Honestly, I kinda like Chamath-the-CNBC-talking-head. He’s iconoclastic and smart. A little too much Ben Shapiro / college debate team-esque with the “if I talk really fast maybe you’ll just ignore that jaw-droppingly stupid thing I just said”, but better than the usual CNBC fare regardless.

But Chamath-the-portfolio-manager? Raccoonery in action.

Here’s the Social Capital 2020 annual letter, published five months into 2021. There’s no mention of the disastrous year to date, which demands that you ask the core Epsilon Theory question: Why am I reading this NOW? But even taken on its own terms – hey, let’s talk about 2020 performance going into June, 2021 – this is just a complete crock.

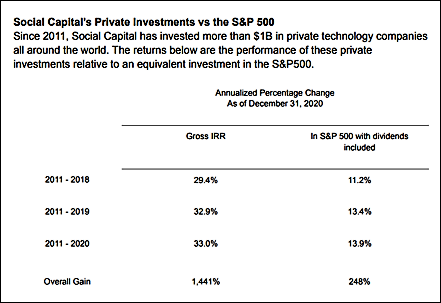

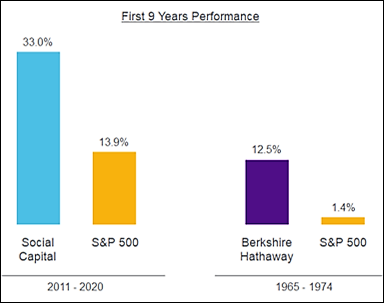

Chamath describes his fund’s performance as “gross IRR” over aggregated multi-year periods. We have no idea of the fund’s performance in 2020, even in “gross IRR” terms, but are required to compare 2011-2019 average annual return to 2011-2020 average annual return. Then Chamath compares his “gross IRR” to S&P 500 total return over the same periods. Then he compares that to Berkshire Hathaway over “the first nine years” of the two investment funds. LOL.

The final picture below – a tweet I put out after a Chamath tweet storm in early March – highlights the rest of his Raccoon math.

When I think about all the compliance pushback I’ve gotten on investor letters and marketing decks over the years … when I think about all of the SEC and regulatory proctology exams my funds have endured … this just makes me so angry.

Start the discussion at the Epsilon Theory Forum