Notes from the Field

All Notes From The Field

Notes From the Field

What does farming have to do with investing? Quite a lot, actually. In this first of a series that takes on a life of its own, Ben discusses bees and bonds, eggs and ETFs, and more.

The Goldfinch in Winter

Part 2 of Ben’s Notes from the Field series, in which he considers the question: what can a bird teach us about value investing? To everything there is a season.

Horsepower

There is no animal more important to the ascendancy of Western Civilization than the horse, and no invention more important than the horse collar. After all nothing shapes history like advances in productivity. Part 3 of Ben’s Notes from the Field series here.

The Arborist

In Part 4 of the Notes from the Field Series, Ben identifies how the natural lines of a tree and shaping the tree to follow those lines over time is a lot like shaping a portfolio.

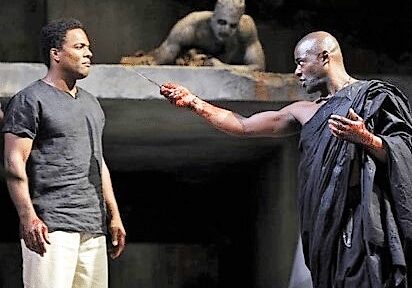

Always Go To the Funeral

There’s a pose that very sick farm animals sometimes take when they’re near death, where they lie down and twist their head way back into their shoulder in a very unnatural way. It’s an odd sight if you don’t know what it signifies, a horrible sight if you do.

Both the Republican Party and the Democratic Party are starting to twist their heads back into their shoulders. I don’t know if it’s too late to save them or not, but I’m increasingly thinking that it is. We need to start thinking about the funeral, who’s going to speak, and what they’re going to say.

Sheep Logic

In Part 6 of the Notes from the Field Series, Ben observes that we think we are wolves, living by the logic of the pack. In truth we are sheep, living by the logic of the flock.

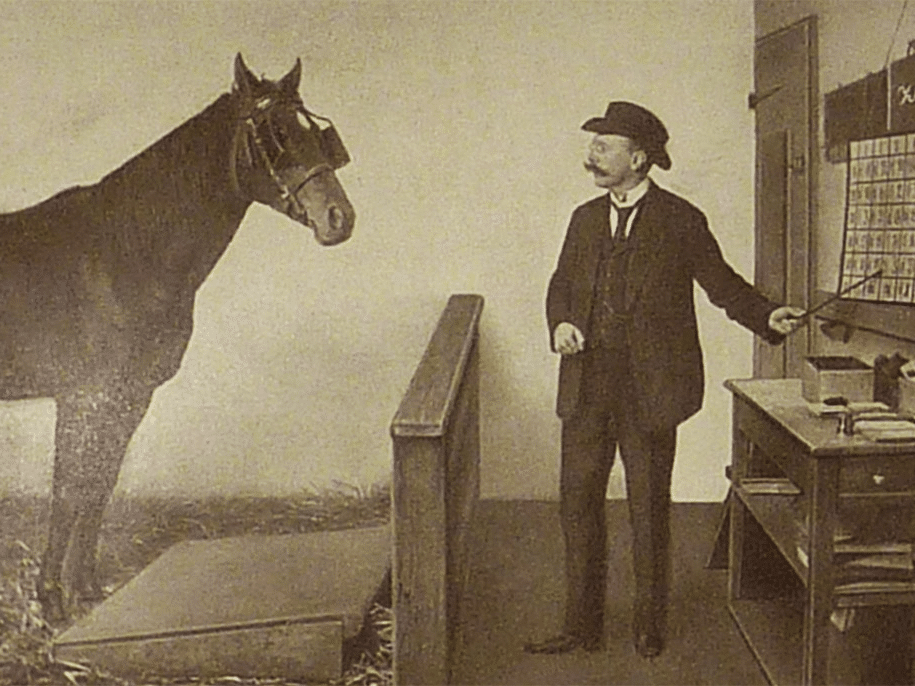

Clever Hans

Part 7 of Ben’s Notes from the Field series reminds us that you don’t break a wild horse by crushing its spirit. You Nudge it into willingly surrendering its autonomy. Because once you’re trained to welcome the saddle, you’re going to take the bit. We are Clever Hans, dutifully hanging on every word or signal from the Nudging Fed and the Nudging Street as we stomp out our investment behavior.

Pecking Order

The pecking order is a social system designed to preserve economic inequality: inequality of food for chickens, inequality of wealth for humans. We are trained and told by Team Elite that the pecking order is not a real and brutal thing in the human species, but this is a lie. It is an intentional lie, formed by two powerful Narratives: trickle-down monetary policy and massive student debt financing. Part 8 of the Notes from the Field series.

The Three-Body Problem

What if I told you that the dominant strategies for human investing are, without exception, algorithms and derivatives? I don’t mean computer-driven investing, I mean good old-fashioned human investing … stock-picking and the like. And what if I told you that these algorithms and derivatives might all be broken today? You might want to sit down for Part 9 of the Notes from the Field series.

Too Clever By Half

The inevitable result of financial innovation gone awry, which it ALWAYS does, is that it ALWAYS ends up empowering the State. When too clever by half people misplay the meta-game, that’s all the excuse the State needs to come swooping in and crush them, just as they are with Bitcoin today they did with Bear and Lehman in 2008. Installment #10 from Notes from the Field.