Back in the day, Pravda was the official newspaper of the Soviet Communist Party and Izvestia was the official newspaper of the Soviet government. They were, in the lingo of these matters, “organs” of the Soviet Union. Today Pravda is the official newspaper of the Russian Communist Party and Izvestia, self-described as a “Russian national newspaper”, is owned by Gazprom. LOL.

Speaking of the Soviet Union, I’m old enough to remember when a sclerotic and failing Leonid Brezhnev was the perfect symbol of the sclerotic and failing USSR, when the advanced age and decrepitude of Soviet leadership was a global joke. Wanna guess how old Brezhnev is in this photo, taken two years before his death? He’s 73.

Anyhoo …

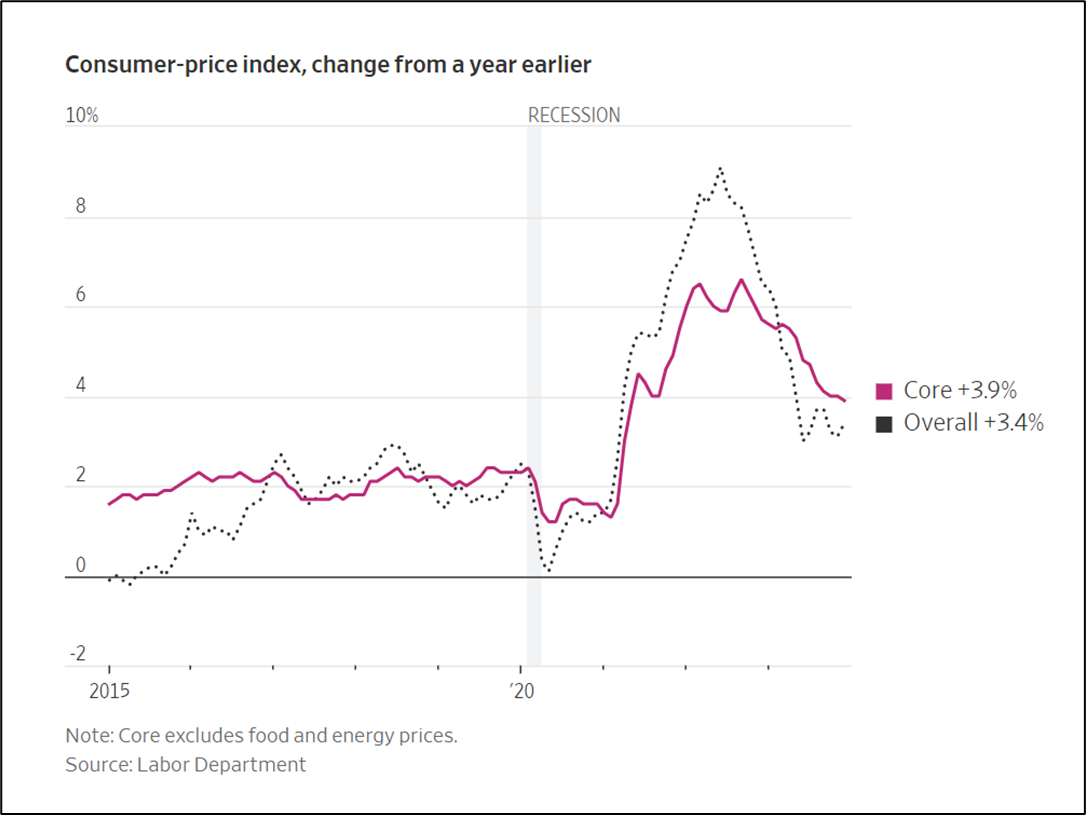

Last month I wrote a note about media framing of the monthly CPI release. The point was that the Wall Street Izvestia was altering its graphical presentation of CPI reports to encourage the perception that inflation rates were continuing to fall rapidly as opposed to flatlining over the past six months. Money quote from Non-Linguistic Inflation Framing in the Wall Street Journal:

Today both Wall Street and the White House are determined to tell you a story that inflation is over, mission accomplished. Wall Street because they want a cheaper price of money and the White House because they want to win an election.

It’s not a lie, per se, but it’s not a truth, either. It’s all just story, all the way down, not just in their words but in their pictures, too.

For the past year, since March 2023, the WSI has graphically emphasized the core inflation rate, officially because everyone knows that everyone knows that core inflation is what you should really be paying attention to and overall inflation is for chumps, truthfully because core inflation rates have continued to decline since last June and so present a Narrative-appropriate picture, as opposed to overall inflation rates which bottomed out last summer. The presentation emphasizing core inflation looks like this from a month ago, with a dark red line for core inflation and a faint dotted line for overall inflation:

Honestly, I didn’t think that it was possible for the WSI to outdo themselves on this score with yesterday’s coverage of the CPI release, but well … here we are.

Good Lord Ben, Sometimes it does feel like we are living in a George Orwell novel.

The headline should have read: " Wall Street does not get the perfection it’s priced for"

Of course, we also have the “Super Core” which is really going in the wrong direction as it was up .8% in Jan, certainly no need to mention that, but it’s nice to have in case we need it to tell our story at a later date.

A note yesterday from Brian Westbury:

But the most troublesome piece of today’s report came from movement in a subset category of prices that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, and is a useful gauge of inflation in the services sector. That measure jumped 0.8% in January – the biggest increase since April 2022 – when the US was experiencing the height of its inflation scare. In the last twelve months, this measure is up 4.4% and has been accelerating as of late (up at 6.7% and 5.5% annualized rates in the last three and six months, respectively), stoking fear that inflation has become entrenched in the services sector. The spike in Super Core prices in January was largely due to increasing prices for transportation services (+1.0%), medical services (+0.7%), and hotels/motels (+2.4%). Meanwhile, the US economy and labor market continue to chug along. No matter which way you cut it, the Federal Reserve has little reason at this point to start cutting rates anytime soon. How they respond to the incoming economic data in the months ahead could determine whether we repeat the inflationary 1970s.

Might be time to change the formula altogether, or use some more targeted zip codes for those owner equivalent rent “surveys”. Call more of those damn flyover states!!

The bullshit is piling up so fast we need wings to stay above it!

Just checked the online version for the WSJ and there was nothing, nothing on the red hot PPI data for this morning.

Hmmmmm.

Couple that with Housing Starts, Industrial Production, and Retail Sales —starting to make the case for STAGFLATION.

Westbury this morning:

A key economic mistake people make is thinking growth

leads inflation. One reason they do that is because inflation is a

monetary phenomenon. When money is too easy, first growth

rises, and then inflation rises with a longer lag due to excess

dollars in the system. This process reverses when money is tight,

first growth slows, then with a longer lag inflation does too.

That makes 2023 an anomaly. The economy has remained

resilient, but year-over-year consumer price inflation has

moderated from a peak of 9.1% in mid-2022 to 3.4% in

December 2023.

One theory is that the high inflation was all due to economic

bottlenecks and supply constraints during COVID, so the end of

lockdowns and the process of getting back to normal has

expanded supply, leading to both faster growth and lower

inflation. There’s no doubt that the imposition of lockdowns and

then the re-opening from those lockdowns had “supply-side”

effects – first negative, then positive – and are consistent with

this explanation.

But it’s a flawed explanation. If supply constraints and

their loosening were the key drivers of inflation, we would

expect pandemic driven inflation to be followed by outright

deflation as the economy reopened and returned to normal. That

clearly hasn’t happened, and inflation remains stubbornly high.

Instead, we believe monetary policy played the key role.

The M2 measure of the money supply soared 41% in 2020-21,

the fastest since World War II. This measure of the money

supply then declined 3.2% in 2022-23, the largest two-year drop

since the Great Depression. These swings in M2, the relative

sizes of the swings (larger up than down), and the long lags

between shifts in M2 and inflation do a much better job

explaining the inflation pattern of the past few years.

The problem with this theory of “monetary dominance” is

that classical liberals like Milton Friedman and the Austrians

would expect economic growth to take a hit before inflation were

brought back down to normal. And yet Real GDP grew 3.1% in

2023, which is above the 2.0% long-term trend.

So what gives? Our belief is that the US injected so much

money, so rapidly, that the economy couldn’t absorb it

instantaneously. So, now, what we have seen is that even though

M2 has declined, we still haven’t absorbed all the money that

was added. Some call it excess savings, we call it excess M2.

But the US has finally absorbed the excess money, and

fiscal stimulus is waning as well. And guess what? Recent

reports for January show an economy that may be weakening

faster than most investors realize. Retail sales fell 0.8% for the

month and have declined in three of the past four months.

Manufacturing production fell 0.5% in January and

manufacturing excluding the auto sector (the auto sector is

volatile) has declined four months in a row.

Meanwhile, home building got hammered in January, with

both housing starts (-14.8%) and completions (-8.1%) dropping

sharply. It’s possible that colder than normal January

temperatures were a factor, as well as unusually high

precipitation, but the drop in starts was in every major region of

the country, the drop in completions happened in most regions

(except for the West), and while weather was bad, quantitative

measures of national heating requirements were not unusually

high in January.

We’ve had bad weather before – and apocalyptic weather

reports are clearly clickbait for some in the news media – but

housing starts in January were the second lowest for any month

since mid-2020, during the onset of COVID when lockdowns

still prevailed in much of the country. In other words, we see

these data potentially signaling broader economic weakness,

consistent with the drop in retail sales and decline in

manufacturing production in January.

And yet inflation was also a problem in January, with both

consumer and producer prices rising 0.3%, faster than the

consensus expected and inconsistent with the Federal Reserve’s

2.0% target inflation.

A weakening US economy with inflation remaining

(temporarily) stubbornly high would be consistent with the

monetary dominance story of inflation’s rise and fall and would

also be a problem for the stock market. Using our Capitalized

Profits Model, with a 10-year Treasury yield at about 4.25%,

economy-wide corporate profits would need to rise 30%+ to

justify an S&P 500 at 5,000. But there’s no way profits (ex-Fed),

which are already high relative to GDP would surge that much

higher in a soft economy. The current consensus puts profit

growth at roughly 10% this year.

Time will tell if the weakness in January becomes more

widespread. On the surface, the job market still looks fine, with

payrolls up more than 300,000 in both December and January.

But the labor market can be a lagging indicator.

Unprecedented policies during COVID have created noise

in the data. But underneath it all, we still believe Milton

Friedman had it right. A decline in money will lead to recession,

and then a decline in inflation.

Can someone assist with the meaning of PCE report today. I keep reading it’s up, but that is really good news?

I think it came in right in line with expectations.

Given last weeks CPI I think people were worried it might be hotter.

The PCE core services inflation came in hot. Worst monthly spike in 22 years . That’s a category Powell has been concerned about. This category, core services , is where consumers spend the majority of their money.

I don’t think it was a good report for those expecting the Fed to cut rates.

Wall Street didn’t want this at all and will avoid talking about it.

But Powell and the Fed will pay attention

Thx…that’s why i was scratching my head this am and thought of the recent ET posts on inflation. PCE is bad = Good is quite the spin. Also heard, “markets are up big today…due to inflation numbers…Fed MAY CUT RATES LATER THIS YEAR”…that made me chuckle.

I could post this tidbit on several inflation related threads. Bloomberg interviewed Judd Cramer, a Harvard lecturer, who has written a paper about how mortgage interest rates aren’t influencing the CPI but are still impacting consumer confidence. Tidbits from the interview are that changes in the CPI calculation in 1983 took mortgage rates out of the CPI (one of scores of changes over the years intended to massage the headline number lower). Cramer’s math is that the CPI would have peaked near an 18% y/y change in this cycle, vs the high 9%'s just with the old methodology. Consumers feel this, through lower housing affordability, even if the number we are trained to obsess over misses it. Conspiracy theorists on inflation have followed Shadowstats for years, reverse engineering what the CPI would have been under the old methodologies. And, to Ben’s point in the post, many pundits I see argue to remove the 40% shelter component when analyzing the CPI today, which completely eliminates shelter from one’s cost of living!

So while I appreciate the above, it is also worth mentioning when these papers do something well. And the WSJ has run two articles on global maritime concerns over the past couple of days that have been well-reported and frankly, excellent. One was on the sinking of a freighter in the Red Sea by the Houthi militias, and the other was a first-person account of a Philippine supply convoy harassed by Chinese vessels in the South China Sea. As I am on mobile, and it is two articles, I will not link them here, but they are both worth reading. They are what journalism can and should be.