Every so often, things fall apart.

In the words of those who lived it, here are the vibes and the semantic signatures of the twentieth century’s most devastating social collapses.

From the meaning in their words, wisdom for our future emerges.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

This is an exclusive subscriber-only preview of the first six chapters of Rusty Guinn’s upcoming book Outsourcing Consciousness: How Social Networks are Making Us Lose Our Minds. The book explores how evolution, polarization, and technology are slowly transforming humanity into a hive mind - and what we can and can't do about it.

The Long Now is everything we pull into the present from our future selves and our children. We are told that the economic stimulus and the political fear of the Long Now are costless, when in fact they cost us … everything.

Tick-tock.

Men of God in the City of Man is a nine part series about a Narrative virus that infected the charismatic and Pentecostal churches in the United States. It isn't a story about Christian Nationalism. It isn't a story about January 6th. It isn't a story about why people voted for Trump. It is a story about a story. It is a story about the language that created a self-sustaining movement defined by its unwavering belief in a fundamentally corrupt electoral system.

Men of God in the City of Man

Amid the Widening Gyre of politics and the black hole of financial markets, the only anchor is us, together, walking with Clear Eyes and Full Hearts. Experience Ben's original 4-part series.

Outsourcing Consciousness

The Long Now

Men of God in a City of Man

Things Fall Apart

Recent Notes

Things Fall Apart (Part 1)

Part 1 of a three-part series on what it means to have a polarized electorate and a monolithic market. Today’s note: the Age of Ridiculousness and the decline and fall of the American Empire.

It Was You, Charley

Part 3 of the Three-Body Alpha series, written for anyone puzzled by value’s underperformance over the past NINE YEARS. Systematic value still works in markets warped by the Three-Body Problem, but works differently.

Letter From a Birmingham Museum

MLK Day reminds us of the foundations of a UNITED States of America, a reminder that has never been more important to take into our hearts.

It’s not too late, you know. We can still find that unifying narrative of what America can – and should – mean.

Mental Toughness!

Investing requires mental toughness, but it doesn’t require us to pretend that we — or our colleagues — are invincible. More often, it instead requires us to acknowledge our weakness.

The Acrobat and the Fly

Many of the memes that drive our political behaviors inherently push us toward Competitive Games and tribalism. Resisting these memes means losing both arguments and credibility – and we have to be willing to do both.

This Is Why We Can’t Have Nice Things

Part 13 of the Notes from the Field series discusses The Narrative Machine, which can help us see the invisible memes that drive our political behaviors. Because you’re smart enough to make up your own damn mind.

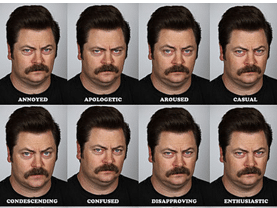

The Many Moods of Macro

Part 2 of the multi-part Three-Body Alpha series, introduced in Rusty’s recent Investing with Icarus note. The Series seeks to explore how the increasing transformation of fundamental and economic data into abstractions may influence strategies for investing — and how it should influence investors accessing them.

The Narrative Giveth and The Narrative Taketh Away

Two negative narratives have derailed ebullient markets – Inflation and Trade War. While I think both are here to stay, I’ve put inflation through the Narrative Machine first. The result? Inflation is Coming.

Investing with Icarus

The allure of a fundamental truth is powerful. Investors are hungry for that kind of clarity about markets, but it doesn’t exist. In the first in a series, Rusty discusses a framework for investing in a time of Icarus.

The Icarus Moment

We live in a Cartoon Age, an era not of alienation per Karl Marx, but of alienation per Groucho Marx. What’s the cause, what’s the future, and what do we do about all this? It’s a TL;DR cri de coeur in Part 12 of Epsilon Theory’s Notes from the Field series.

What is it, really?

The #1 question investors ought to ask of a financial services company trying to sell them something is: “What is it, really?” If you don’t know what you’re investing in, you’re liable to end up eating a lot of crunchy frogs.

Good Job!

This is Part 11 of Ben’s Notes from the Field series. I don’t need to calculate a Sortino ratio to know if my dogs are doing a Good Job. Same with active investment management. Same with active citizenship. It’s all about embracing Convexity, not as a mathematical cartoon, but as a philosophy.

Is Volatility Back?

On this special episode of the Epsilon Theory podcast, we share an excerpt from a conference call we recorded on February 13 discussing our thoughts on the market selloff earlier in the month. You’ll hear from Christopher Guptill, co-CEO and chief investment officer at Broadmark Asset Management and Dr. Ben Hunt, author of Epsilon Theory.

The Fundamentals Are Sound

Most investors think that other investors think that last week’s correction was about vol-selling. The real story? Everybody knows that everybody knows that inflation will change the way portfolios are built and managed.

Too Clever By Half

The inevitable result of financial innovation gone awry, which it ALWAYS does, is that it ALWAYS ends up empowering the State. When too clever by half people misplay the meta-game, that’s all the excuse the State needs to come swooping in and crush them, just as they are with Bitcoin today they did with Bear and Lehman in 2008. Installment #10 from Notes from the Field.

Things That Go Bump In The Night

Everyone reading this note has, at one time or another, gotten scared about markets and decided to hedge their professional portfolio or personal account. The Game of Markets is changing. But should we be scared?

Year In Review

We’ve had a heckuva busy year at Epsilon Theory, so to ring out 2017 I thought it might be helpful to distribute a master list of our publications over the past 12 months. We’re long essay writers trying to make our way in a TLDR world, so even the most avid follower may well need a map!

The Three-Body Portfolio

In a two-body market, the interactions of fundamental data and prices are generally predictable. In a three-body market, the epsilon — investor behaviors in response to narratives — exerts a powerful gravitational force which must be considered when building a portfolio.

The Three-Body Problem

What if I told you that the dominant strategies for human investing are, without exception, algorithms and derivatives? I don’t mean computer-driven investing, I mean good old-fashioned human investing … stock-picking and the like. And what if I told you that these algorithms and derivatives might all be broken today? You might want to sit down for Part 9 of the Notes from the Field series.

Wall Street’s Merry Pranks: Things that Matter #4

The libertarian paternalism of a Nudge culture in finance has created an industry of investors who care about fees but have forgotten about taxes, trading costs, slippage and behavioral costs of actively trading passive instruments.