Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

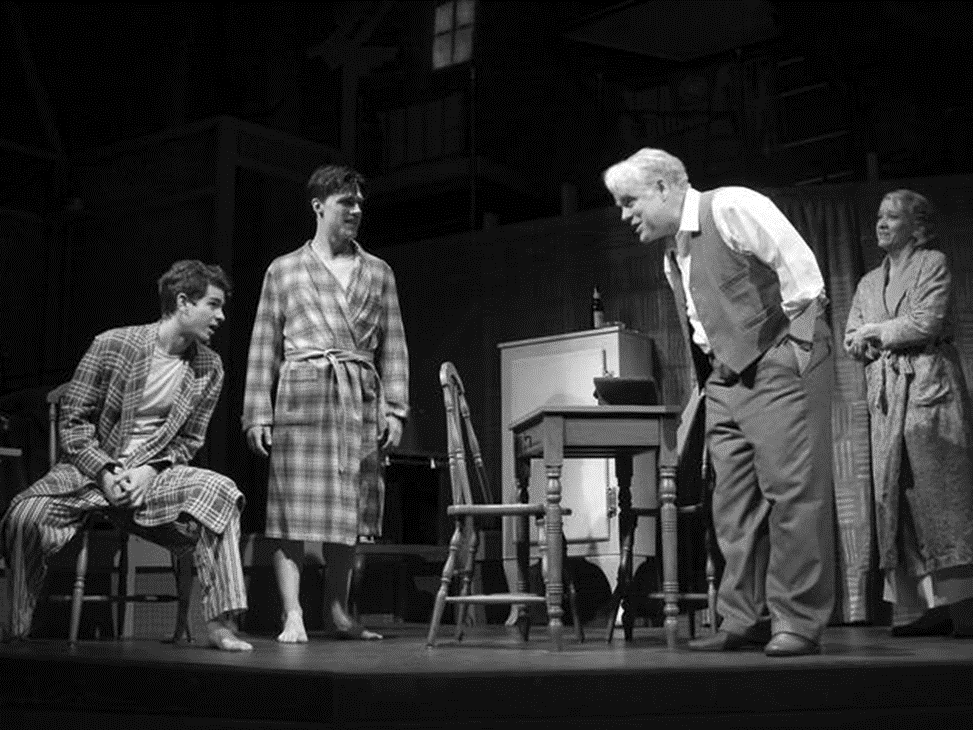

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

Honestly, you could replace 90% of the daily news with a collection of Mitch Hedberg one-liners.

“People either love me or hate me … or they think I’m okay.”

Our modern addiction? Fiat News.

Today’s Zeitgeist is about winning when we’re losing, the polarizing power of hyperbole, more on SRI/ESG, a wonderful specimen of the Mad Creditor Letter and a less-wonderful specimen of the Obligatory Press Release.

Everything about the Zeitgeist is working to steer promising minds toward cultivating the skills and temperament needed to succeed in a Fiat World. We are creating a generation of missionaries.

Just one small problem: a competitive game among missionaries is a stag hunt. The dominant strategy for each of us individually is bad for us all. So what the hell do we do?

Today’s Zeitgeist is about crashes on crashes, Nplpalooza 2019 and hunger-striking ruined property tycoons.

But mostly we celebrate the hedge fund industry’s effort to shake off last year’s challenges. From all of us, thank you for this gift of what we will just assume is uncorrelated alpha.

A Weekend Edition of the Zeitgeist, where we turn from financial markets to find the narratives and stories from the last week or so that were most connected to common narratives in culture and politics.

Climate change! Secretive boards! A gazillion dollars! Boat Race Bank!

Wait…Boat Race Bank?

It’s the Zeitgeist on Epsilon Theory, where we all knew we were living in a world of Fiat News. We just needed to refocus on fundamentals.

For fund managers and asset management executives, the fundraising question is often the most important and most inscrutable. Understanding how narratives and career risk factors interact with decision-making processes is critically important.

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…