be it for a packaged cookie or your investment dollars, capitalism’s sales “model” asks a lot of its participants’ patience and sanity. Sadly, the alternative is worse, but IMO, we might have to take another trip through that dystopia to educate another generation about its horrors before society is ready to put up with capitalism’s awful hucksterism again.

I could have written the same ⇧ about the piece above the housing one - the one with the two (for God’s sake) Ameritrade ads and the one E*Trade and one Schwab ad stuffed in at the bottom.

Re, Greece, since I haven’t been paying attention to the balls and strikes in that game, my only thought was, really, they can borrow money again: QE really is the mother-of-all debt-forgiveness plans.

I’m not sure that constant selling is so much a distinguishing feature of capitalism as much as it is that selling people on ideas in a capitalist system takes the form of advertising and narrative instead of propaganda, expropriation and beatings. Power is power, although in full disclosure, I did just watch the new GOT trailer.

I agree and prefer Ford overselling its pickup truck to me than the state selling me its monopolistic version of the news (or physically beating it into my head), but was arguing that, in this country, since we have much more of the capitalist version of selling and less of the state (and a softer version of it than in a totalitarian state) that we have forgotten that the alternative to capitalism’s sales model isn’t utopia, but something much worse.

Once experiential quantification is properly embedded (into children), heli-skiing is inevitable and capitalism wins. Try going a day without using the self-referential words: good, better, best and their opposites. “Have a day!” ((Because better is better.))