Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He plays guitar and drums on the worship team at his church in Connecticut, and dabbles in cooking, whisky, progressive rock and beating Ben at trivia.

Articles by Rusty:

Humility is in short supply on Wall Street. But the humility! meme is not. Developing a process to understand the difference is important for any asset allocator.

Ben and I are pleased to announce the launch of Epsilon Theory Live – our audio/visual supplement to the existing written Epsilon Theory content! Epsilon…

The iPhone XS launch is attached to the strongest pre- and post-launch narrative of any September launch since the iPhone 6. Does that tell you how to trade it? No. Can it help you think about how different outcomes might shape your thesis – and the thesis you believe other investors are following? Yes.

It’s easy to feel like we need more than hope to pass through troubling times, and it’s usually true. But sometimes hope is exactly what we need.

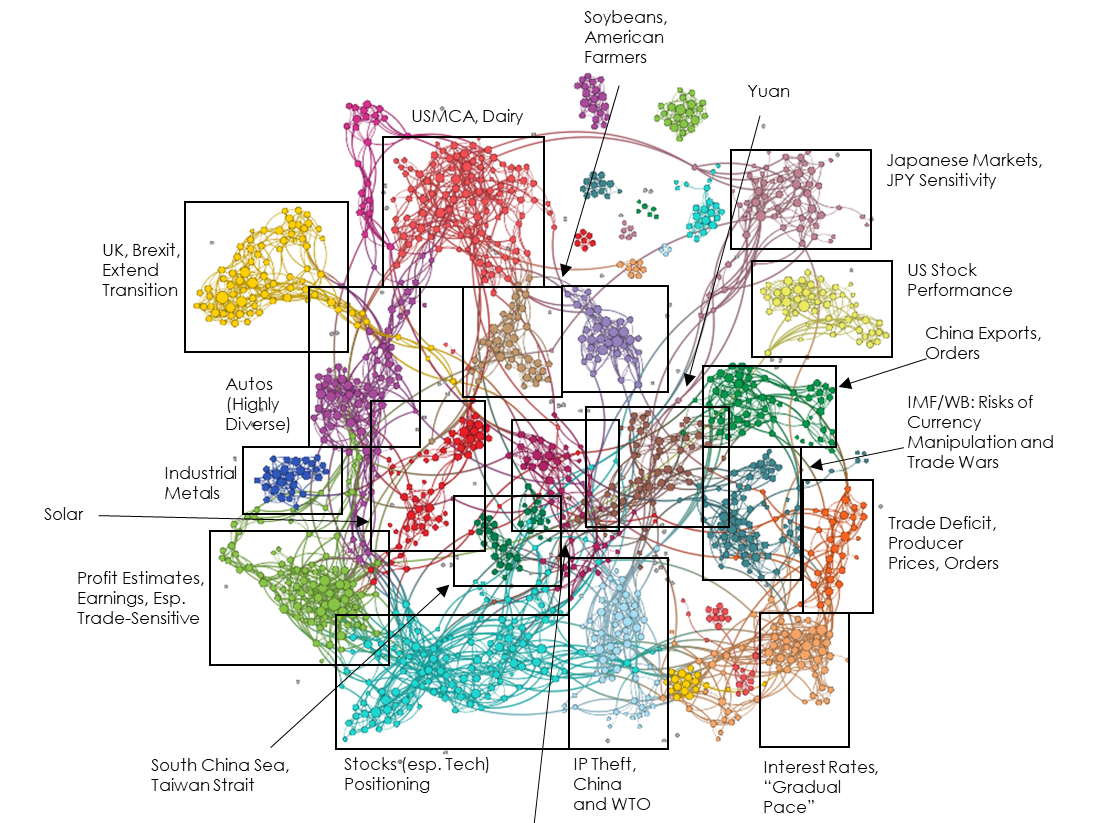

After several months of increasing cohesiveness around an inflation-is-coming narrative, attention to the topic has been tapering in early Q4 Right now we think this…

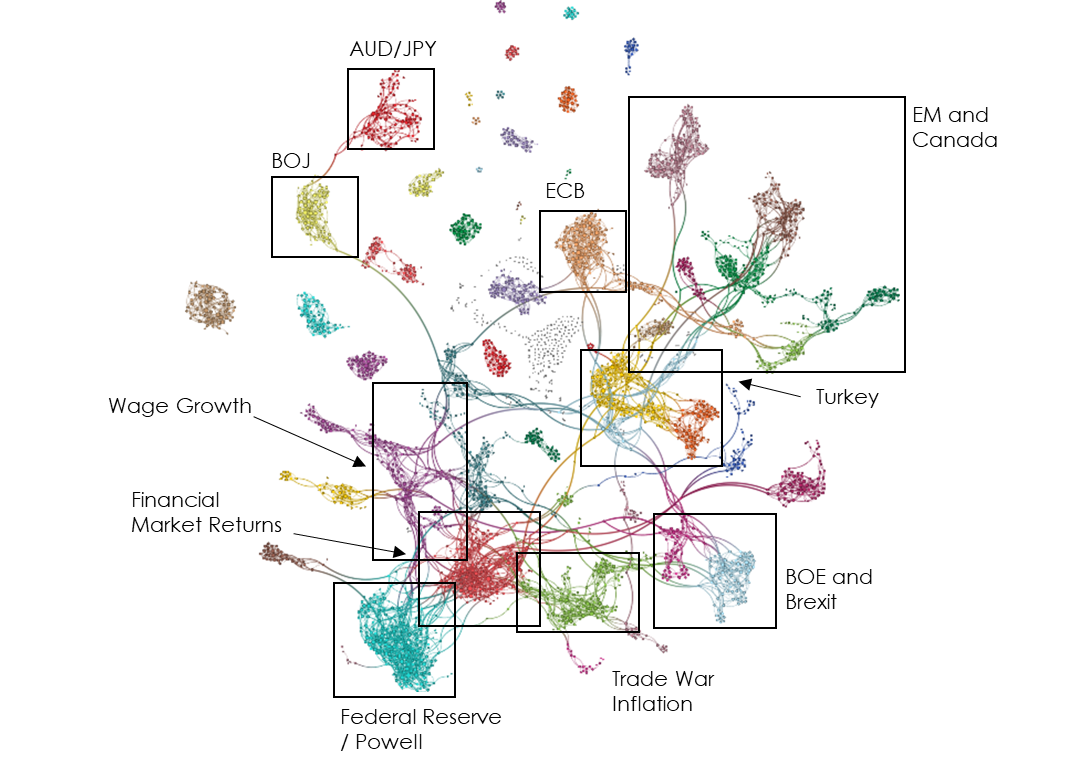

The narrative of coordinated global central banking policy has been restrained for an extended period, including most of 2018. After a brief rise along with…

While it is only a single data point, our October attention measure rose from its very low base over the prior three months. Our aggregate…

After climbing as usual (and, we think, in more muted fashion) in connection with mid-term elections, attention to US Fiscal Policy narratives ticked down modestly…

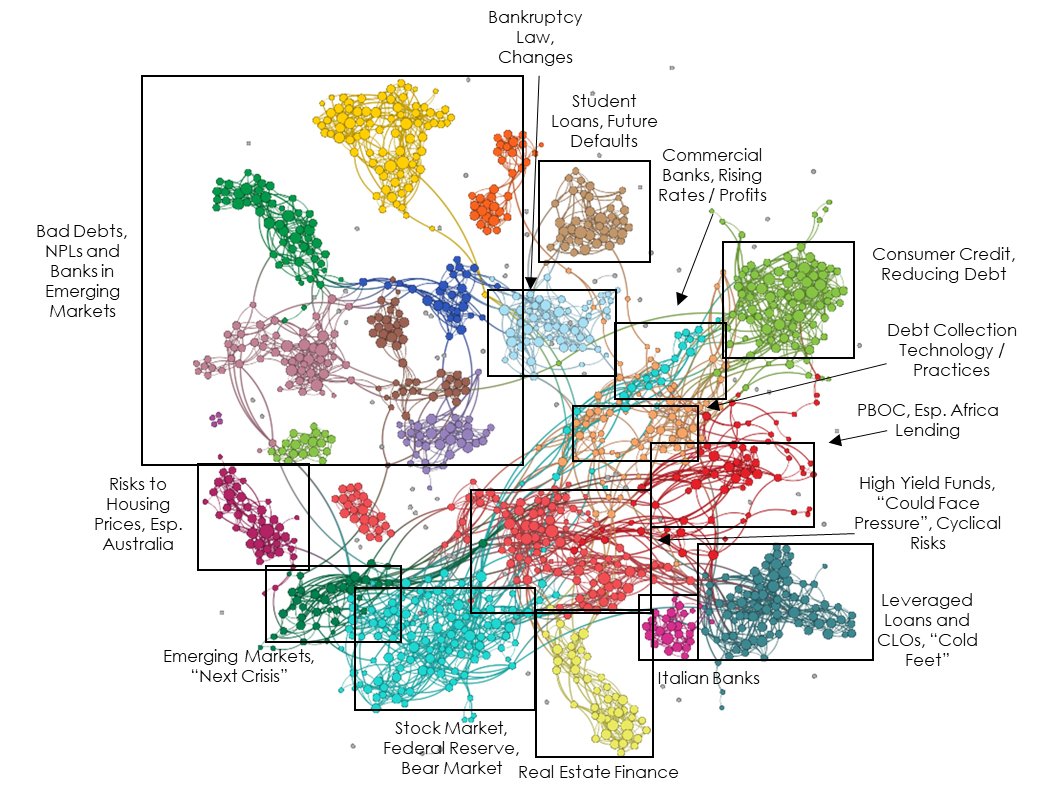

While articles including key credit terms continued to rise in October, their internal coherence continued to fall. This means that stories tended to cover individual…

Using facts in your analysis doesn’t make your analysis a fact. Punchy language that leans on these ‘facts’ doesn’t often stand up to scrutiny.