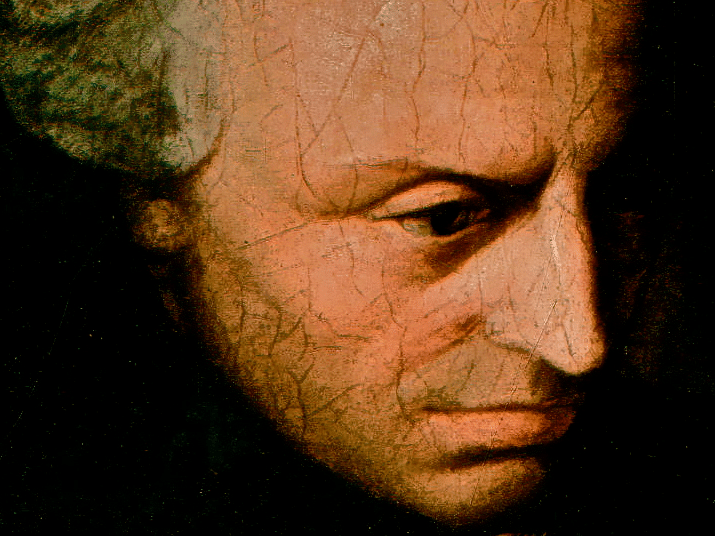

Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He plays guitar and drums on the worship team at his church in Connecticut, and dabbles in cooking, whisky, progressive rock and beating Ben at trivia.

Articles by Rusty:

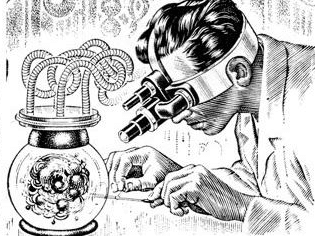

Part 2 of the multi-part Three-Body Alpha series, introduced in Rusty’s recent Investing with Icarus note. The Series seeks to explore how the increasing transformation of fundamental and economic data into abstractions may influence strategies for investing — and how it should influence investors accessing them.

The allure of a fundamental truth is powerful. Investors are hungry for that kind of clarity about markets, but it doesn’t exist. In the first in a series, Rusty discusses a framework for investing in a time of Icarus.

The #1 question investors ought to ask of a financial services company trying to sell them something is: “What is it, really?” If you don’t know what you’re investing in, you’re liable to end up eating a lot of crunchy frogs.

Most investors think that other investors think that last week’s correction was about vol-selling. The real story? Everybody knows that everybody knows that inflation will change the way portfolios are built and managed.

In a two-body market, the interactions of fundamental data and prices are generally predictable. In a three-body market, the epsilon — investor behaviors in response to narratives — exerts a powerful gravitational force which must be considered when building a portfolio.

The libertarian paternalism of a Nudge culture in finance has created an industry of investors who care about fees but have forgotten about taxes, trading costs, slippage and behavioral costs of actively trading passive instruments.

If you can manage to find a truly independent voice in your personal, political and financial life, pursue it with reckless abandon. Don’t set it to the side so that you can build a brand or make an impact. Get your ass out of the boat, grab your bow, strap on your broadsword and sound the pipes. All that’s left is to decide what song you’re going to play.

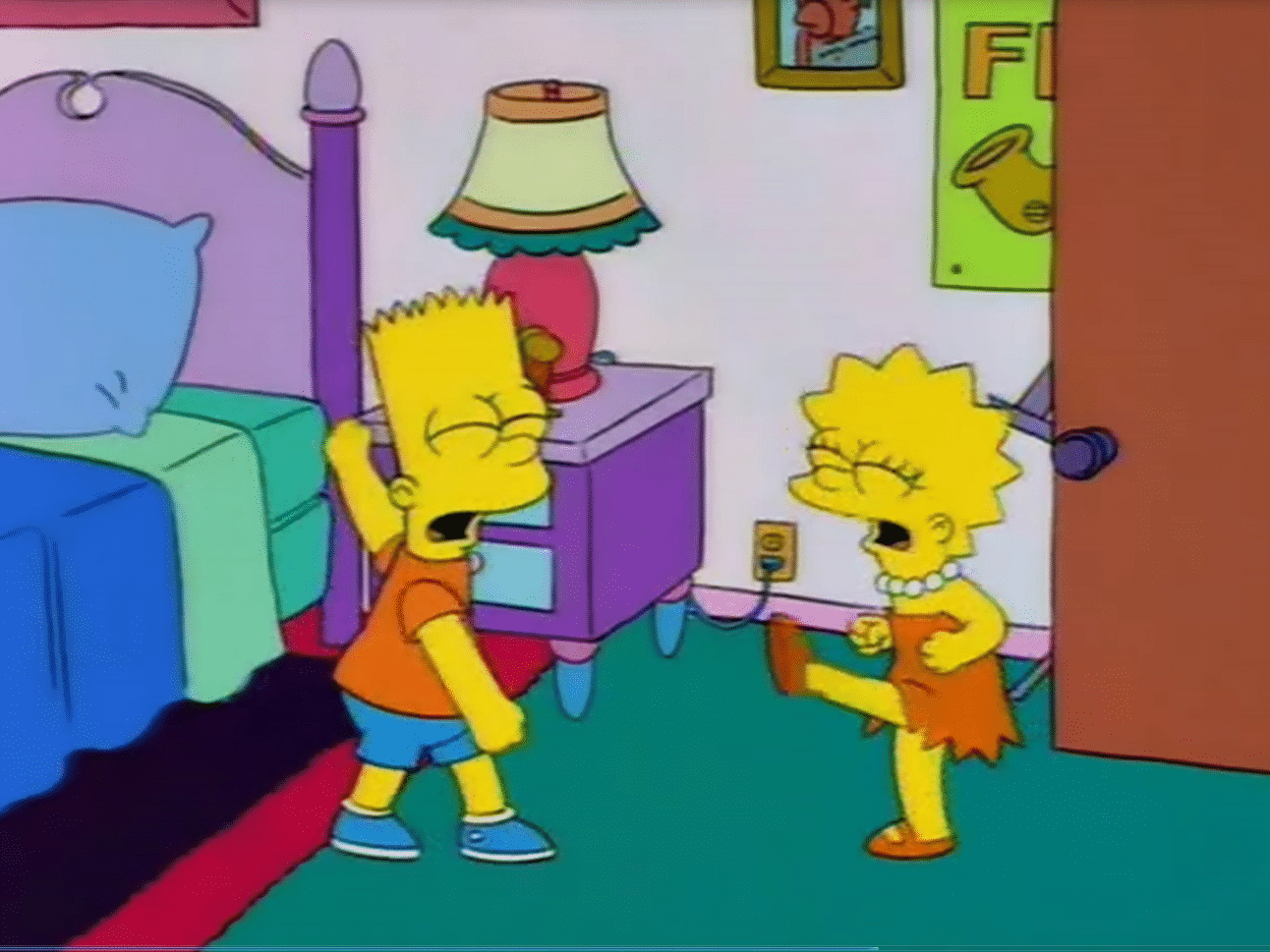

The behaviors that influence markets must be considered in context of archetypes, the languages and identities which group investors every bit as much as identity politics groups voters.

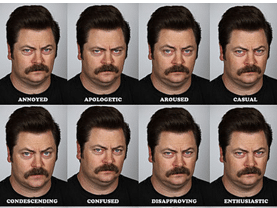

When we try to define others’ Cartoon, we take away their agency, and strip away their humanity. And we do it with our clients, every time we guess what behavioral box they fit it.

Benjamin Graham famously said that the market is a voting machine in the short run, and a weighing machine in the long run. This is a right-sounding idea. It is also wrong. Behavior matters over every horizon.