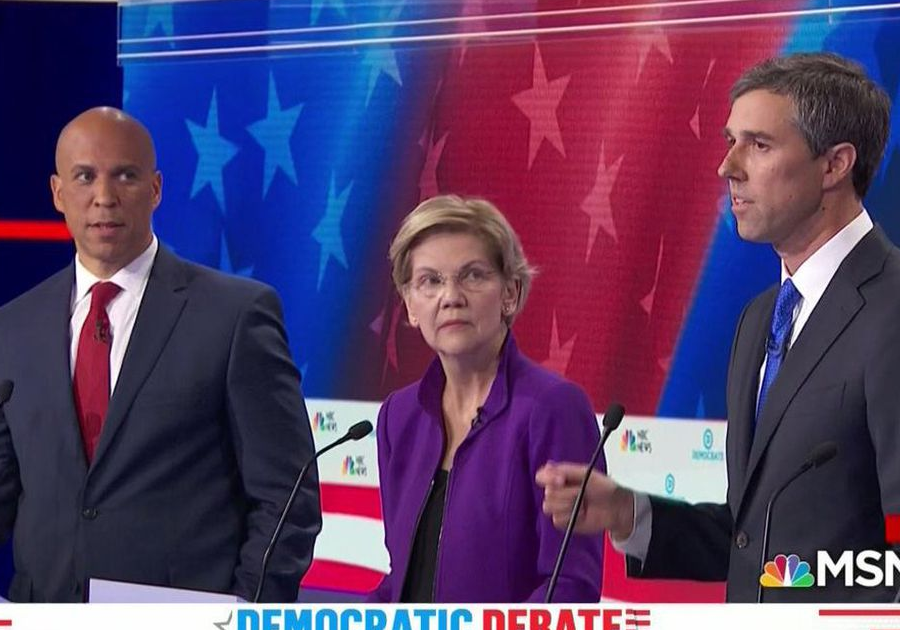

In celebration / abject dread of the 2020 election cycle that is already upon us, Epsilon Theory is

The ET Election Index – April 2019

To learn more about Epsilon Theory and be notified when we release new content sign up here. You’ll receive an email every week and your information will never be shared with anyone else.

Continue the discussion at the Epsilon Theory Forum

The Latest From Epsilon Theory

DISCLOSURES

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results. Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results. Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

While I deeply appreciate this much-needed lens into the co-evolution of political dynamics and the memetic structures they spawn, I worry about your use of the broader concept of “cohesion” in reference to memetically-precipitated tails wagging behavioral dogs.

Despite the fact that this inverted feedback mechanism exists, it is but one reason why such narratives would show up as “cohesive”, as measured by this metric. Namely, assuming narratives possess a tie to reality–however tenuous–we must separate the degree to which narrative “cohesion” represents accurate distillations of underlying behavioral patterns as opposed to self-fulfilling fabrications.

Else, we risk cynically blinding ourselves to the fact that narratives do in fact emerge from an underlying reality, even when that process of emergence has been co-opted by people and institutions who understand how to consciously transform digitally-meditated rhetoric into a form of supernormal stimuli (Missionaries in ET-lexicon, I suppose). Cohesion may represent primary signal in connection with the underlying dynamical reality, or it may represent a cynically manipulated simulacra of this signal. And while you rightfully encourage skepticism of the latter, this metric establishes a frame by which the latter is assumed to always overshadow the former. Interestingly enough, this tension appeared (to me, at least) as the root of most of the caveats / ambiguity that emerged during yesterday’s ET Live.

The rationale behind my concern is best summarized by your own identification of the need for an “attention” metric as proxy for the degree to which collective focus possesses the tendency to fuse conceptual structures beyond the threshold of pragmatic utility (at least from the consumer’s POV).

Essentially, I’m making the claim that by making invisible the contribution of meaningful underlying pattern to narrative cohesion, the “cohesion” metric appears to violate the spirit of the the attention metric as presently formulated. In my view this is a critical flaw along the “cohesion” dimension, and will likely bias reader / viewer perception of your analyses too strongly toward the notion that the tail not only wags the dog, but has in fact devoured it whole. I suspect at times it’s tempting to believe this, but am not convinced of its pragmatism.

Aside from that–and as alluded to earlier–this is basically the only part of the election cycle to whose unfolding I look forward. Keep up the amazing work.

In Service to the Pack,

Matthew