Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Deutsche Bank ‘Merger of Weakquals’ Seems Least Bad Option, Report Says [Bloomberg]

So we got that goin’ for us, which is nice. Still, let’s take a look at the sentiment map of news media from the last quarter that has discussed the prospective merger to….oh, God, my eyes!

China Sees U.S. Ahead in AI [EE Times]

Very interesting. The contention is that both China and the US have active internal media narratives arguing that the other is ahead. A bit of a Space Race feel. The author provides some anecdotes, but is it true more broadly? I don’t think we can answer definitively, because we don’t have access to tools to perform similar NLP on Chinese language media.

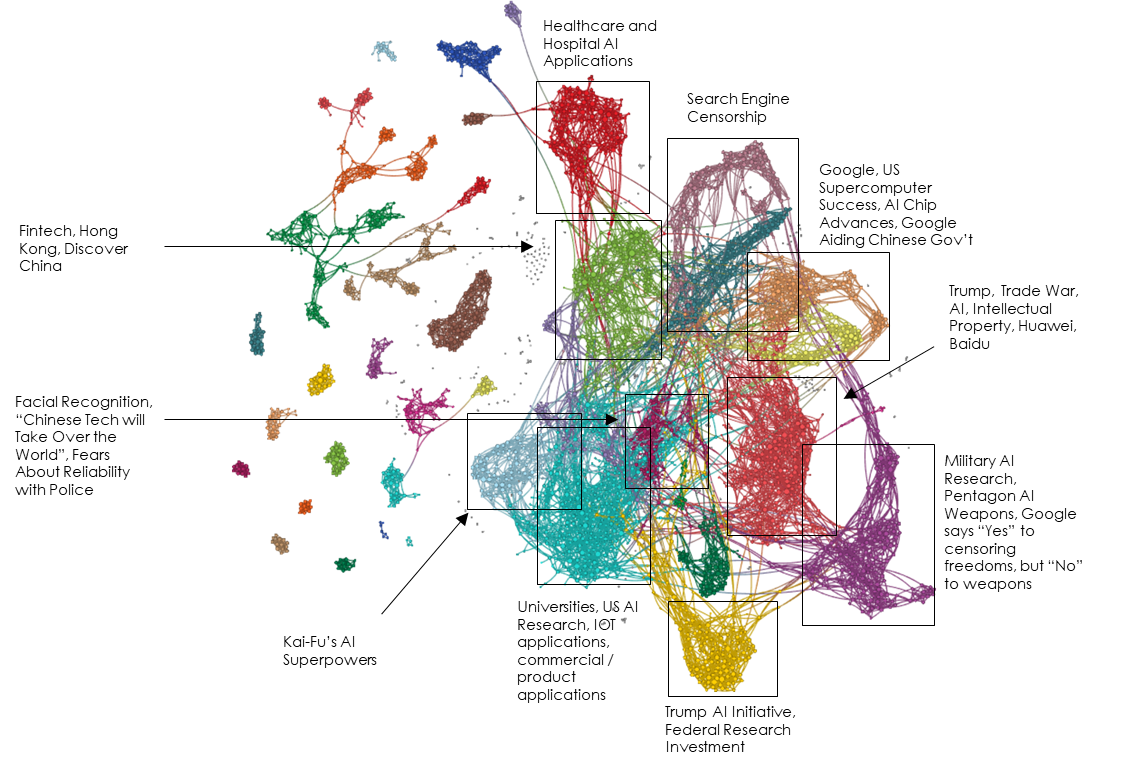

Still, we do have Chinese English-language media, with all of its very interesting quirks and deviations from what you’d get inside the wall, so to speak. I thought it would be interesting to explore how even that differs from US-based English-language media. Below is a narrative graph of 2,215 articles published in the last year about AI, China and the US by China-based English-language publications. And by the way, I’m not going to continually caveat the bias embedded in the selection of English-language sources. Yes, it’s a big deal. At any rate, here is the graph:

First observation? For some reason which completely eludes me, these articles are insanely well-connected, which means that they are using very, very similar language. To have this kind of clustering over a full year of articles is…not something we see very often. I’m not saying it’s Communists, but…it’s Communists. Want another hint? The most connected, most central cluster in the graph is defined by articles making the argument that “China is not the AI-powered dystopia you think it is.” Well, okay, then. I’m glad we’ve settled that.

My second observation is the shockingly large focus linking the arts to AI. Again, I’m not sure how indicative that is of a truly different cultural Zeitgeist as opposed to explicit state influence, but the third largest cluster in this narrative graph’s leading distinguishing n-grams are: “cultural”, “artist”, “films” and “museum.” That’s not just a few articles about a robot that painted a picture.

The third and most important? I think the EE Times author is right on the narrower point. At least in English-language sources, the story that “we must do more to compete on AI” has tendrils in nearly every topical cluster. In clusters about VC, entrepreneurship and funding, articles lament the challenges attracting foreign capital. In clusters about every different product application, articles focus on the need to develop wholly domestic research platforms and industry to compete. What’s missing are any links to security, intellectual property, defense applications and cyberwarfare.

My take?

Chinese English-language news is actively cultivating the narrative that China is aggressively investing in AI technology because it is beautiful…and maybe a little bit because it must. Because American corporations and venture capital structures are admittedly so far ahead. Not for any nefarious national security reasons or internal political and social management reasons, of course. In fact, maybe we should all just band together to work on this.

I have no idea how TRUE any of that is. Sorry, not my beat. But it IS absolutely the narrative the missionaries are promoting.

So what about US-based sources using the same query over the same time period?

I’ll be the first one to say that Big Tech’s willingness to participate in Chinese censorship pisses me off. The “but they’ll have better access to free information than they did before” song-and-dance is nothing more than just cynical post hoc rationalization. I’ll also be the first one to say that state-run facial recognition and surveillance technologies scare the hell out of me. I’m an American and I’m not pretending my piece here is journalism. With some caveats for our tendency to see new technologies as new reasons to launch weapons, I think our values on this topic are generally the right ones, and I’d prefer that those values win.

But I can believe all that AND still recognize that so much of what’s in the above is ALSO a cultivated network graph of how people want me to think about this issue. Yes, a happy clappy graph of China-based English language news sources pretending that Chinese AI interests are about making wonderful new paintings, beating Korea at Go and not at all about surveillance and military aims (ha ha, where ever did you get that preposterous idea?) looks frustratingly like propaganda. The ratio of positive-to-negative sentiment in the “Facial Recognition” topical cluster from Chinese English-language sources is nearly 10-to-1. The ratio in US-based sources is about 2-to-1…in the other direction.

But the Chinese-AI-is-an-existential threat, this-is-all-about-national-security, and we-will-all-die-if-we-don’t-do-something-big that involves spending money, building weapons and electing the right person feeling that I get from the second graph gets my libertarian streak tingling too.

Brookfield-Oaktree tie-up creates alternatives giant; Acquisition seen as a good reset for Oaktree after AUM stagnates [P&I]

While it isn’t formally on our Fiat News list, vague attributions such as “seen as” in a headline are a pretty reliable tell that you’re being told how to think about something. I think that it’s probably pretty innocuous in this case – the Common Knowledge around Marks will predispose people to assume that Big Decisions are probably Good Decisions, journalist or not. Still, as always, read carefully when you see these tells.

Excuse me, stewardess. I speak post-merger asset management exec. That translates to, “Five years, tops.”

Yuan eases as investors refocus on trade, slowdown risks [Reuters]

After one full day of…uh…’euphoria’, financial media needed but a single Asia session to conclude that investors were taking a ‘longer look’ at something. If there’s one thing you should remember when reading these overnight / pre-market updates, it is this: The reporters principally source their ideas from trading desks and the sell-side more broadly. These reports are the journalistic equivalent of a waiter barking out the specials the chef wants to push to clear inventory.

Kilcullen Joining Diamond S Shipping as CFO [Press Release]

I’m sure all the people at Diamond S Shipping are lovely, but the real Diamond S is a Tex-Mex / Southern diner in my hometown of Brazoria, Texas. LPT: get the steak fingers.

See Keanu Reeves Shoot Countless People in New ‘John Wick 3’ Trailer [Rolling Stone] AND New Zealand Needed Six Days to Ban Military-Style Firearms for Good [GQ]

Sometimes the narrative machine is a little too meta for its own good.

A perceptive Twitter friend of mine recently proposed that here in the US, Big Tech will increasingly pivot to a narrative around a US-China Tech Arms Race to keep itself in the good graces of the State (given that tech has censorship! problems on the right and monopoly! problems on the left). So perhaps needless to say, it was extremely interesting to see this analysis today.

It seems the Chinese AI missionaries are hewing to Deng’s old dictate that China should “hide its capacities and bide its time” …

Big tech has tools to build narrative, micro-target persuasive messages and analyze large data sets in a manner that lobbyist and special interest could only dream of in the past. When faced with an existential threat, I would bet that they will Cambridge Analytica the hell out of it.

Fascinating stuff on the Chinese propaganda machine Rusty. I’m having trouble wrapping my head around what it takes to engineer that type of cohesive messaging across thousands of articles, hundreds of writers, all over a year. Insert picture of the Borg here.