Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories. On the weekend, we leave finance to cover the last week or so in other shifting parts of the Zeitgeist – namely, politics and culture. It’s not a list of best articles or articles we think are most interesting … often far from it.

But these are articles that have struck a chord in narrative world.

Narrative Map – All US Non-Markets Stories (3.31.2019 – 4.6.2019)

The Times Can’t Let Go [Patriot Post]

I suppose it shouldn’t be surprising that the most interconnected story to the narratives permeating all non-financial news is an opinion piece from a right-wing site about the Mueller Report. It could just as easily have been a left-wing opinion piece from, say, Mother Jones.

I hope you aren’t sick of them yet, because, unfortunately, these “the real story in the Mueller investigation” pieces aren’t going anywhere. They are the perfect fodder for the Widening Gyre because their contentions cannot be proved or disproved. The political right can and will contend that the entire affair was a media-fueled failure, and that the unwillingness of the media to own up to its role is the ‘real story’. The political left can and will contend that the investigation uncovered enough to make Trump unelectable, that there was collusion, even if the scope of the investigation couldn’t be definitive about it, that it’s really about the cover-ups and unwillingness to make all the materials public, etc. etc.

I’m not offering an opinion on the truth of either contention, just the observation that deeply-held, tribe-identifying, non-falsifiable claims are almost impossible to root out.

Echoes from under the stadium [BYU-Idaho Scroll]

Why is this so interconnected? Well, if you can cram discussions of college football, religion, music and language (singing hymns in Spanish) into a short article, you’re going to find yourself connected to a lot of different topics.

I’ve told the story before of a man – Dr. Eph Ehly – who guest conducted a large choir I sang with in Texas. Dr. Ehly believed that the American folk song was fading from our cultural memory. He lamented it. His lament was for the loss of everyday musicality, the idea that singing was a thing people did when they worked, when they traveled, when they gathered socially. It was also a lament for the idea of a working cultural Common Knowledge, songs and poems and texts we all knew and expected that others would know (and know we knew).

Dr. Ehly made us learn and memorize about a dozen of those songs. As it happens, a number of years later I found myself in an inn in Austria where some local musicians and a bit too much wine all around ended with me trying to teach a group of marginal English speakers a couple verses of Oh, Shenandoah. It was only 15, 20 years ago that this happened – and yes, it really happened (hooray, cask wine!) – but it’s hard to imagine this kind of familiar/foreign experience happening today.

Hymns are a sacred thing, but they ARE the folk songs of a lot of American sub-cultures. I suspect that the knowledge of Amazing Grace, How Great Thou Art, and most spirituals are going the way of secular folk tunes. Would 25% of Americans know a verse by heart? Fewer? Still, this isn’t a “good old days” thing. I’d be positively thrilled with cultural common knowledge of something modern, something popular! But as it happens, I know only two examples of what I mean by a true Folk Song, a true Hymn, a holy, cultural, musical thing that has stuck around in spite of it all:

The first are Christmas carols.

The second? Pick a random little town in Texas, and go to the high school football stadium on a Friday night. Stand up in the bleachers whenever you feel like it, and shout out as loud as you can, “The stars at night are big and bright.”

How the Left Embraced Elitism [New York Times]

ALL populism leads to power vested in a political elite, David.

Let us not pretend that a sitting president pressuring the head of an ‘independent’ central bank to explicitly buttress asset prices is somehow exerting less concentrated power than a goofy environmental plan that will never get off the ground (and won’t even be the defining issue of 2020, which I increasingly expect will be health care / health insurance).

The influence of the influencer [UMASS Daily Collegian]

Another college paper!

I don’t have much to say about the intent of the article itself, but the influencer is not a surprising interconnected topic. It touches the intersection of technology, media and business. As I’ve observed – and as part of our media and NLP research, researched – influential social media presences, I’ve discovered two things that were surprising, at least to me:

- The remarkable advertising revenue-generation potential of a successful social media-based influencer.

- The similarly remarkable difficulty (for those who have tried) faced by most social media-based influencers seeking to convert that marketing influence into more traditional forms of influence and power (e.g. corporate, political, etc.). Still very different signaling/credentialing worlds with different governing narratives.

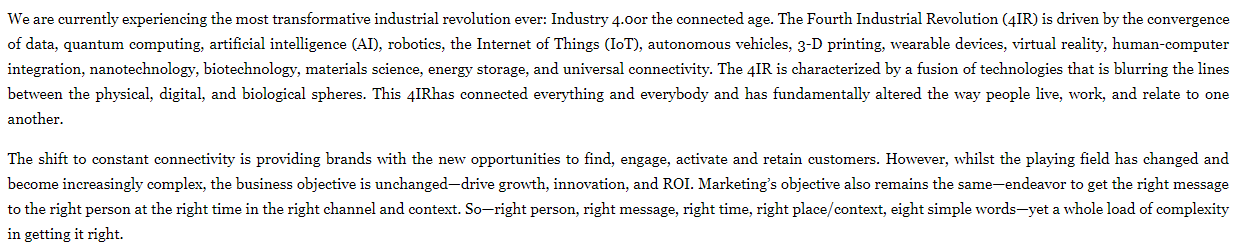

The Evolution Continues: The Platformization of Marketing [CIO Review]

Sorry, that’s as far as I got before my Buzzword Bingo card was full. I’m gonna take my winnings and go play the nickel slots.

Seeking Tomorrow’s Masterpieces [Pittsburgh Post-Gazette]

Ben and I have written about and are fascinated by art curation, despite the horrors of our art knowledge relative to other topics. Below are our trivia scores by category on Learned League, which I provide utterly without any authorization from Ben. I’m on the left, and he’s on the right. At least in the trivia world, we are uncultured swine. Third column gives our correct answers percentage. Brutal.

But we are still fascinated by the topic because of its credentialing structures, its missionaries, and the fact that the value of a painting, the designation of something as a masterpiece is a complete narrative construction. This is an entire industry built upon foundations of common knowledge and narratives!

To me there is so much that investors can and should learn from those who assess the value and marketability of visual art. While there are still some aesthetically minded folks like me who look at that blue clay bowl up there and say, like the uncultured swine we are, that it looks like something we made in elementary school art class, by and large art is an industry brokered by people who are much more aware and less embarrassed that they are playing a common knowledge game and not just ‘evaluating the artistic value’ of each piece. Everyone knows that it’s about convincing the right people and creating the right buzz and the right story about why something ought to be valuable.

That means that the games played are one level deeper into the Keynsian Newspaper Beauty Contest than what most people are playing in markets. It also means that the visible games in the art world look much more like the games played in finance that we prefer to imagine we are keeping a secret. You mean you own that stock in part because you believe other investors will begin appreciating some trait about it and buying into its Story? You rebel!

In other words, if you want to see what investors are doing in secret, watch what art investors do in the open.

Marvin Gaye: You’re the Man [All About Jazz]

Why is the review of a previously unreleased 1972 album from Marvin Gaye connected to everything else in media in the last week?

Give the thing a listen and find out for yourself. Most (all?) of the songs were familiar to me and have been released on anthologies, but as a single composition the album is very fine. You could do worse on a Saturday in spring than listen to one of the finest voices ever recorded.

It’s probably unlikely that wealthy people could organize themselves to take turns overpaying for objects which can be donated to museums for tax deductions. Nobody thinks like that.

I have said for a while that people should pay more attention to the art market. Not just to get a different perspective on things, but society/economics etc stand “down wind” from culture. Contemporary art is a great insight into emerging cultural trends and norms.

Also, the deepest pockets are involved in buying and selling art. Seeing the art market provides an added insight into capital flows that looking at the financial markets all day just simply cannot provide.

Agreed. Thanks, Sean!