Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He plays guitar and drums on the worship team at his church in Connecticut, and dabbles in cooking, whisky, progressive rock and beating Ben at trivia.

Articles by Rusty:

We have built industry standards around minimizing the appearance of risk. As a result, we now have an epidemic of ability-signaling, when what we really need is humility.

The mechanics of effective storytelling and the tells of Fiat News are very similar. Add knowledge of them to your news-reading arsenal.

Take it from a list of terrible pop songs (and one OK, if overrated song from the Doors): lessons that provide an answer instead of a process are usually lessons badly taught and badly learned.

Nobody likes to admit it, but the investment industry hires and invests with the smartest-seeming people that seem sufficiently likable. And it doesn’t work.

There is a huge gap in the Narrative and language used to describe private equity and hedge funds. Even when it is correct, it calls for caution in our discussions and decision-making.

Sometimes the meanings of words change. Sometimes that doesn’t mean anything. Sometimes it does.

A brief selection of stories from my daily news routine that made me wonder: “Why am I reading this now?”

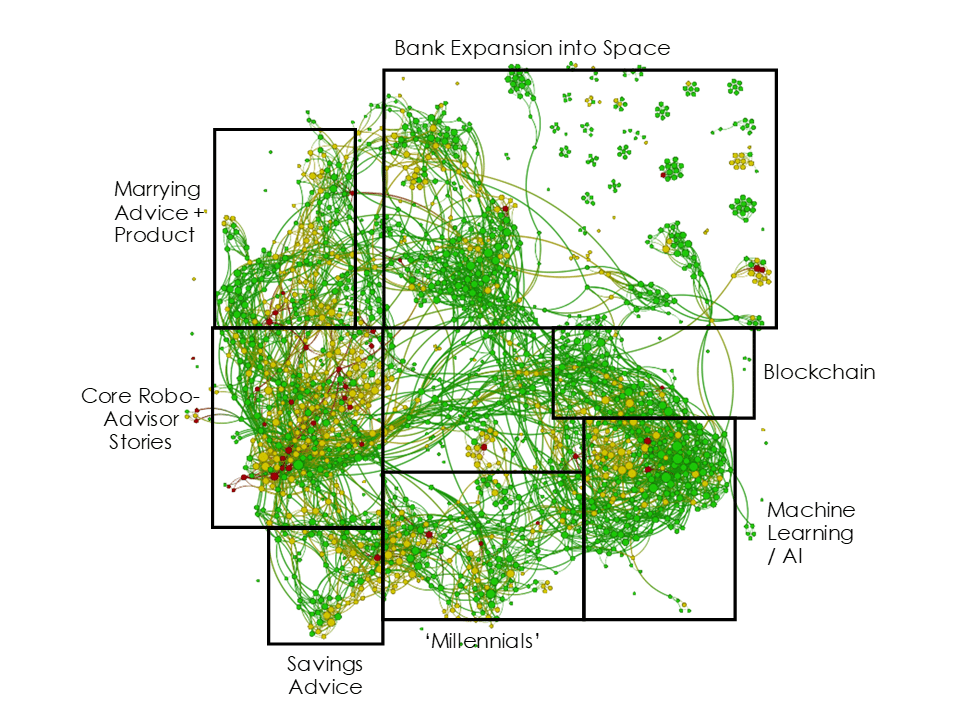

When it comes to robo-advisors, there is a wide gulf between Common Knowledge within the industry and without. I’m not sure what that means yet, but it means something.

Your time horizon is not infinite. Your institution’s time horizon is not infinite.

The purpose of Meme and narrative is getting us to sit down and shut up. In the investment committee room, no kind of meme does this more effectively – and more counterproductively, than the risk meme.