Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

What is fentanyl? [Washington Post]

An opioid crisis piece? Why did this rise to the top of a query of financial media articles? What’s the connection? This:

Yet municipalities still have trouble accessing the drug, partly because of the cost. Narcan, the commercial name for naloxone as a nasal spray, can cost between $70 to $150. But the injectable version, known as Evzio, can cost around $4,000.

If you haven’t heard it from someone else already, then hear it here: drug prices will be a platform pillar for every single candidate in the 2020 elections. In the same way that it even finds its way into discussions of the opioid crisis, it is attached in some way to all three of the components of the changing Zeitgeist we have written about – deflation to inflation, cooperative games to competitive games, and capital markets transformed into political utilities.

“Drug prices are too high in the U.S. and that has to change” is now Common Knowledge.

It will be interesting to observe whether the “We are subsidizing the world’s drug costs” narrative that Trump will promote will carry the day over the “We need to expand and reform drug insurance” narrative that Democrat candidates will offer.

And yes, this is a high-attention topic for pharma.

Some CRE Investors Switch Up Strategies as They Weigh Risk [National Real Estate Investor]

Oh, well that clears things up.

It reminds me of the old Mitch Hedberg bit: “People either love me or hate me…or they think I’m okay.”

What if All the World’s Economic Woes Are Part of the Same Problem? [New York Times]

Our first two-time Daily Zeitgeist article appearance.

This isn’t news coverage, so I wouldn’t apply the Fiat News label here, but it takes about 10 paragraphs before the author figures out that the story all the research is telling about productivity and corporate investment, etc. is about interest rates, a story that Ben has been telling for quite some time. It IS the New York Times, however, so before we get to that, we have to properly frame everything in terms of the very powerful narrative of inequality as the root cause of all society’s ills.

Ben and I don’t disagree on whether the economy would be more productive with more hundred thousandaires and millionaires and fewer billionaires. We do disagree a bit on whether allowing the state to participate in steering a society toward that outcome is a desirable or morally defensible way to achieve that. Where we do agree is that inequality can be both symptom and cause, but in practice is more symptom than cause. And the cause is fiat everything – Fiat World.

Forget No Fees. ETF Breaks Ground by Offering to Pay Investors [Bloomberg]

OK, let’s leave aside the meta-game observation about saying the quiet part out loud.

- Yes, the scheme is manipulative and kind of dumb.

- Despite all that, yes, the scheme will probably work…at first.

- No, it’s not vastly dumber than the amount of articles written about ETFs going from 5 to 2 bp, or from 2bp to free.

We have firmly established our enthusiasm for low-cost product. But that’s a preference in the real world. In narrative-world, we think the financial media obsession with complete, utter irrelevancies like a couple basis points does investors a disservice. It also leads to ink being spilled on nonsense like this.

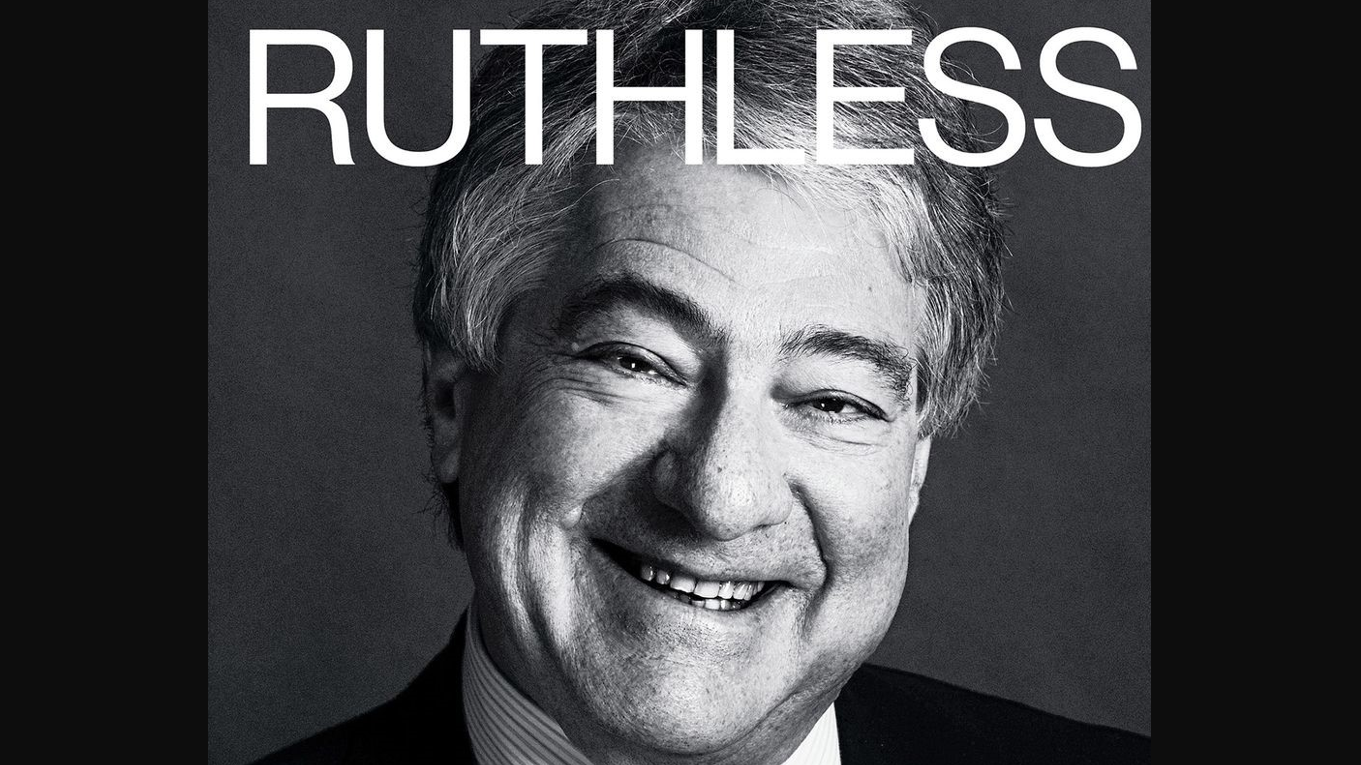

Why We Like Rallies Led By Semiconductors: Jim Cramer [The Street]

As The Cramer likes to say, there’s always a bull market somewhere. The most persistent bull markets I know are advice markets based on unbridled optimism OR on unbridled pessimism … perma-bulls and perma-bears are always in demand. But the job security is better for unbridled optimism. Plus you avoid the Grumpy Grandpa audience, which can be a real drag.

The biggest advantage for the optimist advice market is that there’s a clear mechanism for getting paid. If you’re up, you’re up … there’s more money in the pot than there was before, and some of that can easily go to the cheering squad. If you’re down, though, even if you’re down less than you would have been otherwise … you’re still down. Investors are thankful for less bad losses. But they don’t pay for them. This is as true for the largest institutional investor as it is for the smallest personal account.

Get Report!

But why would anyone buy Evizo (an autojector connected to a mini-computer) when they can by a generic naloxone prefilled syringe at CVS for $30? The whole comparison is disingenuous. Who would pay $3970 to press a button to inject instead of pressing down on a plunger?

The Mitch Hedberg bit about doing LSD out in the woods because you’re less likely to run into an authority figure, but then running into a bear, is a parable all investors should meditate on!

" It IS the New York Times, however, so before we get to that, we have to properly frame everything in terms of the very powerful narrative of inequality as the root cause of all society’s ills."

Most religions open every prayer by paying respect to the deity or the core principals of the religion. For the NYT, that is moral superiority, which today takes the form of indignation at income inequality.

Re, ETF fees. I almost think the industry - while hating the fee compression (life was easier when the client just shut up and paid you 1% to index) - would rather talk about the “benefit” of saving the client 2bps than the lack of outperformance, the complexities of truly managing to after-tax returns or the other hidden fees and costs it wants the client to not notice.

Heck, I wouldn’t be surprised if firms were intentionally slow-walking to the low-fee end state, not to capture the last dollar, but to be able to roll out the LOWER FEES! bread and circus several more times.

I’m against picketing, but I don’t know how to show it.

I’m against narrative, but I don’t know how to explain it.

There is absolutely some shameful slow playing here!

I’m not sure why they would buy it, but I’m pretty sure I know why they would include it as their example in a big feature piece in WaPo!