I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants as a replacement is not a stable system that is possible as a replacement.

We make it no secret that our research program here is all about using natural language processing to identify and measure narratives in the world. But is Narrative truly only shaped by verbal and written communication? Do Missionary statements have to be made with the mouth?

Of course not.

Here’s narrative missionary Max Scherzer, pitcher for the Washington Nationals, providing an exaggerated form of protest against the revised MLB enforcement policy regarding the use of foreign substances. The umps have generally been inspecting hats gloves and belts for these substances. Max decided to give them a little, shall we say, extra on the belt removal.

Here’s Oakland Athletics pitcher Sergio Romo, picking up every nuance of Scherzer’s crystal clear communication to the commissioner’s office.

Scherzer and Sergio’s sticky substance strip show is memetic perfection in the form of malicious compliance. There is no press conference speech either pitcher – or the others who will no doubt mimic their displays in the coming days – could have made that would have more clearly shifted Common Knowledge to the belief that the foreign substances rule was being applied, interpreted and policed in an absurd, preposterous way.

Bold prediction: this narrative doesn’t peak until Joe West enrages Zach Greinke into an NC-17 display on national television.

— Rusty Guinn | June 23, 2021 | 9:21 pm

The average American news consumer is exposed to far more headline text on news websites, social media apps and content aggregation sites than they are to the prose of the articles themselves. It should be no surprise, then, that more Fiat News and Missionary behavior exists in headlines than almost anywhere else. It typically gets a pass because, well, the whole job of a headline writer is to summarize what an article is about. But that’s precisely the task that lends itself so perfectly to telling us how we should think about the article. What’s important? What should our conclusions be? How should we feel about it?

I’ll give a free subscription to our free newsletter if you can find the fiat news language in this gem of a headline to a CNN news article.

Here are the companies rushing workers back to the office — and the ones that aren’t [CNN]

Aside from the general observation to take care in our content consumption habits, remember that it is the constant barrage of articles – and headlines – like this that reinforces our belief that the missionaries of the “Work From Home Forever!” narratives are dominating the field, at least in the Narrative war.

— Rusty Guinn | June 22, 2021 | 9:58 am

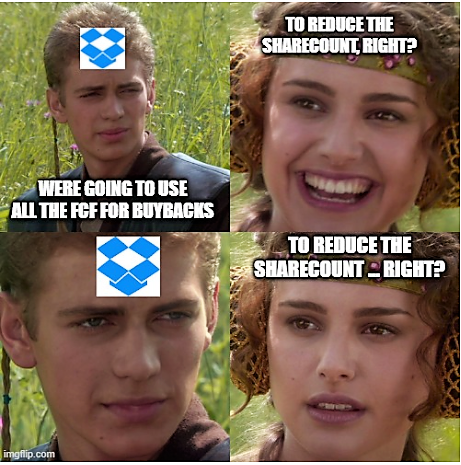

I saw this work of art on Twitter today, referring to Dropbox management using stock buybacks to sterilize their outrageous stock-based comp, and it made my day.

The Epsilon Theory notes I wrote about stock buybacks in 2019 are the most controversial thing we have ever published. They generated more anger, more arguments and more cold shoulders from the mainstream finance community than anything else we’ve done. Here’s my position:

When stock buybacks are used to sterilize stock-based comp (i.e., a company gives managers stock with one hand and buys it back from them with the other hand), no money is “returned to shareholders”. This is true whether or not management actually sells its shares into the buyback program.

Stock buybacks only “return cash to shareholders” to the degree that the buyback program reduces the sharecount. To the degree the buyback program does not reduce the sharecount, but simply sterilizes new issuance to management, it is purely a transfer of wealth from shareholders to management.

As the kids would say, it’s just math.

I think you would be AMAZED at the proportion of stock buyback programs that go towards sterilizing stock-based comp. I certainly was. I think it’s the greatest transfer of wealth in human history.

Not to founders. Not to entrepreneurs. Not to risk-takers.

Nope … to managers. To asset-gatherers. To fee-takers. To rent-seekers. To rakes.

Yep, Jamie Dimon is the rake. But then so is every S&P 500 management team. So is every Wall Street management team. That I’m aware of, at least. It’s the water in which we swim.

“Yay, Stock Buybacks!”

It’s amazing how many people get very angry at me when I say this.

Anyhoo … in addition to The Rake, here are the notes that started all the fuss.

— Ben Hunt | June 15, 2021 | 4:04 pm

In Epsilon Theory-speak, we use “Yay, Good-Thing!” as shorthand for a Narrative that takes a linguistic construction that we all agree is a Good Thing (something like “capitalism” or “freedom” or “democracy”) and turns it into a behaviorally powerfully argument for something that is decidedly not that Good Thing, but can be painted with other behaviorally powerful words into something that sorta kinda looks like that Good Thing if you squint really hard and you say the behaviorally powerful words loudly enough.

In rhetorical construction, “Yay, Good Thing!” is a variation on begging the question (in the correct way of understanding that phrase, where the conclusion is assumed in the proposition), or if you’re in marketing or sales you would recognize this as a variation of the assumptive close. The typically-but-not-always unspoken corollary to the “Yay, Good Thing!” narrative construction is “You’re not against Good Thing, are you?”, which is the linguistic stick to the “Yay, Good Thing!” carrot.

Socrates would call “Yay, Good Thing!” sophistry, and he hated the Sophists with a deep and abiding passion. Same. In the modern world, the Sophists are powerful government and corporate interests (aka the Nudging State or the Nudging Oligarchy if we’re going to continue in Epsilon Theory-speak), and the “Yay, Good Thing!” construction is their go-to narrative weapon in the Forever War of stripping away our autonomy of mind.

If you want to read more about our take on “Yay, Good Thing!” narratives, here’s the Epsilon Theory note that started all that.

Anyhoo … I was thinking about “Yay, Good Thing!” today because of how the “Yay, Environment!” implementation of this narrative device is being used to shape the politics of two issues that we’ve been writing a lot about recently: work and crypto.

“Yay, Environment!” is now one of the primary threads in the narrative-world battle over the future of work.

It’s a very powerful narrative thread. It’s a big reason why “Remote work is here to stay!” is winning this narrative war, and you are going to see a lot more “Yay, Environment!” rationalizations for remote work policies in the future.

Similarly, “Yay, Environment!” is now one of the primary narrative threads in the narrative-world battle over the future of Bitcoin.

Here’s the latest, from Elizabeth Warren, but you’re no doubt familiar with Elon Musk’s oeuvre here, as well.

And yes, this construction of “Yay, Environment!” does indeed speak the usually silent part – “You’re not against the Environment, are you?” – out loud. And yes, you’re going to be seeing A LOT more of this narrative. Not because it’s right. Not because it’s wrong. But because it WORKS.

It’s all just another weapon in the ongoing narrative war for Wall Street control and US Treasury visibility over Bitcoin.

— Ben Hunt | June 10, 2021 | 9:24 am

It wasn’t enough for ProPublica to do actual news reporting by publishing these tax records.

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

No, they had to tell you how to think about their news reporting.

They had to turn news into Fiat News by constructing a metric of “true tax rate” based on unrealized capital gains, because … you know … the actual true tax rate just wasn’t damning enough for ProPublica’s purposes.

To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

What is Fiat News? It’s the presentation of opinion as fact. It’s an interpretation of factual events projected with the same authority as the factual events themselves.

Fiat News (in this case the opinion that wealth in the form of unrealized capital gains should be taxed) is to hard news (in this case the tax filings of the very wealthy) what fiat currencies are to hard currencies.

We write a lot about Fiat News. Here’s the money quote from the note that started it all, Fiat Money, Fiat News:

There’s really no such thing as “real money”, i.e., gold and silver as a medium for exchange or a store of value, in existence in the world today. That used to be the meaning of gold, but those days are long gone. Today fiat money completely and utterly dominates all global commerce and exchange. Why? Because it supports the existential aims of government: taxation (sovereignty), price control (stability), and liquidity provision (growth). Without the invention of fiat money, global GDP today would be at … I dunno, maybe mid-18th century levels? Something around there, I’d guess.

Fiat news serves exactly the same existential aims of government, just in a less overt (but more powerful for being hidden) fashion. There’s just too much at stake for status quo regimes, what with modern referenda like Brexit and national elections like we just experienced in the U.S. and are forthcoming this year throughout Europe, for regime institutions to do anything other than double-down in their embrace and promulgation of fiat news.

Ten years from now we will be awash in “news” to a degree that we can hardly imagine today. That’s what happened with fiat money, and that’s what I think happens with fiat news.

The exponential growth in fiat news is still ahead of us, not behind us.

Gresham’s Law: bad money drives good money out of circulation.

Hunt’s Law: fiat news drives hard news out of circulation.

— Ben Hunt | June 8, 2021 | 9:42 am

The cure for the cancer of gun culture and police culture is not to be found in reform laws around guns and police, but in reform ideas around culture, ideas that create a new dimension of American society that rejects LARPing and LARPers alike.

Inflation

What made Bitcoin special is nearly lost, and what remains is a false and constructed narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

Sorry, we couldn't find any posts. Please try a different search.

Crypto

Recent Notes

The Intentional Investor #27: Daryl Fairweather

Join Matt Zeigler on The Intentional Investor podcast as he interviews Daryl Fairweather, Chief Economist at Redfin and author of the new book “Hate the Game: Economic Cheat Codes for Life, Love, and Work.” In this engaging conversation, Daryl shares her journey from MIT to the University of Chicago, her experiences navigating corporate America, and how she applies economic principles to everyday life decisions. With her unique background spanning academia, tech, and real estate, Daryl offers fascinating insights on using economic frameworks to understand human behavior and make better decisions.

Scoreboard

We live in a world awash with narrative.

It’s worth celebrating those rare moments where a man gets to thumb his nose at those narratives, point to the sky, and say “Scoreboard.”

I Broke the Dam

Some want us to believe that the narratives that shape belief are universally promoted from the top down.

That hasn’t been true for a long time.

Crashing the Car of Pax Americana

I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants as a replacement is not a stable system that is possible as a replacement.

Narrative Shopping

The Trump administration has flipped between a half dozen distinct narratives telling us what these tariffs are really about.

Why? Because they needed to wrap the truth in a better story. Time to go Narrative Shopping.

The Intentional Investor #26: Danika Waddell

Join host Matt Zeigler as he interviews Danika Waddell, founder of Xena Financial Planning, in this engaging conversation about career pivots, financial independence, and creating a more inclusive financial services industry. Danika shares her journey from accounting to launching her own financial planning firm during the pandemic, and how her personal experiences shaped her mission to help women in tech achieve financial independence.

The Intentional Investor #25: Cullen Roche

In this episode of The Intentional Investor, host Matt Zeigler sits down with Cullen Roche, an economist, writer, and financial maverick who has carved out a unique space in the world of finance through his independent thinking and unconventional approach. From his large Irish Catholic family to his journey through finance, Cullen shares an intimate look at how curiosity, non-conformity, and a commitment to understanding complex systems have shaped his professional and personal life.

The Goldstein Machine

A threat built on a shred of truth, an existential fear, and our utter inability to stop it is the perfect tool for psychological control at scale.

It is a Goldstein Machine.

The Intentional Investor #24: Ben Hunt

In this profound follow-up conversation, Matt Zeigler welcomes back Ben Hunt to explore the evolution of Hunt’s writing and worldview. Beginning with reflections on their childhood relationships with religion and storytelling, the discussion moves into Hunt’s journey with Epsilon Theory – from its market-focused origins to his current philosophical crossroads.

The Intentional Investor #23: Kevin Muir

Kevin Muir, author of the Macro Tourist newsletter and a seasoned trader, joins The Intentional Investor for a fascinating conversation that weaves together trading, life lessons, and Canadian culture. From his early days mastering Monopoly statistics to pioneering computer-driven trading strategies at RBC in the 1990s, Kevin shares candid stories about finding his path in finance.

Kevin discusses growing up as the older brother of a professional hockey player, his journey from discount brokerage manager to institutional trading desk, and how becoming a father changed his perspective on risk and career. He offers unique insights into market psychology, friendship, and the importance of finding work you genuinely love.

It Was Never Going To Be Me

The Road to Serfdom is not an endless road, but its path and duration, what I call the Great Ravine, is not up to us to choose. While we walk this road the only thing we can save is our souls, and we do it with one simple sentence: It was never going to be me.

The Intentional Investor #22: Eric Markowitz

In this engaging episode of The Intentional Investor, host Matt Ziegler interviews Eric Markowitz, exploring his fascinating journey from investigative journalism to investment research. The conversation weaves through Eric’s formative years, professional evolution, and life-changing experiences, offering valuable insights into the intersection of media, investing, and personal growth.

DeepFreak

In seven days, a narrative about AI tech technology became a narrative about what it meant for chip manufacturers, which because a narrative about national security.

The Intentional Investor #21: Corey Hoffstein

Join Matt Zeigler as he sits down with Corey Hoffstein, a successful entrepreneur and financial innovator, for a candid conversation about his remarkable journey from video game programmer to financial pioneer. In this wide-ranging discussion, Corey shares the story of his career trajectory – from teaching himself programming at age 12 to founding Newfound Research and developing groundbreaking investment strategies.

A Death in the Family

Today I know that the meaning of the American Presidency is dead, and like the loss of a beloved family matriarch it’s a loss I’ll never get over. I know that I have to accept it, but I’ll never get over it. And right now I’m still pretty angry at ALL of them.

The Intentional Investor #20: Dr. Preston Cherry

Join host Matt Zeigler as he sits down with Dr. Preston Cherry, founder and CEO of Concurrent Wealth Management and author of “Wealth in the Key of Life.” From his father’s treasured vinyl collection to transformative “fog years,” Dr. Cherry shares his journey of discovering the deep connections between music, money, and meaning.

The Four Horsemen of the Great Ravine, Part 1

Every so often, things fall apart.

In the words of those who lived it, here are the vibes and the semantic signatures of the twentieth century’s most devastating social collapses.

From the meaning in their words, wisdom for our future emerges.

Data Engineer I

We’re looking for a Data Engineer to help build and maintain the data pipelines that power our AI-and NLP-driven narrative analysis platform. You’ll work with everything from structured financial data to unstructured news and social media content.

Business Analyst

Second Foundation Partners is looking for a Business Analyst to help us build tools that make sense of the world’s narratives using generative AI.

Digital Content Writer I

Second Foundation Partners needs a talented, passionate writer intrigued by the opportunity to bring data to life through engaging daily content about media, markets, and sports.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.