To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

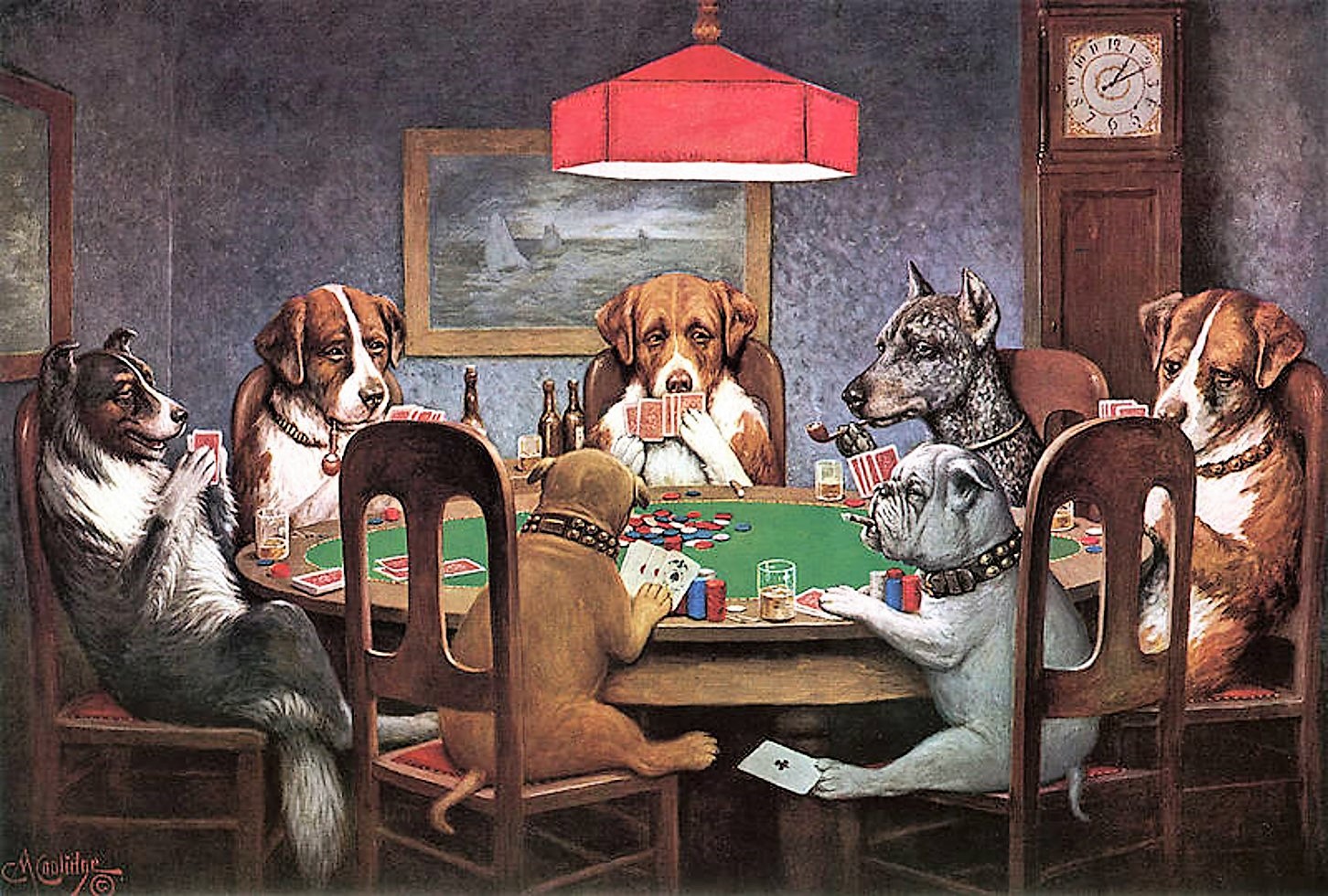

There’s an old saying in poker: don’t just play the cards, play the players.

It’s the same thing in markets. You can’t just focus on the cards you’re dealt, i.e., the fundamentals of this stock or that stock. You also have to focus on the other players who are playing these same cards, and that means understanding the behavior of a crowd of buyers and sellers in the stock market.

Just like in poker, sometimes the cards/fundamentals don’t matter at all. Sometimes poker players will think they have an edge in understanding the other players sitting around the table, and before you know it, there’s a huge pot in the middle of the table regardless of what cards have been dealt.

That’s exactly what has happened with Tesla stock over the past few months. There’s a huge pot of money in the middle of the table in the form of an enormous market cap for Tesla as the stock keeps getting bid up, and none of it has anything to do with the fundamentals of the company.

And, despite what I know you’ve heard, almost none of it has anything to do with people buying the stock because it’s “cheaper” since the stock split. Oh sure, we’ve all heard stories of the idiot friend of a friend who either thinks they’re getting four brand new shares of Tesla with the 5:1 split or believes it’s more “affordable” now that it’s been split. But the truth is that fractional share purchases have been a standard feature of every retail Davey Day Trader’s online stock trading platform for months and months. If you wanted to buy $100 worth of Tesla stock, you didn’t need a stock split to make that happen (and the stock split didn’t lower the price per share to that level anyway). The truth is that these stories about the idiot friend of a friend are just that – stories – not entirely apocryphal, maybe, but nowhere near even a rounding error in the average daily trading volume (more than 70 million shares per day) of Tesla stock.

The feeding frenzy on Tesla has nothing to do with that handful of rubes buying the stock because it’s more “affordable” after the split. It has something to do with traders buying the stock because they believe the story that there will be rubes buying the stock because it’s more “affordable” after the split. And it has everything to do with traders buying the stock because they believe that other traders believe the story that there will be rubes buying the stock because it’s more “affordable” after the split.

This is the Common Knowledge Game in action. It is the power of the crowd watching the crowd. It is the power of – not what you think is true, and not what you think the crowd thinks is true – but of what the crowd thinks the crowd thinks is true.

Today, the crowd thinks the crowd thinks that there are newbs and rubes buying the stock because it’s cheaper post-split. And that is what’s driving the feeding frenzy in Tesla shares. Apple, too.

It’s an old idea in investing, dating back at least to John Maynard Keynes in the 1930s, who called it the Newspaper Beauty Contest to use as market analogy the social media of his day. Maybe we should call it the Robinhood Effect.

But in both the 1930s and the 2020s, the idea is the same: in markets like these, the fundamentals don’t matter. You can play any hand you’re dealt! What matters is the story around a company or a stock, and what matters even more is whether it’s a story that everyone believes that everyone else believes.

How does the game end? When you stop reading stories about the idiot friend of a friend buying “cheap” Tesla shares for the first time. Not because there were ever enough of these newbs and rubes to actually make a difference in Tesla price action, but because the story that these newbs and rubes are out there will be broken. You’ve seen exactly that happen in the past few days. Now that the stock split is over and there are no new online articles shouting “idiots who don’t understand stock splits will be buying Tesla hand over fist!”, the Common Knowledge Game breaks the other way.

But you know who understands this game really well? Elon Musk. Tim Cook, too. That’s why Tesla is selling up to $5 billion worth of fresh stock while the price is so high. Think of it as the house taking their rake from the over-inflated pot of money now sitting in the middle of the poker table.

So don’t worry about Elon and Tim. They’ll find another story to drive another round of the Common Knowledge Game.

They always do.

In the case of both Tesla and Apple, there are some actual “fundamentals” that were at work in the recent huge runups after announcement of the stock splits. Specifically, large short positions in stocks that are splitting can cause a short squeeze. Shorted stocks are covered by the short sellers with borrowed stock. The mechanics of splits and proper crediting of the additional shares can temporarily take shares loaned to short sellers back out of circulation until the split shares ex date forcing some short sellers to have to cover. That is exactly what happened in TSLA and Apple…and likely was a lot more important than the few folks that might have actually thought the split shares were somehow more fundamentally attractive (doubt if many really) and likely more important than anyone playing the stocks believing there would be large demand related to misunderstanding of splits.Market mechanics are a “fundamental” and in this case were the main factor in the “split-related” runups more than any retail investor stupidity.

In this (overdetermined) situation, I agree that the “market mechanics” explanation is most likely.

And these explanations have been part of the (market) lore since forever, or at least since the guys with the brightly colored jackets have been on CNBC. (So also subject to

common knowledgeeffects.)I have a minor vocabulary beef with calling it “fundamental”.

[narrator: he’s not gonna “beef”; he’s just writing some software in this domain and is thus forced to name all the things, and he’s not gonna call it that. Needs a clean separation between company data and company security market data, which is already a “derivative” from the “fundamental” perspective of the company itself.]

I hear you, Abe, although in my experience it’s more often the PM who covers the short position in advance of the split just because he doesn’t want to go through the hassle of any fund accounting weirdness, especially if it’s happening at month end, rather than the prime broker calling in shares or making the shares hard-to-borrow. Kinda like shorting a high dividend stock through the ex-date … lots of PMs just don’t want that hassle

Tesla at $200 going to $800 was aided by short covering. After that, it just hasn’t had a large enough short position to attribute the rest of the move to shorts. It did look like everyone and their mother was buying because the stock was going to be included in the S&P 500. PT Barnum couldn’t have narrated that story better, and now it will hang out there to keep the shorts away. Between that and being valued like a software company at a gazillion times revenue, just a crazy run. Anybody listen to Grant Williams podcast with TC charts? I have no position, it’s just a fascinating story. I want to say #BITFD, but it just feels like nice guys finish last and as Trump says “we have to protect our genius”.