To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

I’m willing to bet that fewer than half of Epsilon Theory readers know who Angelo Mozilo is. And that’s a shame, because no one better epitomizes the intense financialization of the American stock market from 2001 – 2007 than Angelo. No one better epitomizes the corrupt lending and securitization practices that led directly to the Great Financial Crisis of 2008 than Angelo.

The fact that Angelo Mozilo was allowed to pay a $67 million fine (leaving him with only … oh, $400 million or so left over) on SEC insider trading charges and walk away scot-free from ALL criminal prosecution is something I will NEVER forgive Eric Holder and Barack Obama for. Google “friends of Angelo” when you get a chance. Only Dick Fuld, who oversaw the Repo 105 fraud at Lehman (and who also skated from any criminal OR civil prosecution), makes my blood boil more than Angelo Mozilo.

But this isn’t a note about Angelo Mozilo.

This is a note about Countrywide’s quarterly earnings call in 2008, when Angelo, in response to an analyst’s question, said that sharply increasing mortgage delinquencies and failures were NOT limited to sub-prime, but were now in Alt-A mortgages, too.

I’ll never forget that call. With one comment, Angelo gave the lie to everything Ben Bernanke and Hank Paulson had been saying about the “well-contained” nature of the sub-prime mortgage crisis. You could almost feel the thermonuclear energy coming off that call and spreading throughout the professional investment community.

Markets were never the same after that.

From that call forward, no professional investor responsible for Other People’s Money trusted a single word they heard from Bernanke or the Bush White House on the “containment” of sub-prime delinquencies. No professional investor worth his or her salt trusted a single word they heard in the following months from Merrill and Bear and Goldman and Citi about the marks they had on their RMBS assets. This wasn’t just a US thing. The Europeans were much more flagrant liars. Even as all hell started to break loose for US banks in the summer of 2008, European banks valued their massive portfolios of Alt-A securities at 97 cents on the dollar, all rated AAA, natch. They were ALL liars. All of them. Without exception.

After that Countrywide earnings call in 2008, I trusted NO ONE in government or Wall Street to tell the truth about the mortgage crisis.

And that’s the way I feel about COVID-19 today.

In 2008, you could not trust a single word that anyone in government or the financial services sector told you about their exposure to bad mortgage securities. And because you had zero trust … because you had zero visibility into the actual exposures that banks actually had … you SOLD.

In 2020, it’s exactly the same thing. I do not trust a single word that anyone in the U.S. government (or the Japanese government or the Chinese government) tells us about our exposure to this virus. I believe that most professional investors feel the same way.

And when you have no trust … you SELL.

The problem for the US government is that once they lose trust, it doesn’t really matter what they say. Does an article like this one inspire trust?

https://www.mercurynews.com/2020/02/28/coronavirus-government-defends-disputed-uc-davis-test-expands-surveillance/

For me the killer example of governments doing utterly unforgivably damaging things to their own people was when the USSR went ahead with the May Day celebrations in Kiev (100 km (62 mi) from Chernobyl) with massive crowds outdoors after the Chernobyl disaster that occurred on Saturday 26 April 1986, exposing the population to radiation. It makes me want to build a citizen controlled global radiation detection network.

The Chernobyl analogy is exactly right . . .

One reassuring thing is that the limitations on testing and test kits works on both the numerator and denominator, and so while the spread is likely under reported, the severity is likely over reported. This is no excuse for the UC Davis incident.

Trust though, is why Donald Trump is president, and why Bernie Sanders will be the next president. Trust is why “not QE” will be QE infinity. And trust is why, the White House just tweeted, “we’re in the midst of the Great American comeback!”. 机/機

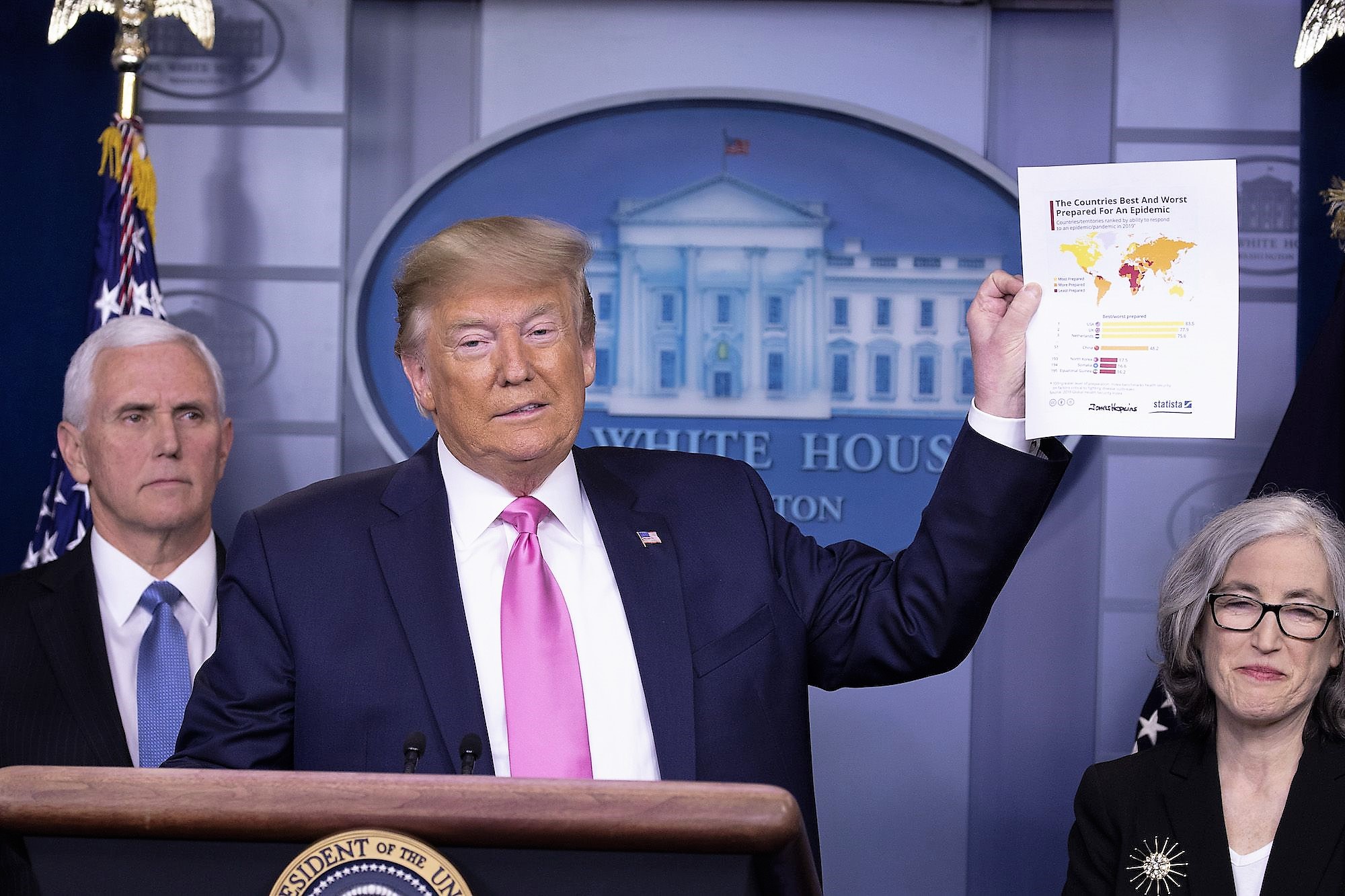

Is it just me, or does it look like he wrote “Johns Hopkins” in black sharpie on the bottom of that Statista 1-pager that some intern found on the internet?

It probably refers to The Center for Systems Science and Engineering (CSSE) at JHU. See https://systems.jhu.edu/research/public-health/ncov/

I think the only conclusion we can draw from the lack of testing and test kits is that we don’t know what we don’t know about this thing yet.

He did.

To step out of the matrix…….

I observed that in Hong Kong, the virus situation seems to have stabilized. We Hong Kongers have zero faith in anything the HK government says these days, & the HK medical teams went on strike to force the government to close most border crossings to Mainland China.

People are hiking and going outdoors into nature for their health, and even the anti-government protests have restarted.

Is there more Coronavirus hiding or lurking in the dense housing estates? Maybe. But HK people are anal to the point of hypochondriac about flu or any such sickness, and would immediately get tested if there were any symptoms.

So just observing conditions around us, it would appear that for now, this situation has stabilized.

Can it resurface or restart? This we have no clue at the moment.