Back in the earliest Epsilon Theory days, I used to write a regular Mailbag note that was modeled after what Bill Simmons used to do for his ESPN Sports Guy column and then later at Grantland. I tried to make it funny and entertaining, with a smattering of new writing and observations, and I’d always end it the same way Bill did, with an absolutely nutso reader email and the tagline: Yup, these are my readers.

I think it was a popular feature for Bill, and it was for me, too. But we both outgrew it.

For me, it was the realization over the years that what I wanted to write about – how to make our way as citizens and investors in a fallen world – just wasn’t that funny. I mean, the subject matter is not dull and what I write doesn’t need to be deadly serious, but it’s not a freakin’ game. It’s not sports. It’s not entertainment.

To be clear, I’ve got no beef with those who want to approach politics and markets as entertainers. I think that the people staking out this turf are extremely gifted at what they do, and I personally find them quite enjoyable to watch/read/hear. Professional clowns have always enjoyed a bright, lucrative career in America, and I, for one, am fully supportive of their life choices. But it’s not my choice.

Coming into 2021, Rusty and I decided that our primary initiative for Epsilon Theory would be to find new ways to support our “pack” – truth-seekers united by a commitment to examining the thorny problems of citizenship and investment with Clear Eyes and to engaging each other with Full Hearts.

Over the past eight years, we’ve supported our pack by publishing more than 1,000 notes and articles, almost all of them evergreen and many of them novella length. At one point I counted up the words and it came out to writing War and Peace … twice. Going down a hundred rabbit holes can be a lot of fun, but at this point it’s just too much content to handle. Sometimes even I forget about an article I’ve written!

So we’re taking the core Epsilon Theory articles out from behind the paywall, organizing them, and making them available for everyone, paid subscriber or not, to access in the form they prefer to access them. That means PDFs for people who like to read from a printed page. That means audio recordings for people who like to listen, available directly on the website, or as Epsilon Theory on Tape through iTunes and Spotify. Here’s our first release of the ET canon, the 2018 four-part series Things Fall Apart.

Things Fall Apart

What does it mean to have a polarized electorate and a monolithic market, and how do we make our way through that world as citizens and investors?

Clear eyes, full hearts, can’t lose.

So yeah, we’ve published a lot over the years. I’ve written a lot over the years. Why? Because I’ve got something to say. I don’t write what I think is going to be popular. I don’t write for an audience. I try to write entertainingly, but I don’t write to be an entertainer. There’s a big difference! I write because I am compelled to write. I write because I am a writer. I write because I’ve got something to say, and by god, I’m going to say it.

And writing with that compulsion, speaking what I have to say with authenticity, without trying to please an audience, has been a personal blessing beyond measure. Why? Because it has connected me with my pack, with literally thousands of people from literally all over the world who share my faith in both the small-l liberal virtues of a personal autonomy of mind and action and the small-c conservative virtues of honor and duty. In every aspect of my identity, both personal and public, I am a better person and a happier person for finding my pack.

But here’s the thing.

We’ve ALL got something to say, and we ALL deserve to find our pack.

It’s not just for some of us. It’s for all of us.

That’s why we created the Epsilon Theory Forum – a safe space for truth-seeking human beings to speak their minds and engage directly with each other, a safe space to find like-minded human beings and work as a pack to make a better world.

Here, I’ll show you. Here are some of the recent posts on the Forum from ONE of our more than 100 threads, presented without edits. Here is some of the best and most thoughtful content on the internet today.

Here is the Mailbag that we need.

Here is the Mailbag that we deserve.

Inflation Observations

Here’s a link to the NYT article that clicked a couple of observations in my head:

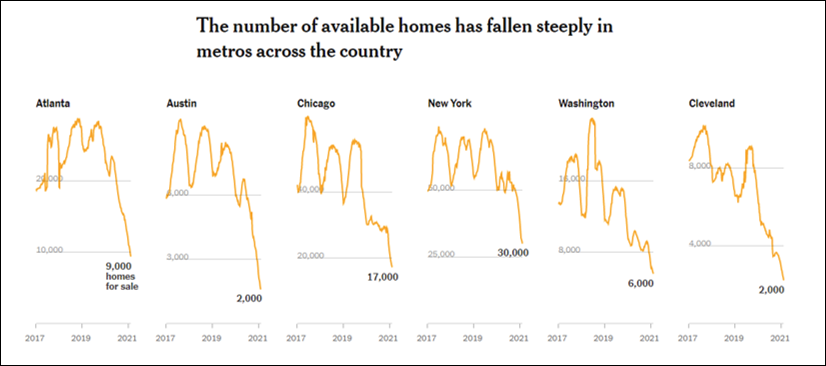

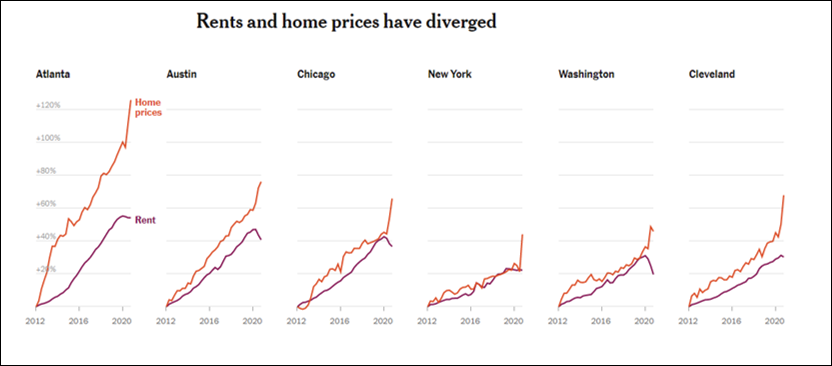

Where Have All the Houses Gone?

And the two money graphics from that article.

The ET note on all this is “The Opposite of 2008“.

COO of a multi-family housing company. We focus on value-add rehab of B/C communities and merchant build development.

Construction costs are significantly higher. The biggest and most obvious is the massive runup in lumber costs. 3x since last year. https://www.bloomberg.com/news/articles/2021-03-11/lumber-prices-to-extend-surge-as-north-america-shortfall-deepens

Another big one is appliances, we’re not seeing big price hikes yet – most suppliers are keeping those constant still. But we are seeing HUGE delays in availability. Getting ranges/refrigerators/washer dryers is like finding hen’s teeth. 2-3 month delays have been standard for many months.

We haven’t seen any dramatic change in labor cost/availability yet.

I don’t see any world in which housing costs aren’t going up significantly in near future.

Can’t remember if I posted this somewhere else, but in southern Delaware we just hit an all time low on inventory on available homes…. 6 days worth. Interestingly rents have been flat for 10 years at around $1.50/sf. Seeing tremendous demand for rental units, but the rental rate seems to be lagging big time.

We’ve been in a massive labor shortage for several years now. Last year it went supernova as J1 visas were always a large component of our seasonal workforce at the beach. Since Covid they’ve been nonexistent and that threw fuel on the labor shortage fire. We are seeing kiosks/robots everywhere that’s possible and $15/hr everywhere else.

Apparently the Berkshires is the second fastest growing (price appreciation) housing market in the country after Stamford? I find this fundamentally impossible to believe, but that’s what’s reported:

I can tell you it was the MOST crowded winter in terms of traffic, people at stores (we’re still doing curbside) and so on. Plumbers booking weeks out, etc.

Just anecdotal of course, but it rings true that more folks are here, and I know a dozen NYC expats who’ve settled into the neighborhood for good.

I follow the prices of deeply discounted rehabs in C-D neighborhoods for potential flip in Pittburgh PA. In 2018-2019 you could get those for a song ($2k-$15k) in D neighborhoods and ($15-$35k) in C or even B- areas. Now those decrepit homes sell for $50k+ within 48 hours.

Sales price of fixed properties have jumped from $50-90k in D areas and $75-$130k in C or B- areas to $90-$180k across the board. Last year, there were perfectly habitable small SFH homes in C areas for $55k (cash) and $65k (mortgaged).

Here is what is happening in my local market (may or may not translate nationally).

– Decreased supply of homes because the courts/property auctions have screeched to a halt, freeze on evictions and mortgage moratoriums.

– No one wants to sell their house and move in a pandemic

– Every white collar family wants a bigger house in the suburb/exurb

– The pandemic affects mostly renters and renters are not in the buying pool. So, there are landlords looking to dump unproductive rentals for a fair price. Only catch is you will have to deal with unpaying tenants and an indefinite ban on evictions. BTW in addition to PA state eviction ban local courts and sheriffs will also be very resistant to a deluge of evictions even without a formal ban.

– If you talk to realtors, a lot of the buying here and in other midwestern markets is attributed to “the coastal (NY and CA) investors” refinancing their over-priced homes and causing inflation in “our local market”. Easy to see the link to Fed policies here.

I’ve been practicing real estate law and consumer bankruptcy law for 15 years, primarily in NY. I have never, in all of my years, had this many real estate clients purchasing and I have never had less clients filing for Chapter 7 Bankruptcy.

A few things to note: There is NO inventory in NYC for the types of places people want (mostly Brooklyn townhouses, which are on fire) and there is plenty of inventory in new development condos and absolutely no one is buying (Developers are at the mercy of lenders in terms of dropping prices so the units just sit). You are likely to see a massive number of buildings go into foreclosure and/or sold while you have a mass of people looking for homes. It’s essentially cognitive dissonance.

I currently have 1 client filing for Bankruptcy. 1. This is in the midst of obscene unemployment in NY.

I know of major banks that are putting the brakes on HELOC applications and almost artificially increasing their rates because they don’t have the bodies to deal with the number of applications coming in.

No idea what any of this means but it’s the raw info I have.

I’m in NYC and run in blue collar circles. The general consensus is that because of Covid the “State” will not remove/evict people who are not paying or that are struggling. Homeowners are generally more responsible but many landlords (especially outer borough ones are panicking). I’ve literally had people tell me “what are they going to do” and many are opportunistic ? I believe there is a reckoning coming when we return to “normal” in the next 6-12 months. I can foresee tremendous pressure on politicians to provide $ to a large swaths of people even as the economy picks up many of them need it but there is a significant portion that have become accustomed to working off the books and getting stimulus/unemployment.

I was in Manhattan yesterday and I’d say certain neighborhoods (Chelsea/LES) about 30% of businesses are closed and some blocks are closer to 40% of shops are closed. Many of the white collars workers will not come back 5 days a week because the commute was too brutal for many and will now will opt to come in 2-3 days a week (Tue-Thur) and that is not factoring in how smaller companies will try to reduce their office footprints which will further affect local business.

Crime – I have lived in NYC my whole life and the only reason we are not seeing 1990s level crime is video surveillance. Between building/business/and State video surveillance it is very difficult to commit crime without getting captured on video and caught. This is the only reason why the defund the police mantra is not fully dead in NYC because the surveillance is suppressing the crime drastically.

Anyways that’s my blue collar view of NYC metro currently.

The color i’ve received on 2020’s historically low Chap 7’s, it’s a function of PPP (this affects Chpt 13 filers too). Essentially, the Florida bankruptcy court (federal court so applies nationally) ruled that SBA was unable to lend PPP funded capital to firms that are/have filed. Therefore, the advise that small businesses are getting is to delay filing as long as possible (take on more debt in s/t) until extinguishing debt burden b/c once you do, you cut off a key source or capital.

Meanwhile, out West, In the northern Rockies we seeing a “Zoom town” effect. One in every three buyers is from out of state. Some are retirees, some are investing in second homes, some are remote workers. 2020 saw an 11% year-over-year increase in home prices with a 12% increase in sales volume. Oddly, we’ve seen a jobs recession but not an income recession – meaning the working poor are losers while mobile tech workers are gainers .

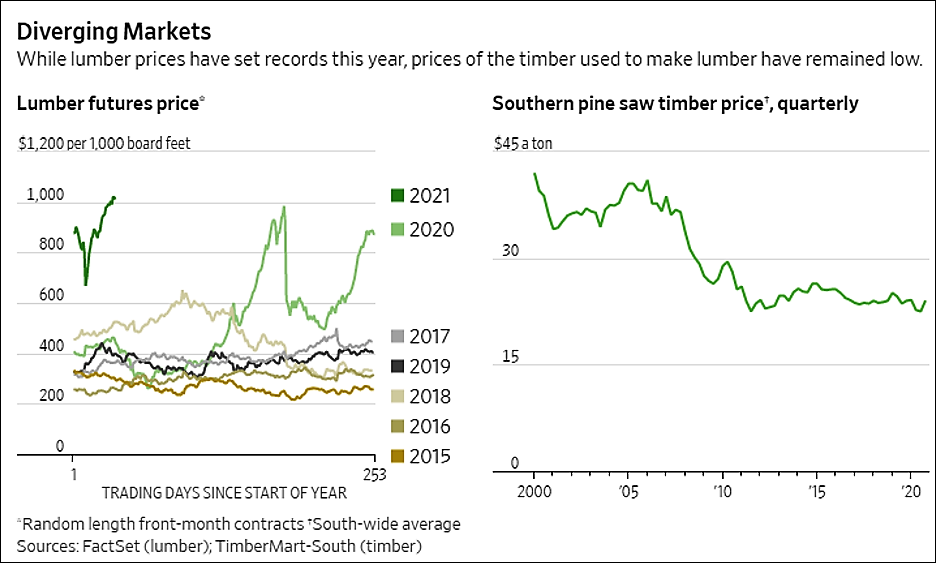

Interesting WSJ article on lumber here. It’s the sawmills?

Lumber Prices Are Soaring. Why Are Tree Growers Miserable?

“Timber growers across the U.S. South, where much of the nation’s logs are harvested, have gained nothing from the run-up in prices for finished lumber. It is the region’s sawmills, including many that have been bought up by Canadian firms, that are harvesting the profits.”

“Sawmills are running as close to capacity as pandemic precautions will allow and are unable to keep up with lumber demand. The problem for timber growers is that so many trees have been planted between the Carolinas and Texas that mills are paying the lowest prices in decades for logs.”

“The surplus of standing pine is such that growers, foresters and mill executives expect that even with mills sawing at capacity and new facilities coming online, it could be another decade, maybe two, before enough trees are felled to balance supply with demand.”

I understand all the posts I have read so far on this discussion are based in the US, Ben/ Rusty, I would like to add some international colour, this is not just a US issue developing. If I am in the wrong thread let me know and I will repost in somewhere more relevant.

Grant Williams had a presentation about the Australian Housing market May 2019, “Down Under Pressure” you can find it on his website. House prices in Australia continue to climb.

Meanwhile across the Tasman, New Zealand is facing a similar story.

This forum/ website being focused on Narrative, I see that title as interesting because if house prices fall are we then a poor nation?

For those on the ground it is getting harder and harder to enter the property market. How does an apprentice Blue Collar tradesman enter the property market if his wage is $22 per Hour, by the time he saves his 20% deposit the house prices will have moved beyond his reach.

I do not have solutions to offer. CPI has been broken as a tool for measuring real inflation for some time, when do the policy makers see this and respond with policies that help?

From The Economist, talking about South Korea:

https://www.economist.com/asia/2021/02/25/south-koreas-government-has-failed-to-make-housing-cheaper (paywall)“Apartment prices in Seoul as a whole rose by 58% in the three years to December 2020”

“The price of the average flat in the city is about 16 times the median household income, compared with around 12 in London.”To combat this, the government has restricted mortgage lending, and created new taxes to reduce flipping, which only seems to have made the market more expensive. They also have a supply mismatch, where many homes that are for sale aren’t what people are looking for (too small, wrong area). That last bit reminds me of what @gabbana92 was saying about Brooklyn townhouses versus condos.

The current approach by the government is apparently to mandate “more than 600,000 flats are built in the capital area by 2025 […] if necessary by building them itself”

And then in China, you need to literally win a lottery in some cities for the right to purchase a ludicrously priced apartment.

I’m curious if anyone knows of a large metro-area (let’s say, a city with at least 1 airport or regional train hub) that ISN’T facing skyrocketing housing prices.

Had to point out that the “success” of an affordable housing project in Seattle that delivered 55 units for $23.5 million shows how housing affordability for the bottom third of the US population is not even being addressed. Costs per unit need to be low enough to charge rents those at 60% of Area Median Income (AMI) can afford. Anyone in the minimum wage orbit can’t get to 50% of AMI. Units costing $427,000 on average are 4-5X the price point urban areas need to hit to spit out an apartment rent of $650-800 per month. And, everyone in the for-profit food chain doesn’t want the added competition, nor do the taxpayers want the properties exempted from the tax rolls which is the clearest path to keeping the units affordable (at least in no income tax but high property tax Texas). Property tax is typically one-third the annual cost of managing a common apartment complex here. The majority of the affordable housing deals I read about in Texas set aside a small number of units for those at 80% of AMI just to get subsidies without addressing the 300,000 residents of the Houston area that lack sufficient quality housing to occupy.

From what I see this housing price boom is all about the preferences of the highly educated, top 20%, taking advantage of work from home and record low mortgage rates. Input cost inflation is making it difficult for the supply response to the added demand to occur without inflated building or remodel costs amplifying the higher prices. Austin is even crazier than Houston. Big tech moving from CA has resulted in a new process. Houses list during the week. Bids are due by the weekend (any bid less than a 10% premium won’t fly), the highest bidders get one more chance to improve their bids before the “winner” who typically pays 15-20% over an already inflated y/y price change, gets the house. No contingencies for inspections either! Friends of my kids stuck in this brutal situation say most homes get at least 20 offers. This has pushed the market in Austin for older, needing updates, but well located, 1000-1500 sf housing on the order of $600-700 per sf. Houston is still much more affordable due to the crushing loss of energy jobs in the past 6 years.

Living in rural Eastern Shore on the Chesapeake Bay. The real estate market in the cute coastal towns is just on fire and has been since the pandemic hit last March. People are not wanting to buy lots and build as that takes too long, they are looking to buy existing homes. At first we had families escaping the DC Metro area who were going to zoom to work, but our lack of good schools (or even mediocre schools) ended that trend rather quickly. Our lack of broadband also dampens the work from anywhere spirit. Now the buyers are all second home and retirement home purchasers. Inventory is extremely low. It is amazing to me how much folks are paying for homes that need a lot of renovations. Homes are going for $200k more than they were 3-4 years ago. I have not seen anything like this bubble since 2005-2006. The big difference is the absolutely non existent inventory. Boomers that bought here in 2005-2006 should be selling into this melt up but they are not. Homes are being sold sight unseen over zoom. This will not end well.

The trend that follows on from this is that more traditional “locals” are getting priced out of local markets. School teachers that come here right out of college had a hard time finding affordable places last summer. All of the good rentals were going airbnb for tourists. The locals are getting pushed out of the cute towns further into the county. Additionally, some of the transplants are protesting against certain local industries and are trying to get former industrial and commercial land flipped to residential. A hardware store is now a tourist shop selling tshirts and taffy. The tourist retail trade does not pay well in the off season. It is making our economy more fragile, but the new residents feel good about buying sea glass from local stores. All of their professional services, from doctors, dentist, accountants, banking, vets, etc they buy in their primary community. It has a ripple impact through the whole economy.

Final thought – a climate wrinkle. I have met a few second home buyers who bought on the Delmarva rather than the outer Banks because we have much less hurricane activity here. A perfect confluence of events rippling through the community where my ancestors quietly farmed for generations.

I work in recreational vehicle sales, and while the names of manufacturers and individual representatives of these companies are redacted and I can’t attach the confidential dealer price sheets, here are two of the emails I got last week:

“I wanted to get this information to you ASAP. On Friday you will be receiving notification from [redacted] management of a price increase of approximately 2%. Anything invoiced starting on March 1, 2021 will receive this price increase. Units that have a retail name attached to them in our system that are invoiced during the month of March will be price protected, but only those invoiced during the month of March. Any retail sold units that are produced and invoiced after the month of March will be at the higher price.

If you have any questions please feel free to give [redacted] or I a call.

Stay safe and healthy.”

“I’m sorry for the all the updates, but it seems like with all the variables in production right now things aren’t just changing weekly, or even daily, but hourly.

At this point going forward, even though there are still 2021 models being scheduled and built you need to start pricing as if it’s going to be a 2022 model just in case it does roll into a 2022 – adding a 3% increase to the current attached price sheets.

Below in the original email I specified some models that are definitely concluded for model year 2021. However, even if the model is not on the list – going forward from today please add the 3% to all models.”

Lead times that used to run 6-8 weeks are running easily double that, and we are seeing multiple price increases that are applied at the invoice/manufacture date, not the order date, during that time, so pricing to retail consumers has to reflect the possibility of unannounced price increases coming down the line. Rising prices of lumber, steel, and aluminum are cited as the causes, but it’s also worth noting that shipments are at all time highs and there are nationwide inventory shortages. Consumers seem to be getting acclimated to less inventory, longer lead times, and rising prices, reporting similar problems buying vehicles and other consumer goods.

I work in residential brokerage and development in Southern California. Below are a few notes on what I have seen this cycle:

Over the past 9 years, since the housing market bottomed, the two times inventories moved out of the typical 4-6 month supply range were in the back half of 2018 into 2019 and very briefly in Spring 2020 – both following material stock market pullbacks – and also now, while the stock market is bubbly and retail participation is high. https://fred.stlouisfed.org/graph/fredgraph.png?g=BwIS

There has been a significant pick up in existing home sales over the past 6-9 months. Both late 2018 and Spring 2020 saw low sales. https://tradingeconomics.com/united-states/existing-home-sales

I think the wealth effect mostly drives these buying patterns. As buyers see their retirement / brokerage accounts up, they feel like they can afford more and when they are down they are concerned that the housing market may dip. Also, retirement account balances are used as assets in qualifying mortgage applicants, with higher balances resulting in higher loan limits. This year, I have seen more than one proof of funds submitted with high offers (relative to list price) that included 2021 gains in retirement accounts of 5%. While I appreciate the “Transitory” narrative is being pushed out, I do think a stock market correction could quickly shift these dynamics.

As millennials form households and boomers retire in place, there are multiple converging demographic trends increasing housing demand and reducing supply of listings over the next decade, some summarized here: twitter.com/1MainCapital/status/1366167299137429505

New listing supply is being constrained in the short run by those not willing to list their home during COVID, as listing requires allowing strangers into your living room. There have also been a few areas of financialization in the housing markets this cycle that limit housing supply:

1) Home flipping is becoming institutionalized, through both iBuyers and large distressed home purchasing companies. 5%+ of existing sales in most metro markets are “flips” changed hands more than once in a year. 2) In higher priced and urban markets airbnb short-term rentals were first a small investor niche, but we are now seeing consolidation through VC backed tech companies. 3) Private equity purchased many homes early in the cycle, with yields highest in lower priced markets. https://www.bloomberg.com/news/articles/2019-10-04/the-decline-in-owner-occupied-single-family-homes.

I’d like to switch the conversation to transportation for a moment. I drive for both Lyft and Uber in Tallahassee. Or maybe I should just say Uber because the demand for rides is so insane just for Uber rides that I don’t even bother to turn on the Lyft app. No matter what time of day I’m out there I get the same question from riders, “where have all the driver’s gone?” This huge mismatch between demand for rides and supply of drivers has been going on for several months now. Riders tell me that when they look for a ride they often see a message ‘NO DRIVERS AVAILABLE’ . The usual wait to get a ride is anywhere from 25 to 40 minutes assuming they can find a driver. Uber is offering big incentives every week to get drivers out on the road but it doesn’t seem to make much difference in number of driver’s but is doing lot to increase my earnings . Of course inflation is ratcheting my expenses higher. Just since the first of the year I’m paying 20% more for gas, 50% more for car washes and 10% more for insurance.

I’m sure there are people that use ride hailing on this forum so I’m curious if they see this huge disparity between number of drivers and riders in other cities or if this situation is just peculiar to Tallahassee.

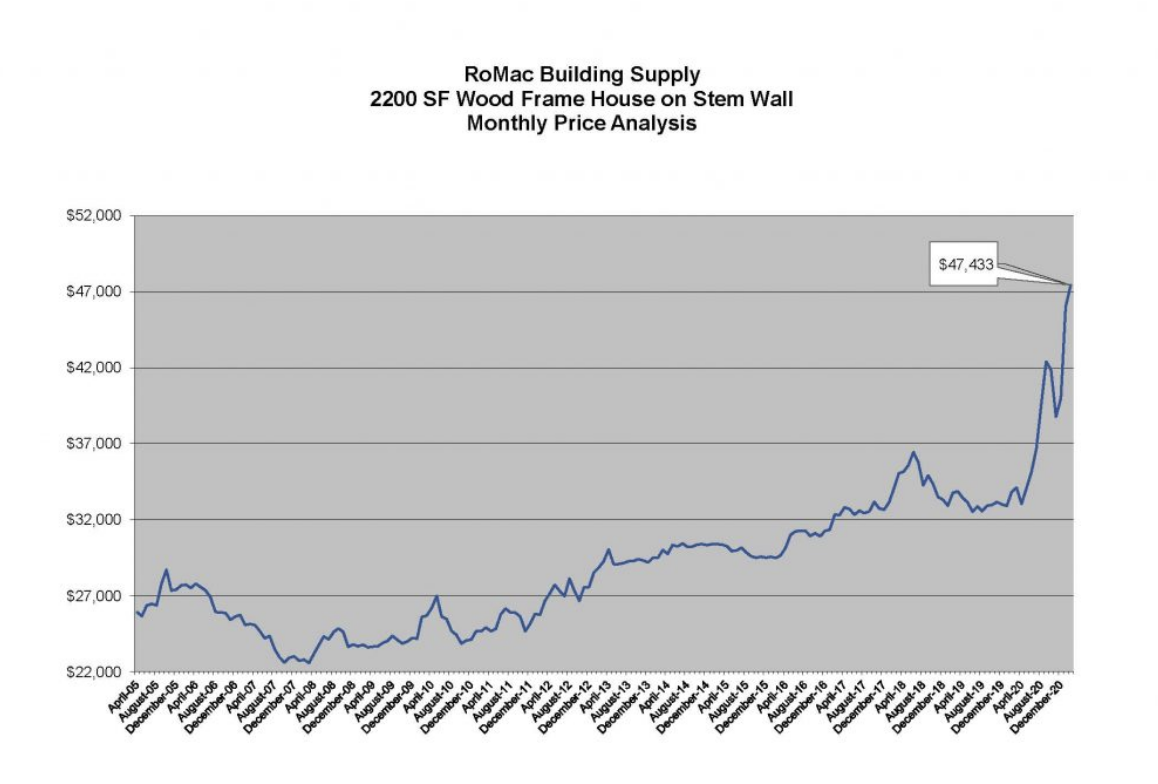

I own a small building supply business in Central Florida. We’ve been tracking the wholesale material cost to build a 2,200 square foot house since 2005. The index is up 40% over the last 12 months. When we update in March that will go to 45-50%, which will put the 15 year annualized change at around 4%.

Labor and land development costs have also been significant drivers of price, especially for houses on the low end. In most of Florida, you’re looking at a minimum of around $50k before you break ground ($20k permits and $30k infrastructure/land). Based on current land sale pricing and labor rates, that number will likely be $60-$65k for lots starting development today.

On the material side, we are seeing shortages and extended lead times on all products. Two of the major window manufactures are 20+ weeks out, and we are seeing that number grow each week. We have contracts for most of our lumber, but even with those we are having to call vendors daily in order to make sure our orders are fulfilled. There’s a huge shortage of roofing shingles, we recently had a truck shipped that was ordered in July. We’re currently running some base and shoe mold ourselves as all of our vendors are currently out of stock.

If you want to see the history of the index, our monthly reports can be found here – https://www.romacfl.com/whole-house-index/

Did I say one thread? Sorry, but I can’t help myself. Here are a few posts from one of our many crypto threads.

Crypto and Grandma

I have questions about cryptocurrencies and its place in an investor’s portfolio, and frankly only seem to find people talking their book about it. I think I have a handle on the blockchain technology, but would appreciate peoples’ thoughts on the following:

1) Are Cryptocurrencies an appropriate store of value (inflation hedge) for the moderate investor?

2) How does one tell the difference between the coins, or why would I choose one over another?

3) (The Big One) If Monetary authorities can decide to issue their own cryptocurrencies at some point will the new sanctioned cryptos destroy the value of the unsanctioned?

Thanks in advance for your help!

I got started with blockchain tech in 2015, Bitcoin in mid 2016, and other forms of cryptocurrencies a few months after that. Mostly as a developer playing around with the tools/making tiny POCs, and investing a little bit. This space is complicated, and it sounds like you already know a good bit, even so I’ll try to share my two satoshis : )

TLDR: maybe.

(All that follows is opinionated and not personalized financial advice … you all know the disclaimer)

1) They can be. Why is anything a hedge against inflation? Either it moves against an asset/currency by design, or enough people treat it as a hedge against inflation that it acts like it does. Crypto tends to fall into the later category. Nothing in the code of Bitcoin (and when people talk crypto they mostly mean BTC) requires it to move tightly against the dollar, except maybe over the long term that there’s a fixed supply of BTC and an expanding supply of USD/most fiat.

I think the bigger hype-factor around bitcoin has been that it’s still ‘new’. If you started in 2012, 2015, even 2017, the idea was that the value would explode as it became ‘mainstream’. At this point it almost is mainstream, I think, so that’s less true now. But I could be wrong about that last point, many have called the top on adoption before and been wrong.

At the heart of BTC there is an ongoing debate about what it’s for. It is a store of value (digital gold), is it a medium of exchange (a proper currency)? The debate about that has influenced the direction of technological change/updates to the underlying protocol. In general that’s caused a big drag on the ability to make changes to the platform, which is in part why there are so many cryptocurrencies (Bitcoin Gold, Bitcoin Cash, Bitcoin Silver, Bitcoin Dark, Litecoin, and many more are just copies of Bitcoin with some small thing changed because of a disagreement among developers or miners or whatever, and that’s before all the non-BTC-based coins)

2) There are a LOT of cryptocurrencies, well over 1,000 with multi-million dollar market caps, but only a few dozen that have crossed the multi-billion level. Most of these projects are open source, and start with a series of whitepapers detailing their technical/planned technical specifications. The best way to tell the differences is to read through those whitepapers. ‘Is this a good investment’ is largely a question of ‘how unique is this technology?’ ‘how big of a problem does it actually solve?’ and ‘can this team actually execute?’, in other words, the kinds of questions you’d ask a technology startup – which is what most of these projects are.

Outside of that, these are largely decentralized communities, so there are various levels of explainer videos/group chats (often on Telegram)/forums with people explaining stuff. Of course there are also lots of people ‘talking their book’ as you put it quite nicely, so buyer beware.

Many projects have an official Telegram/Signal group (which may or may not actually be moderated). Also worth looking up any blogs maintained by the core development team.

Sidenote… Honestly, I don’t even think it’s productive to think of ‘cryptocurrency’ as a single investment, or even as a single asset class. Some projects try to be mediums of exchange, some stores of value. Some are ‘tokens’ and aren’t meant to be currency at all but rather represent some other real world asset. Some ‘tokens’ are just used as identifiers in a project trying to overhaul how digital identity or online voting is managed. And then we could get into whether we are talking about a fungible or non-fungible token… it just goes on.

The way I think of it: There’s this cool technology of blockchain, which has been fragmented into various degrees of public/private, Proof of Work/Proof of Stake, and other technical distinctions, and then there are thousands of projects trying to build new technologies/businesses/scams on top of those various tools collectively referred to as ‘blockchain’. It’s overwhelming, and fascinating.

3) Probably for some, ya, certainly it weakens the case for those using cryptocurrency for ease of use. For Bitcoin part of the appeal has always been that it’s outside the control of a government, so I don’t think the case for it as a hedge or appeal for preppers will entirely go away. I imagine China or even the US Fed announcing a digital currency would cause a brief shock to cryptocurrency, but many of them would survive.

… Personally, I’m wary of a lot of the cryptocurrency space. I own a bit of Bitcoin. I own a much smaller amount of Ethereum and a few other coins and tokens. Nothing I’d loose sleep over loosing. And I try to keep an eye on the developments some projects have on crypto’s use or Blockchain more generally. It’s a wild time to be alive 😀

Anyway, I hope some of that is helpful/actually answers your questions!

Hi —, here’s the document I prepared as a private guide to my fellow cryptocurrency explorers looking to make their first step into the world of DeFi from the standpoint of a token speculator. It’s done primarily via tutorial on how to use Uniswap, the most popular Ethereum-based (roughly) decentralized exchange.

It’s very colloquial but I’m sure that’s OK with readers also comfortable with the BITFD narrative. It assumes a high level of familiarity with using, owning, and trading cryptocurrencies.

It was written early September 2020 and the number and quality of tools mentioned have both increased.

Here’s the link: https://www.epsilontheory.com/download/47486/

So my question on Bitcoin or other crypto’s, how is supply determined? And how can you access the ledger and aggregate info? I mean, trust is great, until it’s broken, and then the whole product fails, correct? I’m just an individual retail trader, don’t have any clients, been trading markets for better part of 25 years, but lately everyone asked about bitcoin. I repeat this answer all the time, I think it’s going to $0, but it might go to $100,000 1st. I have traded bitcoin, but it seems to me because it’s so tied to retail, at the 1st sign of trouble in markets, it’s going to tank. Why? What’s the old saying, you don’t sell what you want, you sell what you can? I may be wrong on this, but I have this picture of every Robin Hood trader owning bitcoin. I understand the inflation narrative, but I still can’t get past what would stop a cascade of selling with a major market correction. And if you look at a chart of the last year, to my eyes, Bitcoin and Tesla have a pretty high correlation.

Hey —, nice questions. Hope you don’t mind if I indulge in typing out my not-so-brief thoughts… (for some reason, whenever someone starts asking about cryptocurrency, I get this itch to start explaining as much as I can 😀 )

If by supply you mean circulating supply of bitcoin, that’s programmatic. New bitcoin are created and awarded to the miner who validates each new block (which happens ~ every 10 minutes). The amount that is awarded was originally 50, and is halved every 4 years (currently 6.25). That’s where the 21 million cap reached around 2140 comes from. This playlist includes a really great breakdown of that process: https://www.youtube.com/watch?v=9k9af3N3LuM&list=PLlxD870D8ZImgoCOxXfnXDdTg-kA93q2T&index=15

For accessing the ledger, all transactions are broadcasted under a specific protocol, and anyone listening for the messages can read them (there are guides on how to setup such Bitcoin ‘nodes’, or you can use a block explorer, like https://www.blockchain.com/explorer)

As an example of the above, this is a recent transaction of Bitcoin: https://www.blockchain.com/btc/tx/32ccb0ccb36f56eba151538a014646820fcd6dbcfd5695f0222b82bc0339e80a

As for what sets the price of bitcoin … what gives anything value? I’m not trying to be clever or dismissive. Precisely because cryptocurrency is so strange to so many people, I’ve found it to be a wonderful topic on which to ponder that question more broadly. I mean, yes, using digital money that some stranger invented is kind of weird. Then again so is buying stocks. Tiny fractions of a collection of other strangers’ capital and IOUs which might entitle us to a portion of their future earnings. That seems normal because we’ve been doing it for centuries in some form and it’s proven to be useful.

Now, I’d absolutely agree with you that bitcoin’s latest rise is fragile. It probably will again crash, like it did in 2012, and in 2019, and earlier this year. No idea when that will happen though, or if next time will be the last.

When you talk about trust though, that’s a really interesting topic. I think the only way to completely and permanently break trust in Bitcoin would be either to hack SHA256 (the hashing algorithm underpinning a lot of bitcoin’s cryptography), or successfully conduct a 51% attack (buy up more than half the computing power to disrupt the transaction validation process).

In case it wasn’t already clear, I really enjoy diving into the technology behind cryptocurrency. Even if bitcoin, ethereum, and the rest all tank to $0, I still love that they’ve demonstrated the complex technology of Proof of Work and Blockchain. There have been so many interesting whitepapers and projects about new forms of identity and ownership over the last decade thanks to them, and I consider that the most powerful contribution of this space.

If I may ask, are you solely drawn to cryptocurrency as a potential investment/inflation hedge, or do you see some other value for yourself personally?

And because I really can’t help myself and I really like where this thread is going, here’s one more set of posts from a thread started just this week.

Growth vs. Sustainability

Every other species, over time, has found some natural homeostasis within their ecosystem. Humans have not. We’ve been growth animals from the start. Sure, other species would employ the same growth strategy if/when they could but it’s been our unique ability to change and manipulate our environment to better suit our survival needs to the detriment of the needs of others that has allowed for the unmitigated success of homo-sapiens. Our economic model, “survival of the fittest” is based on our very understanding that the optimal evolutionary route is – growth at all costs. As Ben likes to say, it’s hard wired in our DNA.

So, I do not think a shift to sustainability from Growth (besides the bullshit ESG metrics every Fortune500 will adhere to) is a likely one. Growth, is the water in which we swim, and it is something that NEEDS to be true. It’s lifted millions out of poverty, put xbox’s and flat screens in the homes of every American that wants one, spread democracy throughout the world, kept an entire class of political do-nothings employed for the better part of 40 years, And, most importantly it’s allowed anyone who has experienced any sort of success in their life to be comfortable with the fact that they “earned” it. If the other guy coulda, he woulda, but he wasn’t strong/smart/connected enough to do so and that’s the way the world works…..so whatevs. Growth is the Status Quo. And while a change is necessary I don’t see it happening soon, or harmoniously when it does.

There are different types of growth in and of a society. One of them would be centrally planned and another would be individual decisions of the participants. The means by which these growth vectors act would be policy tainted (ESG) monetary inflation by the former and savings by the latter (Keynes v Say).

To guess a hard problem unknown (like how many silver dollars in a large jar or something like the #future#), a small number of information processors is less likely to collide with the truth than a very large number. The pins on a political economist’s computer generated Galton board model are not yet as recursive as the members of the crowd watching the crowd, in real time. A difficult truth for now.

A belief in “progress”, that there is an up-and-to-the-right arrow of time and history, is the most fundamental water in which we swim. For example, it’s at the core of both capitalism AND Marxism.

Like everyone on these posts, I worry that the political dynamic here is inexorably “sustainability for thee, growth for me”, whether we’re talking about our local communities, our domestic politics, or our international politics.

1. Prior to Peace of Westphalia and European colonization, most of earth’s surface was inhabited by populations that existed in communities, with family and community at the center, rather than central governments issuing orders and permits regarding resource exploitation. These societies did not exhaust their resources in the relentless pursuit of growth as you describe, and they did adopt practices, policies and lifestyles that were oriented around care and preservation of natural ecosystems. My own ancestors existed this way until 1834 when they came under British rule, and within ~75 years from then the British system of centralized government and fiat rule had destroyed the traditional culture and values while concurrently decimating plentiful resources that had been preserved for millennia. There still does remain considerable wildlife and the practice of traditional harvesting for food and medicine by my family and the community but a tiny fraction of what it was even a century ago. The destruction of community and decentralized socioeconomic existence globally is a major reason why the entire world adopted the mindset that you rightly describe as pervading the world today, but it is not correct to say that “Every other species, over time, has found some natural homeostasis within their ecosystem. Humans have not.”

2. Modern consumers have extremely poor and incomplete understanding of how natural resources like timberland, grassland and marine ecosystems exist and function, and equally poor understanding of how forest products, ag products and marine products are produced and consumed. When human populations grew to a point where resources could no longer be treated as inexhaustable, the concept of “sustainability” came into vogue, and droves of poorly informed people developed the desire to learn about these things. Because people are inherently lazy and always look for shortcuts, they were (and still are) highly susceptible to being misled through abstractions that cartoonize and oversimplify concepts in order to lead them to conclusions that governments and large corporations find most convenient. I tried to capture this point in a post titled The Bewildered Herd, that the masses will always be led to do and think whatever the oligarchs want them to do, and that NGOs and other groups are really only doing as much as the oligarchs will permit them to do, and exactly in the manner that the oligarchs want. I watched this happen in timber and forest product markets, and now I’m watching it happen in fisheries and seafood markets, where whatever level of mediocrity enables the Industrially Necessary value chain to function becomes broadly established as the gold standard. Meaningless titles and certifications like Forest Stewardship Council Chain of Custody, “certified wood”, Marine Stewardship Council (which I call Mafia Seafood Control), etc. are all promoted by a broad section of oligarch-funded and oligarch-controlled factions in order to legitimize mediocrity and establish it as being “sustainable”.

3. The reality, imo, is that when resources become scarce relative to population size (as they clearly are today) and economic growth is [at least in part] the sine qua non of a strong and prosperous society (as it clearly is today), the focus of any intelligent effort toward achieving what we hope is “sustainable” must be on capturing more economic value from the resource – in other words being more diligent and less wasteful. For example, only decades ago it was believed that herring stocks were inexhaustible and could be harvested without any thought to catch limits. So much so that herring uses included grinding fish into a slimy paste that was used to help haul logs out from the woods. Today, herring stocks are depleted and under severe strain, and if they are going to be harvested then care and thought should be applied to finding the highest economic value application of the resource. Similarly, as recently as last decade the byproduct species of timber harvests or minorly defective logs were simply left to rot in forests, and timber to lumber, wood chip or pulp value chains were full of high-earning intermediaries that added relatively little value to the process. Today, as resources have grown more scarce, supply chains are being disintermediated and every bit of value is sought for capture right down to the last toothpick. As resource scarcity continues to grow, the focus should be on genuinely developing and implementing commercial processes all along the value chain that are more efficient and value-oriented.

4. The greatest obstacle to efficient and responsible resource utilization is the centralized government system captured by oligarch/large corporations that controls access, policies and regulations w.r.t. resources, *and* with respect to the messaging that reaches consumers. This makes a purely bottom-up approach to meaningful change practically impossible. Those whose sizeable investments in physical infrastructure and systems bind them to older and less efficient ways of monetizing resources are not in a position to change quickly to better ways, but they are in a position to prevent others from pursuing and achieving those better ways, and that is exactly what happens. That is a major reason why farcical metrics for ESG and farcical third party certifications for “sustainability” are able to gain currency with the mainstream population while suboptimal practices can persist everywhere everyday almost unabated.

I used to close these Mailbags with, “Yup, these are my readers.”

Today?

Yes, this is OUR Pack.

We are now more than 900 Pack members strong on the ET Forum, with more than 1,000 posts contributed by smart, clear-eyed, full-hearted people from all over the world and all walks of life. Like you.

How do we keep it a safe space? By keeping it private. By allowing anonymity. By having “unfettered” conversations, to use the disapproving term of the New York Times, where you can (imagine this!) disagree with someone or (gasp!) say something stupid and not be branded with a scarlet letter forevermore.

The ground rule for the ET Forum is the Golden Rule – treat everyone as you would wish to be treated. That’s the essence of Full Hearts, too. That’s the essence of every system of ethics worthy of the name: to treat others as autonomous human beings possessing an inherent and inalienable dignity, never as an instrument, never as a means to an end. And to receive the same treatment in return.

You are welcome to talk about stocks in the ET Forum, but please don’t be a Raccoon.

You are welcome to talk about politics in the ET Forum, but please don’t be a Rhinoceros.

How do we make our way in a difficult world? I don’t know the Answer. I don’t think there is an Answer. But I do know the Process. And that Process is this: the Pack will figure this out … together.

We call ourselves the Epsilon Theory Pack, because The Long Now is going to get a lot worse before it gets any better, and there is strength in numbers. Watch from a distance if you like, but when you’re ready … join us.

And yes, the ET Forum is for paid subscribers only. That’s how we keep the trolls out, that’s how we create a safe space, and that’s how we are building our business. We are a totally independent company, beholden to no one, and in the immortal words of Don Barzini, we are not communists.

That said … if you know in your heart that this is where you belong but you can’t afford the subscription, maybe you’re a student or maybe you’ve hit a rough patch, send me an email directly ([email protected]) and we’ll figure it out.

We are not communists. We are not entertainers. But we are a pack. And the pack takes care of its own.

Thanks for all this, Ben. Here are a couple of things that are rattling around in my head.

- I am reading more about the Canadian housing market. My casual observation is that they didn't have a washout like we had in 2008 and so prices didn't pull back much. Canada is a relatively small economy and a housing crisis ala' 2008 probably doesn't have global ramifications...but...I fear that sounds like something Bernanke said in 2008 too. So, if Canada has a housing collapse, does it bleed into the global (and US) financial system?

- I have been doing a lot of reading on money. I just recently published a serial on CBDC here https://www.confluenceinvestment.com/category/weekly-geopolitical-report/. Recently read a book https://www.amazon.com/Making-Money-Philosophy-Crisis-Capitalism/dp/1781682658 which delves into the philosophy of money. Kind of blew me away. Here is my issue. We have a clear case of currency debasement going on now; M2 is soaring, fiscal/monetary is expanding, etc. Every financial/econ podcast I listen to is saying "inflation is coming". But, if you look at the Distributional Financial Accounts from the Fed, the bulk of cash is held by the wealthy. It isn't even close. We don't have data on this series back very far but I have been wondering...what does inflation look like when the bottom 90% of households don't have much cash and are deeply in debt? I have been thinking that maybe we are in a mashup of WWII (which means more fiscal spending and yield curve control) and Japan, 1986-90, where the BOJ kept jamming liquidity into the system because there was no inflation and yet we all know what the Nikkei and real estate prices did. In other words, under conditions of extreme inequality, inflation isn't in goods prices but assets.

Anyway, thanks.bog

It’s great to be able to read the “highlights” of the forum threads like this. I often find myself unable to really dig in there because of time constraints.

In a refrain I gasp to myself far too often, this post alone make the price of an ET membership a complete steal. The gems around housing price inflation and thoughts on crypto will definitely be invaluable for my investing, and the thoughts on growth will help me become a better world citizen and pack member. Keep up the good work, Ben + the rest of the pack!

Just to harmonize with Cody and Daniel, this distillation from the mailbag is top tier among ET posts.

Thank you, Daniel!

Same! We’ll be publishing a weekly email with these highlights.

Thanks, Pat!

I’ve been reading an excellent review of the ideas of Henry George over on Astral Codex Ten - the other blog I scan daily for new articles or comments. The review is here:

https://astralcodexten.substack.com/p/your-book-review-progress-and-poverty

but be warned, it is very long.

George recommended a Land Value Tax for the issue of poverty not declining as progress is made. I have some sympathy with George’s ideas because I have lived in Asian countries where house prices bore no relation to income levels. Now I live in a Spanish city, Valencia, where empty lots and derelict buildings are found in the old city because the owners see the capital appreciation and have no incentive to sell or redevelop. An LVT of 80% of the land value would encourage them to think otherwise.

Proud pack member.

On the housing shortage, Wolf Richter (as usual) made some fantastic observations here (TL;DR federal subsidy of 2d home 1st mortgages is dropping by 50% starting in June). https://wolfstreet.com/2021/04/01/the-explosive-surge-of-mortgages-for-second-homes-housing-bubble-math/