To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Shale Companies Had Lousy Returns. Their CEOs Got Paid Anyway. (Wall Street Journal)

It’s been a bad few years for investors in shale companies, but a pretty good few years for shale company CEOs.

The leaders of U.S. shale companies received some of the largest executive pay increases in corporate America, even as their shareholders lost billions of dollars, a Wall Street Journal analysis has found.

There’s something about Wall Street Journal headshots that make you look guilty.

Maybe it’s the black-and-white, maybe it’s the uncanny valley stippling, but whatever it is, I have no doubt that this is why the Wall Street Journal editors used this two-by-two composite of headshots as the social media image for their broadside against shale company CEO compensation .

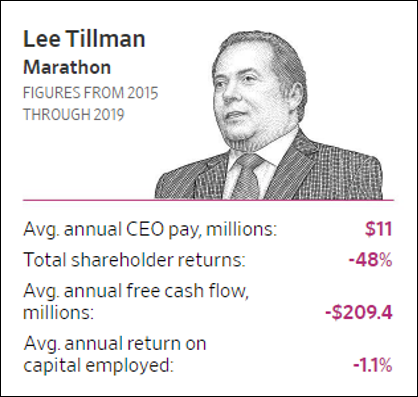

Similarly when you dig into the article, the words are just filler for the four individual headshots, together with their cash comp and stock price performance data for the five year period 2015 – 2019.

I mean, you don’t even need to read the article to get your blood pressure up. Tens of millions of dollars every year to each of these guys. Hey, I could do their job for a fraction of that money! Clearly these guys are guilty of … something. But guilty of what?

In the eyes of the Wall Street Journal, the mortal sin committed by these CEOs – all of whom are professional managers, not founders or entrepreneurs – is NOT that their professional managerial compensation is ridiculous and extreme. No, the mortal sin is that it’s off-Narrative, that there’s no pleasant veneer of positive “total shareholder return” to justify their professional managerial compensation. We are told that these four CEOs are over-compensated because the stock price is down, not that they are over-compensated, period.

These CEOs violated the “Yay, shareholder alignment!” narrative, and THAT is why they are singled out and hung out to dry by the Wall Street Journal.

These four CEOs are presented as “bad apples” in an otherwise perfectly healthy system of professional management behavior. They are presented as scapegoats for a SYSTEM of massive wealth transfer from shareholders to the professional managerial class.

This article is not an attack on that system. It is a defense. It is telling you that the system is fine … we just need to do something about these bad apple CEOs who do not properly “align” their compensation with shareholders.

One day we will recognize the defining Zeitgeist of the post-GFC Obama/Trump years for what it is: an unparalleled transfer of wealth to the managerial class.

Not founders. Not entrepreneurs. Not visionaries.

Just don’t expect to find that recognition in the pages of the Wall Street Journal.

But…but…MBA degrees are ridiculously expensive! Gotta justify them somehow.

(Though there is a rumor that we may be hearing about that soon as well…)

Considering how low nat gas prices have been for the past decade, Mr. Dinges from Cabot has at least achieved a positive cash flow. Sub $2 natural gas isn’t conducive to making money. And as poorly as the share price has performed it is head and shoulders better than their shale gas peers who are down 70 to 80 per cent if they haven’t gone bankrupt. Stock performance these days is all about the story you tell and the fossil fuel story is a story no one wants to hear.

“don’t hate the playa, hate the game”

Which is why we need to change the game !!

Since Epsilon Theory taught me to see managerial class abuses, I’ve started seeing them everywhere ?

I saw a satirical blog post yesterday that summarised the problem perfectly: https://defmacro.substack.com/p/how-to-get-promoted. Rewards are apportioned according to how well you have done at building a fiefdom, not how much value you create. The CEO level is just the biggest, worst level of a rotten pyramid.

Nice read! If you enjoyed that you will love https://www.ribbonfarm.com/2009/10/07/the-gervais-principle-or-the-office-according-to-the-office/

I have not read anything better on the structure of organizations and how / why it is the sociopaths who get ahead of everyone else.