Not for the first time, I was struck by the financial media’s take on today’s CPI release. Here was how the Wall Street Journal framed it right before the data came out.

It’s not that inflation might pick up again, it’s that the “downturn” in inflation might “stabilize”. It’s not that inflation remains way above the Fed’s target, it’s that “the rate of price gains” may continue to fall.

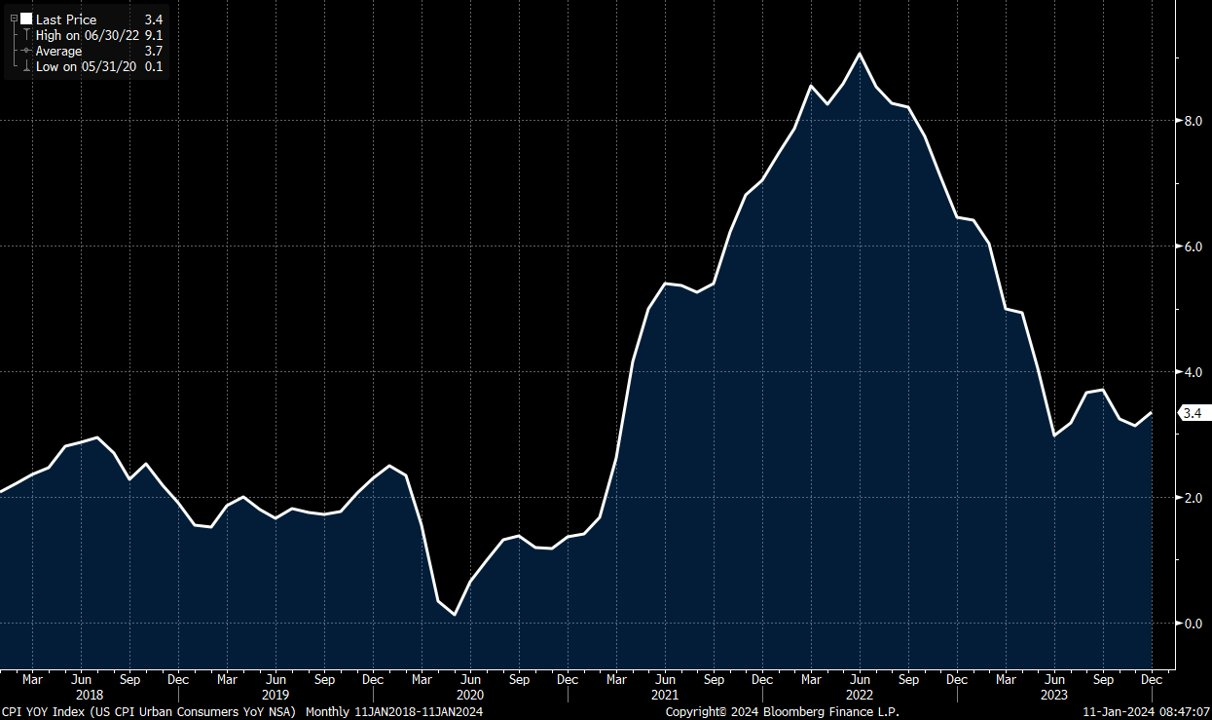

In truth, headline CPI bottomed in June and hasn’t budged a bit (except to eke higher) over the past six months. I don’t know why this is so hard to understand.

But hey, hey, hey! Why are we talking about headline CPI anyway? We all know that core CPI is FAR more important and is what we should all be paying attention to! Hence this graphic in the WSJ recap article of the CPI report this morning, with the core rate in bright red and the headline or overall rate in a faint dotted line beneath:

Being a westerner, I am quite partial to suggestive images of the Dollar wearing sexy lingerie.

Is that wrong?

As for the Pound, well all I can say is despite the dowdy appearance and the occasional headache, its a goer.

Compelling analysis Ben that proves your point even more emphatically than the word-based analyses. A picture is worth a thousand words. I would guess that more automated approaches to image analysis are now within reach of ET.

I believe ”July 2022” is a typo here, should instead be “July 2023.” I point it out only because it confused me in the context of the various examples and timeline.

Totally agree, and might I suggest another medium worthy of exploration: intonations of the human voice, AKA audio.

Thank you! Got it right in caption and wrong in the text. Appreciate the correction!

As a daily WSJ reader, I have been sensing a distinct ‘Pollyannish’ editorial bias in the graphic displays. However, I did not take the next step the compare the tabular data to the graphics. Thanks for the insightful analysis. Is the WSJ a prominent member of the ‘Wall Street Cheer-leading Team’? Do they want eye balls on screen? Do they know how to use fear & greed?

Its all over the place. Headlines, ledes, contents. Same with Bloomberg.

The finance industry needs interest rates to come down and no inflation and the main cheerleaders in the MSM are there to help them out, as always.

It strikes me that the most telling part of the article is that a subway token is up to $2.90! talk about paying more for worse service. I would expect hedonics there to be out of sight.

But thank you for highlighting the ongoing BS that passes for news reporting.

What is this token thing that you speak of?

Speaking of which, my wife informed me that my Metrocard will soon be a museum piece.

I remember the Y tokens from going to visit my Dad’s office in the city in the early 70s.