Editor’s Note: It’s been almost two years since I wrote my last Mailbag note, which is kinda pathetic. My excuse has been that we’ve got an incredible commentariat on the ET Forum, with hundreds of comment threads and thousands of individual comment posts, and we make public the comment threads on our published notes. Limiting comments to paid subscribers is one of the best decisions we ever made! But it also means our hundreds of thousands of casual readers can’t easily see why I say that the subscriber posts on the ET Forum are the best thing on the Internet today.

So I’m taking some of the comments on Hollow Men, Hollow Markets, Hollow World and incorporating them into a standalone note. We’re also putting up a PDF version of the note, as well as an audio recording of the note (also on iTunes and Spotify).

All of this – mailbag of subscriber comments, PDF and audio recording of the original note – are outside the subscriber paywall.

If this is a community you’d like to join, a full paid subscription is $20/month or $200/year. There are no minimum time requirements on the monthly sub, and a 30-day full refund period on the annual sub, so your risk in signing up is minimal.

Watch from a distance if you like, but when you’re ready … join us!

Data Sources?

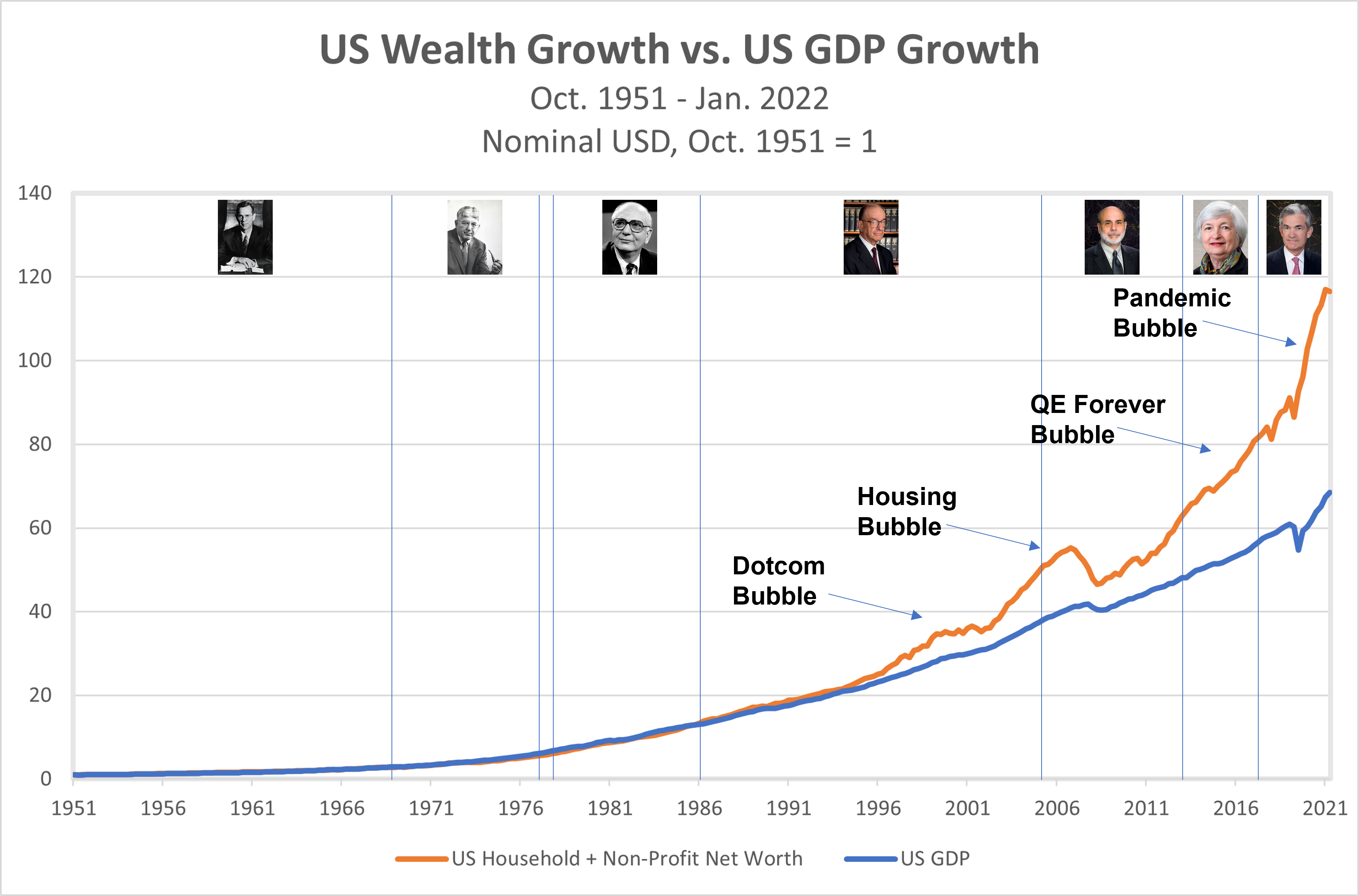

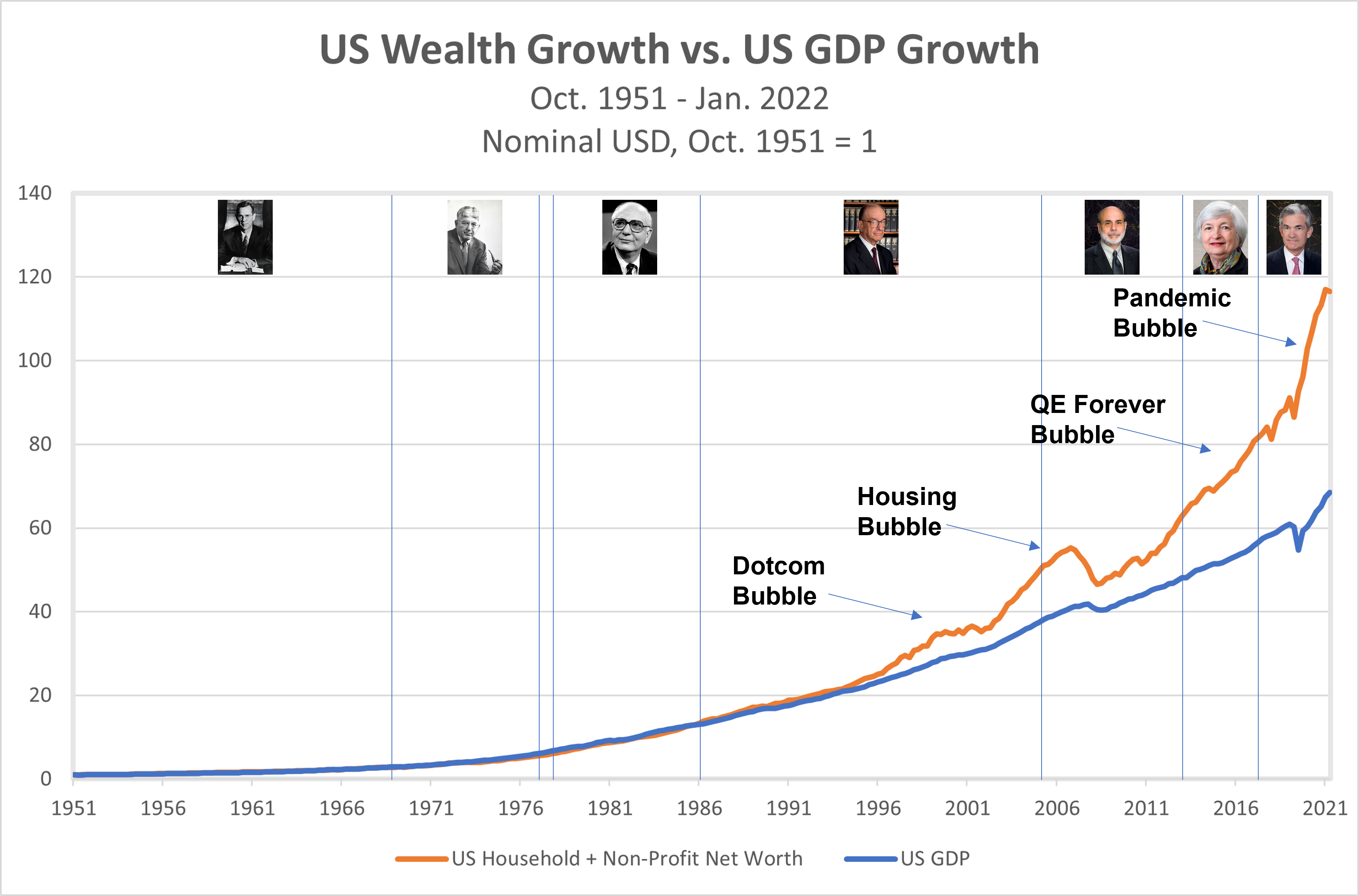

Does the data set for the orange line in the chart get updated, monthly, quarterly or annually? (could you also link to the data set directly? Not sure I’m finding it exactly when I search on FRED)

I’m curious to see what the YTD damage has been so far in trying to forecast for the period ahead.I’m also curious about the size and impact of crypto on this data set. To go from a $2 trillion market cap at the beginning of January.

jtpocean

Here’s the link to the Household + Nonprofit Net Worth (it’s measured quarterly): Households and Nonprofit Organizations; Net Worth, Level (TNWBSHNO) | FRED | St. Louis Fed

And here’s the link to US Nominal GDP (also measured quarterly): Gross Domestic Product (GDP) | FRED | St. Louis Fed

As for the impact of $1 trillion in crypto losses, total Household + Nonprofit Net Worth in the US was about $150 trillion at the start of 2022. The largest component of this, by far, is residential real estate. Behind that are financial assets like US Treasuries and US stocks. A trillion dollars in crypto losses is only about 0.66% of the total, just a drop in the bucket.

How Should a Fiduciary Act in Light of This Note?

What is a person with fiduciary duty to do after reading this excellent post?

Schase

Thanks for a really nice piece. It is a difficult thing to look at old reports and realize what you didn’t know. That takes a deep sense of self and remarkable ego strength.

I spent about an hour on the phone with a financial advisor yesterday; the conversation began with “what do I tell my clients when they say the dollar is going to be worthless?’. I felt a bit like Col. Jessup. The real truth (at least a bit of it) is that we have so seriously mismanaged the world since the fall of the Berlin Wall that we managed to bring defeat from a wonderous victory. My take is that after the Berlin Wall fell, America’s leadership decided it no longer needed to pay attention to the rabble; it went whole hog to efficiency at the cost of everything else to maximize “shareholder value”:. In that process, we destroyed our industrial base; the pandemic revealed how the lack of redundancy has left us in a dangerous position. It’s worth nothing that we thought it was OK to put the world’s most sophisticated semiconductor foundries in the range of China’s short-term missiles or base the entire German industrial machine on cheap Russian oil and gas. Or built retailers without stockrooms. Inflation becomes a real problem not just when there is too much money chasing too few goods but when I am not confident the goods will be there and thus I will pay any price.

So. what I told the advisor is that we are looking at a world of short duration assets, short business cycles, and really difficult financial markets. I don’t think he really heard it.

I have always been struck by John 5:1-8. The cripple at the well thought he knew what he needed; help to get in the pool if it stirred. Instead, Jesus showed him what he really needed, which was faith in him.

Thanks again, Ben.

bogrady

This answer is not intended to be snarky, we actually did a Pack sourced OH where I was tasked with leading a discussion about how to invest with inflation. I didn’t have many great answers other than reminding everyone of the water we all swim in.

1) Financial services asset allocation models (all of them) lean heavily on the correlations and returns produced during a falling inflation, falling interest rate, financializing, higher P/E, 40 year backtest.

2) Investors expecting that model output to generate real returns above lost purchasing power to inflation, aren’t thinking critically enough about a rising inflation, deleveraging world that we keep discussing is unfolding from zero rates and high valuations.

3) The last time we did have inflation in the US in the late 70’s/early ’80’s the lines on Ben’s chart had not disconnected from each other. Interest rates were high single digit or low double digit so the duration of a bond portfolio was extremely short to yield 8-10%+. Therefore, rising rates just offset some of the coupon income earned and did not produce negative total returns from bonds. Because bonds yielded so much and inflation was so high, stocks routinely traded at 6-10 P/E’s. Again, it is harder to lose much money in a recession owning a stock that starts with an 8 P/E and yields 5% and isn’t junk financed.

4) Knowing the facts in #3 tells an investor nearly NOTHING about how inflation and higher interest rates will impact a portfolio of stocks and bonds today. Witness the performance of the 60/40 balanced portfolio being the worst ever calculated in a half. High quality bonds are down 10-12%! Why? Nearly no coupon and very long maturities in the benchmarks today… Ben’s extended market cap line shows that a stock missing sales, having margin issues or whatever causes an EPS miss easily drives the price down 20-50% when they pay nearly no dividends and trade at excruciating valuation.

5) Owning overweights like energy, other commodities, and holding hedges like a long dollar position can mitigate some of the carnage. But, the math of high valuation, a return of inflation, and a resulting rise in interest rates makes all manner of the diversified portfolios that worked the past 30-40 years challenged. Remember that these inflation hedge recommendations touted are typically only a small allocation to an overall portfolio and by themselves cannot fix the big picture.

That is an unfortunate answer, but I hope it elicits a better understanding of the dilemma all investors face.

jpclegg63

My answer to this question – how should a fiduciary act in the Hollow World, and what sort of advice should a financial advisor give to their clients – has been the same for the past nine years, since I first started writing Epsilon Theory.

As fiduciaries, we must act as stewards of the future, not as managers of the now. We must invest in what is real.

What the future means will vary greatly from person to person. Ditto for what is real. Personally, I have a very expansive view of what is real (includes intellectual property, for example) and a very specific view of what the future is (the lives of my children and their children). Your mileage may vary.

As for the role of financial advisors, I wrote this six years ago:

All real assets are not created equal, of course. I’d much rather own an asset that generates some sort of cash flow than one that just sits there, but price will usually (although not always) take care of that differentiation. The most important consideration, I think, particularly when using public markets, is to get as close as you can to the fractional ownership share in the asset itself and as far away as you can from the casino chip. What that means in practice is getting as high up in the capital stack as you can while still having an equity claim on assets. … It’s making this sort of evaluation where I think that active managers, whether it’s in equity or in fixed income, can prove themselves, and where I think there’s a role for fundamentally-oriented, stock-picking active managers. It’s not because I think they can stock pick their way to outperformance versus a passive index while we’re in a policy-driven or policy-controlled market, but because I think they can identify a margin of safety in my public market ownership of real assets and real cash flows better than a passive index.

Hobson’s Choice

The maximum regret of every investor in every time period is being the sucker. During a decade of QE, being a sucker was defined as not being levered long to risk assets. During the next decade of QE-unwind, I think being a sucker will be defined as being caught in one of the inevitable series of blow-ups of over-levered, over-financialized companies you didn’t realize were borrowing short and lending long until it was too late. You’ve already seen the first wave of this in crypto. There will be more of these waves, and not just in crypto. But also in crypto.

The best financial advisors (and fiduciaries more broadly) minimize their clients’ maximum regret. Just do that, and you’ll be a hero.

Entropy, Energy, and How Societies Fail

Point 1. Apocalypse Now – greatest movie of all time. The only reason it is second to Pulp Fiction on my favorite movies list is because Pulp Fiction is far less harrowing to watch (amazing they are referenced in the same note!). Even thinking of Martin Sheen’s line reading, “I don’t see any method…at all…sir” – haltingly because he is too bewildered by the encounter to do anything but tell the truth, but also aware that in this audience with a mad king who fancies himself a god, any word he utters might get him killed – gives me chills every time. The strange thing is, living in this insane world, where people have given themselves over to ridiculous narratives and worship of missionaries, I feel just like Willard in that moment when I tell people what I really think (not literally killed…yet) of the nonsense they apparently buy into.

Point 2. I’m sure many have seen this website, chronicling how myriad indicators of real productivity and growth abruptly stagnated as indicators of the paper wealth and the “hollow” economy took off starting around 1971 : https://wtfhappenedin1971.com/ I’ll repeat my refrain that while these effects are often attributed to leaving the gold standard, and no longer having “sound” money, I think those are actually both the effects of increasingly restricted supply of cheap energy. Tim Garret of University of Utah has produced a series of papers directly linking economic growth and wealth production to the rate of increase in primary energy consumption as a matter of thermodynamics. https://twitter.com/nephologue/status/1537848492323876865 2

The idea is that, increasing the potential to harness untapped energy and resources and integrate them into organized networks of utility is, in a literal physical sense, what wealth production is. Producing wealth means either growing those networks or make them work faster and more interconnectedly, both of which require energy. If your ability to do that is limited or diminishing, you will not see real growth, although you may still see nominal growth.

“If there is a large difference between the nominal and real GDP, it appears in economic accounts as high values of the GDP deflator or as hyperinflation. Interpreted physically, civilization dissipates energy along previously produced networks. Even as current production continues to grow these networks, there is concurrent fraying of those previously constructed that is sufficient to offset any productive gains.”

In other words, when nominal growth exceeds the requisite level of primary energy consumption, this shows up as inflation (and probably other ‘hollow economy’ indicators). The US left the gold standard in ’71, but consider also that it suffered severe energy supply shock lasting about a decade. What happened? Stagflation – high inflation, low real growth, the hollow economy really began then. Look at the pandemic. Primary energy consumption dropped precipitously as a matter of demand, then demand returns only tentatively due to latent pandemic related drag, combined with two absolutely titanic money bazookas – what followed? Massive inflation, Bitcoin → Bitcoin!™, stocks → Stonks!, crypto bubble, housing bubble, everything bubble.

This matters because EROEI of energy sources has been steadily falling for several decades, meaning the ability to increase primary energy consumption has been getting increasingly restricted. It was thought that we would hit peak oil in the 2000s, and while that was averted thanks to revolutionary innovations in tight oil and shale, output increased but EROEI did not improve nearly so much. And so we are still on a path to an ever-increasing proportion of energy having to be reinvested into future energy harvests, reducing the potential for real growth. This is terrible news, by the way, for so-called renewable energy sources by which might be the area where we are seeing perhaps the largest misallocation of capital in economic history. The only thing that could improve this situation is nuclear, or some yet undiscovered energy source (not energy carrier, which is what batteries and hydrogen cells are).

So, we have to recognize that the monetary policymakers have been playing a crooked game for the past few decades, especially the last one, but the reason they are doing that is perhaps because, as a matter of physics, it is the only game in town.

Point 3 This isn’t just a story about the wealthier sect ripping off the rest. There was massive amounts of fraud in the COVID assistance programs for rent and unemployment assistance from regular people. Many of the COVID rent protections and assistance did not actually require a person to declare that COVID had any effect on their life in any way. In New York it was basically a “get out of rent free” card, later ruled unconstitutional by the New York Court of Appeals as a taking. In some states the unemployment benefits could be and were utilized people who were not actually employed in the YEAR prior to the pandemic, and now the unemployment agencies are in a situation where they are trying to claw back money and demand something, anything to prove that you did in fact qualify for unemployment. Unfortunately certain political factions wanted to PREVENT the enaction of measures that might have mitigated this amount fraud waste and abuse.

What’s going on here is that, in an era of limited real growth, Malthusian competition effects are taking over. It’s okay to pretend fraud and abuse don’t exist, at least not among your constituents, because the pie isn’t growing and we’ve gotta do what we gotta do to get our piece. So we adopt whatever Narrative suits us, and to hell with truth or sanity. And this really increases the risk of disastrous nationalization and price control policies.

My Answer There is a third way, between wealth destruction and disastrous economic management policies. We need massive investment in energy supply, first for fossil fuels supply increase, and deployment of nuclear and research into the discovery of new energy sources. This is the only way to repay what’s been stolen from the future without destroying what we have now. Or, maybe, another way of saying it is, this wouldn’t be stealing from the future the way we are now, but borrowing from it and in return creating greater growth potential for the future.

david.c.billingsley

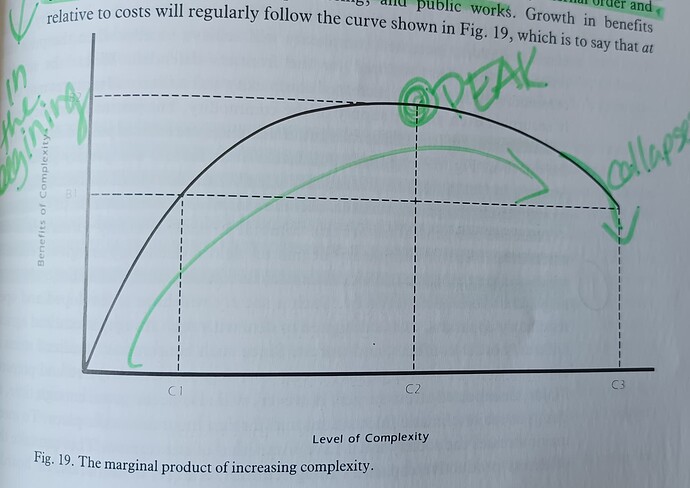

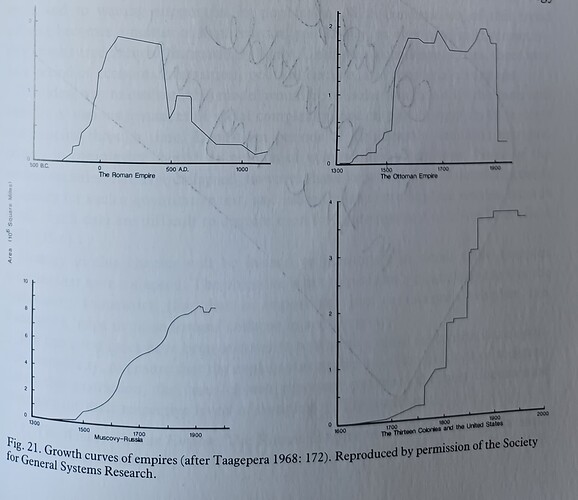

I’d also like to point everyone to a somewhat obscure work, Joseph Tainter’s Collapse of Complex Societies. He argues based on data from Roman Empire, the Mayans, and Chacoan Society of the American Southwest, and modern results, that the collapse of complex societies can be explained by the following:

1) human societies are problem-solving organizations;

2) sociopolitical systems require energy for their maintenance;

3) increased complexity carries with it increased costs per capita; and

4) investment in sociopolitical complexity as a problem-solving response often reaches a point of diminishing marginal returns.

“It is possible to speak of sociocultural evolution by the encompassing term ‘complexity,’ meaning by this the interlinked growth of the several subsystems comprise a society. This growth carries an associated energy cost, which before the development of fossil fuels was largely met by human labor. Growth also yields an array of benefits, including administration of resource storage and distribution, investment in agricultural, energy, and minerals production, internal order and external defense, information processing, and public works. …[A]t some point in the evolution of a society, continued investment complexity as a problem solving strategy yields a declining marginal return.“

(please forgive the previous owner’s markup)

Society begins to break down as

“… [t]ax rates rise with less and less return to the local level. Irrigation systems go untended, bridges and roads are not kept up, and the frontier is not adequately defended. The population, meanwhile, must contribute ever more of a shrinking productive base to support whatever projects the hierarchy is still able to accomplish. Many of the social units that comprise a complex society perceive increased advantage to a strategy of independence, and begin to pursue their own immediate goals rather than the long-term goals of the hierarchy. Behavioral interdependence gives way to behavioral independence, requiring the hierarchy to allocate still more of a shrinking resource base to legitimization and/or control. Thus, when the marginal costs of participating in a complex society becomes too high, productive units across the economic spectrum increase resistance (passive or active) to the demands of the hierarchy, or overtly attempt to break away.”

Most of the resistance from the non-ruling class will be passive. For example, “[i]n both the later Roman and Byzantine Empires, the overtaxed peasantry offered little resistance to the foreign incursions that ultimately toppled these regimes.”

That bold sentence I emphasized as especially disturbing given @bhunt’s comments on how the ruling class might choose to respond to the lack of real growth in the long term. He argues that one of the classic responses is temporary resurgences in state strength as they re-assert control at a new, higher level. These will be your strong leaders and authoritarians, but exercising increased power of course leads to greater complexity and imposition on the productive base of society, and only at best stalls the ultimate decline.

It’s not all doom and gloom though!

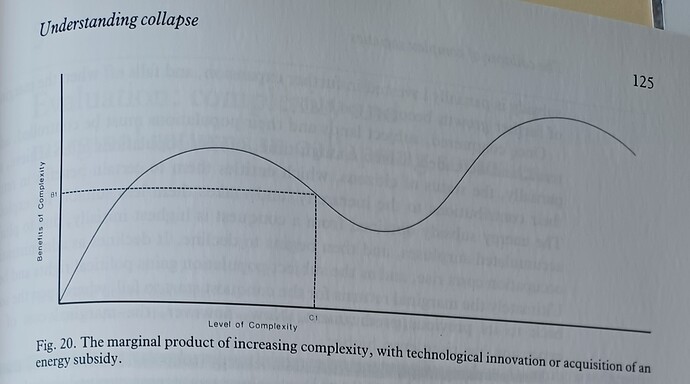

“For human societies, the best key to continued socioeconomic growth, and to avoiding or circumventing (or at least financing) declines in marginal productivity, is to obtain a new energy subsidy when it becomes apparent that marginal productivity is beginning to drop. Among modern societies this has been accomplished by tapping fossil fuel reserves and the atom. Among societies without the technical springboard necessary for such development, the usual temptation is to acquire an energy subsidy through territorial expansion.”

So we need a new energy subsidy! We are tapping out fossil fuels, the atom is not fully tapped out yet, so we can increase reliance on that. No idea what the next new energy discovery will be.

Territorial expansion for the entire world economy is only possible through…interplanetary expansion and there’s some new energy source there? Maybe Elon is right about colonizing Mars and we really are at the beginning of a space travel revolution? That’s not where I thought reading this note would take me but…here we are.

david.c.billingsley

This is a marvelous contribution. Thank you. It reminds me of a small theory I cooked up one day while reading other peoples tedious ideas about why Mayans civilization declined.

The Guatemalan Highlands in particular have nurtured a vibrant Mayans civilization for many centuries. They have even managed to cope through the survival of their verbal traditions.

Here it is – as the priestly class in the cities of the Yucatán Peninsula grew more and more top-heavy, taxes became an ever heavier burden. For centuries the priests had contributed through their brilliant development of astrology to predict when to plant. In a region where the weather does not change that much that was a big advance. Over the centuries peasants gained enough experience that they could figure these things out for themselves. You count the moons, you count the days, you burn some incense, and hope for the best. Supplement that with offerings to whatever deity it is you think it might be helpful. Make a few offerings to the competition. Who knows which deity might actually help.that year? This is how Mayans still behave- pay a Mayan priest to sacrifice a chicken, then go say some prayers and burn candles at the Catholic Church if you don’t get results. And if you still don’t get results, swing by the evangelical church, sing loudly, and make a donation.

So maybe groups of peasants started moving away. If They got caught they could just say they were looking for more fertile fields.

It’s a simple theory – peasants wandered off because they did not want to support the priestly class anymore. It’s not really very different from the theory of Roman subjects on the frontiers offering no resistance to the Goths when they came through. It’s a soft “meh” and shrug by the producers in response to being overtaxed and underserved.

I have no data to validate this idea, nor do I need it. It’s a private musing by someone entirely sick of the overcomplexity of the scholarly class.

Pat W

Actually, you’ll find that data in The Collapse of Complex Societies !

Tainter observed that most of the time the lower classes in a given society will not be organized or interested enough in presenting overt or violent resistance to the system, which in the decline period is in a vicious cycle of being increasingly burdensome but providing less and less benefit for its subjects. And so what we observe is that outside of isolated uprisings and upheavals, most of the resistance is the ‘meh.’

I’d probably argue the biggest soft ‘meh’ that I see today is my generation’s (elder Millennials) reluctance to participate in traditional productive growth, such as home ownership and having children. We’re doing those things, but when we get around to it. Children were just too burdensome economically given the precarity we faced coming into our 20s. I wish I could find this twitter exchange from a couple years ago, but someone asked, “What’s the most effective birth control method?” Someone responded “Daycare costs $500/week.” Home ownership? So you want me to use all of my liquidity to take on hundreds of thousands in debt to buy one single asset, that I will then also have to pay taxes and maintenance on? Yeah…maybe after my hundreds of thousands in graduate school debt is paid off when I’m 40. Getting a fancy education toward a professional job that pays for a house used to be as close to a guarantee of safety if not affluence as you could get. Now thanks to diminishing marginal returns, we millennials were told it was a minimum, something necessary but not sufficient. And it might turn out to be even less useful than that.

But there is much more potential for chaos and violence when the members of the middle or upper classes attempt to harness the dissatisfaction of the lower classes in order to topple the ruling class. Other historical observers have noted, for example, that most revolutionary leaders throughout history are members of the middle and upper middle classes. Ray Dalio in Changing World Order says to watch out for the leader who is well-educated from a middle class background, is charismatic, and able to lead and work well with others to build big, well-run organizations.

Right now it seems like we certainly have a Widening Gyre as people fight over what people (knowingly or knowingly) perceive as a no-longer-growing pie. It seems to me this is resulting in the educated middle classes adopting radical or even nonsensical beliefs having to do with the legitimacy of institutions that are perceived to have failed the common man.

On the left this manifests itself as a foundational belief in the inherent illegitimacy of our institutions due to their history of actual and imagined oppression of “marginalized groups.” The problem of course is that the oppression has generally gotten less actual and more imagined over time and so they are constantly having to invent new classes of victims and ever more arcane theories of oppression. On the right it seems it be showing up as bizarre, sometimes even idiotic conspiracy theories about the straightforwardly corrupt and criminal behavior of the elites at the expense of the masses generally – and, of course, good old-fashioned anti-semitism.

The thing that makes me most afraid today is not even the absurdity of things you can hear the educated classes commonly claiming to believe. I have started to think now that absurdity is in some way becoming the point. People are quite intentionally infecting others with these ridiculous narratives in self-conscious disregard of truth and fact – and that disregard is the signal of one’s allegiance to their faction and strength of their opposition to the enemy factions. The goal of political discourse is no longer discourse, it is recruitment. Jacques Ellul wrote in Propaganda that:

“The aim of modern propaganda is no longer to modify ideas, but to provoke action. It is no longer to change adherence to a doctrine, but to make the individual cling irrationally to a process of action. It is no longer to transform an opinion but to arouse an active and mythical belief.”

That was written in 1973. I don’t need to recount all the social, economic, and technological developments over the past 50 years that have made the potential for these effects orders of magnitude stronger.

But I don’t yet see who the charismatic leader of a big, well-run organization might be from either camp. I do wonder if the fractiousness that our technological means introduce, combined with the fact that everybody in modern society is somewhat well-educated by historical standards, is preventing a real leader who can harness/exploit popular discontent from emerging. Like, there are too many potential leaders competing with each other in a highly fractious and alienated society of LARPers for any one to reach a critical mass of support. I’m not sure I would call that a hope, but it’s … something giving us time.

david.c.billingsley

This is surely a force in media that has siloed itself based on the audience it seeks to reach. I agree it is absolutely happening in politics and ET has spilled lots of ink on the approaches. Thinking about finding the big, well-run organization that has a charismatic leader is challenged by these very realities. If the organization was entrepreneurial and/or financially successful then the leader is almost certainly a centimillionaire. This is disqualifying for one tribe. If the leadership was shown in academia, union organization, or a career in public service then the other side has their sureties of where the allegiances are (not their side). Maybe a military backround could still pull from each side? I would reason that the spark of an idea/movement is a more likely source rather than the strength of a particular personality. I associate the American Revolution founders as men who carried a set of ideas forward and then became famous for taking the risk to execute on the vision.

jpclegg63

I’ve got nothing to add to this tour de force from David Billingsley, other than a newfound desire to study the energy usage of Rome in the 4th and 5th centuries!

That and figure out how we can make a massive push for nuclear energy in this country.

Cash Flows, Capitalism and … Log Scales

Thanks Ben. Great post, finds yet another way to understand and express my horror at what our prideful leaders have wrought over (especially) the last 25 years.

Three thoughts to share:

1) Your working definition of wealth is based on price, i.e. market cap. I have come to appreciate John Hussman’s definition of wealth as being more appropriate. As he puts it, “The wealth is in the denominator [of valuation ratios].” Real wealth is the productive (i.e. value-added) capacity of the assets, not their price. For financial types, it is typically estimated as the discounted sum of future cash flows. When you view wealth this way, you realize that all this evil undertaken to separate price from value is (a) likely fragile, and (b) mostly an exercise to transfer wealth from asset-gatherers (villagers, future bag holders) to asset-holders (sharpies, financiers, politicians, their cronies, sometimes their political constituents, other rentiers, and gamblers). It is not an actual expansion of wealth; GDP comes much closer to measuring that.

2) Much of my anger concerning the sins of our prideful human leaders in recent decades boils down to their wanton corruption of capitalism and the incentives they’ve created to speculate and game rather than truly invest in productive assets that would lift median standards of living. Yes there’s still legitimate alpha to be found based on true productive investment merit, but it’s a relatively rare find and not the quickest or even surest route to success. Why bother building when you can steal instead? The rest of the villagers, especially those too young to have seen anything else, see this outcome as “capitalism is evil” rather than “capitalism has been corrupted,” and we will all likely suffer even more as they exact revenge on the wrong targets.

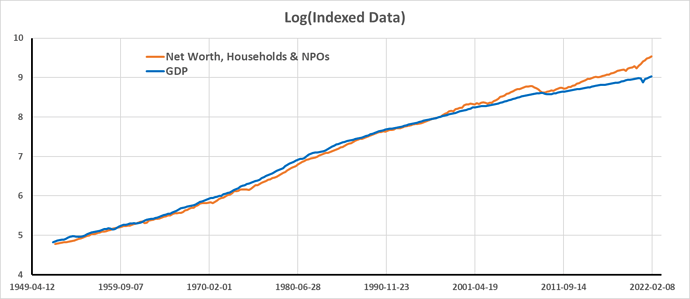

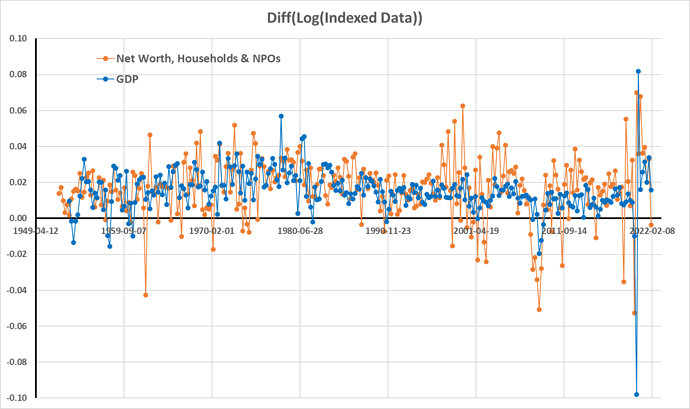

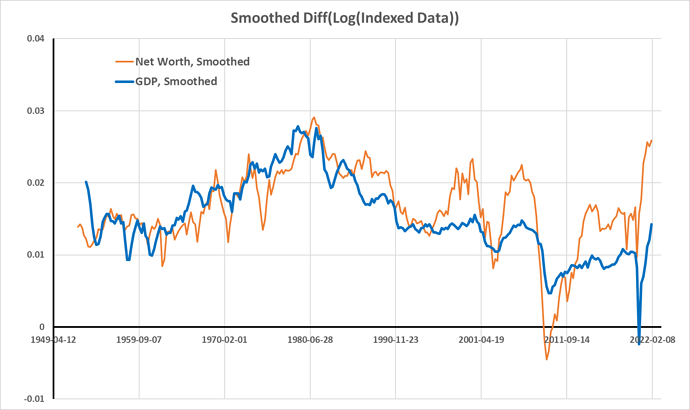

3) Although I saw your request that we not @you regarding log charts, and your claim that they add nothing to the analysis, I respectfully have to disagree. Sorry! Although one can compare slopes of different curves over a given time period without log charts, comparing slopes over different time periods is greatly improved with log charts. Further, doing so in real rather than nominal terms (to the extent one trusts the deflators) allows one to eliminate inflation’s artificial contribution to those slopes and their comparisons across time periods with different inflation rates.

Thanks again and cheers,

kimmel

- I have also come to appreciate John Hussman!

- I will be sympathetic to the concept of crony capitalism to the extent that you will be sympathetic to the concept of crony socialism. Meaning that all forms of social organization look great on paper, and all forms of social organization fall to cronyism when implemented on a mass scale. More and more, I think it’s the mass in mass society that must be undone, starting in epistemic space (the metaverse) and ultimately in meat space.

- As for log charts …

Many excellent points in the original post and in the ensuing discussion, I’ll add two things:

1) The reason log charts are useful is because they simplify discussion about integrated processes – and almost all measures of stock and most measures of flow are time series with I(1) or higher. Applying log-differences lets us talk about a stationary process, which behave in more predictable ways.

2) “Once the dust settles”, that is in the mid-term future once real rates are positive again and price inflation has abated, we’ll hear a lot more about defined-benefit plans. Defined contribution is all the rage in a “lower-for-longer” scenario where LT interest rates decline from double digits down to nil if not negative ; defined benefit might be considered very useful in the opposite scenario.

xmj

@ing Ben when he has specifically asked to not be @ed is like bidding in bridge with a weak hand, can’t go first but maybe can go second! I wanted to see the log charts anyway…and Ben is right they don’t change the analysis, but maybe they do add to it? At the least it removes some skepticism for me and crystallizes the interpretation. Something like by ’85 or so it was clear that the real acceleration in growth experienced 1960-1980ish had been lost. Despite all the efforts since then the slope from ’60-’80, and perhaps not even the 1950-1960 slope, has never been regained until pandemic stimulus.

rechraum

Haha! The truth is that I was a fan of log scales before log scales were cool, and the only thing I object to is that any good thing can be taken too far. It’s like the baseball fan who discovers advanced metrics for the first time and now won’t shut up about OBPS. Everything you need to know about comparing these two growth rates can be eyeballed on a linear scale … it does not take advanced sabermetrics to see that the slope of the wealth line is steeper and steeper than the slope of the GDP line.

That said! Log scales provide a confirmation for what your eyeballs tell you, and give more precision in those slopes beside. I LOVE what rechraum has done here (and I love even more the bridge reference). Thank you!

On Being Born at the Right Time

There is a defensiveness that presents itself in men of a certain age (read: Boomers) whenever you even hint at the notion that perhaps the vast wealth they’ve created was not entirely earned by pure genius and instead relied on a combination of skill, hard work, and being alive at the right time. They do not like to entertain the possibility that timing was as much of a factor as hard work was, because for whatever reason this is seen as a personal insult. Michael Kao (@UrbanKaoboy, a Twitter user I push relentlessly) has dubbed the post GFC era as ‘The Liquidity Lottery’, and I am each day ashamed that I didn’t think of that. It’s the perfect way to encapsulate what happened. Being alive during that time was useful. But being older and established was even better. For a huge chunk of the Baby Boomers the last ~13 years have coincided with the years that they have had the absolute peak amount with which to invest. An annualized return of ~12% does a lot more for the recently retired 62 year old with a huge IRA than it does for the 28 year old who’s setting aside 4% of her $42,000 salary. A rising tide lifts all ships, sure, but some of them had much taller masts when the tide came in.

Desperate_Yuppie

I read your comment, and I totally agreed with it. Then I re-read the first part and as a boomer, I thought why do I agree and why am I not defensive about that statement at all?

Answer: I am reading your comment Post living through the Covid pandemic. I own a small manufacturing business, and I make patented parts for large commercial printers world wide. I know for me, the Covid Pandemic knocked me awake, and knocked my ego down and out too, The Pandemic made me realize, that as smart, hard working and as passionate as I was, when the Government decided to shut down so many industries for our protection, they also shut down the industries that required printed material so overnight my customers (printers) went to idle speed, and many small family owned printers did not survive. My business went to idle speed also. That was when I realized my success was based on a myriad of issues totally out of my control, and purely based on luck of timing and government policies (pro business, currency exchange rates, tariffs / duty, and whether your customers would stay in business or not, or even whether your tenant’s had to pay you rent or not). So post Covid Pandemic Dan definitely agrees. The silver thread in that year of chaos was I woke up and saw reality.

Dan_Rizika

I was radicalized with the fall of the House of Lehman. Others were radicalized with Epstein. Others (like Dan) were radicalized with Covid. Others were radicalized with Uvalde. If you don’t like the word radicalized, you can say the scales fell from your eyes. You can say you woke up and saw reality. It’s all the same thing.

Telling a New Story

Brilliant post… and terrifying. That orange line has a long way to fall before it ever touches the blue one.

This note feels a bit like Jeremiah prophesying the destruction of Jerusalem because Israel refuses to repent from their wicked ways. Like you said, it’s an Old Story.

Because of what faces us, refusing to be Hollow Men will be the greatest challenge we have ever endured.

“I don’t have an Answer with a capital A to Conrad’s question of how to live, and if I said I did you shouldn’t believe me. All I know is a Process. All I know is this: We may work in a hollow market and we may live in a hollow world. Kurtz’s time may be up. But let us refuse to be Hollow Men.“

I sincerely hope we are up to the challenge.

a.song.of.strange.lo

Agreed that open jaw chart should lead to a natural recessionary collapse that would devolve into a massive Great Depression, but of course we don’t live in a natural world. So it will be reacted to with MMT and political survivalism by our leaders on an even more insane level. We’ll get our wheelbarrows of money moment, but it will probably come after a big scary f’ing collapse. Surviving through that roller coaster of depression-Zimbabwe-collapse in a closed system is going to be damn near impossible. The only survivors of these events in history have been the ones to escape the closed system in Weimar/Venezuela/Zimbabwe/Argentina/etc and escape to a country less affected. But we’re not talking a country here. This time the closed system is the entire globe.

The ending is the same as every civilization collapse Old Story. We revert to the natural state of mankind. Tribal/Fuedal/Oligarchism.

chudson

“And then we tell ourselves a new story”

Agreed.I think the only way out is to Grow our way out. No, I don’t mean more Stimulus via Government spending or Tax cuts or QE. They are all played out, wasted really.

I mean organic growth, using a unique strength of America, strength of our culture. That being a culture that’s inherently encouraging to individual endeavors for success and acceptable to individual failures. We love individual rags to riches success stories and accept failures. We’re not Japan.

I think old fashioned free market capitalism is the best way out of a bad hand. One way to accomplish that while utilizing our cultural resources is to have government policies fund and help any and all start-up businesses. Take the money we currently give to our Oligopolies and Monopolies that have such influence over our government and fund start-ups.

In the aggregate, it is start-ups that create the most efficiencies, produce the most non-inflationary growth, use the least debt to achieve. In the aggregate as there are many , many failures. As an extra benefit, it gives hope and energy to the younger generations as nothing is more exhilarating than starting one’s own business. As an additional benefit, start-up businesses can start chipping away at the economic power of the Oligopolies and Monopolies with the ancillary benefit of reducing their political power.

Let’s tell ourselves this “new” story , that free market capitalism works. And that the best form is creative destruction via new companies.

psherman

I think that you left off a third possibility in the potential responses to the widening gap between the increase of wealth and the increase in GDP. That would be the “do nothing” option or just let inflation continue at an ever increasing rate. I guess that one could argue that this option would eventually lead to wealth destruction also but it would be in a longer term.

I have also been thinking about your Conrad Lord Jim quote. Maybe in today’s context you could substitute the word “survive” for the word “live”. Because if your very survival is at stake one isn’t making lifestyle choices.

This “Hollow World” has really changed me. I have stopped getting angry (otherwise I would be angry almost all of the time). Now I just get disappointed. I don’t know what happens next after I stop getting disappointed. I have stopped putting a large effort into maintaining my economic standing. I am putting more effort into safeguarding my survival. It just seems that at some point soon, the narrative and the reality are going to separate so wildly that it will be impossible to ignore. It might happen in Europe this winter.

PreCambrian

Yes, we all know how this Old Story ends. It’s not good for us villagers. As for what new Old Story we tell ourselves … stay tuned for the next note. Here’s a hint.

And yes, it’s by writing myself into a new script that I stop being a villager and an NPC. It’s how I stop being angry all the time. It’s how I find a positive energy within this debacle of a world. It’s how I find hope.

Yep, These Are My Readers

Here’s a summary of this essay as a pop song, “Robber” by Weather Station:

The Weather Station – Robber (Official Video)

The song (actually the whole album) was written about global warming, but your opinion on that makes no difference. The story is the same.

You never believed in the robber

jrs

You thought a robber must hate you

To wanna take from you

The robber don’t hate you

You never believed in the robber

But the robber never believed in you

You’re two halves of the same piece

Divided into two

No, the robber don’t hate you

I’d rather spend my time discussing artisanal mezcals, my current favorite is Del Amigo.

As I read I found myself saying, these are the waters that we swim. I expect stealing forward to infinity. It’s political suicide to allow the lines to converge. The largest voting block needs their portfolios to live. NGMI

trey

Del Amigo is a good value buy! And yes, I don’t think it’s politically possible to let the lines of wealth growth and GDP growth converge.

Bill Simmons, who I used to pattern myself after when he was still the Sports Guy and before he literally went Hollywood, used to conclude his mailbag notes with “yep, these are my readers”. He wrote it for a laugh. I write it with pride. Like I said at the outset, watch from a distance if you like, but when you’re ready … join us!

Reading through these is a lot of fun, and somehow more enlightening. I’ve already read through all of these comments on the message boards, but your editing style and re-publishing them in chunks or themes makes them really shine. I got a lot more out of reading them in this Mailbag! format than I did originally on the boards.