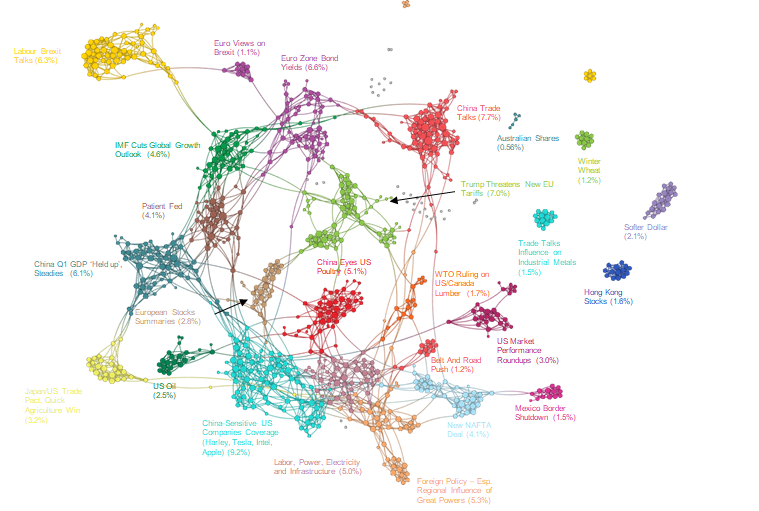

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Lawmakers raise security concerns about China building NYC subway cars [The Hill]

A bipartisan group of House members from New York are raising concerns about Chinese involvement in building New York City subway cars, zeroing in on the potential that the new train cars could be hacked or controlled remotely.

How will you know that the US-China trade narrative is shifting towards a protracted game of Chicken?

When the narrative becomes dominated by national security language and clusters.

Look, Rusty and I have been all over this for a year. More to the point, we have been right.

If you want to know what’s happening with the Trade & Tariff narrative structure, you should subscribe to ET Professional.

This is what we DO.

…and do well!

When the narrative becomes dominated by national security language and clusters.

Soooo, how are those clusters?