Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

There are a lot of angles we could take here.

Advertising and PR isn’t always Missionary behavior, although its primary aim is usually similar. Companies want to cultivate Common Knowledge about a brand or a product. Talking about that would be, if you’ll forgive the expression, very on-brand for us.

We could write about the power of luxury and act-as-if narratives in context of Fiat World and the Long Now. Pretty on-brand there, too.

But neither of those on-brand takes is why we’re featuring this press release.

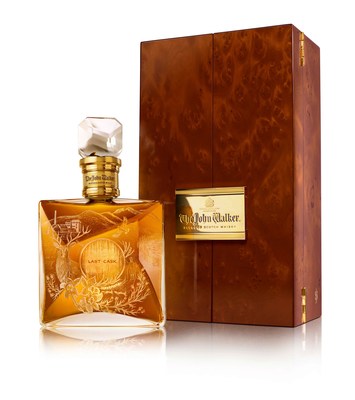

The Last Chance to Taste an Icon of Scotch Whisky [Press Release]

We are featuring this press release because the language it uses makes it the single most connected article in all of financial media today. Not a trade war article. Not a Trump politics article. Not the Fed. Not NIRP. Not currency wars.

Whisky.

And not just any whisky. An absurdly expensive, Rube Goldberg blended construction of old whiskies (not even sure it qualifies as Scotch, actually – a lot of non-barley grain). I love whisky, but have never had this one – it’s $4,000 a bottle, y’all – so maybe it really is some kind of ambrosia. But the main feature here is the use of really old barrel staves, only so many of which exist. It’s a thing which isn’t very likely to impart much of interest to the beverage, but is certainly rare. Because it is designed to be rare.

The reason this sits at the top of our Zeitgeist is because there are few narratives that define that Zeitgeist more than narratives of scarcity and access. Whether think-pieces on expanding definitions of Qualified Purchasers or Accredited Investors to give more investors access to alternatives, or discussions of scarcity in context of Bitcoin, or pension plans discussing why they’re trying to get access to higher capacity mid-market growth / accelerator funds pretending to be venture capital, this language is everywhere.

But there are whiskies that are rare because they have been aged in a barrel made from staves with limited availability and poured into a custom crystal decanter which is then lovingly placed into a burled wood box, all of which are designed to create scarcity, and there are whiskies that are rare because there is a natural lack of something desired. Oh sure, a 1966 Springbank Local Barley or, say, one of the last releases from the now-shuttered Port Ellen are still speculative investments. You are still betting, in the end, on how much someone else values a thing of which there is only so much to go around. Anyone who tells you there’s a whisky in the world for which the drinking experience is worth $4,000 more than comparable options has lost the plot.

But it is different. Of course it’s different. When things really get hairy, the attention paid to the narrative of scarcity is still dependent on the narrative of desirability of the scarce thing.

If you are sold investments on the basis of that scarcity – or told that you should pay this fee or that on a basis of scarcity or access – beware the similarity in language between the true and counterfeit. Not all scarcity and access is created equal, even if the language used to describe them is.

Cialdini’s chapter on scarcity in Influence (Chapter 7) was eye-opening. It turns out that we value scarcity on many levels. You will value an asset even more if I tell you that it’s scarce AND I tell you that information about its scarcity is scarce also.

The prevalence of valuing scarce resources across so many global cultures has always caused me to wonder whether its something that arises out of our genetic history…did a scarcity valuing gene in our ancestors’ history lead to a higher survival rate and…?

If you extend the value of scarcity one level out and ask yourself what are some scarcer resources out there…well art, land, and equities all come to mind. Gold too. Just saying.

Are you trying to drive me to drinking? Because you’re getting veeeery close.

Makes me wonder what the markup on a bottle like that would be in a fine steakhouse.

Will probably make it on the menu at an ‘experience’ joint - one of the Salt Bae steakhouses, if any are still open. $1,000 / glass, maybe? Hard to fathom.

I don’t know that there is a single thread of genetic history that’s linked to scarcity - I think there are MANY. It’s obviously a big topic with meme potential, so it follows that it would make an easy target for the creation of scarcity! memes.

In 2007 I was marketing a levered structured product in the UK. It was designed as a unit with income stripping subordinated debt with sufficient term to eliminate withholding tax and a thin layer of equity. My boss desperately wanted this deal to work, a rival had done one. We were staying at the Dorchester, a perk of traveling with the owner.

It was clear after a couple of days that the UK investors we were being introduced to had zero interest in a highly levered product built on top of income stripping (highly levered) Cdn assets. I retired to the bar at the hotel, ordered a martini and blanched at the bill. It was expensive in 2019 dollars. On the top shelf they had MacCallans by year. I asked how much a shot of the 1952 would cost. 125 pounds for a gill. Went to a chip wagon for dinner.

At Heathrow they used to have a brilliant scotch shop. I bought an unusual Springbank bottled in the 1980s. The bottle was to be shared with the back office on the day the product had the oak stake put through it’s heart. In the depths of 2008/9 there was negative equity but the cash flows always covered the debentures. A series of discount buybacks of the debentures slowly returned some value to the equity. The product had the oak stake around 2013 with the debentures made whole and only moderate loses for the equity. The Springbank did not disappoint.

I hadn’t at the time thought about segmenting our industry by archetype. The structured product was raccoon activity. At our shop it stopped. While I don’t identify with the coyote meme, I do punch the Looney-Tunes time clock under the sheep dog meme. It’s time for the sheep dogs to clock in.

This is great stuff - would love to hear more of these memories. I’ll confess that I probably identify more with the sheepdog, too, although as opposed to “too clever by half” I suppose our identifying trait is “constantly surprised by just how far some people will go to make a buck.”