Rusty Guinn

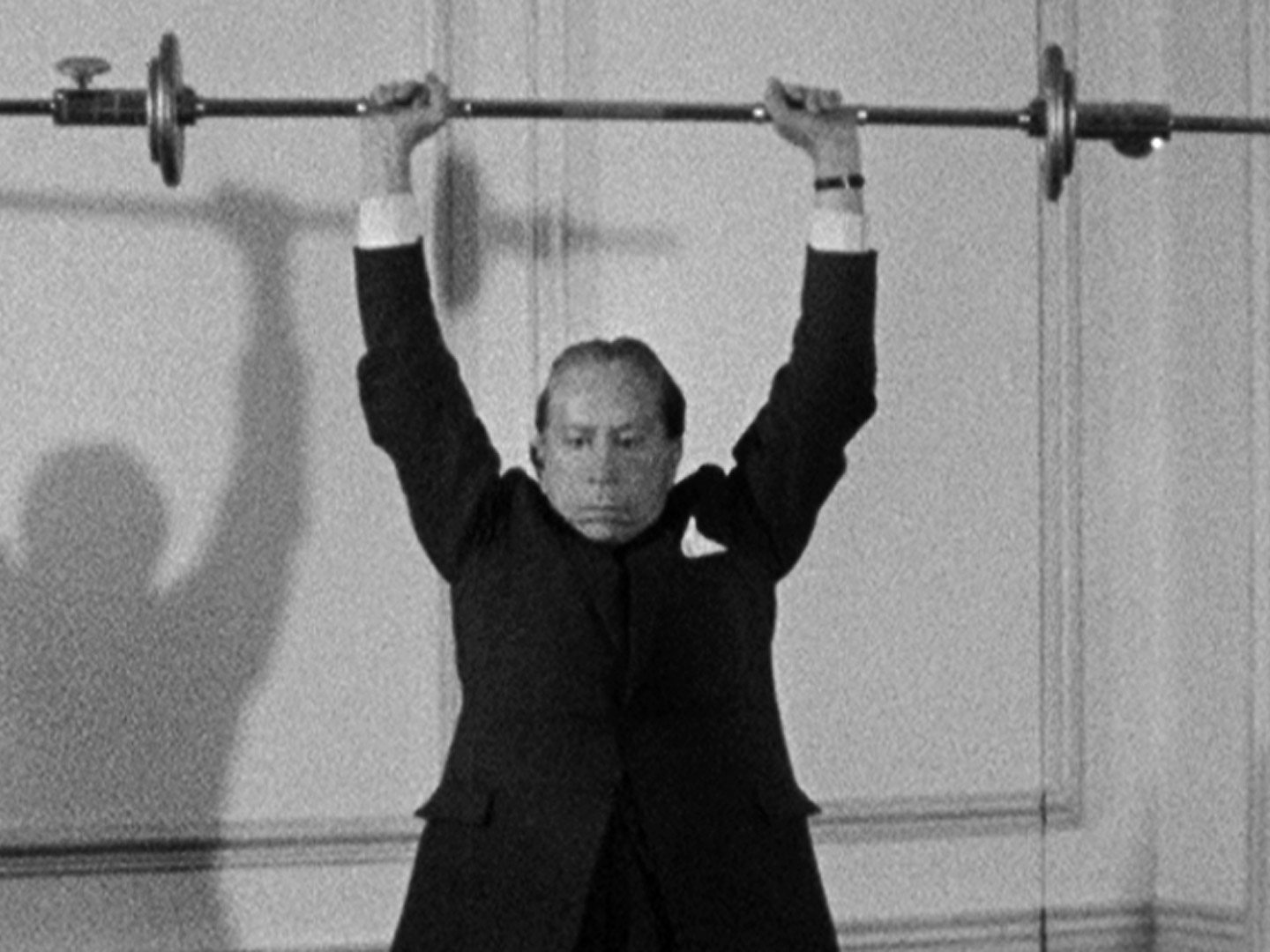

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

There’s light at the end of the pandemic tunnel, and there’s light at the end of the pandemic Narrative tunnel. No, on second thought I think that’s an oncoming train called “election season.”

We have written that one of the major social changes occurring at present is the transformation of capital markets into public utilities.

The COVID-19 pandemic and policy response have accelerated that transformation. It is now the water in which we swim.

Join us this afternoon for the Pandemic Edition of Office Hours! As usual, we start promptly, so if you don’t have video within a short…

We are now in the Flooz.com phase of the “how is COVID-19 going to change the world forever” process. Be careful out there.

There was no greater sin between 2009 and 2020 than enduring a ‘constant drag on returns’. This is the Meme of Yay, Efficiency!, and it permeates every layer of our economy and markets.

This is not a chronicle of errors and mistakes made during COVID-19.

This is the story about the inevitable, simultaneous failure of each of the institutions designed to operate in our interest.

It is the story of how we respond to fragility with resilience.

We provide an update on our thinking about narrative structure as of April 7, 2020. In short, there is an emerging “we flattened the curve” narrative. We think it has some meaningful implications.

We have been asked to discuss our views about the CARES Act. In order to facilitate future such requests, we have provided what we hope to be a helpful rubric.

Sometimes investors and corporate executives will beg for a miracle to bring mostly dead assets back to life. That’s OK. But we don’t have to give it to them. And we don’t have to treat their requests as news in themselves.

Saying that “America needs to reopen for business” isn’t the same thing as doing what we need to reopen America for business. Words matter, but actions matter more.

Let’s do the right things. Now.