Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

Trust in media is being debased from without and within. The Clear Eyed, Full-Hearted answer? Don’t pick and choose. Set yourself against both threats.

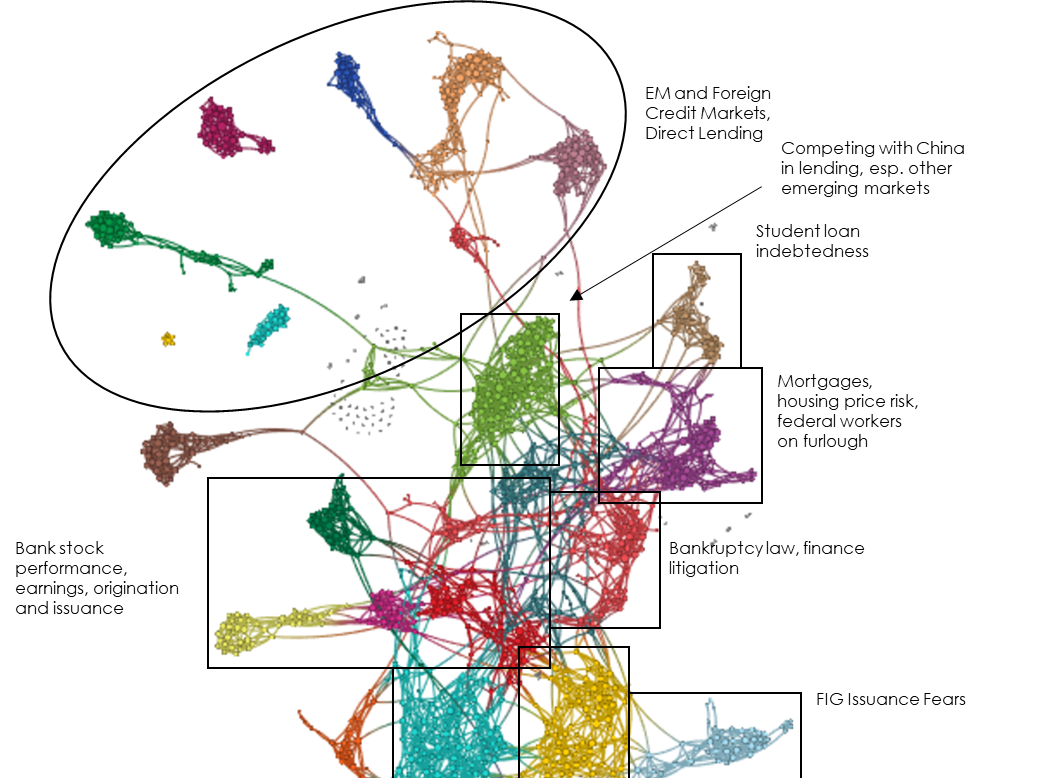

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. The attention on credit and credit cycles has increased slightly, but most of…

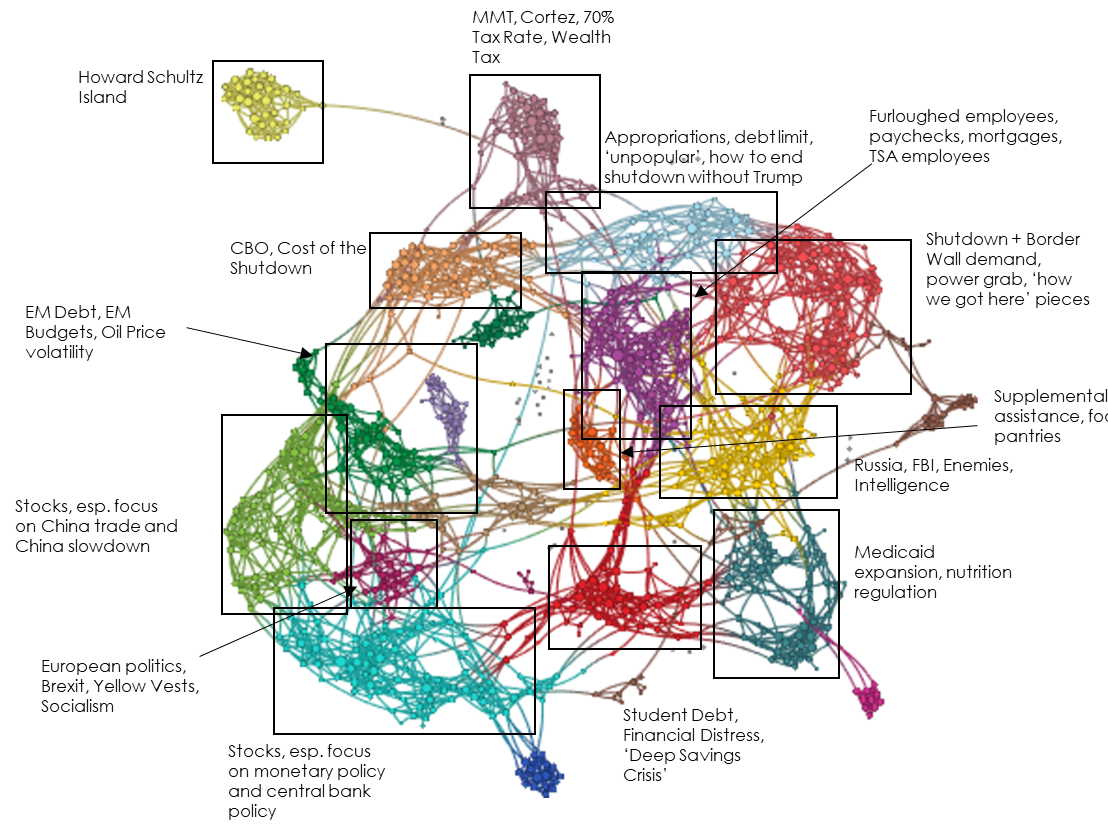

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to fiscal policy narratives has dramatically increased in January. The shutdown (and…

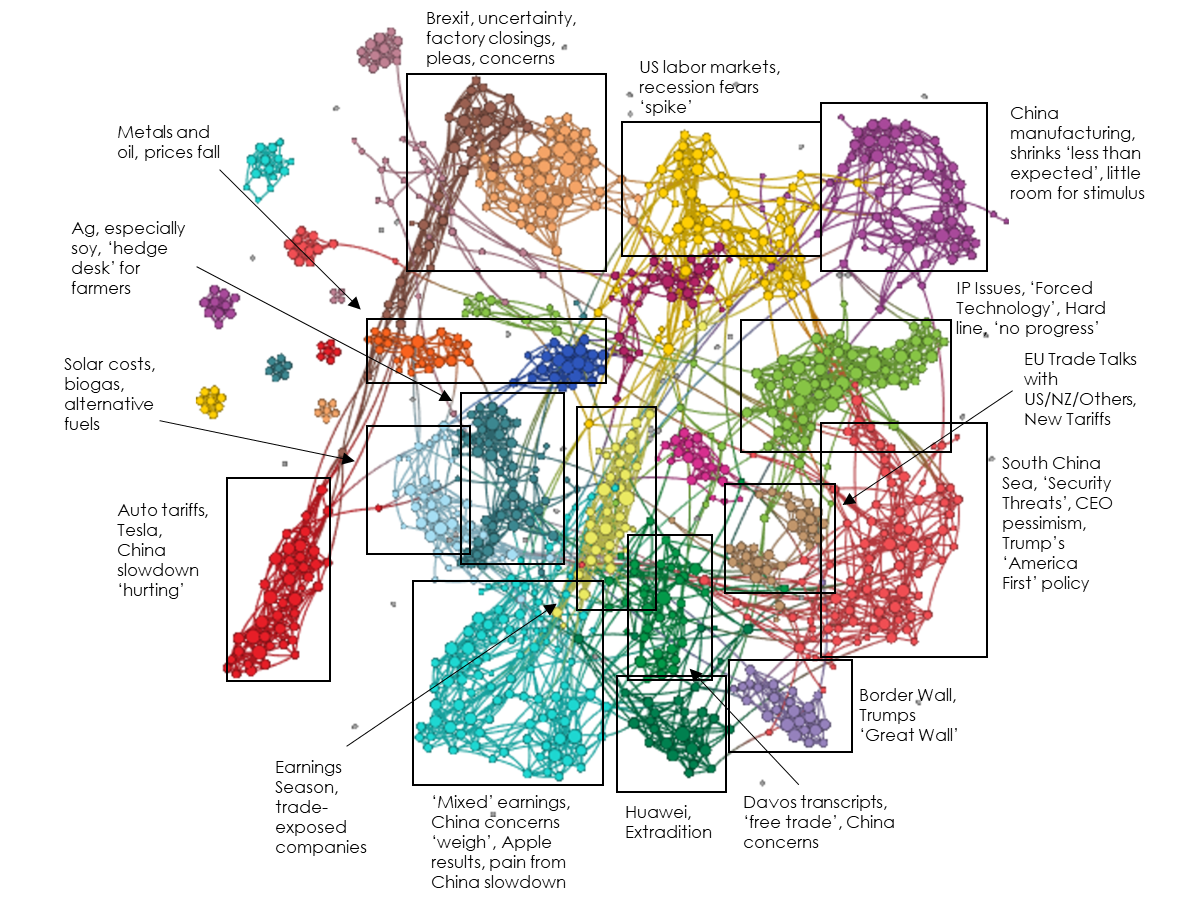

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention on Trade and Tariffs is now as high as we have measured…

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to central bank narratives continued to rise in January, to nearly the…

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Our attention measure for Inflation narratives rose somewhat in January, probably the result…

In which we hear the term, ‘megadeal hunger’, contemplate a Larry Fink v. Ken Fisher celebrity steel cage match, and boggle at the unironic advocacy of regulation as the solution for lack of trust in blockchain applications.

The near-term focus of financial markets coverage seems squarely on M&A in the U.S. Elsewhere, Lord Fink (!) roasts Corbyn and Australian housing has become a media obsession.

In which we see a week full of insurance earnings, continued trade concerns, ‘warming to nuclear’ and a humble request to stop naming things “Exelon.”

There is a paradox – only it isn’t really a paradox – in that to act boldly on and hold loosely to our beliefs requires us to design processes which are subject to an almost opposite standard.