Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

“They’ve built their own prison, so they exist in a state of schizophrenia. They’re both guards and prisoners, and as a result they no longer have – having been lobotomized – the capacity to leave the prison they’ve made, or to even see it as a prison.”

My Dinner With Andre (1981)

The US Federal Reserve should use forward guidance now [FT]

“The global economy is slowing, US business investment has stalled and the yield curve, which reflects market expectations of future interest rates, has inverted — a quirk that preceded previous recessions. How should monetary policy respond?

The Federal Open Market Committee, of which I am a participant, will consider this question at our September meeting. Absent some surprise reversal in these economic developments, I will argue that we should not only cut the federal funds rate, but that we should also use forward guidance to provide even more of a boost to the economy than a rate cut alone can deliver. ”

Neel Kashkari, President of the Minneapolis Federal Reserve Bank

I haven’t been very nice to Neel Kashkari.

He is my poster child for the concept of the stalking horse, and here’s a sample of what I’ve written about him in the past.

And okay, I’ll admit it. This FT opinion piece that he wrote the other day absolutely triggered me. It’s just so … Neelish … with rare gems like this:

“If the Fed had made a firm commitment to keep overnight rates at zero for the next 10 years, the 10-year treasury rate would likely have been close to zero.”

This is what passes for deep thought on the pages of the FT these days.

As the kids would say, I can’t even.

How does the Fed of today bind the Fed of ten years from now, Neel? How does that work, when it won’t be the same people and you meet every six weeks or so to set new policy on a purely discretionary basis?

FFS.

So triggered as I was, I leapt to Twitter to register my displeasure and begin a rage engagement.

I know, I know … not very nice. Maybe even “nasty” as our President would put it if I were the Danish prime minister.

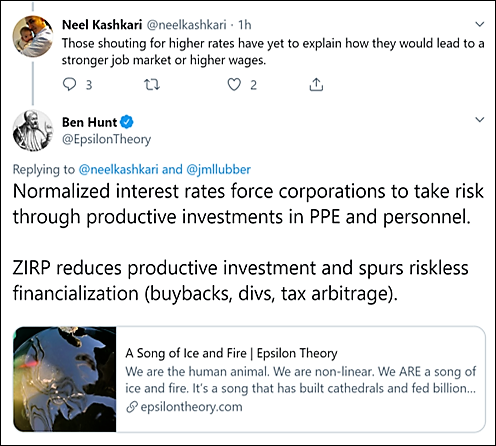

But then the weirdest thing happened. No, @neelkashkari did not reply to my mean tweet. But he DID reply to one of the people who replied to my tweet. So I replied to that.

Now I figured that would be the end of that. In fact, I took this screenshot and tweeted:

“I mean, there’s not a chance in hell that Kashkari engages with this seriously, but since he asked …”

And then a miracle happened. We started a conversation.

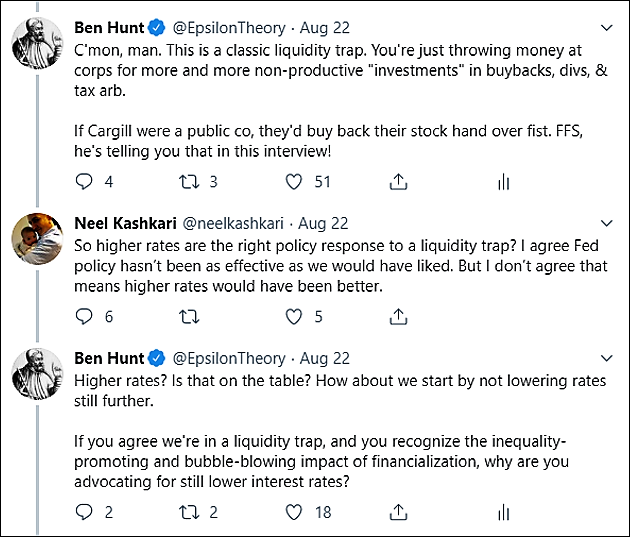

You’ll notice that Neel is a fan of the strawman argument, where he will say that you are arguing for something (higher rates) that you aren’t. More on this later.

And here I thought we were done for sure. BTW, here’s the link to my note on risk-taking by corporations and why zero or near-zero interest rates kill that:

But no! We had one more strawman question.

NARRATOR: Neel was not genuinely interested.

There I go, being mean again. But I say that he wasn’t genuinely interested because these are the stock questions that Kashkari asks to intimidate people into submission: how do you get stronger labor results with higher rates and what specific announcement would you have made in year xxxx? Every town hall and every twitter exchange … these are the questions he asks to demonstrate some form of dominance over puzzled questioners.

So I said my piece and got it out there. But it wasn’t a real conversation. It was me talking to a wall.

And who knows, maybe one day I’ll get to have a genuine conversation with Neel or Jim or Jay or Lael or Richard or one of the gang. But I doubt it.

We can’t have a real conversation with central bankers because they are both guards and prisoners of the island of policy and thought that they’ve created.

They are Number Two in the classic TV series The Prisoner.

Yes, they are there to maintain order on the island and break the spirit of Number Six, but it’s not an accident that pretty much every episode has a new Number Two “in charge” of the island. Number Two answers to Number One. They are ALL stalking horses. They are ALL prisoners.

And sure, I’m a prisoner, too.

And sure, they’ve got that giant white ball following me everywhere in the form of their stock questions and press conferences and fake dialogues.

But I’d rather be in my shoes than Neel’s shoes.

Because I am not a number. I am a free man.

Be seeing you.

Fantastic that you got that far with him. Did he just not respond to your last comment, “But QE2 turned…?”

Number 6: Whose side are you on?

Number 2: That would be telling…

Ben…be careful, my friend before they come remove you from your home in the middle of the night. In my view the best way to describe this is a change in regime (not political). You throw a ball straight up in the air. Tho going up, it’s decelerating all the way…that is until it is not only decelerating (negative acceleration), but is motionless for an instant before inflecting, falling, and accelerating in doing so. It is this inflection point at the end of a debt super-cycle as to why previously workable and descriptive financial physics don’t apply. Yes, you can calculate when the ball will become motionless and reverse direction…not so with debt. What the central banks did in the Panic of 2008 is essentially change the -32ft per second squared deceleration…making it say -20 ft per second squared…BUT all they did was forestall the inflection. In fact, I’d argue that in changing the acceleration due to gravity number, they added even more mass to the object on the way down…and the force with which the thing will thud to the ground is that much more destructive/impactful bc even though the acceleration has been changed so too the mass (amount of debt…140%+ pre-crisis levels) to a much bigger number. Sooo, F (force)= Mass (now very much heavier) x A (acceleration…though smaller). At the end of the day, all that counts is the force with which the thing hits the ground…which it will eventually and with much greater force/impact.

Thanks for putting that up !

2 comments, one of which I might have made before :

This is an old quote from Peter Drucker ( some 2001 interview ) : “The idea that the Federal Reserve chairman has power is a delusion. The only power he has is over the interest rate, and the interest rate has ceased to be important because businesses are no longer dependent upon borrowing from banks. The interest rate is only important to the stock market, to people that short or buy on margin. For the economy – yes, if it goes up to 18 percent or down to 2, but half a point is a symbolic gesture”.

From my own experience running small companies – that is VERY true. When business was good, I would happily borrow even at USD rates of 1% /month. When business was bad/no business……what was the point of borrowing ? There was no profit to be made, only the possibility of uncollectable debts owed to me for forcing clients to take merchandise they couldn’t sell………….I didn’t take any money….regardless of the interest rate……

Neel Kashkari – reminds me again of those extremely book smart intellectuals….they are always trying to corner you into making a definitive prediction – what industry should the government promote, what sector has the best chances, etc……what guarantee is there that this policy response will work………when in fact an open capitalistic economy grows on the unpredictable, the surprises , which academia calls innovation.

To repeat your quote “ There is no predictive algorithm for social systems”.

If there was, Socialism would work – ( paraphrasing George Gilder)

I seem to remember some Fed official hand-wringing about asset prices getting too frothy (yeah, right…stop it; stop; I love; I love it) a few years ago. IF the Fed were really worried about creating stock and bond bubbles…all it would need to do is jack up margin requirements…which it has NOT. In days of old asset prices were a reflection of the economic condition/growth. Now, asset price inflation is seen as fuel for economic growth (no way speculation, excess consumption, and mal-investment)…at least in the Fed’s eyes. If markets as a public utility (must remain elevated/be levitated ad infinitum as a matter of policy) are the modern form of bread and circuses as well as fuel for economic growth…how far does asset inflation have to go before becoming utterly unhinged from intrinsic value? Now, never? Hussman’s Margin Adjusted CAPE puts us at the most expensive in HISTORY. What’s more Grantham refers to profit margins as “the most mean reverting of data sets”. At what point does this thing blow? When it blows, it’ll blow big…as asset shocks have preceded the past two recessions, and the next one will be a whopper…finally finishing what not allowed to run its course in 2008. The only question in my mind from an event causality standpoint…will Fed policy impotence be the cause or the commonly realized effect of the next bust?

Hi Ben - thanks for letting the pack see the P-O’d Ben, not just the thoughtful, deep-thinking pack leader. And no, I don’t think you were being mean. You met arrogance on the field of battle with Truth, and Neel left the field. One can only hope that it will sink in that he & the Fed don’t have all the answers. Thanks again for sharing.

Perhaps part of ‘Clear Eyes’ means we stop pretending the goals of the Fed (and other policy Stalking Horses) are what we are ‘led to think’. If you look at the present outcomes of Financialization and Central Bank Policy over the last 5 decades and consider that the present situation is EXACTLY what the Financiers had in mind, it makes a lot more sense. It also gives us a good idea of what to expect in the future.

This also ties in with the whole MMT Discussion. To quote Roucheforque, http://roacheforque.blogspot.com

“This my friends is MMT. It is no theory, and again, it has been in practice for decades. And it is never used for the purpose of shoring up income equality, it is used EXCLUSIVELY to increase income INEQUALITY. So in effect, MMT will NEVER be anything more than a theory for its “left leaning Socialist progressive” proponents. Rather, it is a practical tool for the ruling classes to increase wealth and power at the expense of the working class tax base.”

I don’t think the Fed is concerned with USA GDP, inflation, unemployment…because the people that put people in the Fed aren’t.

I think they are trying to weaken USD so that it doesn’t kill the global economy/monetary system.

If a global reset, Fed very likely loses its power. So from their perspective, NIRP is worth a shot.

Off the top of my head, first level thinking with a healthy dose of paranoia and cynicism.

“How far does asset inflation have to go before becoming utterly unhinged from intrinsic value?” Feels like it happened about a year and a half ago.

intrinsic value is an impossible concept.

it feels like an extremely weird thing to say in a capitalist world where values fluctuate all the time and differentiated views on value is what makes a market.

and yet, there you have it, a generalized belief that values are intrinsic and objectively discernible.

weird.