To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

American Airlines to Cut 19,000 Jobs by Oct. 1 When Federal Stimulus Ends (WSJ)

“American Airlines Group Inc. said it would shed 19,000 workers by Oct. 1 as the carrier prepares to downsize to cope with the coronavirus pandemic’s blow to travel demand, which isn’t expected to rebound for years.

The reductions include 17,500 furloughs of pilots, flight attendants, mechanics and others, as well as 1,500 cuts from management and administrative ranks.

Airlines received $25 billion in federal aid to pay workers through the end of September to avoid mass layoffs.

Unions and airline officials have advocated for another round of funds to keep employees on the job through March 2021.“

Doug Parker, American Airlines CEO and Chairman of the Board, wrote a letter to his employees today that pretty much defines high-functioning sociopathy.

I’m going to reprint excerpts from that letter – which is couched in the saccharine vocabulary of modern team-speak, but is in truth a shakedown letter to employees and a ransom note to the US government – and then I’m going to tell you a few things about Doug.

Dear fellow team members,

We respect and greatly appreciate the sacrifice these team members have made, and continue to make, for American and their fellow team members.

Even with those sacrifices, approximately 19,000 of our team members will be involuntarily furloughed or separated from the company on Oct. 1.

The one possibility of avoiding these involuntary reductions on Oct. 1 is a clean extension of the PSP.

If you haven’t already done so, you can let your elected officials know just how important a PSP extension is to you, your families and our economic recovery.

The American Airlines team is no stranger to adversity, and in adversity, we always come through.

We will come out on the other side of this crisis. Until then, take heart that we will get through this together.

The professionalism and care this team has shown over the past six months has been nothing short of extraordinary. We are all American Airlines, and we will survive, and one day, thrive again. Thank you for all you are doing now, and tomorrow, to carry us through.

Know who’s not sweating the October 1 firing line? Know who’s surviving and thriving just fine, thank you very much?

Doug Parker, that’s who.

Here are some fun facts about Doug Parker and his “leadership” of American Airlines since he became Chairman and CEO of the company in 2013, after its merger with US Airways. All of this (and more) can be found in a long note I wrote on the airline bailout back in March.

Do The Right Thing

I’m angry that I have to write this note about the airline industry and how to structure the bail-out of United, Delta, American and Southwest. But I must, because the raccoons and the high-functioning sociopaths are looking to get their private losses socialized and their private gains locked in. Bailout the airlines and their rank-and-file employees? You bet. Bailout the CEOs and Warren Buffett? Not a chance. Read more …

From 2014 through 2019, Doug Parker pocketed more than $150 million in cash through his sale of 3.6 million shares in American Airlines. That’s in addition to the $50 million in stock he still owns (and net of the pittance that Doug has paid for all of these shares). That’s in addition to the $100+ million in cash salary and cash bonuses and deferred comp and stock options and incredible perks that Doug has received. Nope, cash comp and deferred comp are for suckers. Just ask Jamie Dimon.

These stock sales were particularly egregious in 2015 – 2016, where for a twelve month period Doug pocketed between $4 million and $11 million in stock sales per month, and again in 2018, when for a brief shining moment American Airline’s stock price went above $50. Wouldn’t you know it, Doug just happened to choose that moment to sell 437,000 shares of stock, more than twice as much stock as he had ever sold before and almost 5x the usual size of his stock sales.

But surely, compensation like this is well earned. Surely, American Airlines has outperformed its competition, built a solid franchise, and delivered nice returns to its investors.

LOL. Don’t call me Shirley.

From 2014 – 2019, the same years that CEO and Chairman Doug pocketed $200 million in real money stock-based comp, American Airlines had *negative* free cash flow of $3.2 billion.

And took on an additional $14 billion in debt.

And bought back $13 billion of its stock.

How did all this work out for American Airlines shareholders from 2014 – 2019?

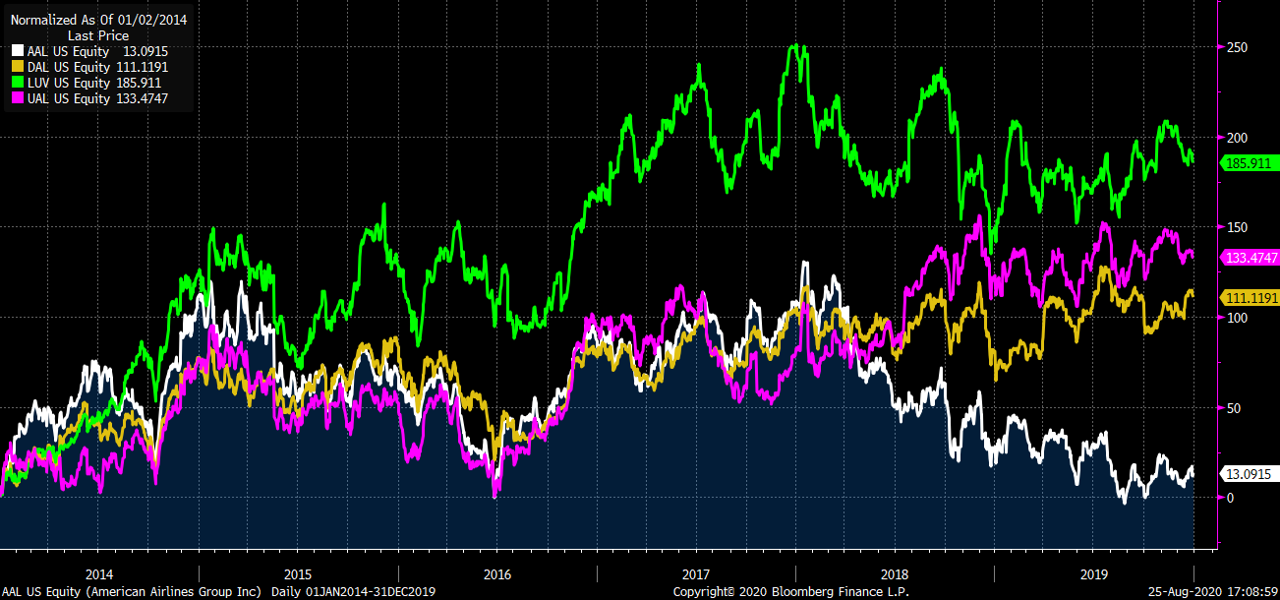

That’s American Airlines in white, Delta in yellow, United in purple, and Southwest in Green.

Over this six year period, AAL stock was up 13%. Not 13% per year, but 13% over SIX YEARS of the best bull market in history.

Barf.

Doug Parker is not an entrepreneur. Doug Parker is not a founder. Doug Parker has never built a goddam thing in his life. Doug Parker is not on your “team”.

Doug Parker is a financial analyst. Doug Parker is a manager. Doug Parker is a risk taker with other people’s money and other people’s lives.

And for that, Doug Parker is a centimillionaire many times over.

One day we will recognize the defining Zeitgeist of the Obama/Trump years for what it is: an unparalleled transfer of wealth to the managerial class.

It’s the triumph of the manager over the steward. The triumph of the manager over the entrepreneur. The triumph of the manager over the founder. The triumph of the manager over ALL.

Welcome to The Long Now.

BITFD

I’ve seen that letter more times than I care to count. As we say in the cockpit, “standard briefing.” It’s been going on the entire 35 years that I’ve been in the industry. The Obama years marked the point at which, to use a phrase that you’re fond of, they just stopped pretending.

As an, ahem, “related” aside, there is nothing quite like an over-leveraged real estate executive asserting a moral imperative for workers to return to the suddenly obsolescent office buildings he developed:

“When it comes to reviving

the economymy rent rolls, we are all essential workers.”https://www.wsj.com/articles/its-time-to-open-new-yorks-offices-11598393805?mod=hp_opin_pos_2

Wow, what a douche!

Definitely a disgrace, and I feel so terrible for the employees affected by this.

On a lighter note, love the subtle “Airplane!” reference, Ben!

I remember reading the first note you wrote about this and I had my “this is when I became radicalized” moment. Burning $13b on buybacks is an amazing feat, especially when you consider the negative cash flow.

I want to propose an alternate target here, Ben: instead of focusing in on the CEOs who do this, why are we not seeing a groundswell of activists coming in and eviscerating the boards that rubber stamp this bullshit? Round them up and publicly shame them to the point that nobody would ever even consider putting them on another board for the rest of their lives. Regular investors have no power, but that hardly matters. The people with the real power in this country aren’t in Congress or the White House, they’re sitting at the top of the institutions that own shares in all of the companies. State Street, Blackrock, Capital Group, Fidelity, Vanguard…they all have pretty strong opinions on ESG ex SG these days. Perhaps they need to take more seriously their role as arbiters of governance. Because they’re pretty much the only ones who can do it.

How about all the mutual funds who are the biggest shareholders doing something about this? That drove Bogle crazy.

I thought the same thing as I was reading this article in the WSJ today… “Wow, is this guy talking his position!”.

Seems Tanya was thinking the same thing but expresses the feeling more eloquently.

Either way, Ben is on to something that is going is at the heart of what is wrong with this country and its politics/policies. Very few people in this country are even aware of this. Ben, you are a thought leader on this. You, and the pack, are out ahead. That’s meaningful.

Capital Group, Fidelity, Blackrock, Vanguard, State Street, and Invesco would be the big names in both active and passive that would need to be corralled in order to make a serious push. Throw in a Franklin or a T. Rowe Price too, if possible. If Blackrock can unilaterally decide to cut out coal companies then it seems logical that they can push for better actual governance.

I assume you are talking about Marx but I wish you were talking about Thomas Carlyle instead, whose history: The French Revolution, is much about how decline in public morality/ethics led directly to the cataclysm of said revolution.