I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants as a replacement is not a stable system that is possible as a replacement.

Yesterday, one of Softbank’s largest portfolio companies – Katerra – filed for bankruptcy.

Katerra was at the heart of the relationship between Softbank and Greensill, and I think it’s the most viable path by which the Greensill fraud and financial crimes can be shown to be Softbank fraud and financial crimes.

You can read our full take on Greensill and Softbank here …

… but the skinny is this:

in 2019, Softbank put ~$3 billion into Greensill, turning it into the Vision Fund’s private bank. In 2020, Greensill lent Softbank portfolio company Katerra $435 million. When Katerra ran into trouble, Greensill wrote off the $435 million loan in exchange for 5% of common equity. LOL. A $435 million senior secured loan – which had been packaged and sold to Credit Suisse – was exchanged for a 5% equity position in a bankrupt company.

Credit Suisse has announced that they are filing suit against Softbank over this and all of the other Softbank/Greensill shenanigans. And in the WSJ article describing the Katerra bankruptcy filing, you can see how Softbank is going to try and spin this (all caps mine).

When Katerra ran into financial difficulties last year, Greensill forgave the loan.

SoftBank, in turn, invested $440 million into Greensill, EXPECTING THE MONEY TO GO TO CREDIT SUISSE’S INVESTORS.

Instead, Greensill put the proceeds of the SoftBank investment in a bank it owned in Bremen, Germany, according to a bankruptcy administrator’s report. The report said Greensill had used money it received from SoftBank, including the $440 million, to boost its bank’s capital position and fund Greensill’s overall operations.

The Softbank defense is going to be that their back door pay-off to Greensill for forgiving the Katerra loan was really intended to be a back door pay-off for Credit Suisse, but that rascal Lex just kept the money. Who knew!

As always, the best way to rob a bank is to own a bank.

— Ben Hunt | June 7, 2021 | 11:41 am

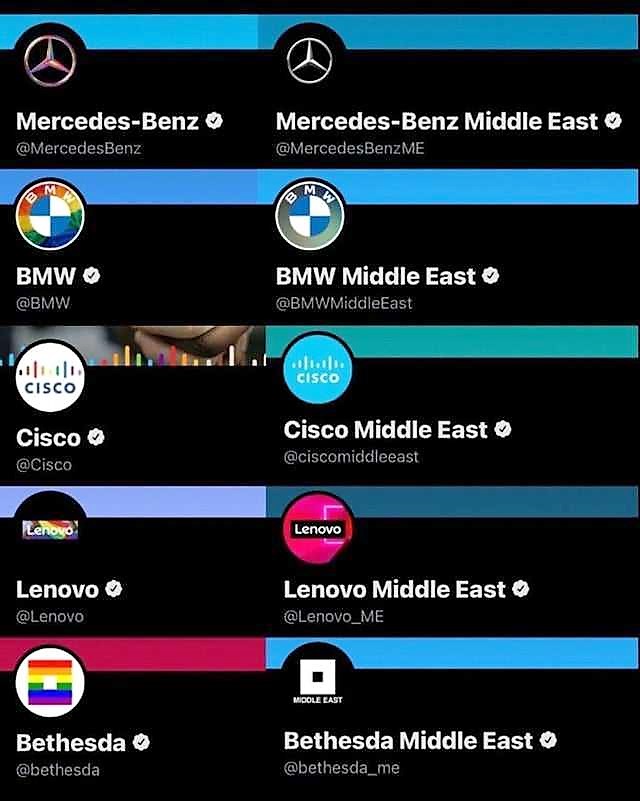

The Deadly Theatre of corporate signaling on Pride Month continues to run rampant, with feel-good rebranding pop-ups in all the geographies where this is a marketing advantage … and nothing in geographies where it isn’t.

What is Deadly Theatre? It’s a performance that is so deeply abstracted from its source material that it has become painfully, obviously artificial to anyone who is paying attention.

And yes, there’s an Epsilon Theory note on that.

— Rusty Guinn | June 4, 2021 | 10:34 am

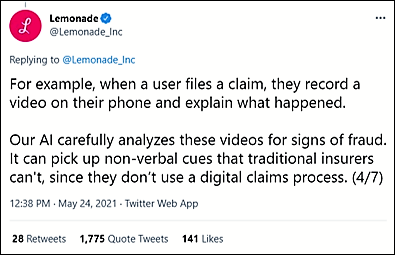

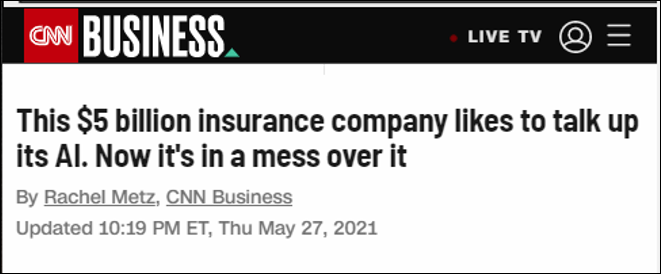

P&C insurer Lemonade (LMND) went public last year and now has a $5 billion market cap. They’re not just a sleepy insurance company, of course. No, no … they’re actually a cutting edge AI Company! TM.

They’ve deleted the tweet above and issued a classic non-denial denial on their blog:

Let’s be clear:

AI that uses harmful concepts like phrenology and physiognomy has never, and will never, be used at Lemonade.

We have never, and will never, let AI auto-reject claims.

LOL. So their AI Jim textbot + video recognition program (I am not making this up) isn’t using phrenology and it can’t auto-reject claims. No, no … the supervisor will reject the claim. BITFD.

— Ben Hunt | May 28, 2021 | 7:47am

Honestly, I kinda like Chamath-the-CNBC-talking-head. He’s iconoclastic and smart. A little too much Ben Shapiro / college debate team-esque with the “if I talk really fast maybe you’ll just ignore that jaw-droppingly stupid thing I just said”, but better than the usual CNBC fare regardless.

But Chamath-the-portfolio-manager? Raccoonery in action.

Here’s the Social Capital 2020 annual letter, published five months into 2021. There’s no mention of the disastrous year to date, which demands that you ask the core Epsilon Theory question: Why am I reading this NOW? But even taken on its own terms – hey, let’s talk about 2020 performance going into June, 2021 – this is just a complete crock.

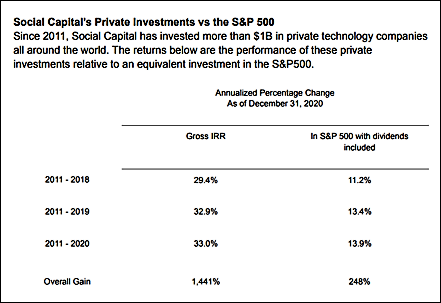

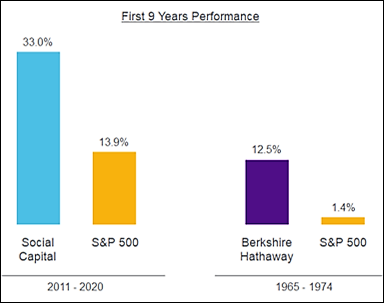

Chamath describes his fund’s performance as “gross IRR” over aggregated multi-year periods. We have no idea of the fund’s performance in 2020, even in “gross IRR” terms, but are required to compare 2011-2019 average annual return to 2011-2020 average annual return. Then Chamath compares his “gross IRR” to S&P 500 total return over the same periods. Then he compares that to Berkshire Hathaway over “the first nine years” of the two investment funds. LOL.

The final picture below – a tweet I put out after a Chamath tweet storm in early March – highlights the rest of his Raccoon math.

When I think about all the compliance pushback I’ve gotten on investor letters and marketing decks over the years … when I think about all of the SEC and regulatory proctology exams my funds have endured … this just makes me so angry.

— Ben Hunt | May 27, 2021 | 10:25 am

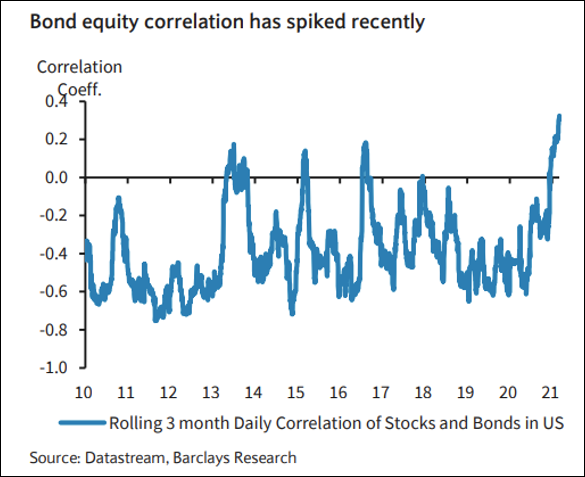

Good chart out from Barclays this morning showing the key problem for investors and financial advisors as inflation fears take root: bonds no longer provide portfolio diversification.

— Ben Hunt | May 26, 2021 | 11:35am

The cure for the cancer of gun culture and police culture is not to be found in reform laws around guns and police, but in reform ideas around culture, ideas that create a new dimension of American society that rejects LARPing and LARPers alike.

Inflation

What made Bitcoin special is nearly lost, and what remains is a false and constructed Narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

This Time Last Year

Sorry, we couldn't find any posts. Please try a different search.

Crypto

Recent Notes

Wall Street’s Not-So-Golden Rule

We are in the early stages of a bank run on the United States and the US dollar, and everyone on Wall Street is heading for the exits, including domestic investors who will exit not because they want to but because they know the Not-So-Golden Rule.

We’ve Tried Nothing and We’re All Out of Ideas

When you’re defending the indefensible, you have to create a symbol powerful enough to keep the masses in line.

“I voted for this” is one of the few capable of sustaining support for policy this extreme.

The Intentional Investor #27: Daryl Fairweather

Join Matt Zeigler on The Intentional Investor podcast as he interviews Daryl Fairweather, Chief Economist at Redfin and author of the new book “Hate the Game: Economic Cheat Codes for Life, Love, and Work.” In this engaging conversation, Daryl shares her journey from MIT to the University of Chicago, her experiences navigating corporate America, and how she applies economic principles to everyday life decisions. With her unique background spanning academia, tech, and real estate, Daryl offers fascinating insights on using economic frameworks to understand human behavior and make better decisions.

Scoreboard

We live in a world awash with narrative.

It’s worth celebrating those rare moments where a man gets to thumb his nose at those narratives, point to the sky, and say “Scoreboard.”

I Broke the Dam

Some want us to believe that the narratives that shape belief are universally promoted from the top down.

That hasn’t been true for a long time.

Crashing the Car of Pax Americana

I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants as a replacement is not a stable system that is possible as a replacement.

Narrative Shopping

The Trump administration has flipped between a half dozen distinct narratives telling us what these tariffs are really about.

Why? Because they needed to wrap the truth in a better story. Time to go Narrative Shopping.

The Intentional Investor #26: Danika Waddell

Join host Matt Zeigler as he interviews Danika Waddell, founder of Xena Financial Planning, in this engaging conversation about career pivots, financial independence, and creating a more inclusive financial services industry. Danika shares her journey from accounting to launching her own financial planning firm during the pandemic, and how her personal experiences shaped her mission to help women in tech achieve financial independence.

The Intentional Investor #25: Cullen Roche

In this episode of The Intentional Investor, host Matt Zeigler sits down with Cullen Roche, an economist, writer, and financial maverick who has carved out a unique space in the world of finance through his independent thinking and unconventional approach. From his large Irish Catholic family to his journey through finance, Cullen shares an intimate look at how curiosity, non-conformity, and a commitment to understanding complex systems have shaped his professional and personal life.

The Goldstein Machine

A threat built on a shred of truth, an existential fear, and our utter inability to stop it is the perfect tool for psychological control at scale.

It is a Goldstein Machine.

The Intentional Investor #24: Ben Hunt

In this profound follow-up conversation, Matt Zeigler welcomes back Ben Hunt to explore the evolution of Hunt’s writing and worldview. Beginning with reflections on their childhood relationships with religion and storytelling, the discussion moves into Hunt’s journey with Epsilon Theory – from its market-focused origins to his current philosophical crossroads.

The Intentional Investor #23: Kevin Muir

Kevin Muir, author of the Macro Tourist newsletter and a seasoned trader, joins The Intentional Investor for a fascinating conversation that weaves together trading, life lessons, and Canadian culture. From his early days mastering Monopoly statistics to pioneering computer-driven trading strategies at RBC in the 1990s, Kevin shares candid stories about finding his path in finance.

Kevin discusses growing up as the older brother of a professional hockey player, his journey from discount brokerage manager to institutional trading desk, and how becoming a father changed his perspective on risk and career. He offers unique insights into market psychology, friendship, and the importance of finding work you genuinely love.

It Was Never Going To Be Me

The Road to Serfdom is not an endless road, but its path and duration, what I call the Great Ravine, is not up to us to choose. While we walk this road the only thing we can save is our souls, and we do it with one simple sentence: It was never going to be me.

The Intentional Investor #22: Eric Markowitz

In this engaging episode of The Intentional Investor, host Matt Ziegler interviews Eric Markowitz, exploring his fascinating journey from investigative journalism to investment research. The conversation weaves through Eric’s formative years, professional evolution, and life-changing experiences, offering valuable insights into the intersection of media, investing, and personal growth.

DeepFreak

In seven days, a narrative about AI tech technology became a narrative about what it meant for chip manufacturers, which because a narrative about national security.

The Intentional Investor #21: Corey Hoffstein

Join Matt Zeigler as he sits down with Corey Hoffstein, a successful entrepreneur and financial innovator, for a candid conversation about his remarkable journey from video game programmer to financial pioneer. In this wide-ranging discussion, Corey shares the story of his career trajectory – from teaching himself programming at age 12 to founding Newfound Research and developing groundbreaking investment strategies.

A Death in the Family

Today I know that the meaning of the American Presidency is dead, and like the loss of a beloved family matriarch it’s a loss I’ll never get over. I know that I have to accept it, but I’ll never get over it. And right now I’m still pretty angry at ALL of them.

The Intentional Investor #20: Dr. Preston Cherry

Join host Matt Zeigler as he sits down with Dr. Preston Cherry, founder and CEO of Concurrent Wealth Management and author of “Wealth in the Key of Life.” From his father’s treasured vinyl collection to transformative “fog years,” Dr. Cherry shares his journey of discovering the deep connections between music, money, and meaning.

The Four Horsemen of the Great Ravine, Part 1

Every so often, things fall apart.

In the words of those who lived it, here are the vibes and the semantic signatures of the twentieth century’s most devastating social collapses.

From the meaning in their words, wisdom for our future emerges.

Data Engineer I

We’re looking for a Data Engineer to help build and maintain the data pipelines that power our AI-and NLP-driven narrative analysis platform. You’ll work with everything from structured financial data to unstructured news and social media content.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.