Every so often, things fall apart.

In the words of those who lived it, here are the vibes and the semantic signatures of the twentieth century’s most devastating social collapses.

From the meaning in their words, wisdom for our future emerges.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

The cure for the cancer of gun culture and police culture is not to be found in reform laws around guns and police, but in reform ideas around culture, ideas that create a new dimension of American society that rejects LARPing and LARPers alike.

Inflation

What made Bitcoin special is nearly lost, and what remains is a false and constructed Narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

Sorry, we couldn't find any posts. Please try a different search.

Crypto

Recent Notes

The Zeitgeist – 5.7.2019

Ever wonder why you don’t ever get hit with a year-end taxable gain from ETFs like you do with mutual funds? They use a legal (for now) pseudo-wash trade with in-kind redemptions.

Now Vanguard is doing the same thing with their mutual funds. And get this … they’ve filed a patent on this.

So amazing that I’m not even mad.

Wage Growth, Groucho Marx Edition

Wage stagnation in 2016 was actually much worse than you were told. Did this make a difference in the Midwestern states that swung the election, in that actual labor conditions were worse than everyone thought they were? I think yes.

Wage growth in 2018 was actually much better than you were told. Did this make a difference in the current Fed/Wall Street/White House narrative that inflation is dead and the easy money punchbowl can be maintained without consequence? I think yes.

For a few days, we’re making this ET Professional note available to everyone to review. We think the ET Pro service is something that every portfolio allocation, wealth management and active investment team can find useful, particularly for risk management.

The Zeitgeist – 5.6.2019

If you’re buying or selling the market because the China deal is on or because the China deal is off, you’re no different from everyone who had a ticket at the Derby. Good luck with that.

Also, what do Warren Buffett and Dune’s Leto Atreides have in common? They both get transformed into near-immortal creatures. I suppose a Cartoon cut-out is more attractive than a sandworm.

The Weekend Zeitgeist – 5.4.2019

It’s the Weekend Zeitgeist, in which we consider a going-forward rule for infrastructure editorials, a different kind of Valley Girl, an emerging Get Out of Dodge narrative, and SEO as a service.

The Zeitgeist – 5.3.2019

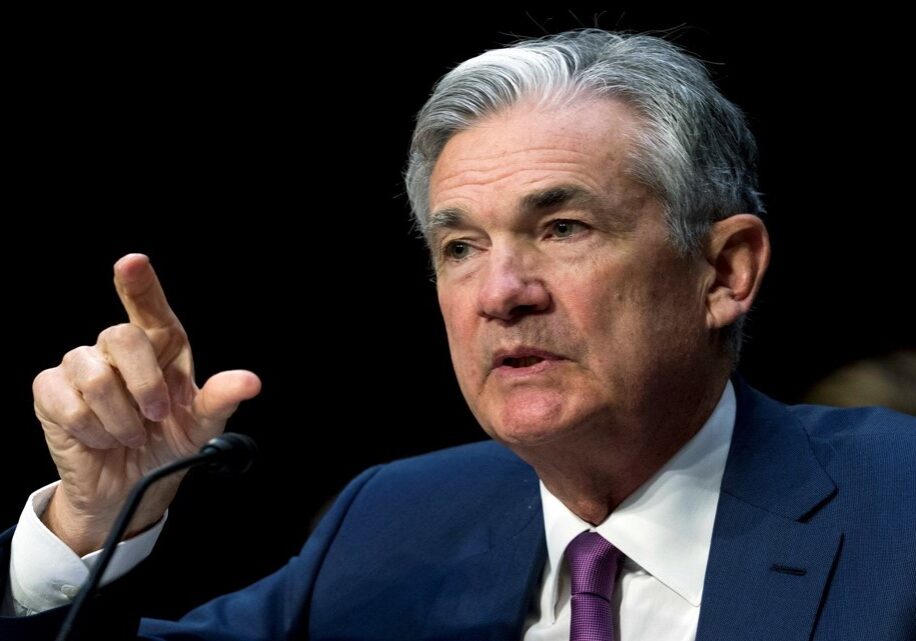

It’s the Friday Zeitgeist, in which people who will never buy a company learn how to do it, Powell delivers a belly-rub and takes away a child’s cookie jar simultaneously, Swiss francs climb the Zeitgeist ladder, a local bank makes it up on volume, and we all declare together that an OK faux-hamburger is more than just a faux-hamburger.

The Zeitgeist – 5.2.2019

Content placement by asset managers is like the elaborate red pouch of the male frigate bird. It is SO wasteful and extravagant that – in an economically perverse way – it demonstrates your evolutionary fitness.

Ditto for why the sell-side still cares about II ratings and “who’s the ax?” and all that stuff that hasn’t mattered for 20 years.

It’s plumage.

In the Trenches: Less Is More

At some point, all Fed Chairs learn that their primary function is just to wave their hands. Jay Powell has learned this sooner than most.

ET contributor Pete Cecchini goes way off the Wall Street reservation with this: the bullish narrative for U.S. equity risk makes sense only if one accepts a narrative that the Fed will proactively move to prevent a U.S. slowdown before it happens.

Don’t believe it.

The Zeitgeist – 5.1.2019

Berkshire Hathaway’s financing for Occidental is in the Zeitgeist today.

What is shadow banking? THIS.

Not that there’s anything wrong with it. Hey, this is Uncle Warren’s true face, and I’m a fan of authenticity in all its forms and ways. But if you think poorly of a guy like, say, Ken Griffin because you think Citadel was “bailed out by the US taxpayer”, and you don’t think EXACTLY the same about Warren Buffett and Berkshire Hathaway … then you’ve been played.

The Zeitgeist – 4.30.2019

It’s the Tuesday Zeitgeist, in which we explore how you could go with this (or you could go with that), the power of AS, my respect for you, IPOs aplenty and the trade/rotation of choice.

Starry Eyes and Starry Skies

The student loan crisis is a Big Deal. And it is only a part of a Bigger Deal: the Myth of College.

This issue will be front-and-center in the upcoming elections. We will all be handed our very own ‘Yay, College’ signs to raise high. More often than not, we will be asked to raise them in service of market-distorting policies which will make our problems worse.

The Zeitgeist – 4.29.2019

Our lead article today is about Uber (driving-as-a-service) and Amazon (shopping-as-a-service). It’s the triumph of on-demand everything, that makes both production and consumption an experience.

What do you get out experiential consumption and production?

You get to hold up a card that says, “Yay, swineherding!”

The Zeitgeist Weekend Edition – 4.27.2019

It’s the Weekend Zeitgeist, which means we leave the world of finance behind us to delve into bipartisan distrust of government, local opinion writers’ opinions on packaging materials, Yoopers, F-35 sales to completely trustworthy foreign partners, Fiat Features and the worst thing I ever saw.

The Zeitgeist – 4.26.2019

Yeah, we’re at that point in the cycle where you will be told about all the wonderful opportunities provided by levered private REITS.

For your IRA.

Because of all this craaaazy volatility in the stock market.

That and the President’s Cheif Economic Advisur tells us why “Dow 36,000” is just the tip of the iceberg.

Notes from the Diamond #7: Hittin ‘Em Where They Ain’t (Part 2)

ET contributor David Salem is back with five core tenets for achieving 5+% real returns over the next few decades.

It’s all a must-read, but I’m gonna highlight #4: “Favor equity investments in companies employing or serving primarily people with abundance as distinct from scarcity mindsets.”

This is the foundation for behavioral economics on a macro scale.

The Zeitgeist – 4.25.2019

What is the only true superpower? The power to name things.

We name Milken and Boesky as junk-bond kings. We name their actions as a spree. We name their outcomes as devastation. We name their instrument as debt.

Today we name it balance sheet expansion.

Every man a king!

The Zeitgeist – 4.24.2019

Say what you will about @jack, but he understands the necessary and sufficient condition for being a successful CEO today: create a Wall Street-supported non-GAAP narrative to describe your company’s financial results.

Tired: MAUs

Wired: mDAUs

All this, plus Russell Wilson continues surfing the Zeitgeist like no one else.

Office Hours – 4.24.2019

In which Ben and Rusty discuss financialization, the incentivizes of low interest rate policy, the ‘financialization’ of education and the meaning of both for us…

The Zeitgeist – 4.23.2019

China’s Belt and Road Initiative is back, baby! Just needed a little narrative happy face of “respect for global debt goals” and “promotion of green growth”. That plus multi-billion dollar non-recourse loans at 2% for a high-speed rail to nowhere.

Plus more on Walmart robots, ESG, and of course Free College!

Just another day of you can’t make it up, fresh from the ET Zeitgeist.

The Zeitgeist – 4.22.2019

The Monday Zeitgeist today is about companies actually being allowed to go bankrupt, the usual DB/CBK chatter, money flow cartoons, great moments in bad metagame, and a decent little personal finance column.

The Zeitgeist Weekend Edition – 4.20.2019

This Weekend Edition is a bit of a downer, but the Zeitgeist is what it is. And the non-financial markets Zeitgeist right now? It’s all about poverty, the spirit of poverty and how people transform our concerns about both into political power.