Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Commentary: Sell-side research struggles to show its worth [Pensions & Investments]

It’s been more than a year since the European Union’s Markets in Financial Instruments Directive II regulation forced asset managers with EU interests to unbundle research payments from the trading commissions they pay to brokerages.

So far, what we’ve learned from the new transparent pricing model is that the availability of research significantly outweighs the buy side’s need for it. Look no further than BlackRock slashing its Europe, Middle East and Africa research budget by 60% in 2018, or the Financial Conduct Authority’s claim that MiFID II saved U.K. equity investors more than $200 million in its first year alone.

Now, the regulation is colonizing the United States. U.S. asset managers from Wellington Management, T. Rowe Price and Invesco — each responsible for about $1 trillion in assets — have lobbied U.S. regulators to bring MiFID II ashore.

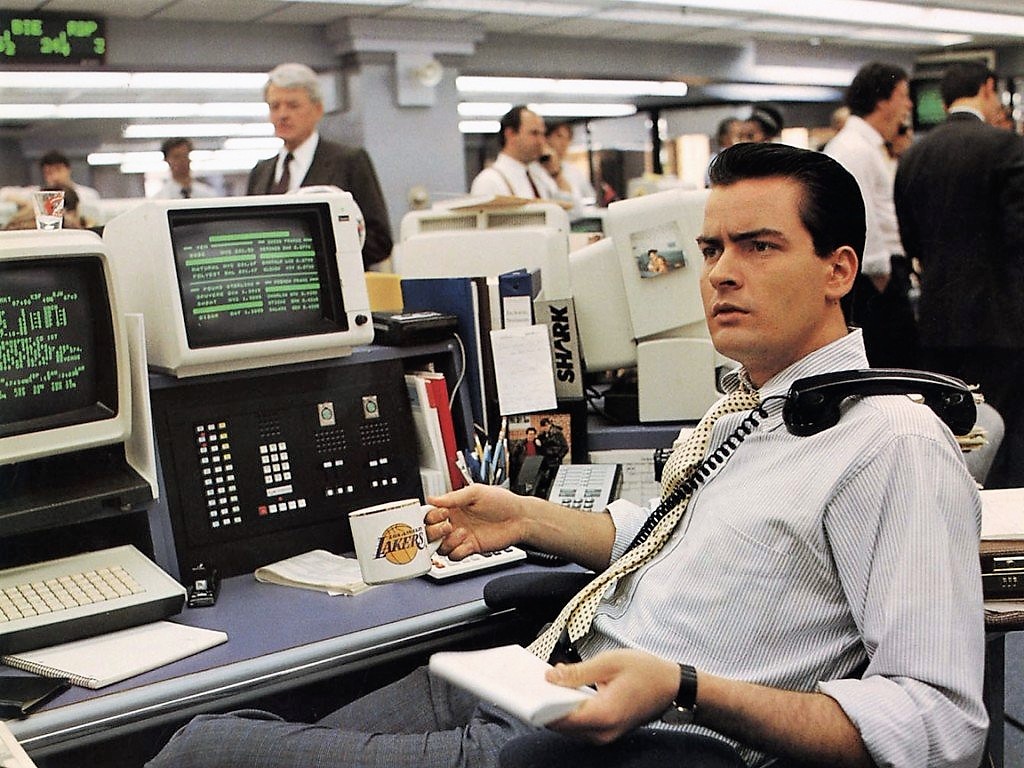

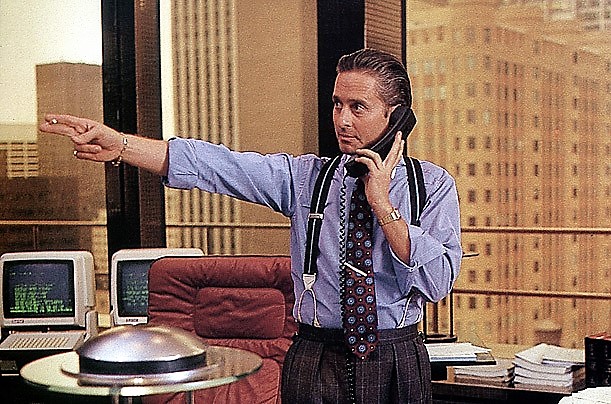

What’s the most valuable commodity Gordon Gekko knows?

Information.

How valuable is Wall Street research? How much information does Wall Street research have?

LOL

The MIFID II regulations in force throughout Europe – which require banks to charge real money for their research and not allow them to “bundle” research with higher trading costs borne by the end client – have been as much of a disaster for the banks’ business models as negative interest rates. Well, maybe not THAT bad, but pretty darn disastrous. Every sell-side research department was always a loss-leader. Now they are loss-disasters, with zero positive externalities. Now they’re just an endless black hole of costs. So they’re being slashed to oblivion.

What MIFID II revealed is that sell-side research just isn’t worth much. It’s just not. And now it’s inexorably coming to the US market, which means that every sell-side analyst on the Street today needs to be polishing their resume.

As if they weren’t already.

Why is sell-side research valueless? As Gordon Gekko would tell you, because it contains no information. See, there are two and only two buy-side use cases for sell-side research.

- To crib the spreadsheet model and put it in your own report.

- To get access to management at conferences and site trips.

That’s it.

So now that I can download a spreadsheet model for every company from FactSet or Bloomberg … now that management has zero desire to appear, much less say something with information, at investment conferences … well, you see where we’re going here.

Oh, you thought someone cared about the OPINION of the sell-side research analyst? You thought someone cared about the ANALYSIS of the sell-side research analyst?

Bwaahahahahahahaha. Hoo-boy, that’s a good one.

As the old (and correct) buy-side saying goes: In a bull market you don’t need an analyst, and in a bear market they’ll kill you.

What is the function of sell-side analysts today? To create stories that drive trading volume. To support those stories by maintaining a suitable media presence. It’s a miserable job. Because you are sooooo replaceable. And you’re a cost-center for the mothership, no different than the IT support department. Which you may have noticed was outsourced years ago.

Sorry, guys, but it’s going to get worse – a LOT worse – when MIFID II comes to New York. Which it is.

Start the discussion at the Epsilon Theory Forum