Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central)…

Markets are boring. Hey, what if we securitized wokeness?

Honest investing means finding a balance between approaches which imply we know everything and those which imply we can’t know anything. It means humility.

We think there are three – and only three – paths to finding this balance. One is the heart of what we are trying to achieve with Epsilon Theory.

This is the fourth installment of Epsilon Theory’s Election Index. Our aim with the feature is to lay as bare as possible the popular narratives…

Wherever self-determination and resistance to the encroaching power of the state and oligarchical institutions find expression, there should our Full Hearts be also.

And our full voices.

At the request of some ET Pro subscribers, we explore current Big Tech Monopoly narratives. We find an increasingly cohesive, negative narrative that has almost no market attention.

There are some stories that we will want to believe no matter how much contrary evidence we find, and no matter how much we know that the story is bogus. And when these stories convey a sense of control? All bets are off.

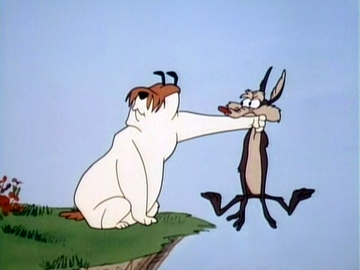

Cartoons are not evil. And yet they are the engine behind The Long Now, and very much at the center of our financial Zeitgeist. What is a clear eyed, full-hearted investor and citizen to do?

You want scarcity? Access to the upper echelons of high society? Well, say no more. It’s your very last chance to buy this most special, most fantastical, most legendary, most unattainable of whiskies.

We received a couple comments from readers that they found the different presentations for the charts and for the raw signal data for Sentiment and…