Peter Cecchini

Contributor

Peter Cecchini is a contributing author to Epsilon Theory, founder of AlphaOmega Advisors, and formerly Chief Markets Strategist at Cantor Fitzgerald

Peter has also previously served as Cantor's interim Co-Head of Equities and head of its equity derivatives business. Prior to joining the Cantor family, from January 2007 to December 2009, Peter was a Partner and Portfolio Manager at Seven Bridges Management, LP. Seven Bridges was an event-driven, special situations hedge fund seeded by Ulysses Management (the successor to Odyssey partners). The fund took long and short positions throughout companies’ capital structures and invested selectively based on a macro-thematic approach. Prior to Seven Bridges, Peter spent four years at BNY Mellon's predecessor, Mellon Financial Corporation (within its Mellon HBV Alternative Strategies, LLC subsidiary) most recently as a Managing Director and group head of distressed investing. He directed securities selection, portfolio construction and portfolio hedging. Until its acquisition by Mellon Financial, he spent three years as an analyst and senior analyst at HBV Capital Management. From 2005 through 2007 and upon its emergence from bankruptcy, he sat on the Board of Directors of a North American integrated aluminum producer. Peter has chaired or served on numerous equity, unsecured, secured and bank steering committees. Before joining HBV, he spent several years as a consultant at a firm he co-owned. Peter speaks routinely at conferences and appears on various media outlets.

Peter is an avid boxer, having boxed to raise money for Petra Nemcova’s charity All Hands and Hearts, which provides services and builds schools for children impacted by natural disasters. He holds an MBA from Columbia University (Dean's List), a JD from Boston University School of Law (American Jurisprudence Scholar) and a BA from Haverford College (in Economics). He is an inactive Member of the NY State Bar.

Articles by Peter:

New from ET contributor Pete Cecchini …

We talk all the time about the informational efficiency of markets. What if the real dimension we should focus on is narrative efficiency?

Negative rates create a cycle of addiction to even more negative rates in the future.

Why? Because captive buyers like pension funds require capital appreciation to make up for negative yield, so central banks must guarantee a commitment to still more negative yields.

New from ET contributor Pete Cecchini!

The desire of central banks to forestall recession at all costs reminds us of the war that groundskeeper Carl Spackler had with the gopher in Caddyshack.

Sure, you can defeat the gopher. But you’ve gotta blow up the golf course with dynamite to do it.

The recent rally in U.S. equities is largely a result of market participants believing they can have their rate-cut cake and eat it, too.

ET contributor Pete Cecchini doesn’t think the Fed will cut rates proactively. Will they cut? Sure. But only if the real-world economic data deteriorates further. Which it probably will.

But don’t eat that cake just yet.

At some point, all Fed Chairs learn that their primary function is just to wave their hands. Jay Powell has learned this sooner than most.

ET contributor Pete Cecchini goes way off the Wall Street reservation with this: the bullish narrative for U.S. equity risk makes sense only if one accepts a narrative that the Fed will proactively move to prevent a U.S. slowdown before it happens.

Don’t believe it.

It all started with the Maestro, Alan Greenspan, and his determination to create a Great Moderation. And it was all going so swimmingly, too, until the Great Disaster of 2008.

Now that there’s so little central banks can do, they are dead set on preventing another downturn before it even starts. So how does risk ‘price’ in capital markets when the cost of capital is constantly set too low? It doesn’t.

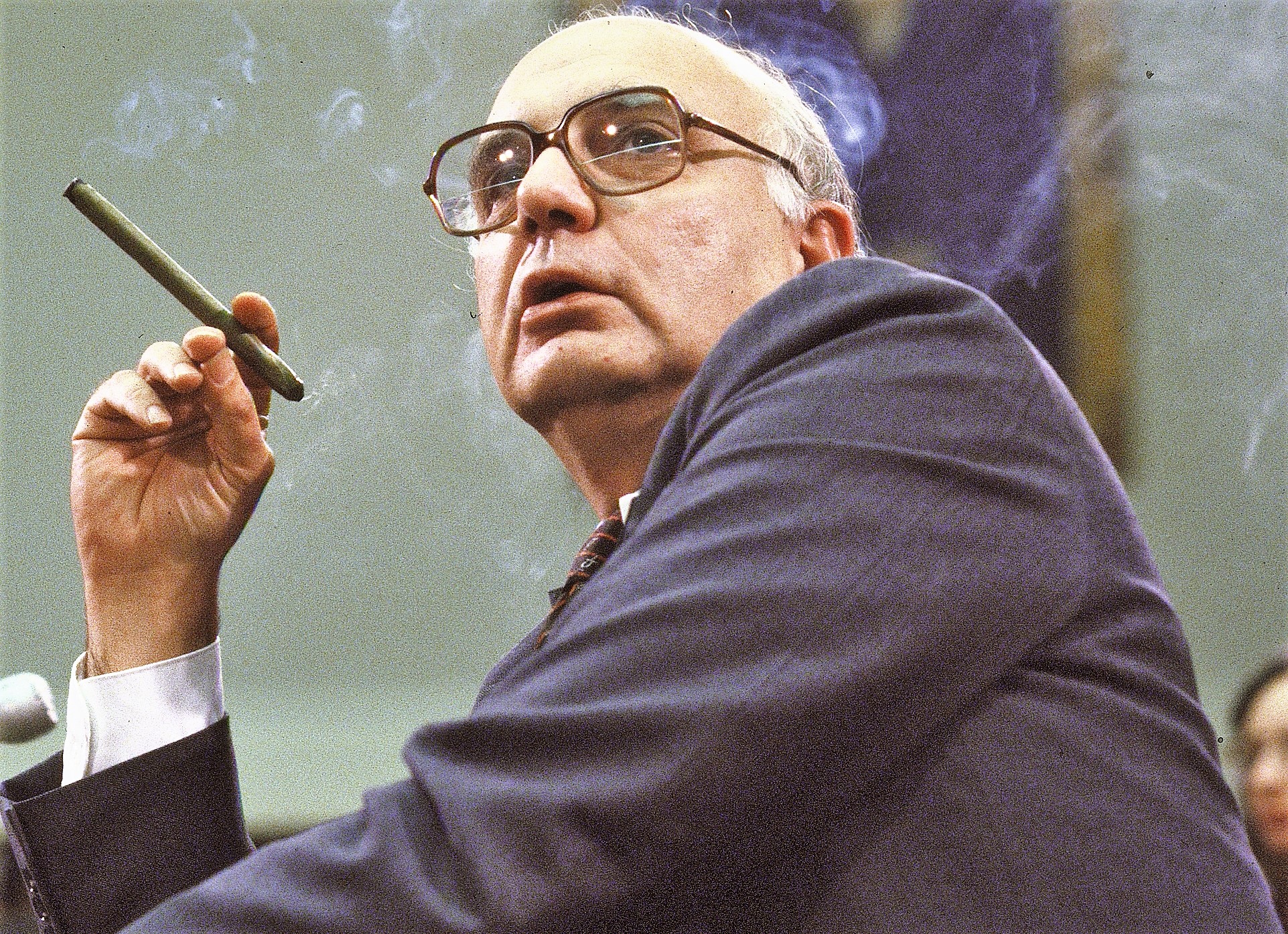

A generation of investors has Paul Volcker to thank for almost 40-years of slowly falling rates. He handed countless baby-boomers a free 100 points of investing IQ, for which most never thanked him. It was as good as it gets.

ET contributor Pete Cecchini, better known as Cantor Fitzgerald’s Chief Market Strategist, is back with the December installment of his series, In the Trenches. For ET readers who want a less philosophical but no less smart take on markets, Pete’s your guy.

In the first note from new Epsilon Theory contributor Peter Cecchini of Cantor Fitzgerald, Peter gives us a window into what a false sense of stability may mean for investors heading into the end of 2018.

- « Previous

- 1

- 2