Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

When our processes of inquiry lack challenge, doubt and obsession with falsifying our best ideas, the result is inevitable. Our conclusions cease to be science and become something else entirely. That something else is a thing sensitive to Narrative, vulnerable to priors and bias. That something else is scientism.

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.

There is very little that an investor can do to more easily become a better investor than to better understand his behavior. But the investor who relies on awareness, discipline and self-control remains susceptible to a world that seeks to influence his standard for correct behavior.

Key articles for companies reporting the week of December 17, 2018, as well as the upcoming meeting of the FOMC.

Common knowledge effects, credentialing and missionaries are everywhere. You may differ in your view of their importance, but if your framework doesn’t acknowledge their role in price-setting, you’re not seeing the full picture.

With some breathing room following an eventful earnings call, we re-examine the narrative around Tesla, and consider whether it has successfully navigated out of its high attention, negative sentiment trough.

No matter how much you try to make mama tell you what part of the snake you’re eating, and no matter how much the answer might comfort you, it’s important to know that neither you nor she is telling the truth.

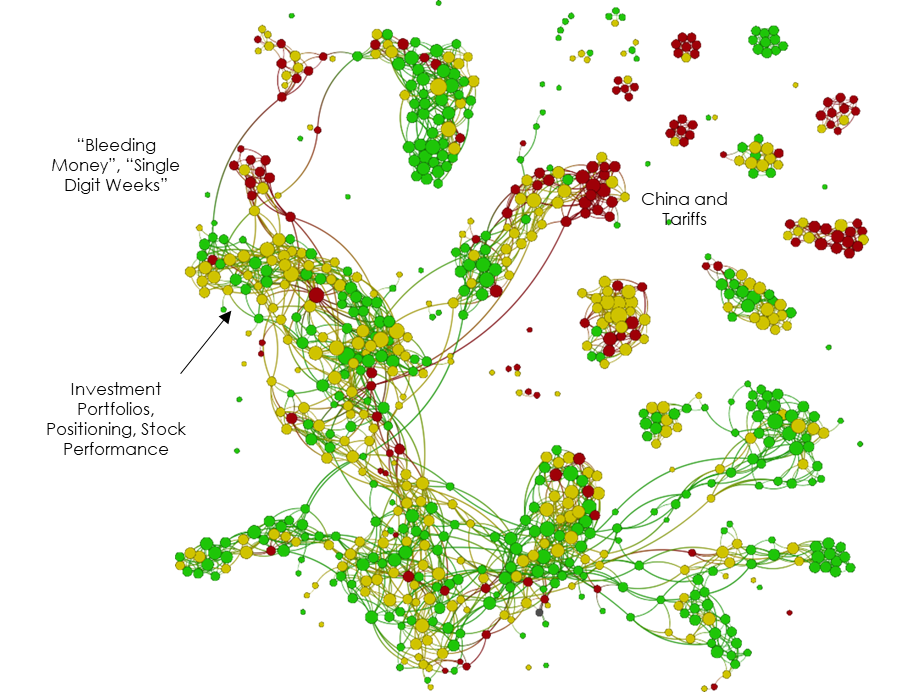

As we’ve written a fair bit recently, the source of Narrative can often be as important as the stories being told themselves. By narrowing the…

Our December 11 edition of Office Hours has concluded, but subscribers can still catch the replay here.

We are pleased to announce the launch of Epsilon Theory Professional, or ET Pro. It is a service designed to leverage our narrative research more directly for investors and asset owners. Learn more about the types of content and research we’re doing here.