Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

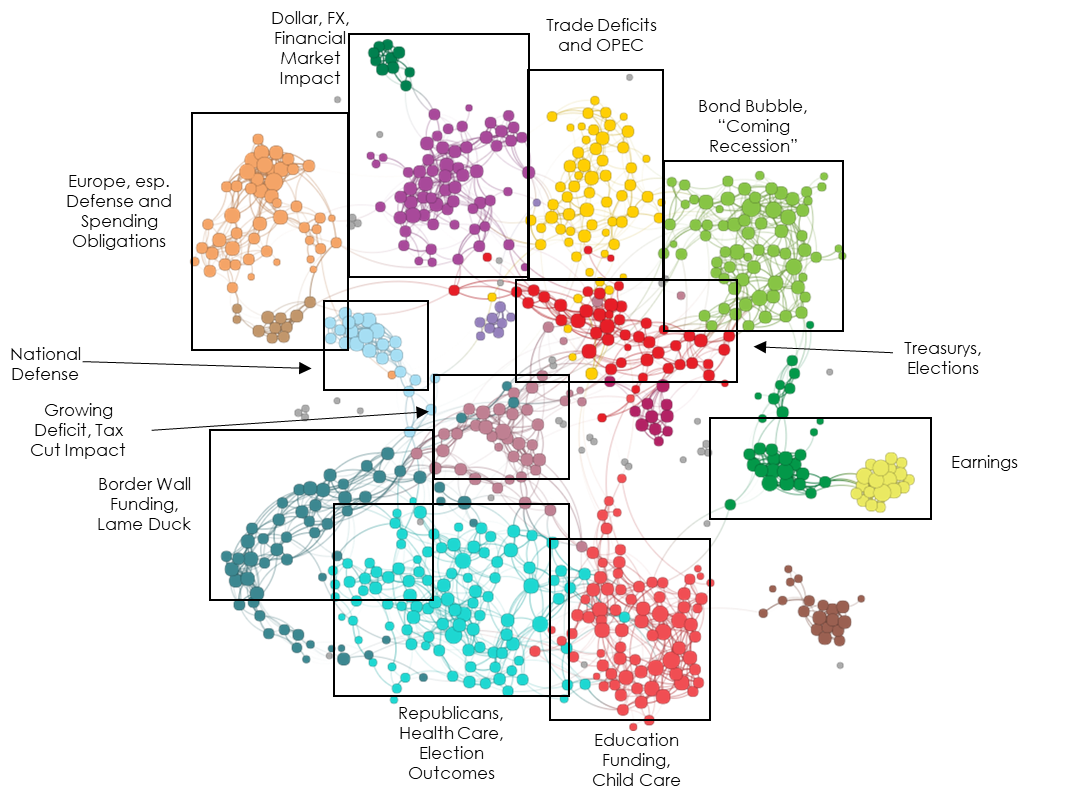

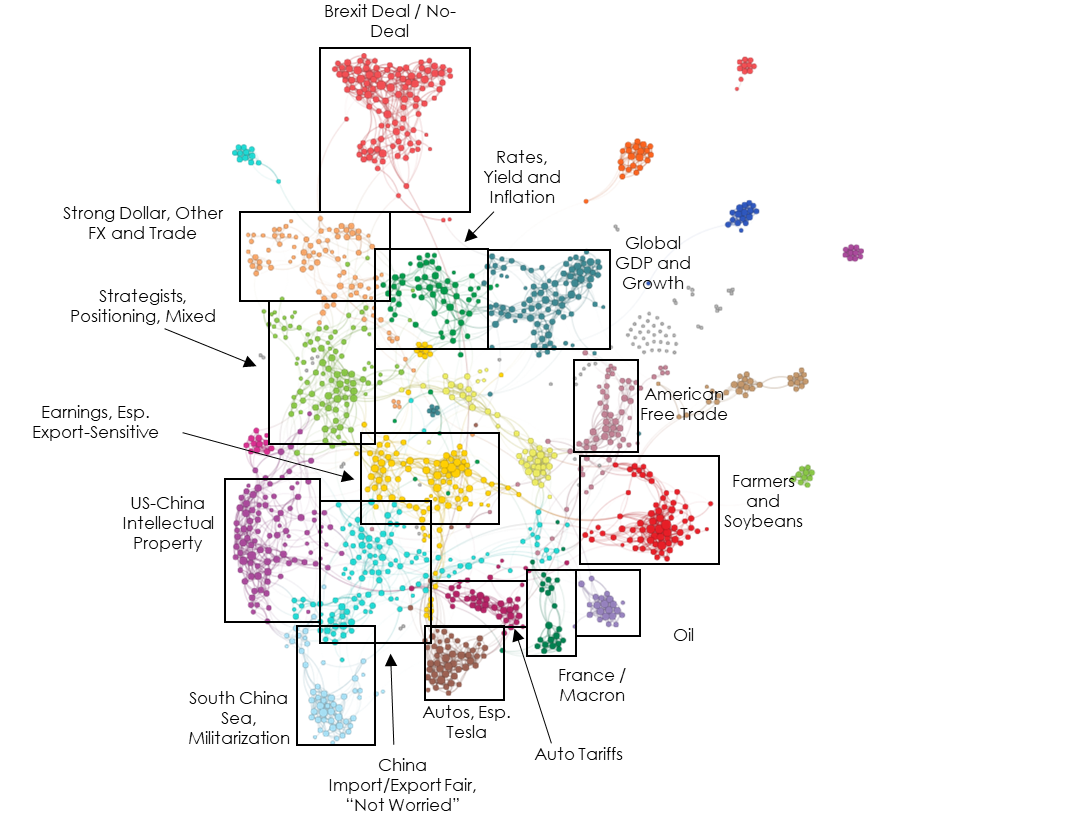

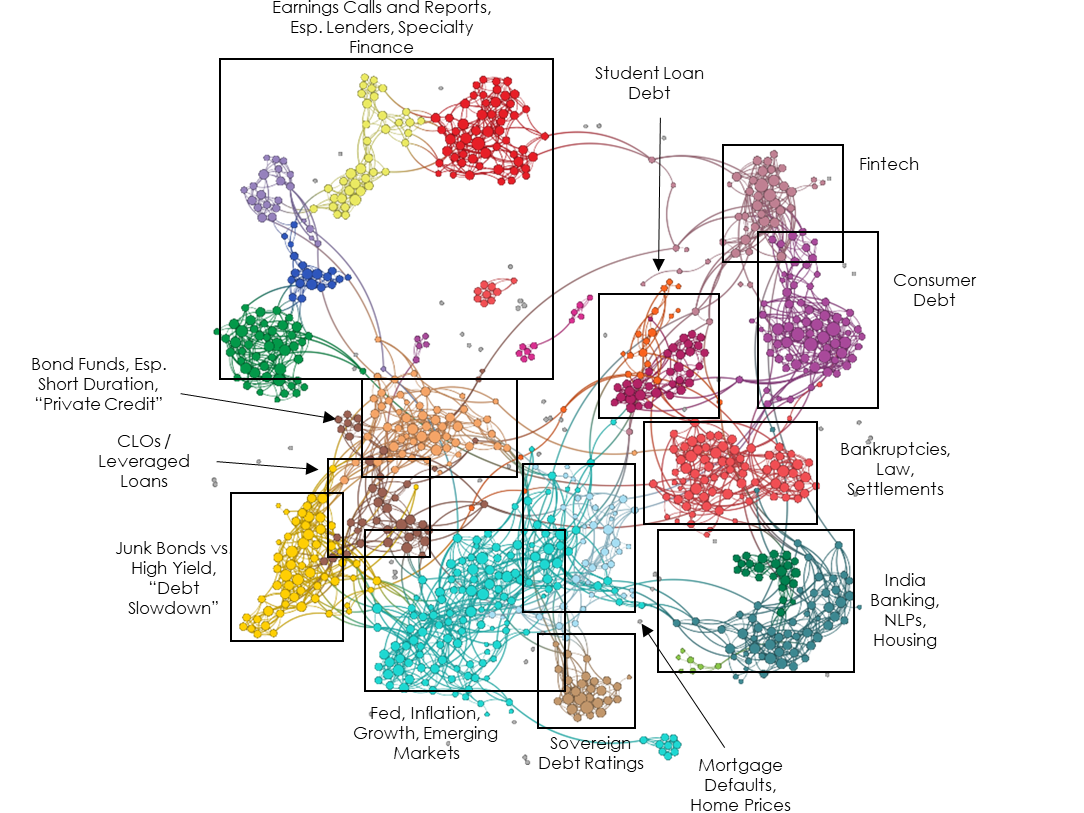

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. After the usual mid-term election Narrative chatter, the importance placed on fiscal…

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Thanks to a remarkably concentrated November point-in-time measure, our attention measure rose sharply. …

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Our single point attention measure rose from floor levels in…

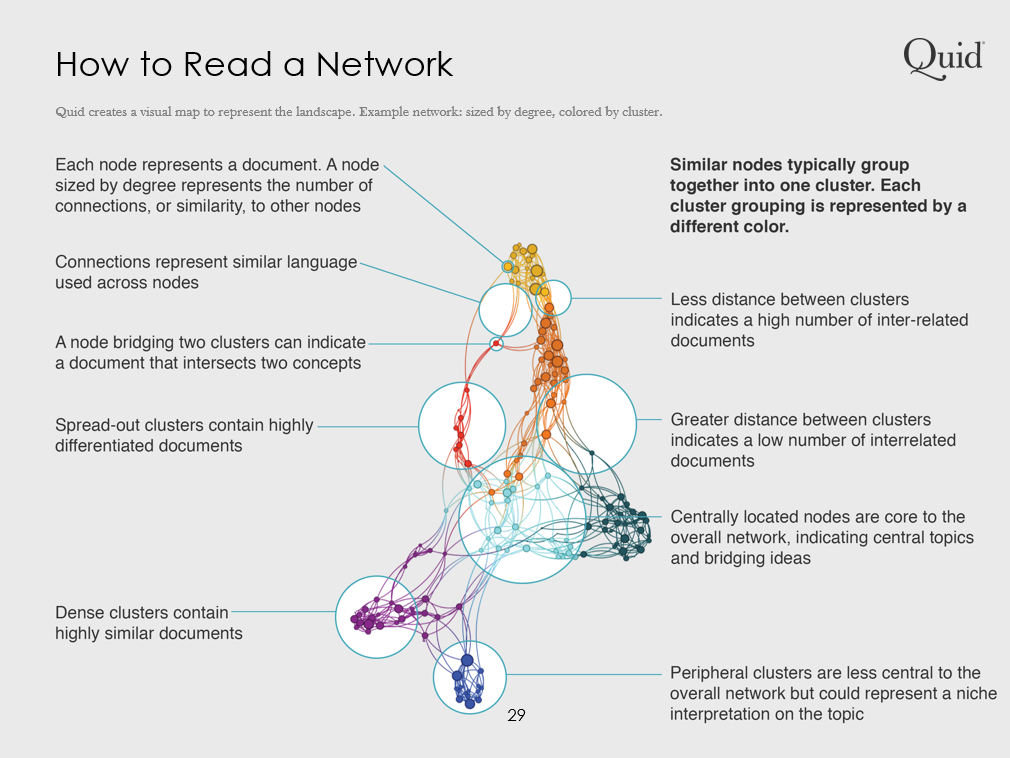

Some of our terminology, exhibits and analyses may not be immediately intuitive. We’ve assembled a short guide to help you familiarize yourself with the Epsilon Theory frameworks.

There are three reasons a person becomes a liar: he believes that he must, he believes that he may, or he believes it serves a Greater Truth.

Key articles for companies reporting the week of December 3, 2018

The emphasis of asset owners on private assets investments is meta-stable – robust to a lot of potential changes in market environment. The reason? The deals! Meme.

To our readers, to our supporters, to our engaged commenters, and to the people who have compared Epsilon Theory to drinking paint, a word: thanks.

I don’t know what the Fed should do in December. But I do know how financial media (and Donald Trump) want you to think about what they should do in December.

When something becomes as necessary, accepted and right-sounding as ‘process’, it can be tough to tell the difference between the Cartoon and the genuine article.